Site Search

961 results for life policy 300109556

- Conversions

- Will Equitable Life sponsor an advisor?

-

We hear you. Equitable Life was ranked #1 for overall segregated funds service performance*.

Each year, Life Ops Consulting Group conducts an independent survey of financial advisors to find out

how satisfied advisors are with the service they receive from life insurance companies in Canada. Since 2015, Equitable Life® has received top marks in overall segregated funds service performance, new business processing, fund/policy statements and post-sales service.

Equitable Life was ranked #1 for overall segregated funds service performance*

We would like to take this opportunity to thank each of you that took the time to participate in this survey. We are proud of the service that we provide and are committed to listening to what advisors want and need to run their business. We work hard to earn your trust and will do what it takes to keep it.

Thank you.

* Life Ops Consulting Group Distribution Service Satisfaction Survey 2019

® denotes a registered trademark of The Equitable Life Insurance Company of Canada.

- About

-

Clients can win up to $5,000 in the RSP Grow Your Future Contest!

RSP season is here and Equitable Life® is giving clients and their advisors a chance to win BIG with the Grow Your Future Contest.

This contest is for advisors and clients working together to build wealth that lasts through the ups and downs.

Two ways to win:

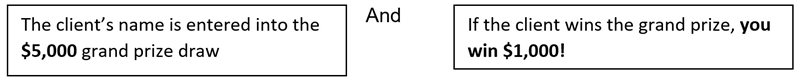

1. Between January 1 and March 1, 2023, if the client makes a deposit into an Equitable Life RSP policy

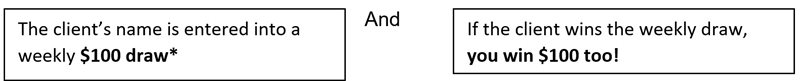

2. Between January 1 and 31, 2023, if the client makes a deposit into an Equitable Life RSP policy*

Full contest details.

Grow the future this RSP season!

Equitable Life is committed to offering clients product, service, and choices that best suit their needs. We are pleased to offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds.

Speak to your Regional Investment Sales Manager to learn more.

*Draws occur weekly from January 9 – February 6, 2023.

® denotes a registered trademark of The Equitable Life Insurance Company of Canada.

Equitable Life® 2023 RRSP Season Contest: No purchase necessary. Contest period January 1, 2023 to March 1, 2023. Enter by making a deposit to an Equitable Life RRSP during the contest period or by submitting a no-purchase entry. Forty-four prizes to be awarded, for a total value of $10,200 CAD. Twenty-one $100 prizes, to be drawn on January 9, 2023, January 16, 2023, January 23, 2023, January 30, 2023 and February 6, 2023. One Grand Prize draw, for a prize of $5,000 CAD, to be held on March 2, 2023. The servicing advisor for the policy to which the selected entrant made the deposit is also an eligible winner: (i) for $100 prizes, the servicing advisor will also receive a $100 prize; and (ii) for the $5,000 grand prize, the servicing advisor will receive a $1,000 prize. For example, if an Equitable Life client is a winner of a $100 prize, the client’s servicing advisor also wins a $100 prize; if an Equitable Life client is a winner of the $5,000 grand prize, the client’s servicing advisor wins a $1,000 prize. Open to legal residents of Canada of the age of majority. Eligible non-winning Entries will continue to be eligible on subsequent Draw Dates. Maximum one $100 prize per person and one $5,000 or $1,000 prize per person. Odds of winning depend on number of eligible Entries received during the Contest Period. For full contest rules, including no-purchase method of entry, see full contest rules.

Posted December 1, 2022

-

Application cloning option now available on EZcomplete

As of September 10th, you will now have the option to clone any Life Insurance and Critical Illness applications that is showing on the EZcomplete dashboard. “Cloning” means the information that has been completed in the existing application is duplicated in a new application.

This feature is meant for situations where multiple applications are being completed and at least one of the parties (the policy owner or insured person) is the same. For example, a single policy owner might own policies on the lives of each of their children. Cloning the application will save re-typing the information about the policy owner into each application.

Please note the following important details regarding cloning:

- Cloning the application will duplicate all information that has been completed in the existing application into the new application.

- In the family situation described above, the information about the policy owner should be completed in the original application. The application should then be cloned before entering any information about the insured person, as there will be a different insured person for the new application.

- Cloning applications can be convenient, but it carries risk. It is imperative that the advisor review every section of the new cloned application to ensure that the information is meant to apply to the new application. If an advisor incorrectly includes information about an individual in the new application, this could give risk to a privacy breach or to liability for the advisor if the questions are answered incorrectly for that individual.

- If the application was submitted and is no longer on the dashboard you will not have the option to clone it.

- You will not be able to change the product type on a cloned application so if you need to select a different product, you will need to start a new application.

- Any documents that were attached to the previous application will not be cloned. The documentation will need to be attached again if required.

- All information from an existing application will be duplicated to the cloned app up to the Signatures step (step 8). Signatures/advisor report will need to be obtained and completed again on the new cloned application.

Resources

Please contact your Regional Sales Manager for more information

-

Important notice: Funds with Deferred Sales Charges

The Canadian Council of Insurance Regulators (CCIR) is requiring all insurance companies to discontinue the sale of segregated funds with deferred sales charges (DSC) effective June 1, 2023. This also impacts ongoing or new deposits to some existing segregated fund accounts. Please contact any Equitable Life clients who may be impacted.

