Site Search

70 results for investor profile

-

EAMG Market Commentary July 2023

Posted July 27, 2023

July 17, 2023

Rates & Credit - The rates market was volatile in Q2 as investors focused on inflation, central bank interest rate decisions, and recession probabilities. Persistent strength in U.S. consumer spending and labour markets have surprised investors and prompted further interest rate tightening from central banks. In Canada, corporate bonds outperformed government bonds and the broader FTSE Canada Universe Index during the quarter, with a total return of 0.2%, versus a loss of 1.0% for government bonds and 0.7% for the overall Index. The corporate bond outperformance was driven by a broad risk-on tone to the market, most notably in April as the market recovered from the banking sector liquidity crisis that developed during March. That said, the market tone remained cautious, with the improved risk premium on corporate bonds tempered by lingering concerns around sticky inflation, high interest rates, and the potential for slower economic growth into the latter half of the year.

Dominance of U.S. Equities – U.S. equity markets posted another strong quarter with the S&P 500 returning 8.7%, outperforming Canada and other major international equity markets. The S&P/TSX Composite, returned 1.2% in CAD. Major developed economies from Europe, Australasia, and Far East (EAFE) returned 3.2% in local currency terms. The highly anticipated re-opening of the Chinese economy has failed to materialize with economic data indicating less strength than previously forecasted. Amid sluggish Chinese growth, closely interconnected economic partners such as the European Union, as well as commodity-driven markets like Canada, have all underperformed the U.S. on a relative basis.

U.S. Fundamentals – Earnings continued to contract versus prior year, albeit at a slower pace than forecasted. Forward earnings guidance improved quarter-over-quarter with corporate sentiment returning to neutral levels. Based on our analysis, we observed that 31% of major companies expect deteriorating financial performance, while 33% expect improved performance, with the remaining expecting no material change. Overall, major U.S. companies remain well capitalized with strong operating margins. However, company guidance indicates a prioritization of cost controls amid increased consumer indebtedness and concerns about the health of the consumer.

Artificial Intelligence (AI) Mania – Despite concerns that the U.S. economy is at a late stage in its economic cycle, that monetary tightening by central banks could go too far, and the fact that earnings contracted on a year-over-year basis, equity markets became more expensive during the quarter with price-to-earnings multiples expanding. This expansion was driven by investors crowding into AI focused technology companies, with the seven largest AI/technology themed companies averaging a 26% return while the other 493 members gained only 3%. Investors rewarded businesses with contributions to AI development (hardware and software components), as well as those with the ability to implement synergies from leveraging the technology. A crowded market surge is not uncommon at this point in the economic cycle, where positive economic surprises, in this instance, strong employment and consumer spending can lead to an upswelling in investor confidence.

U.S. Quant Factors – Using our investment framework, we currently favour exposures to large cash-rich companies with innovative product offerings, which we believe offer the strongest risk-adjusted returns in the current market environment. While the valuation of AI companies seems to defy traditional rationales, the momentum has continued to push the group higher. Consequently, the Quality factor (companies with higher return-on-equity, strong operating performance, and healthy leverage levels) participated in the AI trend and consistently outperformed throughout the quarter. The Low Volatility factor (stocks with lower sensitivity to broad market movement, and lower price volatility) underperformed through the quarter. While the Low Volatility factor typically performs well at this stage of the economic cycle, the fact that a small number of stocks were responsible for much of the market’s return hurt this factor. Lastly, the Momentum factor (stocks with a recent history of price appreciation) initially underperformed during the quarter before rebounding in June. This factor’s recent outperformance suggests that the market is becoming complacent and possibly signals that rotations within the market are slowing as current trends remain in favour.

Canadian Fundamentals – Top line revenue missed forecasts while bottom line earnings were consistent with expectations. Softer-than-expected results out of Canadian financials, as well as underwhelming results from the materials sector, dragged on the aggregate index performance. Earnings forecasts for the rest of the year have been revised downward with analyst expecting index aggregate earnings to detract 2% to 3%. Meanwhile, the Bank of Canada raised its overnight interest rate by 25 basis points, bringing it to 4.75% on the backdrop of robust economic data releases including Q1 GDP and April CPI.

Canadian Quant Factors – The most notable dislocation in Canada was the convergence of the dividend yield of High-Dividend ETFs and Equal-Weight Bank ETFs. We believe that the drag from Canadian banks following the U.S. regional banking concerns in March resulted in a discount of the Quality factor as the performance of the group is sensitive to the movements of banks. While banks did recover around 35% of their SVB-induced underperformance, the nature of banking has attracted investor scrutiny given the view that we are in the late-stage of the economic cycle. That said, this environment is an attractive environment to add variants of the Quality factor, which would gain exposure to a rebounding industry that offers a similar dividend yield to the high dividend stocks.

Views From the Frontline

Rates – On an outright basis, bond yields across the curve continue to look attractive. Economic data remains strong however we are beginning to see the first signs of weakness in spending, jobs and inflation. Slower growth, a more balanced labour market, declining inflation, and tighter credit conditions will likely drive interest rates lower throughout 2023. Market participants remain focused on the extent of interest rate hikes and the duration of a pause required to bring inflation back to the 2% target. With inflation remaining more persistent than previously expected forecasts around the timing, pace and extent of the removal of monetary policy have been pushed into 2024.

Credit – The uncertain economic outlook and risks around slower economic growth later this year merit caution about corporate bonds and a bias towards higher-quality, shorter-dated credit where we think the risk / reward dynamic are more favourable. That said, the “soft-landing” narrative, now more pervasive in the market, could continue to provide support to risk assets, which we view as an opportunity to further pare down higher beta exposure.

Equities – Given the direction of the current economic and company fundamental data, we continue to favour high quality growth segments of the market with strong operating margins. As such, the late cycle conditions in the market reinforce our preference for large cap stocks over smaller, more U.S. domestically focused businesses. The U.S. Low Volatility factor’s underperformance is unlikely to reverse in the short term given the resilience of the U.S. economy. Furthermore, after a steep decline last quarter, we expect that cyclical value will find support in the near term, echoing the increased chance of slowing inflation without stalling economic growth. In Canada, equities are typically more cyclical in nature, which coupled with the potential for an earnings contraction, makes us view the Low Volatility factor as more likely to outperform. Like the U.S., we prefer Canadian high-quality companies to navigate through the late cycle environment. On the heels of poor Chinese economic data and underwhelming stimulus, we are maintaining our overweight to the U.S. relative to Canada and EAFE.

Downloadable Copy

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable Life of Canada® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy. -

GIA Coming to the Equitable FHSA

Many clients have already taken advantage of Equitable’s First Home Savings Account (FHSA), available on Pivotal Select™ Investment Class (75/75) and Pivotal Select Estate Class (75/100).

And now, we’ve got some more great news. We’re working to expand the Equitable® FHSA to include our Guaranteed Interest Account (GIA). But clients don’t need to wait to start earning tax-free income in a FHSA.

If clients want to open a FHSA now but may be interested in an Equitable GIA, simply choose the No-Load Equitable Money Market Fund Select investment option while we work on including the GIA on FHSA. The current yield to maturity is 5.41% gross.1

We will let you know when the GIA is available in FHSA in the coming months. Once it is available, advisors can speak to clients about the GIA options available in the FHSA and select what best suits their needs.

Don’t forget, clients who make a contribution to their FHSA, RRSP or TFSA between January 1 and February 29, 2024, could win $5,000 and you could win $1,000 in Equitable’s New Year’s Resolution, New Year’s Contribution Contest.2

For more information, please contact your Regional Investment Sales Manager.

1 As of January 16, 2024, 4.06% net after deducting the management expense ratio. Yield to Maturity: the market value weighted-average yield to maturity includes the coupon payments and any capital gain or loss that the investor will realize by holding the bonds to maturity.

