Site Search

406 results for benefits of seg fund

- [pdf] Personalized Brochure - What did you wish for this year?

- [pdf] Personalized Brochure - What did you wish for this year?

- Equimax Estate Builder® reprice

-

Insights from a pandemic: Drug trends during COVID-19

We were expecting drug costs to rise this year due to the increase in “specialty” drugs, the shift to more expensive treatments for common conditions, and the introduction of new, costly medications. The COVID-19 pandemic has caused drug costs to rise even more than expected. While this was partly due to increased claims for certain drug categories, the most significant factor was the increase in dispensing fees as the provinces imposed 30-day refill limits.

Costs and claimants surge, drop, then climb again

Initially, as COVID-19 started to spread, we saw an overall spike in the volume and paid amounts for drug claims in March as plan members rushed to stock up on their medications. On our block, the average amount paid per certificate increased 16% in March, compared with the previous year.

This spike was followed by a drop in April after most provinces put 30-day refill limits in place. This led to a decrease in both average paid amounts and quantity per claim as people were limited to smaller refills. But the dispensing fee portion of drug cost tripled for many plan members who had to refill their prescriptions every month instead of every 90 days.

The April plunge was short-lived. Drug claims started to climb again in May as some provinces removed their 30-day refill limits. We’ve seen a continued increase so far in June as all remaining provinces have lifted their 30-day limits.

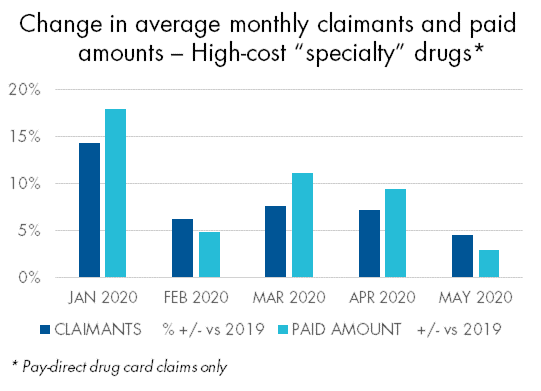

Claims for “specialty” drugs increase

There were some notable exceptions to this trend. For example, both claimants and paid amounts for high-cost “specialty” drugs increased in March, April and May. Thirty-day refills are the norm for these drugs, so they weren’t impacted by the re-fill limits.

There were some notable exceptions to this trend. For example, both claimants and paid amounts for high-cost “specialty” drugs increased in March, April and May. Thirty-day refills are the norm for these drugs, so they weren’t impacted by the re-fill limits.Claims for asthma drugs had the largest surge of any common disease category in March but had no subsequent drop in April. Not surprisingly, claims for mental health drugs increased throughout the pandemic, including a 33% increase in the number of claimants in May.

Going forward, we should see the average quantity per prescription stabilize in future months and return to normal, provided pharmacies return most patients to refills of more than 30 days.

The full impact of COVID-19 remains to be determined. We will continue to provide timely updates on any developments that impact our clients and their plan members or their benefits coverage. In the meantime, please contact your Group Account Executive or myFlex Sales Manager if you have questions.

-

Insights from a pandemic: Long-term COVID-19 drug risks

For the remainder of 2020 and beyond, COVID-19 will continue to add to the existing pressures driving up drug costs. Examples of contributing factors include:

- Claims for acute drugs will likely increase as elective surgeries resume and plan members address non-emergency health issues that were left unattended during COVID-19.

- Plan members whose employers are facing financial strain due to COVID-19 may stock up on their prescriptions in anticipation of losing their job and/or their benefits.

- An ongoing increase in the prevalence and severity of mental health issues and chronic conditions. In May and June, we saw a dramatic increase in the number of claimants for depression, ulcers, blood pressure and diabetes, and depression was associated with 1 in 5 claimants.

All trends thus far suggest we can expect about a 10% increase in average paid amounts per certificate in 2020 compared with 2019. But the impact won’t be the same for all groups. There will be significant variations, particularly for smaller groups, and some may see much larger cost increases.

Unknown COVID-19-related risks

Another risk exposure may come from the costs associated with drugs used to treat or prevent COVID-19. There are currently numerous vaccines in development, and more than 300 clinical trials are underway for both new and existing drugs to determine their effectiveness in treating the virus.

The cost of any vaccine or whether government or private plans will pay for it is unknown. Regardless, there will likely be other drugs indicated for the treatment or prevention of COVID-19 that private plans will be expected to cover. The cost of this impact for private payers is unknown, but potentially high.

