Site Search

348 results for mode change request

-

Market Commentary April 2025

Key Takeaways for Q1

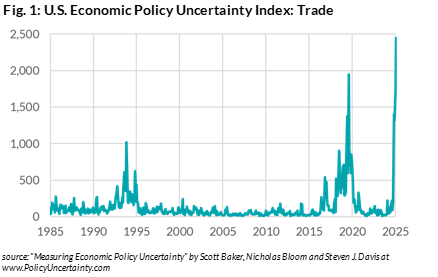

- Economic policy became more uncertain with fluctuating tariff announcements from the U.S. and its trading partners.

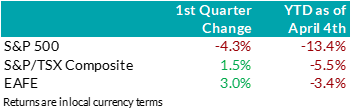

- Global stocks markets experienced heightened volatility year-to-date, reflecting the negative repercussions of tariffs for highly integrated global economies.

- Within U.S. markets, investors rotated out of growth stocks into value and defensive areas of the market.

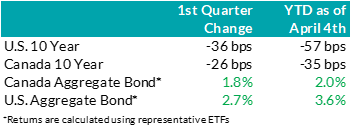

- Bond markets performed well during the quarter as interest rates moved lower.

- Most central banks continued to ease monetary policy by reducing their target interest rates. The U.S. Federal Reserve was a notable exception, electing to wait for greater clarity before lowering rates further.

Economic and Market UpdateEconomic Summary: In the U.S., the latest GDP data confirmed solid economic growth in 2024. However, as President Trump pushes forward his economic agenda, uncertainty surrounding fiscal policy and global trade have dampened market sentiment. Inflation pressures persisted, with the rate of inflation remaining above the central bank’s 2% objective. The labour market in the U.S. remained resilient, with unemployment rate staying low compared to historical norms. The Federal Reserve shifted to a more cautious approach, holding the policy rate steady through Q1 at the range 4.25% - 4.5%. The central bank raised its inflation forecast, lowered growth projections, and warned that “uncertainty around the economic outlook has increased.” U.S. bond yields were lower for most maturity dates during the first quarter, as the market priced in more growth concerns and anticipated more rate cuts from the Federal Reserve.

In Canada, recent GDP data showed stronger-than-expected growth. The inflation rate remained close to the 2% target but rose more than expected in February, and the labour market showed signs of improvement. U.S. tariffs continued to be a significant concern, and it is prompting businesses and consumers to become more cautious and slow their spending. The Bank of Canada warned that the economic impact of the tariffs could be “severe” and expected weaker growth in the coming quarters. For those reasons the Bank of Canada continued its easing cycle, cutting rates by 25 basis points at each of the January and March meetings, bringing the policy rate to 2.75%. Bond yields in Canada were also lower, with short-term interest rates decreasing faster than long-term interest rates as the Bank of Canada’s rate cuts outpaced market expectations.

Bond Markets: During Q1 2025, the FTSE Canada Universe Bond Index returned 2.0% as interest rates declined across all tenors. Although interest rates fell, this was partially offset by higher credit spreads (i.e. the extra yield on corporate bonds versus government bonds to compensate for their extra risk). Consequently, while corporate bonds still generated a positive return on the quarter, they underperformed government bonds. Widening credit spreads reflected the risk-off tone to the market, with on-off-on-off-on(?) tariffs contributing to the uncertainty. Lower-rated BBB bonds generally performed worse than higher-quality A-rated bonds. While credit spreads are higher than they were in December and January, they are still expensive compared to longer term averages. Corporate bond issuance remained robust up until the last week of March, as investor demand kept deals well supported. Overall, the market took in $40 billion in new issuance, the second highest on record, spread over 82 bonds. While corporate bonds are more attractive than in January 2025, we believe the more likely path is towards higher credit spreads as U.S. tariffs impact global growth. We have maintained our conservative view with a bias towards shorter-dated credit but remain ready to invest in longer dated corporate bonds as valuations become more attractive.