2 Equitable’s New Year’s Resolution, New Year’s Contribution Contest: No purchase necessary. Contest period January 1, 2024, to February 29, 2024. Enter by making a deposit to an Equitable FHSA, TFSA or RRSP during the contest period or by submitting a no-purchase entry. One prize for a total value of $5,000 CAD to be drawn on March 8, 2024, will be awarded. The servicing advisor for the policy to which the selected entrant made the deposit is also an eligible winner and will receive a $1,000 CAD prize. For example, if an Equitable client is a winner of the $5,000 prize, the client’s servicing advisor wins a $1,000 prize. Open to legal residents of Canada of the age of majority. Odds of winning depend on number of eligible Entries received during the Contest Period. For full contest rules, including no-purchase method of entry, see the full contest rules.Posted January 17, 2024

-

Market Commentary April 2025

Key Takeaways for Q1

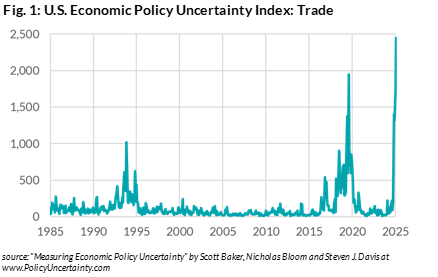

- Economic policy became more uncertain with fluctuating tariff announcements from the U.S. and its trading partners.

- Global stocks markets experienced heightened volatility year-to-date, reflecting the negative repercussions of tariffs for highly integrated global economies.

- Within U.S. markets, investors rotated out of growth stocks into value and defensive areas of the market.

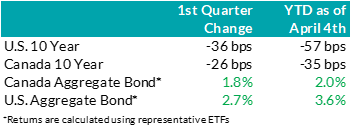

- Bond markets performed well during the quarter as interest rates moved lower.

- Most central banks continued to ease monetary policy by reducing their target interest rates. The U.S. Federal Reserve was a notable exception, electing to wait for greater clarity before lowering rates further.

Economic and Market UpdateEconomic Summary: In the U.S., the latest GDP data confirmed solid economic growth in 2024. However, as President Trump pushes forward his economic agenda, uncertainty surrounding fiscal policy and global trade have dampened market sentiment. Inflation pressures persisted, with the rate of inflation remaining above the central bank’s 2% objective. The labour market in the U.S. remained resilient, with unemployment rate staying low compared to historical norms. The Federal Reserve shifted to a more cautious approach, holding the policy rate steady through Q1 at the range 4.25% - 4.5%. The central bank raised its inflation forecast, lowered growth projections, and warned that “uncertainty around the economic outlook has increased.” U.S. bond yields were lower for most maturity dates during the first quarter, as the market priced in more growth concerns and anticipated more rate cuts from the Federal Reserve.

In Canada, recent GDP data showed stronger-than-expected growth. The inflation rate remained close to the 2% target but rose more than expected in February, and the labour market showed signs of improvement. U.S. tariffs continued to be a significant concern, and it is prompting businesses and consumers to become more cautious and slow their spending. The Bank of Canada warned that the economic impact of the tariffs could be “severe” and expected weaker growth in the coming quarters. For those reasons the Bank of Canada continued its easing cycle, cutting rates by 25 basis points at each of the January and March meetings, bringing the policy rate to 2.75%. Bond yields in Canada were also lower, with short-term interest rates decreasing faster than long-term interest rates as the Bank of Canada’s rate cuts outpaced market expectations.

Bond Markets: During Q1 2025, the FTSE Canada Universe Bond Index returned 2.0% as interest rates declined across all tenors. Although interest rates fell, this was partially offset by higher credit spreads (i.e. the extra yield on corporate bonds versus government bonds to compensate for their extra risk). Consequently, while corporate bonds still generated a positive return on the quarter, they underperformed government bonds. Widening credit spreads reflected the risk-off tone to the market, with on-off-on-off-on(?) tariffs contributing to the uncertainty. Lower-rated BBB bonds generally performed worse than higher-quality A-rated bonds. While credit spreads are higher than they were in December and January, they are still expensive compared to longer term averages. Corporate bond issuance remained robust up until the last week of March, as investor demand kept deals well supported. Overall, the market took in $40 billion in new issuance, the second highest on record, spread over 82 bonds. While corporate bonds are more attractive than in January 2025, we believe the more likely path is towards higher credit spreads as U.S. tariffs impact global growth. We have maintained our conservative view with a bias towards shorter-dated credit but remain ready to invest in longer dated corporate bonds as valuations become more attractive.

Stock Markets – Overview:

Uncertainty surrounding the scope and severity of new tariffs led investors to reassess global economic growth prospects and weighed on risk sentiment. As a result, the S&P 500 declined 4.3% over the quarter, underperforming Canadian and international markets. Within the U.S., investors rotated out of previously favoured growth stocks with loftier valuations – including members of the Magnificent 7 – into less volatile and value-cyclical companies. Meanwhile, Canadian equities returned 1.5% in Q1 despite ongoing trade negotiations and uncertain economic growth forecasts. Surging commodity prices helped the materials and energy sectors outperform, offsetting weakness in the technology and industrials sectors. Elsewhere, major developed markets from Europe and Asia (EAFE) were supported over the quarter by the introduction of a new German fiscal stimulus package and signs of improving Chinese economic growth. Following the quarter end, President Trump announced global tariffs on April 2nd, prompting some trading partners to hit back with retaliatory tariffs. The S&P 500 lost a record $5.2 trillion over two trading sessions and re-entered correction territory, with other global equity markets moving in tandem.

U.S. Equities: While the impact of tariffs has made investors more apprehensive, we have yet to witness a deterioration in financial performance. In fact, U.S. earnings continued to exceed forecasts last quarter, with approximately 70% of companies beating expectations. Furthermore, our bottom-up analysis shows that the skew of corporate earnings surprises continues to tilt positive. That said, we note that companies are providing more cautious guidance amid the increased economic uncertainty and that these earnings largely reflect conditions in 2024, not 2025. Notably, consumer stocks like Walmart have lowered growth forecasts for 2025, citing concerns surrounding consumer confidence and macroeconomic conditions. In addition to clouding the outlook, geopolitical shocks like sweeping tariffs may risk changing how companies choose to operate, including the structure of supply chains and sources of revenue. At this stage, it is still unclear how long these trade tensions will last, as that depends on how other countries choose to respond. If the tariffs are rolled back quickly, many companies may be able to absorb the temporary extra costs without serious damage to profits, and the broader economy could avoid lasting harm. But if the tariffs remain in place for a long time, the consequences could be much more serious; companies might have to change how they operate, restructure supply chains, and raise prices to deal with long-term pressure on profits.

Canadian Equities: Against the backdrop of worrisome trade developments, the Bank of Canada continued to ease monetary policy. While lower rates have helped Canadian companies report better-than-expected profit growth, consensus earnings expectations for 2025 have been revised 2% lower since the beginning of the year, reflecting the expectations for tariff headwinds. Falling bond yields made high quality, high dividend paying companies more attractive, helping this group outperform. Furthermore, the price of raw industrials – a basket of commodities – surged higher over the quarter and as a result, commodity-oriented companies benefitted. More specifically, the materials sector performed strongly with gold prices reaching new all-time highs throughout the quarter. However, if trade frictions continue to escalate and weaker growth projections materialize into a real economic slowdown, the Canadian market, given its cyclical nature and heavy reliance on commodity-driven businesses, remains particularly vulnerable to external headwinds. Moreover, given Canada’s weaker fundamental backdrop, we caution that the recent outperformance of Canadian equities relative to the U.S. may prove short-lived, particularly if trade tension persists.

Bottom line:

Heightened uncertainty surrounding global trade policies, coupled with deteriorating economic growth projections, continued to weigh on investor sentiment. Bond prices benefited from the flight to less-risky assets, with lower interest rates in anticipation of weaker economic conditions. In equity markets, the introduction of broad-based tariffs increased market volatility and drove major indices sharply lower year-to-date. Looking forward, we remain cautious of the recent outperformance of Canadian and international markets relative to the U.S. While tariffs began as a U.S. policy move, the ripple effects extend far beyond American borders, reflecting the systemic fragility that underpins global trade. If trade barriers persist, businesses may be forced to make structural shifts in their operations and review their current business models. Until markets achieve greater clarity on global trade policies, we continue to prioritize exposure to diversified large-cap stocks in the U.S., over defensive or growth-heavy positions. Within Canada, we continue to favour high quality, high dividend paying names with less sensitivity to downgrades in global growth.

Downloadable Copy

ADVISOR USE ONLYMark Warywoda, CFA

VP, Public Portfolio ManagementIan Whiteside, CFA, MBA

AVP, Public Portfolio ManagementJohanna Shaw, CFA

Director, Portfolio ManagementJin Li

Director, Equity Portfolio Management

Tyler Farrow, CFA

Senior Analyst, Equity

Andrew Vermeer

Senior Analyst, Credit

Elizabeth Ayodele

Analyst, Credit

Francie Chen

Analyst, Rates

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy.