Another unknown is what will happen with dispensing fees. While most provinces have lifted their 30-day prescription refill limits, it remains to be seen whether pharmacies will resume dispensing 60- and 90-day refills at pre-COVID levels for private plans. If not, this would mean the dispensing fees will continue to drive up drug costs.

Advisor opportunity

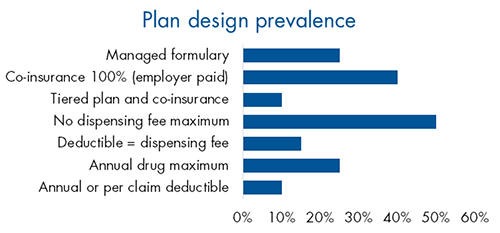

Despite the increase in drug plan risk in recent years, little has changed in plan design trends. Very few plan sponsors have adopted managed plans or other plan design options that could help manage risk.

This presents an opportunity for advisors to educate their clients about the risks their drug plan may be exposed to and the options available to manage that risk.

A practical starting point for those conversations is our Drug Plan Design Tool. With two simple questions, it can help confirm your client’s objectives and identify some best-fit solutions for their plan. Ask your Group Account Executive or myFlex Sales Manager for a copy of the tool.

-

Supporting plan members affected by the British Columbia and Northwest Territories wildfires

Wildfires across Canada are disrupting the lives of many Canadians. During this difficult time, Equitable Life is providing additional support to help affected clients and plan members.

Prescription refills

Plan members who have been evacuated and/or lost their medication due to the wildfires will be able to make early refills until September 17, 2023, through TELUS Health, our pharmacy benefit manager.

Replacement of medical or dental equipment and appliances

Plan members who need to replace eligible medical or dental equipment or appliances due to the wildfires should first call 1.800.265.4556 to confirm coverage.

Disability or other benefit cheques

Plan members receiving disability benefits or other benefit reimbursements via cheques can visit www.equitable.ca/go/digital for instructions on how to sign up for direct deposit. It just takes a few minutes. Plan members can also call us at 1.800.265.4556 if they need help, a replacement cheque or assistance arranging a different mailing address.

Mental health support

Unpredictable, large-scale natural disasters can cause people to experience intense reactions, putting a lot of pressure on their mental health. Having coping mechanisms to deal with the current crisis can be a huge help. Any Equitable Life plan member who needs mental health support can visit Homeweb.ca/equitable to access online resources or contact Homewood at 1.888.707.2115.

For plan sponsors who have purchased Homewood Health’s Employee and Family Assistance Program (EFAP), their plan members also have access to confidential counselling services. The EFAP provides plan members with 24/7 access to confidential counselling through a national network of mental health professionals. Whether it’s face-to-face, by phone, email, chat or video, plan members will receive the most appropriate, most timely support for the issue they’re dealing with.

Plan Administrator support

We realize that the fires are having a profound impact on regular business operations in B.C. and N.W.T. If you have clients that are unable to carry out day-to-day plan administration, they can call us at 1.800.265.4556. They can also contact their Customer Relationship Specialist for support.

This is a challenging time for advisors, plan sponsors and plan members. We will continue to monitor the situation and provide additional updates as appropriate.Questions?

If you need more information, contact your Group Account Executive or myFlex Sales Manager.

-

This year’s Registered Retirement Savings Plan deadline is March 3, 2025.

Have you talked to clients about their Registered Retirement Savings Plan (RRSP) contributions yet? Equitable® offers RRSP products to meet clients’ needs including:

• Daily/Guaranteed Interest Account

• Pivotal Select™ Segregated Funds

• Investment Class (75/75)

• Estate Class (75/100)

• Protection Class (100/100)

These products offer protection and flexibility that clients need, with the tax savings and benefits of a RRSP. Encourage clients to contribute to their RRSP early. And make RRSP contributions a financial priority each year!

What’s new

The Home Buyer’s Plan is offering temporary repayment relief for qualifying withdrawals from their RRSP. This means that clients can defer the start of the repayment period by an additional three years when they make a first qualifying withdrawal between January 1, 2022 and December 31, 2025. This means the 15-year repayment period would start in the fifth year after the year in which a first withdrawal was made. For example, if you made your first qualifying withdrawal in 2022, your first year of repayment will be 2027.1

Tools and materials to help you start the conversation

Often clients have good intentions about saving for retirement. However, even the best intentions need an action plan. As a trusted advisor, you can help clients see the value in making a RRSP a financial priority. We have tools and marketing materials to help you start the conversation. Show clients why an Equitable RRSP can help them to achieve their financial goals in retirement.

