Site Search

961 results for life policy 300109556

-

Kickoff to 2023 with Equitable Life and Robert Gignac

Equitable Life® is pleased to present Robert Gignac, author of the book ““Rich is a State of Mind”. Robert will deliver his new “Stop Playing Chess in a PokerStars World” presentation. Robert’s engaging presentation offers examples of what clients (and prospects) are struggling with today and how advisors can take a leadership role by changing from a one-dimensional game (chess) to a multi-dimensional one (poker).

Your hosts, Cam Crosbie, Vice President, Savings & Retirement and Joseph Trozzo, Investment Sales Vice President, MGA, will highlight some of the ways Equitable Life can help make 2023 a great year.

Learn More

Posted: December 23, 2022

Continuing Education Credits

This webinar has been submitted for continuing education (CE) approval with the Insurance Council of Manitoba and Alberta Insurance Council for all provinces excluding Quebec. Upon approval, you will be sent an email notification to come back to the webinar presentation console to download your personalized certificate from the tool bar. To be eligible for CE credits, you must register individually, watch the webcast in full and complete a short quiz. This webcast is available in English only.

® denote a registered trademark of The Equitable Life Insurance Company of Canada

-

Equitable Life Dynamic Global Real Estate Fund Select: More than an inflation hedge

Some clients may be missing out on the benefits of real estate investments. In addition to providing an inflation hedge, investing in real estate can help to diversify an investment portfolio and manage overall risk.

Check out Equitable Life Dynamic Global Real Estate Fund Select in this issue of Fund Focus.

The fund aims to achieve long-term capital appreciation and income by investing in publicly listed real estate companies across a spectrum of property types and geographies.

Reasons to Invest:- Access to high-quality and diversified real estate assets through public companies from around the world

- Real estate is an asset class highly sought after by pension funds and institutional investors

- The underlying Dynamic Global Real Estate Fund is the oldest real estate mutual fund in Canada (1996)

- A key pillar is protecting capital – manager focus is on providing downside protection

- Competitive MER of 2.64%*

Date posted: April 14, 2023

* effective December 31, 2022

™ or ® denote registered trademarks of The Equitable Life Insurance Company of Canada. -

Equitable Life webcast series presents Mackenzie Investments featuring Arup Datta

Arup will discuss Equitable Life® Mackenzie Emerging Markets Fund Select along with the fund's people, philosophy, process and performance.

Join your host, Cam Crosbie, Vice President, Savings and Retirement, and Arup Datta, MBA, CFA, Senior Vice President, Head of the Global Quantitative Equity Team for Mackenzie Investments.Learn More

Equitable Life continues to spotlight various aspects of our competitive fund lineup and product offerings. This series gives advisors an opportunity to:

• learn more about products and product features,

• hear from industry professionals,

• learn about investment strategies; and so much more.

Continuing Education Credits

This webinar has been submitted for continuing education (CE) approval with the Insurance Council of Manitoba and Alberta Insurance Council for all provinces excluding Quebec. Upon approval, you will be sent an email notification to come back to the webinar presentation console to download your personalized certificate from the tool bar. To be eligible for CE credits, you must register individually, watch the webcast in full and complete a short quiz. This webcast is available in English only.

® denote a registered trademark of The Equitable Life Insurance Company of Canada -

Equitable Life ClearBridge Sustainable Global Infrastructure Income Fund Select: Stability and diver

Although an often-overlooked asset class, infrastructure assets are physical assets that provide an essential service to society. Investing in infrastructure can offer stability and diversification in a well-balanced portfolio.

Check out Equitable Life® ClearBridge Sustainable Global Infrastructure Income Fund Select in this issue of Fund Focus. The fund aims to achieve long-term capital appreciation and income by investing in publicly listed real estate companies across a spectrum of property types and geographies.

Reasons to Invest:- ClearBridge has 50+ years as a leader in active management, with a focus on sustainable investing.

- An ESG (Environmental, Social and Governance) driven investment process: ESG factors are part of fundamental research and a bottom-up security selection process, and risks and opportunities are viewed through an ESG lens.

- Predictable income generation throughout the cycle: Invests in income-generating infrastructure assets, with cash flows underpinned by regulation or long-term contracts.

- Participation in global infrastructure renewal: Both developed and emerging economies are growing their infrastructure assets, producing new investment opportunities.

- Lots of flexibility - broad ranges for sector allocation and geographical allocation

For more information, check out the Equitable Life ClearBridge Sustainable Global Infrastructure Income Fund Select or contact your Regional Investment Sales Manager.