-

EAMG Market Commentary October 2023

October 20, 2023

Rates & Credit - Interest rates increased steadily in Q3 against the backdrop of sticky inflation, strong economic growth, and a tight labour market. In Canada, corporate bonds outperformed government bonds and the broader FTSE Canada Universe Index during the quarter, with a loss of 2.2%, versus a loss of 4.4% for government bonds and a loss of 3.9% for the overall index. The outperformance was primarily driven by the fact that the corporate bond index is less sensitive to interest rates movements (as compared to the government index), all else being equal. The outperformance was also driven by an improvement in risk-appetite, with lower-rated BBBs slightly outperforming higher-rated A bonds. Industries with higher interest rate exposure such as infrastructure, energy, and communications underperformed those with less (notably financials and securitization), consistent with the overall shift in the yield curve.

Equities Lose Traction – Global equity markets lost momentum last quarter with the TSX declining 2.2% while major developed economies from Europe, Australasia, and the Far East (EAFE) fell 1.3% in local currency terms. U.S. equity markets, while falling approximately 3.3%, were cushioned by a strong greenback, with the index declining only 1% in Canadian dollar terms. With inflation prints continuing to be stubbornly high and employment data remaining strong, central bankers emphasized their commitment to a higher-for-longer approach to monetary policy. The hawkish tones out of the Federal Reserve pushed bond yields higher and consequently, pressured equities lower. Furthermore, mixed economic data out of China rattled investor sentiment over the quarter as global growth forecasts came under scrutiny.

U.S. Fundamentals – Although U.S. earnings continue to contract on a year-over-year basis, companies surpassed expectations with investors remaining highly focused on signs of deteriorating operating margins. After bouncing off Q1 2022 lows, forward earnings guidance continues to improve on a quarterly basis. Based on our analysis, ~35% of major companies revised earnings forecasts higher (+2% versus Q2) while ~33% held expectations constant, with the balance expecting deteriorating financial performance. Overall, improved efficiencies through cost-cutting measures and stronger-than-expected pricing power have contributed to resilience in operating margins, and therefore renewed optimism about forecasted financial performance.

Equal Weight S&P 500 versus S&P 500 – Persistent crowding into mega-cap technology stocks – which has driven the majority of market returns year-to-date in the U.S. – slowed at the beginning of the summer before reaccelerating into quarter end. The persistence of this trend has resulted in the equal-weighted version of the S&P 500 index returning a mere 1.8% over the first three quarters of the year, markedly lower than the 13.1% return observed from the S&P 500. We continue to emphasize that a crowded market surge is not uncommon during late stages of the economic cycle, and we remain focused on delivering optimal risk-adjusted returns with quantitative factors.

U.S. Quant Factors – The quality-growth areas of the market continued to outperform last quarter with market participants seeking large cash-rich companies with innovative product offerings and stable operating margins. That said, the pricing power of these companies has weakened more recently with consumers having depleted pandemic-era savings and stimulus. As such, fundamentals are beginning to appear overvalued. Low volatility stocks (i.e. stocks with lower sensitivity to broad market movement and lower price volatility) performed in-line with the overall market for most of the summer before underperforming into quarter-end when crowding into big-tech returned. While top-line projections are forecasted to post stable growth, the basket’s relatively lower operating margins remain a headwind amid surging interest rates. Dividend growth companies, which include businesses with a lengthy and established history of increasing dividends, performed approximately in-line with the broader index over the quarter. With the market forecasting overly-negative fundamental performance, this factor is positioned as a contrarian opportunity in the market.

Canadian Fundamentals – Unlike those in the U.S., Canadian companies reported shrinking operating margins in general, pressuring equity pricing. Like in the U.S., Canadian corporate earnings were mostly consistent with expectations but continue to contract on a year-over-year basis. The energy sector benefitted from a ~30% increase in oil prices during the quarter, as OPEC’s restrictive oil production schedule pushed crude markets deeper into under-supplied territory. Those higher energy prices buoyed performance of stocks in the energy sector, one of only two sectors with positive performance during the quarter, helping partially offset softer-than-expected results out of the financials and communications sectors. Meanwhile, the Bank of Canada continued with its hawkish monetary policy by raising its overnight interest rate by another 25 basis points, bringing it to 5%. Their efforts to slow economic growth are beginning to cause some deterioration in fundamentals and, with one quarter remaining, analysts are expecting Canadian earnings to contract ~9% for the year.

Canadian Quant Factors – With central banks around the world continuing to hike interest rates and uncertainty surrounding China’s economic health, global growth prospects fluttered over the quarter. The cyclical nature of the Canadian market, and therefore its reliance on global partners, saw equity prices put under pressure by growth concerns. As a result, the quality bucket benefitted from defensive positioning by investors and thus resumed its climb in Canada. Investors continue to prefer mature, large businesses that are better positioned in a restrictive economic environment due to their more stable operating margins. The value factor – which was beaten down in Q2 – rebounded last quarter with supply-driven energy strength helping to propel energy stocks higher. Low volatility initially displayed similar performance to the TSX, but energy’s rapid surge into the end of summer pressured the group lower. Given higher risk-free rates, the dividend factor also underperformed over the quarter, with dividend yields becoming less attractive on risk adjusted basis.

Views From the Frontline

Rates – Both nominal and real – rose sharply in Q3 to levels not seen since the Great Financial Crisis of 2008. A healthy labour market, strong consumer spending, persistent inflation and excess supply concerns drove the interest rate increase. Although the economy is starting to witness a deceleration in consumer spending and tighter credit conditions, central banks remain committed to maintaining a higher policy rate for longer to bring inflation back to the 2% target.

Credit – The risk premium for corporate bonds (versus government bonds) has been range-

bound over the past quarter as investors’ evaluations of a variety of scenarios have evolved: soft-landing versus a recession, geopolitical uncertainty, further central bank increases, among other things. On the balance, we do not think the current risk premium adequately compensates for downside risk, and as such, we remain cautious on corporate bonds and have a bias towards higher-quality, shorter-dated credit where we view the risk / reward dynamic as being more favourable.

Equities – Geographically, we began the quarter with a preference for U.S. equities relative to Canada and EAFE. In-line with our expectations, U.S. stocks outperformed the two regions in Canadian dollar terms. That said, weakness in the Euro versus the Canadian dollar was a headwind for our EAFE exposure. With earnings yield – which is the percentage of earnings relative to price – becoming less attractive compared to risk-free rates in the U.S., and the greenback strength becoming overstretched from a technical perspective, we have pared back our overweight U.S. position. Moreover, with Chinese officials focusing efforts on the introduction of new stimulus packages, we believe that more cyclical markets like Canada and EAFE will retrace some of their losses in the near term. Within the U.S., we entered Q3 with a constructive view on high quality growth segments of the market that provide strong operating margins during the current late economic cycle conditions. The factor moved in-line with our expectations, as highlighted in the “U.S. Quant Factor” section, and we are tactically decreasing our exposure amid stretched fundamentals. In Canada, we continue to prefer high-quality companies due to their strong fundamentals, with the group currently displaying momentum versus the broader TSX. Tactically, we are participating in the oil supply shock through the value factor.

Downloadable CopyMark Warywoda, CFA

VP, Public Portfolio ManagementIan Whiteside, CFA, MBA

AVP, Public Portfolio ManagementJohanna Shaw, CFA

Director, Portfolio ManagementJin Li

Director, Equity Portfolio Management

Mohamed Bouhadi, CFA

Senior Analyst, Rates

Tyler Farrow

Analyst, Equity

Andrew Vermeer

Analyst, Credit

Elizabeth Ayodele

Analyst, Credit

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable Life of Canada® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy.

Posted November 3, 2023 -

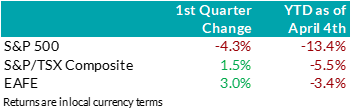

EAMG Market Commentary January 2024

Rates & Credit – Interest rates decreased sharply in Q4 as the market priced in aggressive interest rate cuts by central banks in 2024. The prospect of lower interest rates also drove a strong risk-on tone to the market, with the risk premium on corporate bonds grinding tighter as prospects for a “soft landing” improved. The rally in interest rates resulted in the best quarter for bonds over the past 15 years, with the FTSE Canada Universe Index returning 8.3%. Corporate bonds modestly underperformed the Universe Index with a return of 7.3%. The lower return for corporate bonds was primarily driven by the fact that the corporate bond index is less sensitive to interest rate movements (as compared to the government index), partially offset by the risk-on tone to the market. Within corporate bonds, lower-rated BBBs outperformed higher-rated A bonds. Industries with higher interest rate exposure such as infrastructure, energy, and communications outperformed those with less exposure (notably financials and securitization), consistent with the overall shift in the yield curve.

