Site Search

961 results for life policy 300109556

-

What’s new in EZtransact

We’re excited to introduce the latest enhancement for EZtransact™, our digital self-serve tool. EZtransact now allows you to help clients:

• Easily make segregated fund withdrawals. This functionality is available for all account types, and for the First Home Savings Account, it also eliminates the need to submit additional CRA paper forms.

• Transfer from one fund to another fund digitally, within the same policy and same sales charge options.

These enhancements make it easier than ever to do business with Equitable®. They will help reduce your time spent on paperwork, allowing to you focus on more value-add time and services for clients.

Check out EZtransact. Stay tuned for more exciting digital enhancements coming soon!

If you have any questions, please contact your Director, Investment Sales.

Date posted: July 11, 2024 - [pdf] Supplementary Advisor Contracting Application

- [pdf] Tax-Free Savings Account (TFSA)

- [pdf] myFlex Options Overview

-

Equimax® Participating Whole Life – A whole life solution for everyone

Recently, we made some exciting changes for Equimax Estate Builder® and Equimax Wealth Accumulator®.

These enhancements, launched in February, make Equimax the preferred solution for clients and their families. In particular, buying a whole life solution for children gives them a head start for tomorrow. Life insurance on a child gives them:

- Permanent insurance at children’s rates

- A stable tax-advantaged investment option

- A boost in financial planning

Watch our new Equimax for Children video to learn more. View on Vimeo or YouTube.

Plus, visit our Equimax product page on EquiNet®, then click on the Marketing Materials tab for the latest Equimax marketing materials.

Need more information? Please contact your local wholesaler.

® denotes trademarks of The Equitable Life Insurance Company of Canada.

-

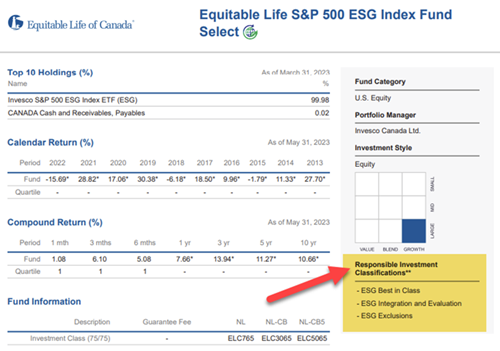

Responsible investing classification on Equitable Life Pivotal Select funds

Recently, the Canadian Investment Funds Standards Committee (CIFSC) classified responsible investing funds under its RI identification framework. The goal of the framework is to help investors and advisors identify and compare responsible investing funds.

We’re pleased to share that the following funds have been assigned multiple responsible investment classifications:• Equitable Life NASDAQ 100 ESG Index Fund Select

• Equitable Life S&P 500 ESG Index Fund Select

• Equitable Life S&P/TSX Composite ESG Index Fund Select

• Equitable Life ClearBridge Sustainable Global Infrastructure Income Fund Select

• Equitable Life Fidelity® Climate Leadership Balanced Fund Select

• Equitable Life Fidelity® Climate Leadership Fund Select

You can find the new responsible investment classifications for our funds by visiting our Fund Information webpage. After selecting a fund with the “Sustainable Investment” icon, the classifications can be found on the right side of the webpage or fund profile PDF:

™ or ® denote registered trademarks of The Equitable Life Insurance Company of Canada.

Posted: June 26, 2023

- Important update MGAs / National Accounts

- Retirement Income Fund & Life Income Fund

-

Equitable Life Webcast Series featuring Fidelity Investments

Equitable Life® continues to spotlight various aspects of our competitive fund lineup and product offerings. This series gives advisors an opportunity to:-

learn more about products and product features,

-

hear from industry professionals,

-

learn about investment strategies; and so much more.

In this webcast, we welcome

.jpg)

Join us to learn about the Equitable Life Fidelity® Climate Leadership Balanced Fund Select and Equitable Life Fidelity® Climate Leadership Fund Select now available in Pivotal SelectTM Investment Class (75/75). Learn about the funds’ people, process, philosophy, and performance.

Learn more

You won’t want to miss it! -

-

Join us for our first Equitable Life Master Class webcast

We’re pleased to introduce the Equitable Life Master Class webcast series. These webcasts offer compelling topics and unique ideas from leading experts to help you manage and grow your business.

Join Equitable Life along with guest speaker Rob Kochel, Director, Invesco Consulting Group to learn:· The ESG client connection opportunities.

· The optimal language to use when introducing ESG to a client.

· Four universal communication principles for better client conversations.

· Words to use and words to lose.

You don't want to miss it!

® denote trademarks of The Equitable Life Insurance Company of Canada.

Posted January 25, 2023