Site Search

961 results for life policy 300109556

- [pdf] Payout Annuity Advisor Guide

- About

-

Changes to the PMPRB

Earlier this month, the Government of Canada announced the final amendments to the Patented Medicines Regulations. These changes will impact how the Patented Medicine Review Board (PMPRB) sets the ceiling price for patented drugs and evaluates if the price of a drug reflects the value it has for patients. The intent of these updates is to enable the PMPRB to more effectively protect Canadians from excessive patented drug prices.

These changes do not come into effect until July 1, 2020. Finalizing the guidelines and consultation with stakeholders will occur leading up to this date. It is yet to be determined which drugs will be included in the final guidelines. It is anticipated the guidelines will initially focus on drugs launched shortly prior to and after July 1, 2020.

Equitable Life supports the modernization of the PMPRB and the ongoing need to evolve drug plan management tools in order to support the health of Canadians and drug plan affordability for public and private payers.

If you have any questions, please contact your Group Account Executive.

-

Do you have clients looking for growth but are concerned about taking on too much risk?

Please join us to hear Dina DeGeer, Senior Vice President, Portfolio Manager, Head of the Mackenzie Bluewater Team and David Arpin, Senior Vice President and Portfolio Manager, Mackenzie Investments, discuss how the Mackenzie Bluewater Team is positioning the Mackenzie Canadian Growth Balanced Fund for future success

Learn about the value of investing in high-quality businesses and how taking a broader approach to fixed income investing can deliver the balanced solution your clients are looking for

Equitable Life is pleased to offer the Mackenzie Canadian Growth Balanced fund as one of six different Mackenzie funds in Pivotal Select™ segregated fund lineup.

Learn More

-

Important update regarding all paramedical appointments

Update regarding parameds for NEW and EXISTING cases:

- In the absence of Parameds, the preferred method is to complete the medical questions in EZComplete

- If you didn’t complete the new medical information, then complete the Health Information Form #1878

- If you are unable to complete the 1878 Health Information Form, then you can order a Video EPara through Dynacare or through Equitable

-----------------------------------------------------------

Equitable Life has made the decision to temporarily stop all face-to-face field service appointments effective immediately to ensure the protection of both our Clients and Examiners. All appointments will be cancelled by ExamOne. Dynacare has already cancelled their appointments.

We are doing this to support social distancing as requested by the Federal and Provincial governments. We are actively working on a plan to provide viable options in the absence of face-to-face paramedical service appointments. This will be communicated shortly.

-

Extending Homeweb to plan members who are losing coverage

We know these are difficult times for Canadian employers and their employees.

As businesses temporarily suspend operations to help stop the spread of COVID-19, some employers have had to make the difficult decision to temporarily lay off employees or put their benefits coverage on hold.

So we are pleased to announce that Homewood Health® and Equitable Life® will extend access to Homeweb, a personalized online mental health and wellness portal, for up to 120 days for plan members who have temporarily lost their benefits coverage due to COVID-19.

Employees and their family members will continue to have access to the Homeweb website and mobile app, including:

- iVolve, Homewood’s online self-directed Cognitive Behavioural Therapy treatment tool to help manage mild to moderate anxiety and depression;

- Resources and information to support themselves and their family members through the COVID-19 pandemic;

- An interactive online Health Risk Assessment to help identify and address health risks; and

- An online library of interactive tools, assessments and 20 different e-courses that allow each user to learn at his/her own pace.

This will allow businesses undergoing financial hardship to provide some support to employees who are temporarily without benefits coverage.

-

An Exciting Fund Lineup Offered with Equitable Generations

Equitable Generations™ is a Universal Life product that offers investment options that resonate with today’s 21st century client while reducing every fee possible. It also reduces the cost of insurance to help clients maximize their opportunity to purchase coverage and build tax-advantaged wealth.

Fund Features of Equitable Generations:

● 34 fund options, including 18 new investment options, tracking funds managed by Fidelity™, Dynamic™, Invesco™ and more.

● 3 sustainable investment “ESG” (Environmental, Social & Governance) options – because today’s buyer cares as much about impact as they do about returns.

● Target date funds that auto-rebalance over time so that as a client approaches retirement, the fund adjusts its risk automatically.

Learn more about our new funds:

● American Equity Index (ESG)

● Canadian Equity Index (ESG)

● Special Situations fund (Fidelity)

● Sustainable Equity, Balanced, and Bond Funds (Fidelity)

● Target Date funds (Fidelity)