.png)

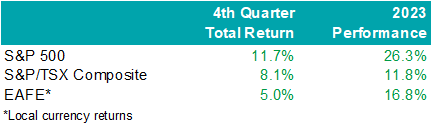

Santa Came to Town – Moving in sync with bonds, global equities jolted higher into the end of the year with cooling inflation data and dovish comments from central bankers. The U.S. market outperformed most regions last quarter with the S&P 500 returning 11.7% in USD terms, bringing the total return in 2023 to 26.3%. The TSX added 8.1% in Q4, boosting the total annual return to 11.8%. Meanwhile, major developed economies from Europe, Australasia, and the Far East (EAFE) gained 5.0% in local currency terms over the quarter, helping the region produce a 16.8% return from the year prior. Prospects of interest rate cuts by the Federal Reserve saw the Loonie rally into year-end and resultantly, investors of Canadian dollar securities witnessed enhanced returns. Strong domestic U.S. economic data helped value pockets of the market outperform. That said, this was not a synchronized trend as China’s economic disappointment weighed on the performance of EAFE.

U.S. Fundamentals – Our work shows that investors are shifting their focus away from operating margins and towards the ability to sustain debt levels ahead of renewing debt obligations. Corporate earnings beat modest expectations last quarter, contracting by less-than-expected on a year-over-year basis. Resilient operating margins continue to attract investors into equities. After three consecutive quarters of improving forward earnings guidance, we observed that the number of major companies expecting deteriorating financial performance grew to ~35%. We note that this is a sharp contrast relative to the optimistic run-up in equity valuations. In general, corporate pessimism has been underpinned by concerns for the health of the consumer, increasing wage pressures, and inflation.

U.S. Quant Factors – While mega-cap technology stocks gave back some ground in the second half, crowding into the magnificent 7 remains noticeable with the cap weighted S&P 500 outperforming the equal weighted index by 12.5% last year. That said, value areas of the market – which underperformed through the first three quarters of the year – were top performing companies last quarter as the prospects for an economic “soft-landing” improved with U.S. inflation continuing to ease without substantial deteriorations of employment or output data. Quality-growth businesses initially outperformed as the higher-for-longer narrative continued to drive investors toward large cash-rich companies with stable margins. That said, this basket of companies gave back relative returns into quarter-end as weakness in operating margins persisted, making fundamentals appear stretched. Low volatility stocks (i.e. stocks with lower sensitivity to broad market movement and lower price volatility) rallied to start the quarter before dovish comments from central bankers improved risk-sentiment and ultimately pushed this basket lower on a relative basis. Lastly, dividend growth companies, which include businesses with a lengthy and established history of increasing dividends, underperformed the broader index as market participants punished businesses that slowed capital growth projects during the rising interest rate environment. While operating margins have declined, the basket’s strong cash flow and low debt burden may be advantageous if the market’s anticipation of impending interest rate cuts proves to be incorrect or mistimed.

Canadian Fundamentals – Although Canadian companies exceeded bleak forecasts last quarter, earnings continue to contract on a year-over-year basis. Return on equity (ROE) – a gauge of how efficiently a corporation generates profits – continued to decline last quarter while corporate costs of capital remain elevated. In essence, Canadian companies are generating less value relative to their financing cost. Value creation underpins the sustainability of dividend payments, which are a unique and desirable attribute of the Canadian market. Meanwhile, the Bank of Canada held its overnight interest rate unchanged with market participants forecasting a higher probability of interest rate cuts in 2024. On the expectations of easing monetary conditions, dividend yields compressed while earnings forecasts improved with analysts predicting that index aggregate earnings will grow 6% to 8% in 2024. At a sector level, the energy industry’s financial performance normalized – in line with expectations – as weakening oil demand expectations overshadowed geopolitical conflict in the Middle East, ultimately pushing crude prices ~21% lower last quarter. The industrials and financials sectors beat expectations, helping offset softer-than-expected results from the consumer staples and technology sectors.

Canadian Quant Factors – The Canadian banks underperformed for most of the year as they reported increasing provisions for nonperforming loans, reflecting forecasts of worsening economic conditions. That said, expectations of interest rate cuts in 2024 helped tame recession fears and eased concerns of slowing loan growth, propelling banks higher in the fourth quarter as they appeared more stable and therefore favourable than prior estimates. The high-quality basket underperformed last quarter as improving risk sentiment in the market reduced the attractiveness of secure companies with lower earnings variability. Furthermore, high dividend payers with solid growth prospects outperformed in the fourth quarter as market participants rewarded companies that demonstrated a strong ability to support future dividends and punished high yielding businesses with less certain financial capabilities.

Views From the Frontline Rates – Interest rates declined sharply in Q4 as inflation continued to trend lower, fears of excess bond supply declined, and the Federal Open Market Committee signaled that the next change to their overnight policy interest rate would likely be lower. Labour market and consumer spending data remain resilient however businesses have indicated slowing across industries, more price-sensitive consumers, rising delinquencies, and concerns about the high cost of debt. Central banks remain committed to achieving their 2% inflation target and most acknowledge that interest rates have likely peaked.

Credit – The risk premium for corporate bonds (versus government bonds) tightened materially over the quarter, with a strong risk on tone to the market as investors priced in lower interest rates in 2024 and a “soft-landing” to economic concerns. Corporate bond supply was well received by the market. On the balance, we do not think the current risk premium adequately compensates for downside risk, and as such, we remain cautious on corporate bonds and have a bias towards higher-quality, shorter-dated credit where we view the risk / reward dynamic as being more favourable.

Equity – In the U.S., we allocated exposure to value names which outperformed over the quarter as the macroeconomic outlook improved on the backdrop of rate cut expectations. Looking forward, we expect that margins will continue to normalize as Covid-induced pent up demand fades. While we do not forecast margins to compress at an alarming rate, we believe sticky wage and input costs will continue to pressure businesses while consumers exhibit further exhaustion. As such, we are shifting our focus toward the balance between company reinvestment in capital projects and upcoming debt refinancing requirements. In line with this view, we favour businesses with stable cash flows and decreased debt loads as we believe they present an attractive contrarian opportunity if soft-landing projections prove to be overstated. Within Canada, we remain attentive to the inverse movements of ROE relative to financing costs over 2023. With the excess between ROE and financing costs compressing, businesses’ ability to create value appears more stretched than earlier in 2023. Therefore, we continue to favour high quality companies in Canada, which is typically defined by high ROE, stable earnings variability, and low financial leverage. Geographically, the U.S. economy appears to be in healthier condition with inflation easing while employment and output data remain stable and hence, our focus will be on capital expenditures. EAFE – which is generally more economically linked to China than North America – contains a large bucket of stable, high-quality businesses that may benefit from any upside economic surprises out of China. Lastly, through the lens of a Canadian investor, the Loonie’s relative value versus other major currencies presents another resource in our investment mandate to derive excess return.Downloadable Copy

Mark Warywoda, CFA

VP, Public Portfolio ManagementIan Whiteside, CFA, MBA

AVP, Public Portfolio ManagementJohanna Shaw, CFA

Director, Portfolio ManagementJin Li

Director, Equity Portfolio Management

Tyler Farrow, CFA

Senior Analyst, Equity

Andrew Vermeer

Senior Analyst, Credit

Elizabeth Ayodele

Analyst, Credit

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy.

-

Equitable Life Group Benefits Bulletin - September 2020

In this issue:

Enhancements to Equitable EZClaim Mobile

New reports available on EquitableHealth.ca* Indicates content that will be shared with your clients.

Enhancements to Equitable EZClaim® Mobile*

We’ve updated our Equitable EZClaim mobile app to process vision claims faster, to provide a new option for submitting documents and to increase password security.

Faster vision claims processing and payment

Equitable Life now provides faster processing of vision claims submitted via EZClaim Mobile.

This means plan members can find out the status of their vision claim almost instantaneously. And, for approved claims, they will receive payment even sooner – often in as little as 24 hours.