Date posted: July 20, 2023

™ or ® denote registered trademarks of The Equitable Life Insurance Company of Canada.

-

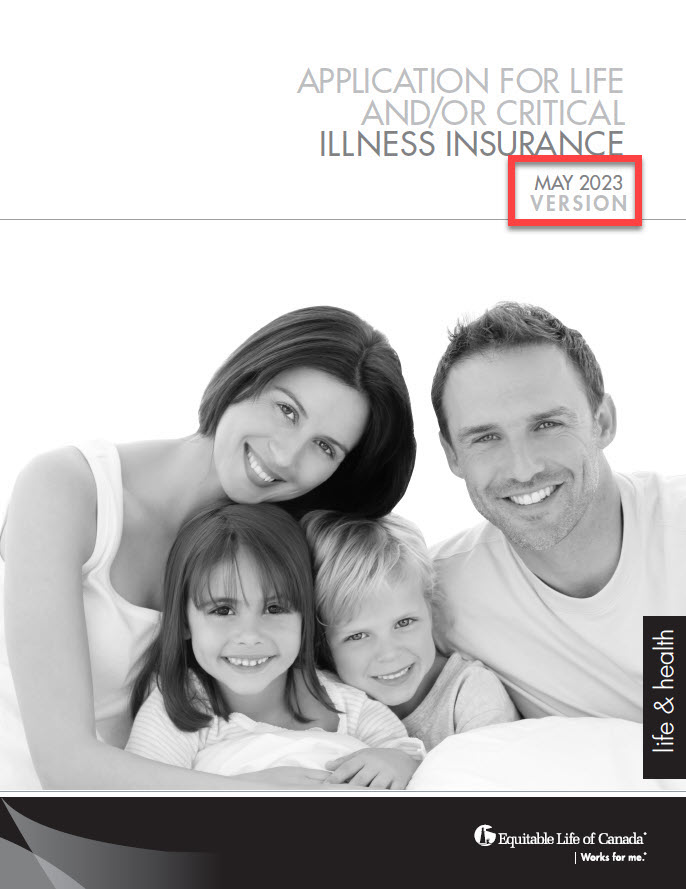

New 350 Life and CI Applications

On August 2nd, 2023, Equitable Life® will be updating the privacy and legal sections on some forms. This includes the form 350 Paper Application for Life and/or Critical Illness Insurance. This change will also be applied on our websites and our online application EZComplete®. These changes are part of Bill 64. The Bill is about the protection of personal and private information in Quebec. This will take effect on September 1st, 2023.

Due to this change, we ask all advisors to use the latest version dated May 2023 of the paper application after August 2nd. Applications in Quebec must use the lastest version from September 1, 2023 onwards.

For all regions outside Quebec, we will support a transition period from ‘old’ to ‘new’ applications until December 31st, 2023. After this date, we will no longer accept older versions of our Life and Critical Illness application.

To make sure you are using the latest version of the application, check the date on the title page. It should say May 2023. See the image below:

.jpg?width=200&height=259)

To order paper copies, click here.

Email completed applications to supply@equitable.ca.

To learn more about Bill 64, please visit Assemblee nationale du Quebec - Bill 64. You may also contact your wholesaler.

® denote a registered trademark of The Equitable Life Insurance Company of Canada. -

Boost your knowledge and earn CE credits

Need continuing education credits?

Equitable® is happy to offer two new online courses focusing on whole life insurance. The courses allow you to learn at your own pace and earn CE credits quickly and easily. You can earn CE credits right away when you complete these courses. All courses are accredited by Alberta Insurance Council, Insurance Council of Manitoba, The Institute for Advanced Financial Education, and Chambre de la sécurité financière*.

New courses:

1. Introduction to Whole Life Insurance

2. Participating Whole Life for the Children’s Market – A Head Start for Tomorrow

3. Harness the Power of Whole Life Cash Value

Existing courses:

1. Path to Success - Expert Advice on Navigating CI Sales

2. Ensuring a Compliant, Needs-based Insurance Sale

3. Where UL Fits in your Product Portfolio

A few important notes before you get started:

• The programs are hosted on Teachable: https://equitable-life-education.teachable.com/

• Username: Please use your email address that you are contracted with

• Password: Equitable

• Please use Google Chrome to access the courses

Start Earning CE Credits!

Check out the individual insurance online learning centre on EquiNet® to stay up to date on new courses.

Questions?

Contact your local wholesaler.