Stock Markets – Overview:

Uncertainty surrounding the scope and severity of new tariffs led investors to reassess global economic growth prospects and weighed on risk sentiment. As a result, the S&P 500 declined 4.3% over the quarter, underperforming Canadian and international markets. Within the U.S., investors rotated out of previously favoured growth stocks with loftier valuations – including members of the Magnificent 7 – into less volatile and value-cyclical companies. Meanwhile, Canadian equities returned 1.5% in Q1 despite ongoing trade negotiations and uncertain economic growth forecasts. Surging commodity prices helped the materials and energy sectors outperform, offsetting weakness in the technology and industrials sectors. Elsewhere, major developed markets from Europe and Asia (EAFE) were supported over the quarter by the introduction of a new German fiscal stimulus package and signs of improving Chinese economic growth. Following the quarter end, President Trump announced global tariffs on April 2nd, prompting some trading partners to hit back with retaliatory tariffs. The S&P 500 lost a record $5.2 trillion over two trading sessions and re-entered correction territory, with other global equity markets moving in tandem.

U.S. Equities: While the impact of tariffs has made investors more apprehensive, we have yet to witness a deterioration in financial performance. In fact, U.S. earnings continued to exceed forecasts last quarter, with approximately 70% of companies beating expectations. Furthermore, our bottom-up analysis shows that the skew of corporate earnings surprises continues to tilt positive. That said, we note that companies are providing more cautious guidance amid the increased economic uncertainty and that these earnings largely reflect conditions in 2024, not 2025. Notably, consumer stocks like Walmart have lowered growth forecasts for 2025, citing concerns surrounding consumer confidence and macroeconomic conditions. In addition to clouding the outlook, geopolitical shocks like sweeping tariffs may risk changing how companies choose to operate, including the structure of supply chains and sources of revenue. At this stage, it is still unclear how long these trade tensions will last, as that depends on how other countries choose to respond. If the tariffs are rolled back quickly, many companies may be able to absorb the temporary extra costs without serious damage to profits, and the broader economy could avoid lasting harm. But if the tariffs remain in place for a long time, the consequences could be much more serious; companies might have to change how they operate, restructure supply chains, and raise prices to deal with long-term pressure on profits.

Canadian Equities: Against the backdrop of worrisome trade developments, the Bank of Canada continued to ease monetary policy. While lower rates have helped Canadian companies report better-than-expected profit growth, consensus earnings expectations for 2025 have been revised 2% lower since the beginning of the year, reflecting the expectations for tariff headwinds. Falling bond yields made high quality, high dividend paying companies more attractive, helping this group outperform. Furthermore, the price of raw industrials – a basket of commodities – surged higher over the quarter and as a result, commodity-oriented companies benefitted. More specifically, the materials sector performed strongly with gold prices reaching new all-time highs throughout the quarter. However, if trade frictions continue to escalate and weaker growth projections materialize into a real economic slowdown, the Canadian market, given its cyclical nature and heavy reliance on commodity-driven businesses, remains particularly vulnerable to external headwinds. Moreover, given Canada’s weaker fundamental backdrop, we caution that the recent outperformance of Canadian equities relative to the U.S. may prove short-lived, particularly if trade tension persists.

Bottom line:

Heightened uncertainty surrounding global trade policies, coupled with deteriorating economic growth projections, continued to weigh on investor sentiment. Bond prices benefited from the flight to less-risky assets, with lower interest rates in anticipation of weaker economic conditions. In equity markets, the introduction of broad-based tariffs increased market volatility and drove major indices sharply lower year-to-date. Looking forward, we remain cautious of the recent outperformance of Canadian and international markets relative to the U.S. While tariffs began as a U.S. policy move, the ripple effects extend far beyond American borders, reflecting the systemic fragility that underpins global trade. If trade barriers persist, businesses may be forced to make structural shifts in their operations and review their current business models. Until markets achieve greater clarity on global trade policies, we continue to prioritize exposure to diversified large-cap stocks in the U.S., over defensive or growth-heavy positions. Within Canada, we continue to favour high quality, high dividend paying names with less sensitivity to downgrades in global growth.