Equitable’s advisor toolbox, available on EquiNet®, includes Product News, Prospecting Letters, Forms, Marketing Materials, Case Studies, Articles and Investment Calculators.

1 www.canada.ca/en/revenue-agency/services/tax/individuals/topics/rrsps-related-plans/what-home-buyers-plan/repay-funds-withdrawn-rrsp-s-under-home-buyers-plan.html

® or ™ denotes a trademark of The Equitable Life Insurance Company of Canada.

Posted February 7, 2025

-

With the Equitable Life FHSA, you don’t have to wait to get clients’ money working for them

The Equitable™ First Home Savings Account is off and running! Thanks to your amazing support, many clients have already taken advantage of the great benefits the FHSA has to offer. Let’s keep the momentum going.

Clients don’t need to wait to start making their dream of home ownership a reality!

With the Equitable FHSA they can put their money to work right away. Available on Pivotal Select™ Investment Class (75/75) and Pivotal Select Estate Class (75/100), the Equitable FHSA offers clients an array of investment products to suit their individual needs and risk tolerance.

Don’t wait. Get clients started today!

And, clients who open a FHSA before December 31, 2023, have a chance to win $8,000 towards their 2024 FHSA contribution. And, the advisor wins $2,000!

To open a FHSA for clients, log into EZcomplete®, our highly rated online application tool. It is easy to use, convenient, and fast.

For more information on FHSA, including a FAQ, and client materials, visit EquiNet® or contact your Regional Investment Sales Manager.

® and ™ denotes a trademark of The Equitable Life Insurance Company of Canada.

Equitable FHSA Contest: No purchase necessary. Contest period September 11 to December 31, 2023. Enter by making a deposit to an Equitable FHSA during the contest period or by submitting a no-purchase entry. One prize for a total value of $8,000 CAD to be drawn on January 16, 2024, will be awarded. The servicing advisor for the policy to which the selected entrant made the deposit is also an eligible winner will receive a $2,000 CAD prize. For example, if an Equitable client is a winner of the $8,000 prize, the client’s servicing advisor wins a $2,000 prize. Open to legal residents of Canada of the age of majority. Odds of winning depend on number of eligible Entries received during the Contest Period. For full contest rules, including no-purchase method of entry, see full contest rules.

Posted November 7, 2023 -

How first-time homebuyers are sourcing their down payments

Did you know that the primary sources for down payments among first-time homebuyers* are:

- Savings outside of a RRSP (59%)

- Gifts (38%)

- Savings within a RRSP (31%)

While 71% of potential first-time homebuyers in Canada are aware of the First Home Savings Account (FHSA), only 33% of them are taking advantage*.

Equitable wants to help first-time homebuyers take advantage of all the benefits a FHSA has to offer. Clients who contribute to an Equitable FHSA between May 1 and September 30, 2025 will be entered into our Close to Home contest, for a chance to win one of two $8,000 prizes. Whether opening a new Equitable FHSA or making an annual contribution, this is a fantastic opportunity to help clients get closer to owning a home.

Advisors, your efforts matter too! You have a chance to win a $1,000 prize if the client you are assisting, in alignment with their unique homeownership needs, is selected as a winner. At Equitable, we believe that when we grow together, success is mutual.

Don’t forget about Equitable’s user-friendly online application, EZcomplete®, or online transaction platform, Equitable’s EZtransact®. These tools are fast, simple, and could bring clients closer to achieving their goals.

Want to learn more? Speak to your Director, Investment Sales.

*Source: 2024 CMHC Mortgage Consumer Survey

Equitable’s Close to Home Contest: No purchase necessary. Contest period May 1, 2025 to September 30, 2025. Clients enter by making a deposit to an Equitable FHSA during the contest period or by submitting a no-purchase entry. Two prizes of $8,000 CAD each to be drawn on October 15, 2025 will be awarded. The servicing advisor for the policy to which the selected entrant made the deposit is also an eligible winner and will receive a $1,000 CAD prize. For example, if an Equitable client is a winner of the $8,000 prize, the client’s servicing advisor wins a $1,000 prize. Open to legal residents of Canada of the age of majority. Odds of winning depend on number of eligible entries received during the Contest Period. For full contest rules, including no-purchase method of entry, see the full contest rules.

Date posted: August 14, 2025