Are you having trouble logging in or accessing certificates?

Email equitablelifemarketing@equitable.ca for assistance.

*Please select the course with “QC credits” in the title for La Chambre credits.

® or TM denotes a trademark of The Equitable Life Insurance Company of Canada. -

EAMG Market Commentary April 2024

April 2024

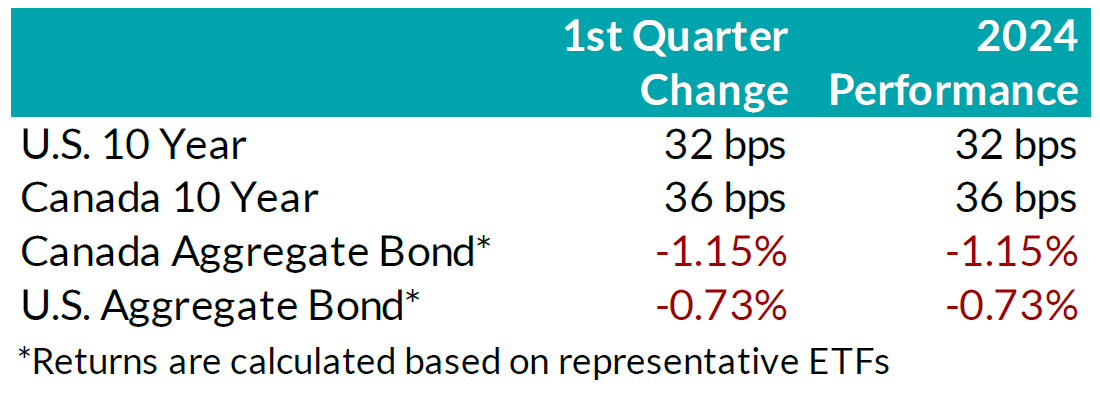

Rates & Credit – Interest rates increased in Q1 2024, giving back half of the decline experienced in Q4 2023 amid consistently positive surprises in U.S. economic data. The positive economic news also drove a strong risk-on tone to the market, with the risk premium on corporate bonds tightening as economic prospects improved. In Canada, corporate bonds outperformed government bonds and the broader FTSE Canada Universe Index (FTSE) with a slightly positive 0.07% return, verses a loss of 1.66% in government bonds and a loss of 1.22% for the overall index. More interest rate sensitive long-term bonds experienced the largest decline, which was partially offset in corporate bonds by the risk-on tone to corporate bond spreads. On a 6-month and 1-year basis, the FTSE remained positive at 6.94% and 2.10%, respectively. Within corporate bonds, lower-rated BBBs outperformed higher-rated A bonds, while industries with higher interest rate exposure such as infrastructure, energy, and communications underperformed those with less exposure (notably financials and securitization).

.png?width=850&height=303)

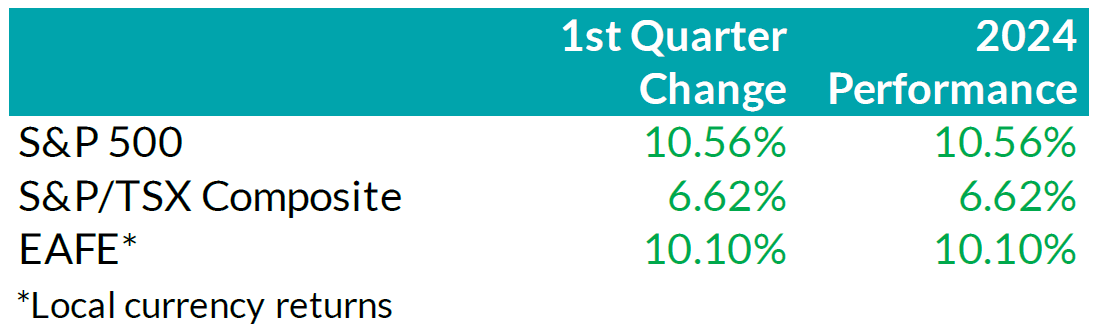

Equity Overview – Throughout Q1 2024, concerns about a recession gradually eased as central bankers adopted a more accommodative outlook on monetary policy. Their growing dovishness reflected confidence that the restrictive monetary measures were effectively curbing inflation as anticipated. Underpinned by prospects of an economic soft-landing, global equity markets rallied to start the year with most major North American indices soaring to new all-time highs during the quarter. U.S. equities continued to outperform other major international markets with the S&P 500 returning 10.6% in USD terms. Major developed economies from Europe, Australasia, and the Far East (EAFE) gained 10.1% in local currency terms, while the TSX added 6.6%. Furthermore, the U.S. economy continued to prove more resilient than most major developed economies, with strong employment and robust output data. As such, foreign investors of U.S. denominated securities achieved enhanced returns, benefitting from a stronger Greenback.