Downloadable Copy

ADVISOR USE ONLYMark Warywoda, CFA

VP, Public Portfolio ManagementIan Whiteside, CFA, MBA

AVP, Public Portfolio ManagementJohanna Shaw, CFA

Director, Portfolio ManagementJin Li

Director, Equity Portfolio Management

Tyler Farrow, CFA

Senior Analyst, Equity

Andrew Vermeer

Senior Analyst, Credit

Elizabeth Ayodele

Analyst, Credit

Francie Chen

Analyst, Rates

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy.

- Par Whole Life Summary

-

Enhanced flexibility and features make Equimax whole life a great choice for your clients

WHAT’S NEW ON MARCH 23, 2020?

The following features are available on Equimax Estate Builder® and Equimax Wealth Accumulator® plans!

.jpg?width=120&height=141) 60 months of EDO payment flexibility1 that fits your clients’ situation

60 months of EDO payment flexibility1 that fits your clients’ situation- Clients can start EDO payments1 up to 60 months from the date the application was signed, or resume up to 60 months from the last EDO payment made, without additional evidence of insurability.

- Applies to Equimax2 policies with an effective date of March 23, 2020 or later.

EDO is available on cases rated 300% or less3 for new and existing clients- For existing clients, if approved, the EDO contract provisions that apply will be based on the effective date of the insurance policy, not the date the EDO was added.

- Applies to Equimax2 policies issued under the 2017 tax rules.

Built-in Disability Benefit Disbursement provides access to cash value in the event of a disability

Built-in Disability Benefit Disbursement provides access to cash value in the event of a disability

- The Disability Benefit Disbursement may provide a tax-free, lump sum payment of up to 100% of the policy’s cash value if the insured becomes disabled.4

- Will be included on Equimax2 policies issued under the 2017 tax rules.5

Want more information?

More information is available on EquiNet® on the Whole Life Insurance Product page under the Resources tab.

Ask your Equitable Life® Regional Sales Manager about Equimax today.COVID-19 & social distancing: Strategy for insurance applications

Using our EZcomplete® online application allows you to keep your distance … while keeping your business moving forward.

Learn more

1 This applies only to policies with an effective date of March 23, 2020 or later. The amount of the EDO payment allowed may be limited to the maximum EDO payment made in previous years depending on the policy year. For approved EDO amounts exceeding $150,000 annually ($12,500 monthly), clients have up to 12 months from the date the EDO application was signed or the date of the last EDO payment to make an EDO payment before a contribution cap may apply. See Admin Guide for full details. 2 Applies to Equimax Estate Builder and Wealth Accumulator; all ages; life pay and 20 pay; single and joint lives. 3 Not available if the policy has a flat extra rating. 4 See sample policy contract for full details, including the qualifications for the disbursement. Policy cash value and death benefit will decrease. Tax laws are subject to change. The payment of the disability benefit disbursement may affect the adjusted cost basis (ACB) of the policy as it is considered payment of a capital benefit. Changes in ACB can affect the future taxation of the policy. 5Subject to our administrative rules and guidelines in effect at the time of the disbursement -

Extending premium relief for Dental and Extended Health Care benefits

We know this is a challenging time for Canadian employers and we continue to look for ways to help your clients manage while still supporting their employees.

As many health practitioners continue to keep their offices closed due to the pandemic restrictions, plan member use of dental benefits and some health benefits remains lower than normal.

So, we are pleased to announce that we are extending premium relief for all Traditional and myFlex insured non-refund customers for Health and Dental benefits for the month of May, as follows:

- A 50% reduction on Dental premiums in all provinces except Saskatchewan, where a 25% reduction will apply due to the re-opening of dental clinics in early-May; and

- A 20% reduction on vision and extended healthcare rates (excluding prescription drugs) in all provinces, which equates to an 8% reduction on Health premiums.