● Details on funds available

● Get all your ESG questions answered with Margaret Dorn, S&P

-

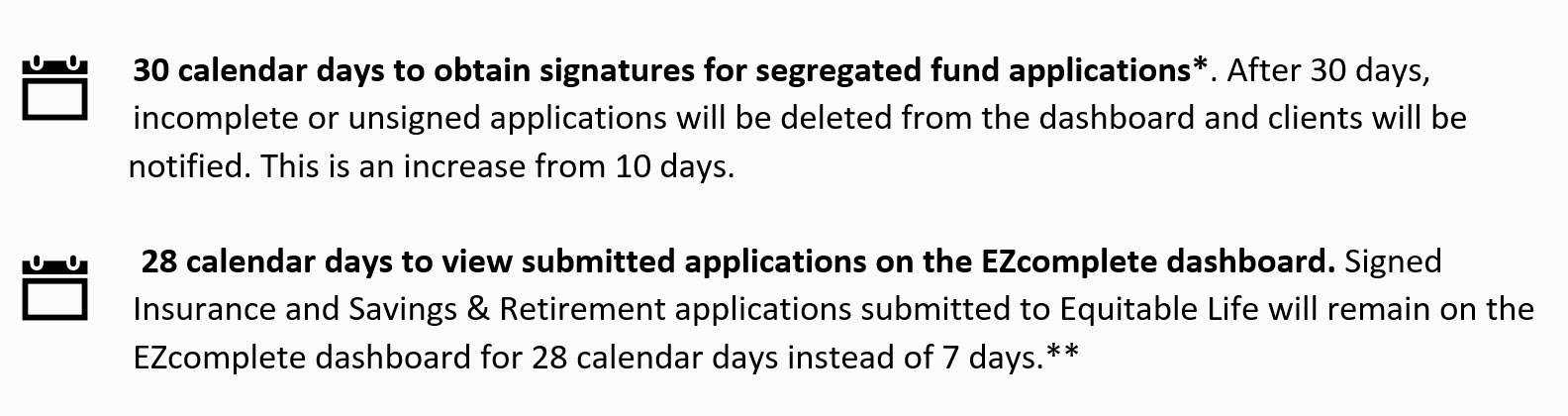

More time to complete and view applications on EZcomplete

You asked for more time, we listened!

Effective January 14, 2023, you will have more time to complete and view in-flight and completed applications on the EZcomplete® dashboard.

You will now have,

.jpg?width=900&height=238)

There are no changes to EZcomplete’s Sandbox. Applications in the Practice Site will continue to be deleted after 10 calendar days.Take me to the Sandbox

Take me to EZcomplete

Play around in the Sandbox with a demo client account.

Submit your applications today.

If you have any questions, contact your Regional Investment Sales Manager or Advisor Services Team Monday to Friday, 8:30 a.m. – 7:30 p.m. ET at 1.866.884.7427, or email savingsretirement@equitable.ca.

*Insurance applications currently offer 30 calendar days

** In-flight applications created prior to January 14, 2023, will maintain the existing 10-day submission timeline.

® denote a trademark of The Equitable Life Insurance Company of Canada.

Posted: January 14, 2023 -

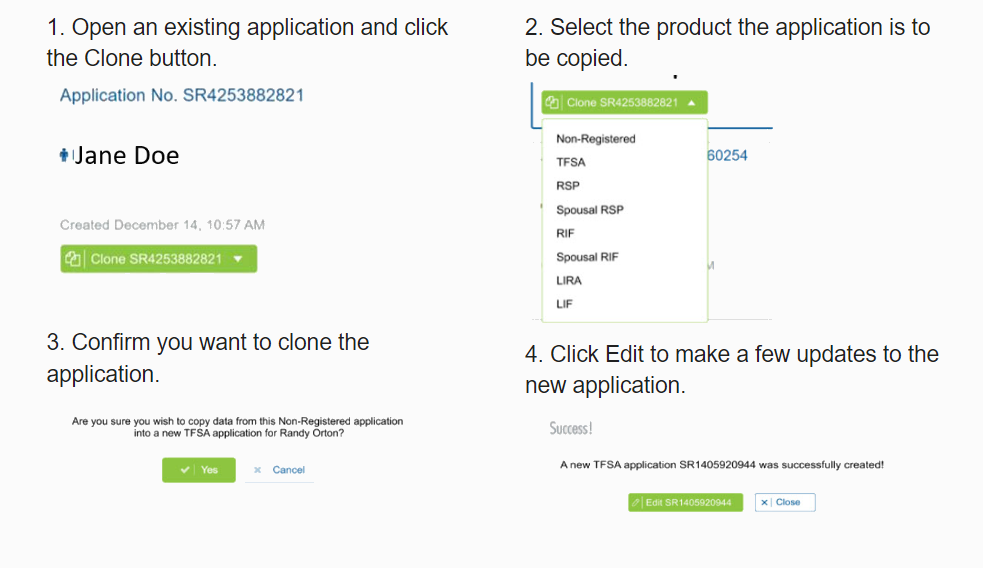

The new segregated fund EZcomplete cloning feature will save time and errors.

The new cloning feature for Savings & Retirement EZcomplete® applications means that advisors don’t need to enter the same client information when completing multiple applications for the same client.

Here's how easy it is to use.

.png)

Best of all, you can clone in progress and submitted applications.

This is just some of the information that will be automatically copied:-

Name

-

Date of birth

-

Gender

-

Occupation

-

Address

-

Phone numbers

-

Email address

-

Social Insurance Number

-

All beneficiary information

The new EZcomplete cloning feature will save advisors time and reduce errors.If you have any questions, contact your Regional Investment Sales Manager

® denotes a trademark of The Equitable Life Insurance Company of Canada.

Posted April 6, 2023 -

-

Equitable’s New Brand – The Power of Together!

On November 1, 2023, we unveiled our new brand and announced the shortening of our brand name to Equitable®. The rebranding includes a fresh new look, and a forward-looking vision for the future – one that honours our 103-year history and our unwavering commitment to clients.

As we start 2024 with a renewed sense of purpose and commitment to clients, together with you, we are more determined than ever to provide more value and impact – to protect today and prepare tomorrow for our clients.

“At Equitable, we champion the power of togetherness. It’s a mindset that drives our behaviours, decisions, and actions to power equitable outcomes for our clients, advisors, and partners,” said Fabien Jeudy, President, and CEO, Equitable.

View the Power of Together video to learn more about Equitable’s renewed purpose and dedication to clients:

View on Vimeo

Questions about our new brand? Please contact your Equitable wholesaler or visit equitable.ca.

® or TM denotes a trademark of The Equitable Life Insurance Company of Canada.

.png?width=500&height=92)

.png?width=500&height=92)

.png?width=300&height=82)

.png?width=300&height=39)