Site Search

756 results for form to restart a pac on insurance

-

Deposits to the Fidelity Special Situations mutual fund are being limited but the segregated fund is

Fidelity Investments® recently said they would no longer accept deposits from new investors into the Fidelity® Special Situations Fund. This notice however does not affect Equitable Life® clients.

The Special Situations Fund will continue to be open to new and existing Equitable Life clients. This includes clients with Pivotal Select™, Pivotal Solutions* or Personal Investment Portfolio segregated funds contracts.

Why is Fidelity limiting access to the mutual fund?

This award-winning mutual fund has grown significantly and now has $3.6 billion of managed assets. To preserve the integrity of the fund’s investment strategy, Fidelity® decided to limit inflows to the fund. Limiting the amount of managed assets held within the fund allows the fund’s portfolio manager to focus on what he does best - finding special situation investment opportunities and capitalizing on positive change within companies and industries across Canada and around the world.

If you like the Special Situations mutual fund, you will value the Equitable Life Fidelity® Special Situations segregated fund. Segregated funds are similar to mutual funds but offer different features and guarantees. To learn about these features, check out the Investment Advantage. To learn more about the Special Situations segregated fund, click here.

For more information about Equitable Life’s segregated funds, speak to your Regional Investment Sales Manager or visit our segregated funds page on EquiNet®.

References:

Fidelity’s press release announcing the limited fund closure

Fidelity® Special Situations portfolio management strategy, webinar featuring Mark Schmehl, Portfolio Manager.

*No Load, Deferred Sales Charge, Pivotal Solutions II

® or ™ denotes a trademark of The Equitable Life Insurance Company of Canada, except as noted below.

Fidelity and Fidelity Investments are registered trademarks of 483A Bay Street Holdings LP. Used with permission. -

Welcome EZtransact from Equitable Life

On July 28, 2021, Savings & Retirement is launching online transactions for segregated funds. A new way to make managing your client’s policies quick and convenient. With a growing need for digital solutions, Equitable Life’s new EZtransact eliminates the hassle of filling out forms, facilitating signatures yourself, submitting copies to your MGA and being tied down to business hours for submitting transactions.

Available on EquiNet's secure website, EZtransact’s first service will allow advisors to setup a one-time or recurring deposit or edit an existing pre-authorized debit already in place. In just five simple steps, EZtransact:- Collects the deposit details,

- Pre-populates pre-existing relevant details,

- Alerts you to any missing information,

- Facilitates the signing process and

- Sends a copy of the transaction to your MGA, eliminating any need for duplicate copies, or additional steps.

“We are excited to be able to launch a new digital solution for our advisors”, said Vice-President, Savings and Retirement, Judy Williams. “We feel this new application complements our existing highly rated EZcomplete® online application process. With both solutions available to advisors, we are making it even easier to do business with Equitable Life”.

If you are already registered with EquiNet, go online today, and give EZtransact a try. If you are not registered, contact your local Regional Investment Sales Manager or, call our Advisor Services Team to have a Regional Investment Sales Manager in your area contact you.

To learn more, click here.

® and TM denote trademarks of The Equitable Life Insurance Company of Canada

-

Ways to reduce net income after age 71 with Equitable Life

Your client is contacting you to ask how to reduce net income after age 71. While each client’s situation is unique, here are a few options to consider.

- Clients with a spouse under the age of 71 can contribute to a spousal Retirement Savings Plan (RSP) up until December 31st of the year the spouse turns 71; provided contribution room is available. This option can also work for those clients over the age of 71 with employment income. This can be useful for small business owners who are still making money over the age of 71 and forced to convert their RSP to a Retirement Income Fund (RIF) or Life Income Fund (LIF).

- For clients with a RIF or LIF, they can strategically elect to use their spouses’ age to calculate the minimum RIF income payment (minimum and maximum for LIF). The idea being that if there is an age gap between spouses:

- Your client makes a RIF/LIF minimum payment lower by using the age of the younger spouse. This is beneficial to clients who do not need a lot of income from their RIF/LIF.

- Your client makes a LIF maximum payment higher by using the age of the older spouse. This is beneficial to clients who want to withdraw as much as possible from their LIFs each year.

To learn more, contact your Regional Investment Sales Manager.

® and TM denote trademarks of The Equitable Life Insurance Company of Canada

-

Excelerator Deposit Option – maximum payment limit changes

The Excelerator Deposit Option (EDO) gives your client the option to make additional payments, subject to specified limits and our current administrative rules and guidelines, above the required guaranteed policy premium. EDO payments can help grow the long-term values in your client’s policy. This change is regarding the maximum EDO payment limit that applies to the policy.