.png?width=850&height=260)

U.S. Fundamentals – Corporate earnings beat expectations in Q4 2023, triggering a wave of upward earnings revision. Stable operating margins, cash flows and debt loads continue to attract investors into equities. Investors appear focused on the company’s ability to sustain debt levels ahead of renewing debt obligations. We observed that the number of major companies that expect improving financial performance shrunk to ~19%. This suggests that concentration risks are likely brewing in the equity market, yet again.

U.S. Quant Factors

Optimistic run-up in equity valuations were mostly driven by the momentum factor. A basket of companies with positive price trends intensified concentration risk in the equity market. We note that momentum factor’ performance sharply contrasted fundamental factors, making us cautious on the market’s complacency. For context, high quality companies, which is typically defined by high Return on Equity (ROE), stable earnings variability, and low financial leverage, placed second in our risk-adjusted performance rankings, and is dwarfed by the ~ 17.9% return observed from the momentum factor.

Canadian Fundamentals – Against the backdrop of underwhelming financial results, ROE – a gauge of how efficiently a corporation generates profits – rebounded in Q4, 2023, after declining throughout most of the year. The improved efficiency metric provided a positive catalyst for dividend investors as the inverse movements of ROE relative to financing costs over 2023 kept investors on the sidelines. In addition, the CRB Raw Industrials Index, a measure of price changes of basic commodities, broke out of recent ranges, providing a tailwind for Canada’s energy and materials sector. Concerns with earnings contraction and macro-economic conditions have subsided.

Canadian Quant Factors – Crude prices soared higher in Q1 2024, with ongoing production cuts from OPEC+ and ramifications of geopolitical conflicts keeping oil markets undersupplied. As such, energy companies benefitted, surging higher and outperforming the broader index, while the low volatility basket – with lower exposure to cyclically sensitive business – underperformed into quarter end. Furthermore, Canadian banks underperformed to start the quarter, giving back some of the sharp outperformance witnessed into the end of Q4 2023. That said, soft inflation data increased expectations of impending rate cuts from the Bank of Canada and, as such, banks performed in line with the broader market throughout most of the quarter. Underpinned by expectations of a dovish switch in monetary policy, investors rewarded dividend payers with a history of increasing dividends, boosting confidence in their ability to support future dividend growth. It is important to note that investors should not let dividend growth’s outperformance overshadow high dividend paying companies’ underperformance; more specifically, investors remain attentive to the businesses’ ability to create value relative to financing costs.

Views From the Frontline

Rates – Interest rates in both Canada and the U.S. increased across all bond tenors in Q1 2024. U.S. inflation data surprised to the upside, remaining stubbornly higher than hoped, while labour market and consumer indicators underscored the economy's continued strength. In Canada, inflation data fell below forecasts, but early 2024 GDP readings exceeded expectations. The market now anticipates a 'soft landing' for the U.S. economy; however, the Canadian economy continues to slow. North American central banks have signaled that we are at the peak for policy rates. The market is currently pricing in approximately two-to-three, 25 basis point interest rate cuts by the U.S. Federal Reserve in the second half of 2024, much fewer than the six-to-seven 25 basis point interest rate cuts that the market had been anticipating even just three months ago. As the Swiss central bank led the way with the first rate cut among developed countries, central banks in major developed economies will closely monitor upcoming data and market developments to determine the timing and pace for rate cuts.

Credit – The risk premium for corporate bonds (versus government bonds) continued to tighten over the quarter, with a strong risk-on tone to the market as investors priced in renewed economic growth in 2024 as compared to previous expectations. Corporate bond supply was robust, with $38.2bn in new issuance, the second strongest first quarter on record. On the balance, we do not think the current risk premium adequately compensates for downside risk, particularly in longer-dated corporate bonds, and have a bias towards shorter-dated credit where we view the risk / reward dynamic as being more favourable.