These reductions are effective for May 2020 and will appear as a credit against the next available billing. We will assess the situation monthly and expect to continue with monthly refunds for as long as the current crisis period continues. The size of the credit may change over time as dentists and other health practitioners gradually reopen their offices. We will confirm premium credits for June (if any) at a later date. Credits for subsequent months will be communicated on a month-by-month basis.

In order to be eligible for the monthly credit calculation and payout, a policy must be in force on the first of the month and remain in force thereafter. The monthly credit calculation is based on employees in force on the May bill. If employees experienced layoffs during the month, that would not affect eligibility for a premium credit as long as the benefit itself is not terminated.

We expect that claims experience and premiums will return to normal once the current pandemic restrictions are lifted.

In the meantime, plan members will continue to have full access to their benefits coverage throughout the pandemic. In many cases, dental offices remain open for emergency services, and a variety of healthcare providers are available virtually.

Commissions

We know the pandemic has put financial strain on your business as well, so we will continue to pay full compensation. Although your overall commission will be unaffected by these premium reduction adjustments, you may see a temporary reduction in your commission payments if you are on a pay-as-earned basis. We will begin to process the commission top-up payments in mid-June and will reflect both April and May premium credits.

Communication

We will be communicating this premium relief program to your clients later this week.

Questions?

If you have any questions, please contact your Group Account Executive or myFlex Sales Manager. In the meantime, we have provided some Questions and Answers below. You can also refer to our online COVID-19 Group Benefits FAQ.

-

Insights from a pandemic: COVID-19 and group benefits plans

We’ve received numerous questions about the impact of COVID-19 and what it will mean for benefits plans in the months ahead. Below is a summary of what we’re seeing so far. In the coming weeks, we’ll explore each of these topics in greater depth.

Disability

Initially, as COVID-19 started to spread, we saw STD claims ramp up quickly. Since then, we’ve seen the number of COVID-19-related STD claims slow significantly. As for LTD, we believe both the incidence and duration of those claims will increase in both the short term and medium term due to COVID-19.

Health and Dental Claims

We saw an overall spike in the volume and paid amounts for drug claims in March as plan members rushed to stock up on their medications. This was followed by a drop in April after most provinces put 30-day refill limits in place. One exception was claims for asthma drugs which surged in March but had no drop in April. Overall, the April plunge will be short-lived; drug costs have already begun to rise in May.

While paramedical and dental claims are down, we are seeing an increase in claims for virtual treatments and emergency dental services. We expect that claims will spike once the current pandemic restrictions are lifted. We’ve already started to see claims rise in provinces that are allowing health providers to re-open.

Despite the shift to more virtual services, we haven’t seen an increase in fraudulent activity. But we continue to be vigilant. Our investigative practices – verifying with the plan member that they received the treatment and have a valid receipt, and that the practitioner has treatment notes – remain the same whether treatment is provided in person or virtually.

Technology

During this time of physical distancing, people are looking for ways to interact with their providers virtually. Fortunately, our business model is almost entirely electronic, and we have several convenient digital options available for plan members and plan sponsors. Our focus in recent weeks has been to remind clients and plan members about these tools and make it as easy as possible for them to activate and use them. And we are continually adding functionality that will allow us to serve our customers even better.

Mental Health/Wellness

Usage of i-Volve, Homewood’s online cognitive behavioural therapy tool, increased significantly in March before levelling back down in April and May. And while EFAP cases fell in April and early-May, the number of cases has begun to climb in recent weeks, particularly for anxiety. In the coming weeks and months, we expect an eventual increase in marital and family issues, as well as depression. We’ve also seen an increase in mental-health-related prescriptions.

Plan Design

It’s too early to predict how the COVID-19 pandemic will impact benefits plan design and how it will change in the coming months. We would love to get your feedback and insights about how benefit plans will evolve and what new features or provisions they should include.