In order to allow for instant processing and faster payment, plan members will be prompted to enter some additional information, including their practitioner’s name, the date of the expense, the type of expense and amount of the expense when submitting their claims for these services.

Equitable Life plan members can submit all vision claims via Equitable EZClaim, including coordination of benefits and Health Care Spending Account claims.

Submit documents from a mobile device

We have added our Document Submission tool to EZClaim Mobile so plan members can conveniently submit documents directly from their mobile device. Applications, change forms, statement of health forms and more can all be easily uploaded whenever and wherever they are.

Improved security with stronger passwords

To help you, your clients and plan members better protect personal information, we have increased the maximum length of passwords for both EZClaim Online and EZClaim Mobile from 12 to 32 characters. This longer character limit makes it easier to create stronger and more secure passwords.

There is no change for plan members, plan administrators or advisors. All existing passwords will continue to function. However, if you choose to update your password you will now be able to choose longer passwords or passphrases.

Why should I change my password?

Changing your password frequently helps keep your information safe. The longer and more random the password, the more secure it is. To improve security even more, a passphrase is recommended.

A passphrase is a series of words or other text used like a password. Because it is much longer, a passphrase is more secure. Although the words in the phrase may be meaningful to you and easy to remember, they can be random enough that the full phrase is difficult for someone else to guess. It’s even better if you use numbers or other characters in your passphrase.

Your passphrase should be:

- Long enough to be hard to guess;

- Not a famous quotation;

- Easy to remember and type; and

- Not used in multiple places.

To change your password:

- Log in to EquitableHealth.ca

- Click on My Information > User Profile

- Click Edit

- Confirm your information and enter your new password

- Click Save

We will be announcing this enhancement to plan members on EquitableHealth.ca.

New reports available on EquitableHealth.ca*

Plan administrators and advisors with reporting access can now download three additional reports any time via the plan administrator and advisor websites on EquitableHealth.ca:

- Premium and Tax – This report provides a breakdown of premiums and taxes paid per plan member for any specific time period for all applicable benefits.

- Occupation and Earnings – This report provides current plan member earnings and occupation information and gives plan administrators an efficient way to report updates to us.

- Employee listing – This report lists all plan members’ information, including name, certificate number, date of birth, province, occupation and salary, as well as benefit coverage currently in place and HCSA allocations.

These reports can be downloaded in Excel format for easy updating, filtering or sorting.

For more information, please contact your Client Relationship Specialist.

*Indicates content that will be shared with your clients

-

EAMG Market Commentary August 2022

August 2022

The S&P 500 fell into bear market territory over the first half of 2022 with the index down -20.6%. This represented a top 10 ranking amongst the most dismal back-to-back quarterly performances going back to 1928. While comparisons have been made to the inflation driven bear market of 1973-74, the economic backdrop today has some significant differences including greater production capacity (factory utilization rates are running about 20% lower vs the 70’s) and a meaningful decline in raw industrial prices which have fallen -11% over the quarter. While these economic anecdotes are potential positives for the future, it’s important to remain cognizant that prices remain elevated.

As such, the US Federal Reserve seems to be taking every opportunity to telegraph their intentions of raising interest rates at the expense of both market and economic performance, so long as inflation remains a threat. Given this hawkish tone, the market narrative has morphed from fears of inflation to a fed driven recession. As a result, the move in the bond market has been swift with the 10-year treasury yield peaking at approximately 3.5% in June to today’s level of 2.7% (lower rates = higher bond prices). This positive bond performance reflects the consensus view that inflation is temporary (2023 CPI forecasts are approximately 3.6% vs the second quarter’s 8.7% CPI reading) and could allow the Fed to adjust their higher interest rate trajectory downward. The Fed also remains confident that a soft landing is achievable, and a recession avoidable.

Investors seem less convinced however, given the Fed has never been able to engineer a soft landing before, and so it’s no surprise equity markets entered a bear market over the quarter, and currently remain in a technical correction (defined as losses greater than -10%). To better assess future performance, we closely monitor earnings results to understand how companies are navigating these economic trends. With nearly 80% of the S&P 500 reported, the results have been better than expected, but still the EPS beat rate and magnitude of beats (actual vs expectation) remain below 5-year averages. This tells us companies are finding today’s economic conditions more challenging than the recent past. Consumer sectors including marketing, retail, autos and textiles posted the 2nd worst performance vs other sectors while the Financials sector saw the greatest challenges with aggregate EPS falling by -15% year-over-year. Wall Street analysts have started to revise S&P 500 forward growth estimates lower, a trend which we expect will continue for several quarters ahead. The forward (12-month blended) P/E ratio of 17.5 times remains 1.5 multiple points above the long-term average which potentially suggests risks may not be fully priced in.

In terms of the S&P/TSX Composite, after declining nearly -14% in Q2 as recession fears around the world jeopardized the global demand outlook, its’ since rebounded over 4.0%. Still, valuation remains below longer-term averages at 11.8x forward earnings with the heavier weighted Financials and Energy sectors trading at 9.5x and 7.9x, respectively. TSX earnings expectations have stalled as of late but downward revisions are lagging US and European counterparts. Additionally, the domestic labour market remains tight which has allowed the Bank of Canada to continue its aggressive rate hike path to curb soaring inflation. For most of 2022 the TSX has benefitted from surging commodity prices but an economic slowdown in China resulting from its commitment to a zero-Covid policy and a potential global recession could prove to be a challenge for the Canadian market.

Equity markets on average lose 30% of their value in recession led bear markets. If we use this as a potential road map, it suggests the S&P 500 could have further to fall. Using past performance as a forward-looking tool however is an imperfect technique and used in isolation of what’s happening today can often mislead.

Accounting for today’s backdrop, we come up with three scenarios of varying probabilities. The first is the most optimistic and includes an engineered soft landing by the Fed, meaning no recession and inflation cools. A less optimistic view is the fed tames inflation with higher interest rates but tips the economy into a mild-to-moderate recession. The outcome would be consumer spending and corporate hiring slow as a result of tighter financial conditions, and therefore financial results are negatively impacted. The least optimistic scenario is one where stagflationary conditions emerge as inflation continues to accelerate at the expense of growth despite higher interest rates, in other words the Fed loses control. The net result would be similar to our second scenario but with much more dire results in terms of unemployment, household spending and impacts to corporate profitability. While we don’t rule out any of the above scenarios completely, we assign the highest probability to the second one where macro economic issues get resolved at some point in the future, but the full effects of inflation and a possible recession have yet to be priced into the market. Currently, this view translates into a slight underweight equity position versus our benchmark with a tilt towards low volatility and defensive strategies along with an overlay of value and dividend paying securities. In other words, we’ve de-risked the portfolios relative to our benchmark to manage potential downside risks but remain meaningfully invested an on absolute basis. As always, time in the market tends to overcome trying to time the market, and so employing a strategic and diversified strategy is often the most prudent approach.

Downloadable Copy

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable Life of Canada® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy. -

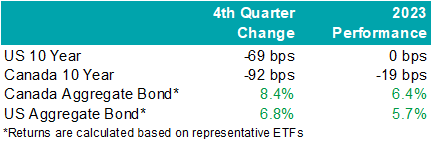

EAMG Market Commentary April 2024

April 2024

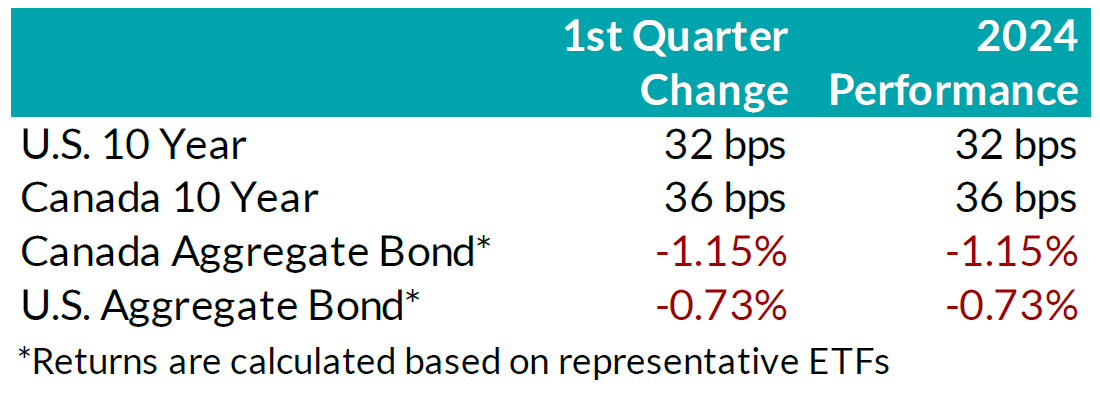

Rates & Credit – Interest rates increased in Q1 2024, giving back half of the decline experienced in Q4 2023 amid consistently positive surprises in U.S. economic data. The positive economic news also drove a strong risk-on tone to the market, with the risk premium on corporate bonds tightening as economic prospects improved. In Canada, corporate bonds outperformed government bonds and the broader FTSE Canada Universe Index (FTSE) with a slightly positive 0.07% return, verses a loss of 1.66% in government bonds and a loss of 1.22% for the overall index. More interest rate sensitive long-term bonds experienced the largest decline, which was partially offset in corporate bonds by the risk-on tone to corporate bond spreads. On a 6-month and 1-year basis, the FTSE remained positive at 6.94% and 2.10%, respectively. Within corporate bonds, lower-rated BBBs outperformed higher-rated A bonds, while industries with higher interest rate exposure such as infrastructure, energy, and communications underperformed those with less exposure (notably financials and securitization).