● NEW! If a request is received to terminate, convert, or reduce the term rider and the term rider has been in effect for 10 years or longer, the EDO maximum for the policy will not be reduced.

For Equimax policies with an Owner Signature Date of June 26, 2021 or after where a term rider has increased the maximum EDO payment limit on the policy

● If a request is received to terminate, convert, or reduce the term rider and the term rider has been in effect for less than 10 years (it has not reached the 10th policy anniversary), the EDO maximum for the policy will be reduced accordingly.

Current rules as to when underwriting is required for EDO payments continue to apply, as do current rules surrounding acceptance of EDO payments and maintaining the tax-exempt status of the policy and can be found in the Equimax Product Admin Guide.

Want more information? Contact your Regional Sales Manager for more information on these changes

-

Increased auto approval means more time to focus on your complex cases

As the year draws to a close, we are pleased to reflect back on our many enhancements geared toward improving our auto-approval rates and the notable impact they have made on our service standards.

Throughout 2021, we have invested significantly in our services and technology, including data & analytics to ensure that more of our new business applications are approved automatically without any intervention, leaving our teams available to engage in settling your complex cases. As a result of these enhancements, over the past 3 months we have improved from 8% of our new business flowing straight through to approval, to an impressive 25% of cases requiring no underwriting*.

There are a number of factors that contribute to this straight through approval success in processing applications, such as simpler cases, applicants with no medical history or medical issues, younger applicants and applications for lower face amounts. These factors, alongside our ongoing efforts to fortify our processes, has resulted in positive feedback from the field.

Advisors have mentioned you’ve felt the impact on our speed and service, and we will continue forward into 2022 with this positive momentum, with further enhancements to help make it easier for you to do business with Equitable Life.

*As of December 2021 -

Manage more details within Contract Delivery for New Business applications

We are excited to announce further enhancements to our eDelivery process to empower you, the advisor, the ability to manage client details more easily within Contract Delivery.

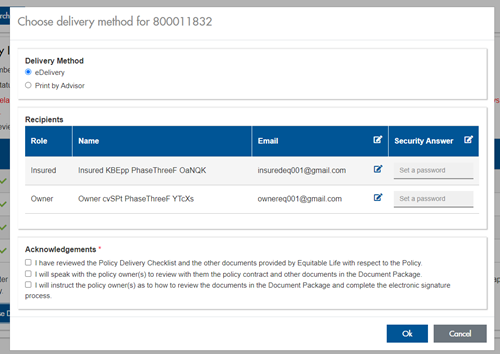

Effective January 15, 2022, advisors will need to create a Password within Contract Delivery when choosing “eDelivery” as the contract delivery method and provide the password to the client to use as their password:

The Password must be between 4 and 100 alpha/numeric characters, and cannot be the Policy number. For multiple signers the password (and email address) must be unique per each signer.

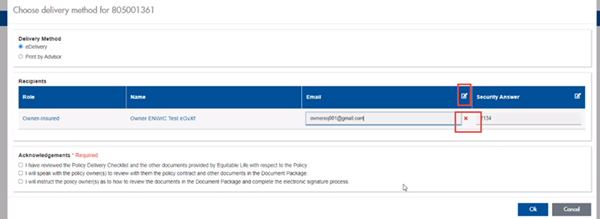

Advisors can now edit and/or update an email address within Contract Delivery, in the event of a bounce back or email change, to keep the eDelivery process moving and avoid delays in processing time. If a lock out occurs, advisors can trigger a resend of the signing email once they add a new valid email address in Contract Delivery. Simply click the pencil icon beside the Email field to enter the valid email address:

Another new feature- in the event a client has declined, the advisor will get an email from Equitable Life®. Click through to EquiNet® within the email to view the message within Contract Delivery that the client provided as the reason for decline under a new “Declined Details” section. This enables you to connect with the client to proceed with the sale by discussing the reasons for decline with them directly.

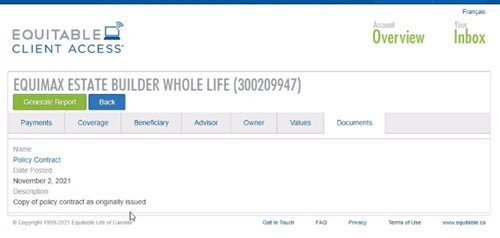

Also new for clients with this enhancement, policy owners of a policy created after January 15 will be able to see a PDF copy of their policy within client access. Note: this PDF copy is as the policy was originally issued.

Resources: -

Product Enhancements - Critical Illness

Equitable Life has exciting product enhancements that will help you offer more options to clients.

Access our Virtual Product Launch NOW. Grab a coffee and get ready for this exciting news! Hear from our leaders and learn about our exciting product enhancements.