Please share your thoughts and suggestions with your Group Account Executive or myFlex Marketing Manager. Or, you can email your ideas to GroupCommunications@equitable.ca.

-

Meghan Vallis named head of distribution for myFlex Benefits and other group benefits updates

Meghan Vallis named head of distribution for myFlex Benefits

We are pleased to announce that Meghan Vallis, our Group Sales Vice President for Western Canada, will head national distribution for myFlex Benefits in addition to her existing responsibilities.

As part of her expanded role, Meghan will lead the myFlex Benefits sales team and develop and implement strategies to achieve the growth of this offering. Meghan and the myFlex team will continue to focus on delivering market leading services for our clients and advisors.

Meghan joined Equitable Life in 2020 and brings more than 15 years of experience in the group benefits industry to her expanded role. She is passionate about helping Advisors succeed to transform their clients' employee benefit experience.

myFlex Benefits is one of the most unique and versatile benefits solutions for small businesses in Canada. It is fully pooled, includes a two-year renewal and features a user-friendly portal for plan members to make their benefit selections. And it’s simple to use: Plan sponsors set a budget and choose from a selection of benefit options. Plan members then use flex dollars to select from the options offered by their employer. Any leftover flex dollars are saved in a health care spending account (HCSA).

If you have any questions or are interested in learning more about myFlex Benefits, please contact your Group Account Executive or myFlex Sales Manager.Changes to Short Term Disability (STD) benefit calculations for 2023*

The Canada Employment Insurance Commission and Canada Revenue Agency have announced the 2023 changes to Maximum Insurable Earnings and premiums for employment insurance.

The following changes to Employment Insurance (EI) will come into effect on Jan. 1, 2023:

How does this affect your clients?

Your clients’ STD benefit will be revised with the updated maximums based on the percentage of EI Maximum Weekly Insurable Earnings shown in their policy if:- Their Equitable Life Group Policy includes an STD benefit that is tied to the EI Maximum Weekly Insurable Earnings, and

- At least one classification of employees has a maximum of less than $650.

If their STD maximum is currently higher than $650 or based on a flat amount instead of a percentage or regular earnings, no change will be made to their plan unless otherwise directed.

If your clients wish to provide direction regarding revising their STD maximum, or if they have questions about the process, they can email Kari Gough, Manager, Group Issue and Special Projects.Coming soon: Survey for Plan Administrators with recent disability claims*

We’ve enhanced our communication processes to help your clients with disability plans manage their workplace absences more effectively. In early December, we will distribute a short survey to plan administrators who may have submitted an approved disability claim in the past six months. The survey will ask recipients about their satisfaction with the frequency and detail of our disability management communications.

The email will come from GBClientFeedback@equitable.ca, and the survey will remain open until the end of the day on December 16, 2022. All responses will be confidential. We plan to use the feedback to help ensure that we’re meeting your clients’ expectations and delivering industry-leading service.

We may also follow up with survey respondents directly, to address any concerns they’ve identified.

* Indicates content that will be shared with your clients. - [pdf] Borrowing Money to Make Money

- Convertibility - The Power of Term

-

Equitable Life Group Benefits Bulletin - October 2022

Introducing new Gender Affirmation Coverage for group benefits plans

Providing an inclusive benefits plan can play a critical role in fostering a workplace culture that welcomes diversity and helps employees thrive. While most provinces cover the cost of gender-affirming surgery, each person has unique needs. Some may require procedures that are not publicly covered.

That’s why we’re pleased to introduce a new coverage option for gender affirmation surgical procedures that are not covered by provincial health plans. Gender Affirmation Coverage helps plan sponsors to close the gap where provincial health coverage ends.Coverage details and eligibility

Gender Affirmation Coverage can be added to any Equitable Life plan with an in-force Extended Health Care plan. It provides coverage for gender-affirming procedures that are not covered by provincial health plans. This might include tracheal (Adam’s apple) shaving and voice surgery. It will also cover some additional procedures to further align the plan member’s features to the transitioned gender, such as facial bone reduction and cheek augmentation. This makes a wider variety of gender-affirming surgeries accessible to plan members and helps minimize their out-of-pocket costs.