Equity – We favour a combination of the Dow Jones and the S&P500 for our broad market exposure. The Dow, a price-weighted index, should have some value and low volatility tilt as it tracks mature large companies. As explained above, concentration risks are brewing in the equity market, and during Q1 this risk was exacerbated by investors rushing into a basket of companies with positive price trends, thereby pushing valuation metrics further into the expensive territory. In our view, it is well-suited to use a combination of the Dow Jones Industrial Average and the S&P 500 for broad U.S. market exposure given the heightened concentration risk. Looking forward, we expect companies to exhibit stable operating margins and therefore, we are shifting our focus toward the balance between upcoming corporate debt refinancing requirements and reinvestment in projects intended to drive future growth. In plain words, we are tactically adding to companies with stable cash flows and decreased debt loads outside of the mega-cap group. In Canada, we expect a modest earnings growth and remain attentive to how efficiently a corporation generates profits relative to their financing cost. We caution against the overly optimistic, commodity driven, “catch-up” trade vs. our southern neighbour. Therefore, we tweaked our investment strategy by rotating out of the low volatility factor and adding to higher yielding quality companies in Canada.

Downloadable Copy

Mark Warywoda, CFA VP, Public Portfolio Management Ian Whiteside, CFA, MBA AVP, Public Portfolio Management Johanna Shaw, CFA Director, Portfolio Management Jin Li

Director, Equity Portfolio ManagementTyler Farrow, CFA

Senior Analyst, EquityAndrew Vermeer

Senior Analyst, CreditElizabeth Ayodele

Analyst, CreditFrancie Chen

Analyst, Rates

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy.

-

100 years strong

As COVID-19 continues, we want to reassure you that Equitable Life remains financially strong and committed to supporting our clients.

We are financially strong and stable

Our commitment to your health, wealth and overall well-being remains unchanged. This global pandemic has impacted the way we do business, but we continue to focus on our strategic goals while meeting the needs of Canadians. These three factors speak to our financial strength and stability:

• Equitable Life has a global credit rating of ‘A’ with a positive trend from DBRS Morningstar in recognition of our ability to adapt to the current business environment and prudent risk profile;

• We are maintaining our current dividend scale for the period July 1, 2020 to June 30, 2021; and

• Our Life Insurance Capital Adequacy Test (LICAT) ratio remains well above our goal and the minimum that is required at 152.5% at the close of the first quarter.We pride ourselves on our customer service

Being recognized for its service culture across all lines of business is a point of pride for a company that includes ‘customer focus’ as one of its three corporate values. In 2019, our dedication to customer service was recognized with these outstanding survey results, proving we have the We have the knowledge, experience and ability to find solutions that work for you:- Equitable Life ranked in the top quartile for segregated fund service in 2019 survey of advisors and MGAs1 ;

- In a 2019 survey of customers from 15 life insurance companies,2 Equitable Life ranked #1 on the Net Promoter Score, a measure used across industries to gauge the loyalty of a firm's customer relationships; and

- A survey of Group consultants, brokers and third-party administrators 3 ranked Equitable Life in the top two insurers across all categories.

We have adjusted our business to become digital

Since the pandemic began, our IT and operations teams have digitally enhanced more than 20 different processes and services to make it easier for us to integrate with our distribution partners in this new reality. Our sales and customer service teams remain open and available to support you and your customers.

We are here with you and for you- To commemorate our 100th Anniversary this year, we donated $4.5 million to purchase and install a new MRI for Grand River Hospital and, as part of our Equitable Gives Back Contest, we donated $50,000 – $10,000 each – to five charities in British Columbia, Alberta, Manitoba, Ontario and Quebec. As well, we are celebrating by randomly selecting policyholders to receive a $100 and three grand prizes. For more information about our celebrations, check out our website at www.equitable100.ca.

As the global situation continues to evolve, rest assured that Equitable Life is unwavering in our commitments to you and the communities we serve. We are here with you and for you.

2 LIMRA CxP Customer Experience Benchmarking Program, Life Insurance In-Force Experience 2019

3 NMG Consulting’s Canadian Group Benefits Survey 2019

-

Extending premium relief for Dental and Extended Health Care benefits

We know this is a challenging time for Canadian employers and we continue to look for ways to help your clients manage while still supporting their employees.

As many health practitioners continue to keep their offices closed due to the pandemic restrictions, plan member use of dental benefits and some health benefits remains lower than normal.

So, we are pleased to announce that we are extending premium relief for all Traditional and myFlex insured non-refund customers for Health and Dental benefits for the month of May, as follows:

- A 50% reduction on Dental premiums in all provinces except Saskatchewan, where a 25% reduction will apply due to the re-opening of dental clinics in early-May; and

- A 20% reduction on vision and extended healthcare rates (excluding prescription drugs) in all provinces, which equates to an 8% reduction on Health premiums.