.png?width=850&height=303)

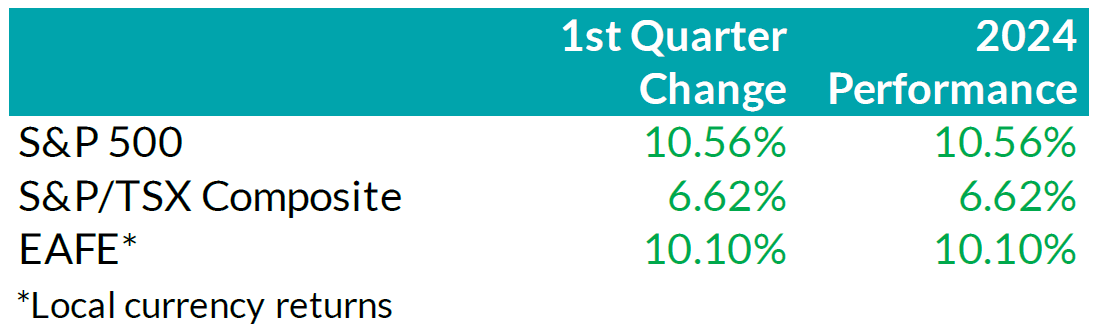

Equity Overview – Throughout Q1 2024, concerns about a recession gradually eased as central bankers adopted a more accommodative outlook on monetary policy. Their growing dovishness reflected confidence that the restrictive monetary measures were effectively curbing inflation as anticipated. Underpinned by prospects of an economic soft-landing, global equity markets rallied to start the year with most major North American indices soaring to new all-time highs during the quarter. U.S. equities continued to outperform other major international markets with the S&P 500 returning 10.6% in USD terms. Major developed economies from Europe, Australasia, and the Far East (EAFE) gained 10.1% in local currency terms, while the TSX added 6.6%. Furthermore, the U.S. economy continued to prove more resilient than most major developed economies, with strong employment and robust output data. As such, foreign investors of U.S. denominated securities achieved enhanced returns, benefitting from a stronger Greenback.

.png?width=850&height=260)

U.S. Fundamentals – Corporate earnings beat expectations in Q4 2023, triggering a wave of upward earnings revision. Stable operating margins, cash flows and debt loads continue to attract investors into equities. Investors appear focused on the company’s ability to sustain debt levels ahead of renewing debt obligations. We observed that the number of major companies that expect improving financial performance shrunk to ~19%. This suggests that concentration risks are likely brewing in the equity market, yet again.

U.S. Quant Factors

Optimistic run-up in equity valuations were mostly driven by the momentum factor. A basket of companies with positive price trends intensified concentration risk in the equity market. We note that momentum factor’ performance sharply contrasted fundamental factors, making us cautious on the market’s complacency. For context, high quality companies, which is typically defined by high Return on Equity (ROE), stable earnings variability, and low financial leverage, placed second in our risk-adjusted performance rankings, and is dwarfed by the ~ 17.9% return observed from the momentum factor.

Canadian Fundamentals – Against the backdrop of underwhelming financial results, ROE – a gauge of how efficiently a corporation generates profits – rebounded in Q4, 2023, after declining throughout most of the year. The improved efficiency metric provided a positive catalyst for dividend investors as the inverse movements of ROE relative to financing costs over 2023 kept investors on the sidelines. In addition, the CRB Raw Industrials Index, a measure of price changes of basic commodities, broke out of recent ranges, providing a tailwind for Canada’s energy and materials sector. Concerns with earnings contraction and macro-economic conditions have subsided.

Canadian Quant Factors – Crude prices soared higher in Q1 2024, with ongoing production cuts from OPEC+ and ramifications of geopolitical conflicts keeping oil markets undersupplied. As such, energy companies benefitted, surging higher and outperforming the broader index, while the low volatility basket – with lower exposure to cyclically sensitive business – underperformed into quarter end. Furthermore, Canadian banks underperformed to start the quarter, giving back some of the sharp outperformance witnessed into the end of Q4 2023. That said, soft inflation data increased expectations of impending rate cuts from the Bank of Canada and, as such, banks performed in line with the broader market throughout most of the quarter. Underpinned by expectations of a dovish switch in monetary policy, investors rewarded dividend payers with a history of increasing dividends, boosting confidence in their ability to support future dividend growth. It is important to note that investors should not let dividend growth’s outperformance overshadow high dividend paying companies’ underperformance; more specifically, investors remain attentive to the businesses’ ability to create value relative to financing costs.

Views From the Frontline

Rates – Interest rates in both Canada and the U.S. increased across all bond tenors in Q1 2024. U.S. inflation data surprised to the upside, remaining stubbornly higher than hoped, while labour market and consumer indicators underscored the economy's continued strength. In Canada, inflation data fell below forecasts, but early 2024 GDP readings exceeded expectations. The market now anticipates a 'soft landing' for the U.S. economy; however, the Canadian economy continues to slow. North American central banks have signaled that we are at the peak for policy rates. The market is currently pricing in approximately two-to-three, 25 basis point interest rate cuts by the U.S. Federal Reserve in the second half of 2024, much fewer than the six-to-seven 25 basis point interest rate cuts that the market had been anticipating even just three months ago. As the Swiss central bank led the way with the first rate cut among developed countries, central banks in major developed economies will closely monitor upcoming data and market developments to determine the timing and pace for rate cuts.

Credit – The risk premium for corporate bonds (versus government bonds) continued to tighten over the quarter, with a strong risk-on tone to the market as investors priced in renewed economic growth in 2024 as compared to previous expectations. Corporate bond supply was robust, with $38.2bn in new issuance, the second strongest first quarter on record. On the balance, we do not think the current risk premium adequately compensates for downside risk, particularly in longer-dated corporate bonds, and have a bias towards shorter-dated credit where we view the risk / reward dynamic as being more favourable.

Equity – We favour a combination of the Dow Jones and the S&P500 for our broad market exposure. The Dow, a price-weighted index, should have some value and low volatility tilt as it tracks mature large companies. As explained above, concentration risks are brewing in the equity market, and during Q1 this risk was exacerbated by investors rushing into a basket of companies with positive price trends, thereby pushing valuation metrics further into the expensive territory. In our view, it is well-suited to use a combination of the Dow Jones Industrial Average and the S&P 500 for broad U.S. market exposure given the heightened concentration risk. Looking forward, we expect companies to exhibit stable operating margins and therefore, we are shifting our focus toward the balance between upcoming corporate debt refinancing requirements and reinvestment in projects intended to drive future growth. In plain words, we are tactically adding to companies with stable cash flows and decreased debt loads outside of the mega-cap group. In Canada, we expect a modest earnings growth and remain attentive to how efficiently a corporation generates profits relative to their financing cost. We caution against the overly optimistic, commodity driven, “catch-up” trade vs. our southern neighbour. Therefore, we tweaked our investment strategy by rotating out of the low volatility factor and adding to higher yielding quality companies in Canada.

Downloadable Copy

Mark Warywoda, CFA VP, Public Portfolio Management Ian Whiteside, CFA, MBA AVP, Public Portfolio Management Johanna Shaw, CFA Director, Portfolio Management Jin Li

Director, Equity Portfolio ManagementTyler Farrow, CFA

Senior Analyst, EquityAndrew Vermeer

Senior Analyst, CreditElizabeth Ayodele

Analyst, CreditFrancie Chen

Analyst, Rates

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy.