Plan members are eligible for coverage with a diagnosis of gender dysphoria from a qualified health care professional.Offering a more inclusive benefits plan

The coverage provides one more way for your clients to offer more inclusive coverage and to offer holistic support to their plan members undergoing a gender transition. We have developed this coverage as a complement to our existing coverage options, including Health Care Spending Accounts (HCSAs), Taxable Spending Accounts (TSAs), Extended Health Care and drug coverage, and Employee and Family Assistance Programs, all of which can provide support to plan members undergoing gender affirmation.

We regularly review our products to ensure that they’re meeting your clients’ needs, and we’re committed to offering products that support diversity, equity and inclusion.

We also continue to review our forms, documents and processes to make them more inclusive. This includes reviewing our online plan member enrolment (OPME) tool to allow for more flexibility with the way plan members identify their gender.Gender affirmation and mental well-being

Gender affirmation procedures can lead to improved mental health outcomes for those with gender dysphoria, as most report an improvement in their quality of life following the procedures. Gender dysphoria may occur when a person’s assigned sex at birth does not match their identity, and people experiencing gender dysphoria typically report psychological and emotional distress, including symptoms of depression or anxiety. By offering coverage where provincial health coverage ends, your clients can support plan members as they seek procedures that align their body presentation with their self-identified gender.

Advantages at a glance

Advantages for plan members include:- Reimbursement for some procedures and expenses, leading to fewer out-of-pocket costs

- May experience improved mental health outcomes after surgery

- A benefits plan that promotes a culture of diversity, equity and inclusion, which may build employee loyalty

- Support for plan member mental health to help those with gender dysphoria thrive

The Benefits Canada 2022 Health Care Survey results are in!

Equitable Life is proud to be a Platinum sponsor for The Benefits Canada 2022 Health Care Survey, Canada’s leading survey on workplace benefits plans. This year’s survey report highlights many fascinating insights across a wide variety of benefits topics, including:- A focus on mental health for both plan sponsors and plan members

- The repercussions of the "shadow" pandemic due to health care delays

- Trends in plan members' overall perceptions of their health benefits plans

- The types of benefits getting more attention from plan members

- The role of remote work in plan member satisfaction

We’re committed to helping you and your clients navigate the evolving landscape of employee benefits in Canada by contributing to this vibrant industry community. To read the full report, visit Benefits Canada.

HCSA and TSA manual allocation reminder

If your clients’ Health Care Spending Account (HCSA) and/or Taxable Spending Account (TSA) have manual allocations, they need to allocate these amounts to plan members each year. Clients should review their plan members’ profiles on EquitableHealth.ca to ensure they have received their allocation(s) for the current benefit year. Your clients may also order HCSA and TSA forfeiture reports on EquitableHealth.ca.

If your clients have Plan Administrator update access on EquitableHealth.ca, they can update these amounts online by doing the following:- Select View certificate

- Select Health Care Spending Account or Taxable Spending Account

- Select Update Allocation in Task Center

- Enter amount in Revised Allocation Amount

- Override Reason – Plan Administrator Request

- Select Save

- Select Reports

- Select New

- Select Next

- Select HCSA or TSA Totals by Plan Member

- Select Next

- Enter end date of 12/31/2022

- Select Next

- Select Finish

- View Report

-

April 2024 eNews

In this issue:

- Competitive – and easy – benefits plans for your small business clients

- Simplifying benefits enrolment for your clients*

- NEW time-off tracking tool from HRdownloads*

- Focus on benefits fraud: Protecting your clients’ plans from abuse*

Competitive – and easy – benefits plans for your small business clients

Supporting your small business clients can be a challenge. It’s tough to find a competitively-priced benefits plan with the features they want. Small business owners may also need more of your time – especially if this is their first benefits plan.