These reductions are effective for May 2020 and will appear as a credit against the next available billing. We will assess the situation monthly and expect to continue with monthly refunds for as long as the current crisis period continues. The size of the credit may change over time as dentists and other health practitioners gradually reopen their offices. We will confirm premium credits for June (if any) at a later date. Credits for subsequent months will be communicated on a month-by-month basis.

In order to be eligible for the monthly credit calculation and payout, a policy must be in force on the first of the month and remain in force thereafter. The monthly credit calculation is based on employees in force on the May bill. If employees experienced layoffs during the month, that would not affect eligibility for a premium credit as long as the benefit itself is not terminated.

We expect that claims experience and premiums will return to normal once the current pandemic restrictions are lifted.

In the meantime, plan members will continue to have full access to their benefits coverage throughout the pandemic. In many cases, dental offices remain open for emergency services, and a variety of healthcare providers are available virtually.

Commissions

We know the pandemic has put financial strain on your business as well, so we will continue to pay full compensation. Although your overall commission will be unaffected by these premium reduction adjustments, you may see a temporary reduction in your commission payments if you are on a pay-as-earned basis. We will begin to process the commission top-up payments in mid-June and will reflect both April and May premium credits.

Communication

We will be communicating this premium relief program to your clients later this week.

Questions?

If you have any questions, please contact your Group Account Executive or myFlex Sales Manager. In the meantime, we have provided some Questions and Answers below. You can also refer to our online COVID-19 Group Benefits FAQ.

-

December 2023 eNews

Insights on EZBenefits from our Executive Vice-President, Group Insurance

When it comes to advising small business owners, it can be tough to find the right group benefits solution. Offering a competitive benefits plan is more important than ever to help small business owners attract and retain talent. They need an affordable solution that’s easy to implement, renew and maintain.

That’s why we launched EZBenefits for small business earlier this year. It’s a unique group benefits solution designed with you and your small business clients in mind.Marc Avaria, Executive Vice-President, Group Insurance, explains:

Find out more

Visit info.equitable.ca/EZBenefits for more details or to request a quote. If you have questions, contact your Equitable Group Account Executive.

Now that cold and flu season is here, many Canadians will start calling in sick or missing work to visit their doctor – if they can get an appointment. Now’s the time to remind your clients that Equitable offers Dialogue Virtual Healthcare. It can be added to any Equitable plan for an additional cost.

Supporting plan members through cold and flu season with Dialogue Virtual Healthcare*

Eligible plan members and dependants receive fast, on-demand access to virtual primary medical care—24/7, 365 days a year. Available for a variety of non-urgent health concerns, Dialogue Virtual Healthcare can make it easier to navigate cold and flu season by providing:- Access to the largest, most experienced bilingual medical team in Canada,

- In-app prescription renewals and refills,

- Personalized follow-ups after each consultation, and

- An all-in-one patient journey to address health issues. This reduces long waits and means less time away for doctor appointments.

Benefits of Virtual Healthcare for plan sponsors

When your clients provide Virtual Healthcare for their plan members, they can help:- Drive employee engagement;

- Reduce absenteeism related to in-person medical appointments;

- Manage chronic health issues;

- Attract and retain top talent; and

- Build a healthier workforce.

Learn how it works

Adding Dialogue Virtual Healthcare to your clients' plans

To learn more about adding Virtual Healthcare to your clients’ benefits plans, contact your Group Account Executive or myFlex® Account Executive. You can also share this resource from Dialogue on managing cold and flu season.

The Canada Employment Insurance Commission and Canada Revenue Agency have announced the 2024 changes to Maximum Insurable Earnings, and premiums for employment insurance. The following changes to Employment Insurance (EI) will take effect January 1, 2024:

Changes to Short-Term Disability benefits calculations*

How does this affect your clients?

To comply with client policy provisions, Equitable will revise Short-Term Disability (STD) benefits with the updated maximums based on the percentage of EI Maximum Weekly Insurance Earnings for policies that meet these conditions:- Policies that include a STD benefit that is tied to the EI Maximum Weekly Insurable Earnings, and

- Policies with a classification of employees that has less than a $668 maximum.

- The additional premium for any increase from their previous STD amounts and new STD amounts will be shown on your clients’ January 2024 Group Insurance Billings (as applicable).

If your clients wish to provide direction regarding revising their STD maximum, or have questions about the process, they can email Kari Gough, Manager, Group Issue and Special Projects.

*Indicates content that will be shared with your clients.