NEW! EquiLiving plans and riders enhanced with:- 20 pay options with coverage to age 75 or coverage for life

- Support from Cloud DX to help monitor a client’s well-being from treatment to recovery.

- Added Acquired Brain Injury as a covered critical condition

- 30-day survival period removed for all non-cardiovascular covered conditions

- No age restriction to claim for Loss of Independent Existence (LOIE)

- EquiLiving Benefit now pays the higher of the EquiLiving Benefit or the Return of Premium Rider Benefit (not including Return of Premium on Death)

- And so much more …

The updated illustration software will be available for download after 9 a.m. ET on Friday, February 11, 2022, and will include all the Equimax and EquiLiving enhancements.

See the Equitable Sales Illustrations Update for information on how to download the software or check for updates.

Please review updates to the commission schedule A for these new enhancements.

Learn more- Transition rules are available

- Watch our virtual launch event video now! (Approx. 20 minutes)

- Watch our product launch intro video here

- Visit our launch event page with product change details and more here

- Marketing Materials

Please contact your Regional Sales Manager for more information. -

Product Enhancements - 10 Pay

Equitable Life has exciting product enhancements that will help you offer more options to clients.

Access our Virtual Product Launch NOW. Grab a coffee and get ready for this exciting news! Hear from our leaders and learn about our exciting product enhancements.

NEW! 10 pay premium option with Equimax Estate Builder®- The new EquiLiving® 20 pay rider options will be available on Equimax® plans

The updated illustration software will be available for download after 9 a.m. ET on Friday, February 11, 2022, and will include all the Equimax and EquiLiving enhancements.

See the Equitable Sales Illustrations Update for information on how to download the software or check for updates.

Please review updates to the commission schedule A for these new enhancements.

Learn more- Transition rules are available

- Watch our virtual launch event video now! (Approx. 20 minutes)

- Watch our product launch intro video here

- Visit our launch event page with product change details and more here

- Marketing Materials

Please contact your Regional Sales Manager for more information. -

EquiLiving offers more options to clients facing a covered Critical Illness condition

Consider these statistics…1 in 2 Canadians will develop cancer in their lifetimes1. They’re just numbers…until the day someone you know is diagnosed, someone who didn’t see it coming. Then it becomes very real - no longer incidence statistics, but costs. Today more people than ever are surviving and living with not only just the physical, but also the financial effects of their illness.

We’re there to help when illness strikes

NEW! EquiLiving® plans and riders have recently been enhanced including:

● 20 pay options with coverage to age 75 or coverage for life

● Support from Cloud DX to help monitor a client’s well-being from treatment to recovery.

● Added Acquired Brain Injury as a covered critical condition

● 30-day survival period removed for all non-cardiovascular covered conditions

● No age restriction to claim for Loss of Independent Existence (LOIE)

● EquiLiving Benefit now pays the higher of the EquiLiving Benefit or the Return of Premium Rider Benefit (not including Return of Premium on Death)

● And so much more …

Learn more

● CI product enhancement video

● Visit our launch event page with product change details and more

● Marketing Materials

Please contact your Regional Sales Manager for more information.

1 www.cancer.ca

-

Step Up Your Wealth Sales with Equitable Life

Step up your wealth sales with Equitable Life® and you’ll be rewarded with a growth bonus for doing more business in 2022. Make this year your best year ever with Equitable Life!

The program rewards advisors who promote Equitable Life’s Savings & Retirement products to existing and new clients as part of an overall investment strategy based on client needs.

Commission Bonus Calculation:

Gross deposits into segregated funds

+ Gross deposits into Guaranteed Interest Account (GIA) contracts

+ 25% of payout annuity sales

― Segregated fund redemptions

― GIA redemptions

= 2022 Net Deposits

All eligible deposits, sales, and redemptions occurring between January 1 and December 31, 2022, will be used to calculate an advisor’s 2022 net deposits.

* The bonus amount will be calculated at the end of 2022 based on net deposits. The bonus will be paid within 90 days following December 31, 2022. Maximum bonus payable is $75,000.

For more information, download our flyer or contact your Equitable Life Regional Investment Sales Manager.

And as a reminder, we increased the CB5 sales option initial commission from 5.6% to 7.0% on Pivotal Select™ segregated funds. The 7% initial commission is effective from May 20 to August 31, 2022 only.** Learn more.

Equitable Life is committed to offering advisors and clients product, service, and feature choices that best suit their needs. We offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds to align with advisors’ and clients’ unique needs.

** Equitable Life reserves the right to end the campaign, at any time and without notice.

™or ® denotes a registered trademark of The Equitable Life Insurance Company of Canada.