-

Market Commentary January 2025

Key Takeaways

Full year 2024:

-

Despite reductions of policy-setting interest rates by central banks, yields on longer-term bonds finished the year higher than they started the year.

-

Positive risk appetite helped corporate bonds perform well, led by lower-quality issuers.

-

Global equity markets posted robust returns, with U.S. equities outperforming other developed markets, driven by heavy concentration into the ‘Magnificent 7’ stocks.

Fourth Quarter:

-

Central banks continued to ease monetary policy in Q4, with the Bank of Canada cutting its policy interest rate more aggressively than did the U.S. Federal Reserve.

-

The Republican victory across both the executive and legislative branches in the U.S. ignited expectations of economic growth, pushing bond yields and stock prices higher.

-

Risk sentiment helped corporate bonds continue to outperform government bonds.

-

Markets remained volatile: while North American stock markets continued to outperform most international indices, Canadian stocks managed to outperform U.S. stocks in Q4, as sources of returns in the U.S. narrowed into year-end.

Economic and Market Update

Economic Summary: In the U.S., economic activity continued to expand at a solid pace in Q4. The rate of inflation continued to slow but remained above the central bank’s 2% objective. The labour market in the U.S. remained resilient, as the unemployment rate has remained low compared to historical norms. A decisive victory for Donald Trump and the Republican Party further boosted expectations for continued growth. The return of the President-elect’s old tactics of threatening tariffs to influence trade, security, and drug control re-introduced some economic uncertainty, particularly regarding the potential return of inflationary pressures. Those concerns prompted the Federal Reserve to slow the pace of its policy easing, as it lowered rates by just 0.25% at each of its two meetings in Q4, following the 0.50% cut in September. Throughout 2024, the Fed reduced rates by a total of 100 basis points, from 5.50% to 4.50%. Nonetheless, bond yields were significantly higher for most maturity terms during the fourth quarter as the market priced in not just a stronger economy than had been the expectation during Q3, implying less interest rate cuts by the Fed, but also growing concerns about the government deficit.

In Canada, growth remained positive during 2024 and improved a bit to close the year, but continued to fall short of the Bank of Canada’s expectations. Similarly, inflation came in lower than expected and below the Bank’s 2% target. The labour market continued to soften for much of the year, with employment growth falling short of labour force growth. The weakness in the labour market and economy, along with tamed inflation, prompted the Central Bank to cut rates at the pace of 50 basis points at each of its two meetings in Q4. For the full year, the Bank of Canada ended up lowering its policy rate by a total of 175 basis points, from 5% to 3.25%. The market has been expecting the Bank of Canada to need to continue cutting rates due to slower economic growth in Canada, but the fear of a possible trade war with the U.S. has made the economic outlook somewhat murkier.

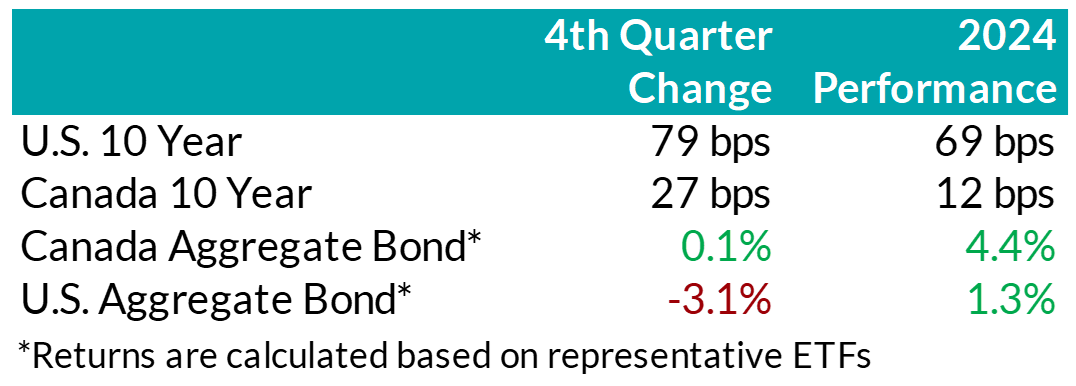

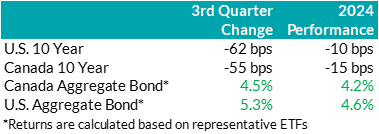

.png)

Bond Markets: During the quarter, yields on mid- to long-term bonds in Canada rose in sympathy with rising bond yields in the U.S. However, bond yields in Canada rose to a lesser extent, and yields on shorter-term bonds were actually little changed over the quarter. The FTSE Canada Universe Bond Index was basically flat during Q4 and posted a return of 4.2% for the full year. Although interest rates rose, credit spreads (i.e. the extra yield on corporate bonds versus government bonds to compensate for their extra risk) continued to grind lower, helping corporate bonds post positive overall returns in the quarter. Tightening credit spreads reflected the generally positive risk-on tone to the market, despite some volatility. Lower-rated BBB bonds generally performed better than higher-quality A-rated bonds. Credit spreads have now generally fallen back to levels similar to those experienced in 2021, when markets did quite well after the pandemic. The on-going appetite of investors for the extra yield offered by corporate bonds over government bonds is indicated not just by falling credit spreads, but also by investors’ enthusiasm to support the primary issuance market. Corporate bond supply continued to be very robust in the quarter, with $30 billion in new issuance, resulting in a record-breaking year with $141 billion of new issuance in 2024. Nonetheless, on balance, we do not think the current risk premium adequately compensates for downside risk, particularly in longer-dated corporate bonds, and have a bias towards shorter-dated credit where we view the risk / reward trade-off as being more favourable.

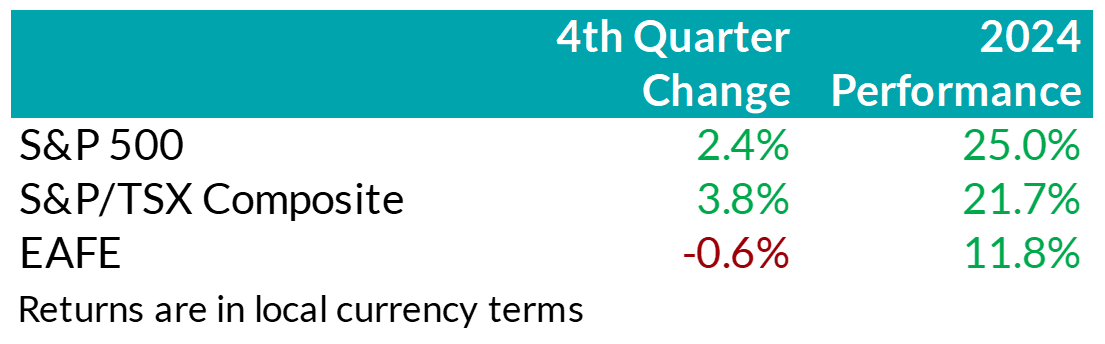

.png) Stock Markets – Overview: Trump’s presidential victory and the Republican party’s ‘red sweep’ in the Senate and House of Representatives sparked optimism surrounding economic growth and a new era of U.S. exceptionalism. As a result, North American equity markets extended their rally in Q4, capping off a year of robust returns. The S&P 500 returned 2.4%, bringing its year-to-date return to 25%. Within the U.S., the broadening of returns paused during the quarter as the chase for growth intensified, with mega-cap growth names like Tesla driving performance. Canadian equities surprisingly outperformed the U.S. market over the quarter, returning 3.8% in Q4, despite threats of widespread tariff negotiations looming on the horizon that could negatively impact Canadian corporate fundamentals. At a sector level, strength in the technology, financials, and energy sectors more than offset weakness in telecommunication companies as well as in the materials sector. Elsewhere, major developed markets from Europe and Asia (EAFE) underperformed last quarter as deteriorating Chinese growth prospects and weak economic growth in the Eurozone weighed on equities. Notably, foreign investors of U.S. denominated securities benefitted from a rebounding U.S. dollar with the dollar index adding over 7.6% in Q4.