How this impacts clients:

In response to the insurance regulator’s recommendation, Equitable Life® will be making changes to the administration of certain segregated fund products, which may impact clients. The details are outlined below:

Pivotal Select™ segregated fund product

On or about May 29, 2023:- Funds with DSC or Low Load (LL) sales charge options will be closed to additional deposits. Future deposits must be allocated to the No Load (NL) sales charge option of the funds available within the policy.

- Any existing amounts held in DSC or LL funds are not impacted and will retain the existing deferred sales charge schedule outlined in a client’s contract. The annual 10% available (20% for RIF policies) for withdrawal without fees continues to apply through to the expiry of the fee schedule.

- If the default deposit instructions that a client previously provided include funds with DSC or LL sales charge options, these instructions will be automatically updated to the NL sales charge option of the same fund for all future deposits.

- If a client has pre-authorized scheduled deposits into funds with the DSC or LL sales charge options, these instructions will be automatically updated to the NL sales charge option of the same funds for all future deposits.

- In alignment with our current administrative rules, if a client has DSC or LL funds, they will not be able to make deposits into No Load Chargeback funds (NLCB and NLCB5) within the same policy.

Legacy segregated fund products

Ongoing deposits to DSC funds are permitted when a segregated fund product does not have an alternative sales charge option available within the contract. This applies to the following products:- Personal Investment Portfolio

- Pivotal Solutions II

- Pivotal Solutions DSC

If a client plans on making additional deposits, they may be interested in alternative sales charge options that do not include DSC. For example, Equitable Life offers “No Load” (NL) and “No Load Chargeback” (NLCB and NLCB5) sales charge options within the Pivotal Select segregated fund contract. In these situations, a new application would need to be completed and submitted.

Please note that draft regulation in Quebec is currently under review which may impact Equitable Life’s approach for Quebec clients with legacy segregated fund products.

Equitable Life will continue to monitor provincial regulatory developments and adjust our approach as needed.

Client communication

We will be sending clients a letter within their December 31, 2022, statement describing their options, and the impacts to their policy (if applicable). We recommend that you contact clients to discuss the contents of Equitable Life’s letter and provide any advice that they may need regarding ongoing deposits to their segregated funds. You can access a copy of the client letter here:If you have any questions, please reach out to our Advisor Services Team at 1.866.884.7427.

December 23, 2022

™ or ® denote registered trademarks of The Equitable Life Insurance Company of Canada. -

Clients can win up to $5,000 in the RSP Grow Your Future Contest!

RSP season is here and Equitable Life® is giving clients and their advisors a chance to win BIG with the Grow Your Future Contest.

This contest is for advisors and clients working together to build wealth that lasts through the ups and downs.

Two ways to win:

1. Between January 1 and March 1, 2023, if the client makes a deposit into an Equitable Life RSP policy

2. Between January 1 and 31, 2023, if the client makes a deposit into an Equitable Life RSP policy

See full contest details. Grow the future this RSP season!

Equitable Life is committed to offering clients product, service, and choices that best suit their needs. We are pleased to offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds.

Speak to your Regional Investment Sales Manager to learn more.

* Draws occur weekly from January 9 – February 6, 2023.

® denotes a registered trademark of The Equitable Life Insurance Company of Canada.

Grow Your Future RSP Contestt: No purchase necessary. Contest period January 1, 2023 to March 1, 2023. Enter by making a deposit to an Equitable Life RRSP during the contest period or by submitting a no-purchase entry. Forty-four prizes to be awarded, for a total value of $10,200 CAD. Twenty-one $100 prizes, to be drawn on January 9, 2023, January 16, 20232, January 23, 2023, January 30, 2023 and February 6, 2023. One Grand Prize draw, for a prize of $5,000 CAD, to be held on March 2, 2023. The servicing advisor for the policy to which the selected entrant made the deposit is also an eligible winner: (i) for $100 prizes, the servicing advisor will also receive a $100 prize; and (ii) for the $5,000 grand prize, the servicing advisor will receive a $1,000 prize. For example, if an Equitable Life client is a winner of a $100 prize, the client’s servicing advisor also wins a $100 prize; if an Equitable Life client is a winner of the $5,000 grand prize, the client’s servicing advisor wins a $1,000 prize. Open to legal residents of Canada of the age of majority. Eligible non-winning Entries will continue to be eligible on subsequent Draw Dates. Maximum one $100 prize per person and one $5,000 or $1,000 prize per person. Odds of winning depend on number of eligible Entries received during the Contest Period. For full contest rules, including no-purchase method of entry, see full contest rules. -

Making it easier to claim for Loss of Independent Existence for EquiLiving Critical Illness insuranc

We have recently changed the definition of Loss of Independent Existence (LOIE). As a result, the Critical Illness claim criteria has also changed. Before, EquiLiving® Critical Illness insurance coverage was issued with a definition of LOIE that required clients to have the total inability to do 3 of 6 Activities of Daily Living (ADLs). Now, clients will only need to give us proof of the total inability to do 2 of 6 Activities of Daily Living (ADLs) to submit a claim for LOIE.

This change makes it easier for clients to claim for this covered critical illness. This change is retroactive to February 2022.

Clients will be sent a notice from us with a personalized endorsement from Equitable Life. This applies to their policy and forms part of their contract. We will approve claims for LOIE as outlined in the endorsement.

LOIE is one of the 26 conditions named as a covered critical illness in an EquiLiving policy or Critical Illness insurance rider on an Equitable Life insurance policy. With a loss of independent existence, some activities of daily living can no longer be done on one’s own. This can happen because of a disease or an injury.

Want to learn more? See the marketing piece: Understanding the Covered Conditions (1248).

For more information, reach out to your local wholesaler.

® denotes a trademark of The Equitable Life Insurance Company of Canada. - Give the Gift of a Head Start