That’s why we created Equitable EZBenefits™, a benefits solution designed with the needs of small businesses in mind. With a range of plan design options and valuable embedded services for plan sponsors and plan members, EZBenefits is available for groups with 2 to 25 employees. And to make things simpler for you, we’ve created an Advisor Concierge Service exclusively for EZBenefits. Whether you have a question about submitting a quote request for a new client or an issue with an in-force client, our Concierge Service is your go-to resource for EZBenefits support.Don’t have any EZBenefits clients yet?

To learn more about EZBenefits, watch our video to learn more or view our brochure.Simplifying benefits enrolment for your clients*

Navigating the benefits enrolment period can be overwhelming – for you, your clients and their employees. It’s difficult to ensure all plan members complete the necessary paperwork before the enrolment deadline.

That’s why we offer our secure Online Plan Member Enrolment tool at no extra cost to plan sponsors. The tool simplifies the onboarding process for your clients and their plan members by eliminating the need for paper enrolment forms.

It also makes enrolment faster and easier for your clients by:- Reducing errors and rework that can occur due to spelling mistakes or missing information on paper forms; and

- Sending automatic enrolment reminders to plan members, resulting in fewer late applicants.

- Enrol in their benefits plan in just minutes from their computer or mobile device;

- Easily enter all their enrolment information, including dependent details, banking information for direct deposit of claim payments and details for coordination of benefits; and

- Designate their beneficiary electronically.

Ready to share our Online Plan Enrolment Tool with your clients? Get them started with these helpful resources:

- Online Plan Member Enrolment Flyer for Plan Administrators

- Online Plan Member Enrolment Quick Reference Guide for Plan Administrators

- Quick Reference Guide for Plan Members

To learn more about how Online Plan Member Enrolment can simplify benefits enrolment for your clients, contact your Group Account Executive or myFlex Account Executive.

NEW time-off tracking tool from HRdownloads*

Through our partnership with HRdownloads®, EZBenefits clients now have complimentary access to Timetastic —a time-off tracking tool that can make it easier to manage employee vacation time, sick days and more.

Timetastic integrates seamlessly with HRdownloads and includes a mobile app to help manage time-off requests from any mobile device.

To see Timetastic in action, check out this demo.

EZBenefits also includes other helpful resources and tools from HRdownloads that can make daily human resources tasks easier, including:- A robust, award-winning HR management platform (HRIS);

- HR documents, templates, compliance resources and articles; and

- A live HR advice helpline.

Learn more about accessing HRdownloads.Focus on benefits fraud: protecting your clients’ plans from abuse*

According to the Canadian Life and Health Insurance Association (CLHIA), benefits fraud costs insurers and plan sponsors millions of dollars each year, which can lead to increased premium costs.

Resources for your clients

Both plan administrators and plan members play a role in preventing benefits abuse. So, we’ve compiled some resources you can share with your clients to help them understand what benefits fraud is and how to prevent it:- CLHIA’s free 15-minute Protect Your Benefits online course for plan administrators and their members

- CLHIA’s Fraud is Fraud program, including their FAQs on benefits fraud

- Our online guide to benefits abuse

- Tips for plan administrators and plan members to protect their plan

How we’re fighting benefits fraud

Our Investigative Claims Unit (ICU) works to detect and eliminate benefits fraud. We use a variety of investigative techniques, including CLHIA-led industry tools to detect and eliminate benefits fraud:- Joint Provider Fraud Investigation Program: A robust program that allows insurers to collaborate on fraud investigations that affect multiple insurers;

- Data Pooling Program: An initiative that pools data between insurers and uses advanced artificial intelligence to further identify and reduce benefits fraud; and

- Provider Alert Registry: A registry that allows insurers to view the results of other insurers’ anti-fraud investigations into specific practitioners.