Stock Markets – Overview: Trump’s presidential victory and the Republican party’s ‘red sweep’ in the Senate and House of Representatives sparked optimism surrounding economic growth and a new era of U.S. exceptionalism. As a result, North American equity markets extended their rally in Q4, capping off a year of robust returns. The S&P 500 returned 2.4%, bringing its year-to-date return to 25%. Within the U.S., the broadening of returns paused during the quarter as the chase for growth intensified, with mega-cap growth names like Tesla driving performance. Canadian equities surprisingly outperformed the U.S. market over the quarter, returning 3.8% in Q4, despite threats of widespread tariff negotiations looming on the horizon that could negatively impact Canadian corporate fundamentals. At a sector level, strength in the technology, financials, and energy sectors more than offset weakness in telecommunication companies as well as in the materials sector. Elsewhere, major developed markets from Europe and Asia (EAFE) underperformed last quarter as deteriorating Chinese growth prospects and weak economic growth in the Eurozone weighed on equities. Notably, foreign investors of U.S. denominated securities benefitted from a rebounding U.S. dollar with the dollar index adding over 7.6% in Q4.

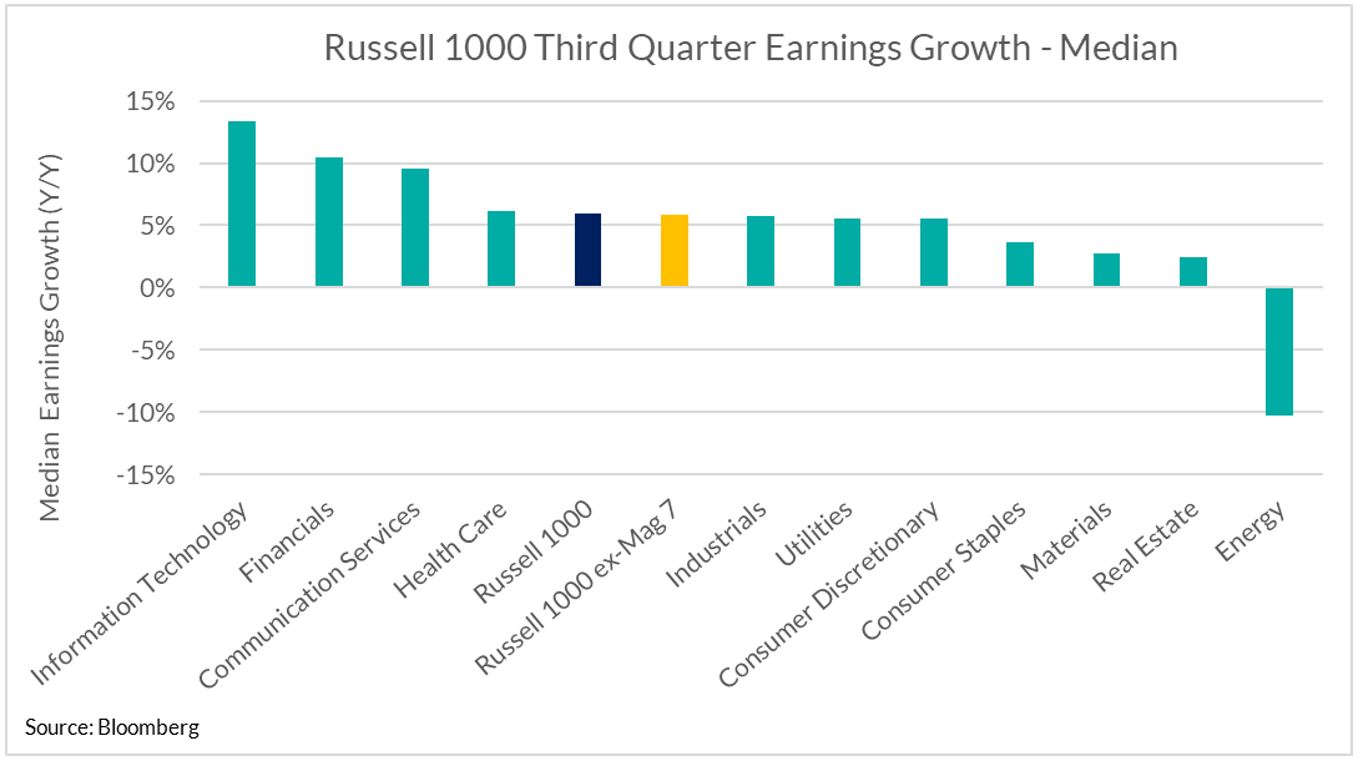

.png) U.S. Equities: U.S. equities remain supported by resilient margins and strong corporate earnings growth with over 70% of businesses surpassing bottom-line expectations last quarter. We remain attentive to the broadening of earnings performance and note that this trend has continued, albeit at a normalized pace versus prior quarters. More specifically, our work shows that members of the Russell 1000, excluding the Magnificent 7, posted median earnings growth of 6% last quarter, down from nearly 9% in Q3 but comparable to Q2 (6%). Looking forward to 2025, analysts continue to forecast U.S. exceptionalism, with forecasts of ~12% earnings growth.

U.S. Equities: U.S. equities remain supported by resilient margins and strong corporate earnings growth with over 70% of businesses surpassing bottom-line expectations last quarter. We remain attentive to the broadening of earnings performance and note that this trend has continued, albeit at a normalized pace versus prior quarters. More specifically, our work shows that members of the Russell 1000, excluding the Magnificent 7, posted median earnings growth of 6% last quarter, down from nearly 9% in Q3 but comparable to Q2 (6%). Looking forward to 2025, analysts continue to forecast U.S. exceptionalism, with forecasts of ~12% earnings growth.

Following Trump’s presidential victory, stocks with greater sensitivity to the U.S. economy, such as small cap businesses, benefitted from expectations of domestically focused growth initiatives. However, stubborn inflation and expectations of fewer interest rate cuts by the Federal Reserve saw the trend of broadening sources of returns pause into the end of the year. Instead, market concentration reaccelerated with investors rushing back towards mega-cap growth stocks. In fact, Tesla – which is approximately 2% of the S&P 500 Index by market cap – contributed approximately one-third of the total index return in Q4, while the Mag 7 as a group contributed over 100% of total returns. In other words, U.S. large cap companies excluding the Magnificent 7 declined in aggregate last quarter.

Canadian Equities: Against the backdrop of cooling inflation and below-trend growth, the Bank of Canada continued to loosen monetary policy. As a result, Canadian companies

showed signs of improving efficiency with return on equity – a gauge of corporate profitability – improving versus prior quarters. Under these conditions, investors remained focused on higher quality, high-dividend paying companies – particularly within the financial sector. Relative to prior quarters, this group witnessed greater contribution out of non-bank financials (such as asset managers and insurance companies), as the premium investors were willing to pay for Canadian banks remained elevated. Across other sectors, the energy sector had a positive quarter as the price of oil stabilized, but falling prices for raw industrials pushed the materials sector lower.

Bottom line: U.S. political developments and subsequent growth expectations dominated market sentiment last quarter. As a result, investors dialed back rate cut expectations and bond yields moved higher. In equity markets, the potential for an era of higher-for-longer rates prompted a resumption of investors crowding into growth stocks. Going forward, we remain cautious of elevated valuations and continue to prioritize diversified sources of returns with a long-term outlook. Nonetheless, despite rich valuations, our base case remains that investors’ enthusiasm for equities will persist in the near-term and stocks should continue to outperform bonds.

Downloadable Copy

ADVISOR USE ONLYMark Warywoda, CFA

VP, Public Portfolio ManagementIan Whiteside, CFA, MBA

AVP, Public Portfolio ManagementJohanna Shaw, CFA

Director, Portfolio ManagementJin Li

Director, Equity Portfolio Management

Tyler Farrow, CFA

Senior Analyst, Equity

Andrew Vermeer

Senior Analyst, Credit

Elizabeth Ayodele

Analyst, Credit

Francie Chen

Analyst, Rates

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy.

-

-

Market Comments - October 2024

Key Takeaways for Q3· Central banks eased monetary policy by reducing their target interest rates.

· Bond markets performed very well during the quarter as interest rates fell.

· Risk markets experienced some volatility, but stock markets had robust returns.

· Canadian stocks outperformed U.S. stocks in Q3, while the sources of returns in the U.S. market were more balanced and diversified than in the first half of the year.

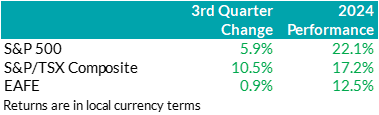

Views From the Frontline