Site Search

1362 results for if

-

Changes to Short Term Disability Benefit Calculations

The Canada Employment Insurance Commission and Canada Revenue Agency have announced the 2022 changes to Maximum Insurable Earnings, and premiums for employment insurance. These changes take effect January 1, 2022.

2021 Amount As of Jan. 1, 2022 Maximum Insurable Earnings (MIE)

$56,300 $60,300 Maximum Weekly Insurable Earnings (MWIE)

$1,083 $1,160 EI Benefit

(55% of the MWIE, rounded to the nearest dollar)$595 $638

How does this affect your clients?

If your client’s Group Policy with Equitable Life includes a Short Term Disability (STD) benefit which is tied to the EI Maximum Weekly Insurable Earnings, and at least one classification of employees has less than a $638 maximum, then to comply with the provisions of their policy, their STD benefit will be revised with the maximums updated based on the percentage of EI Maximum Weekly Insurable Earnings shown in their policy.

The additional premium for any increase from their previous STD amounts and new STD amounts will be show on their January 2021 Group Insurance Billing (as applicable).

If their STD maximum is currently higher than $638 or based on a flat amount (not based on a percentage or regular earnings), no change will be made to their plan unless otherwise directed.

If your clients wish to provide direction regarding revising their STD maximum, or have questions about the process, they can email Kari Gough, Manager, Group Quotes and Issue. -

Increased auto approval means more time to focus on your complex cases

As the year draws to a close, we are pleased to reflect back on our many enhancements geared toward improving our auto-approval rates and the notable impact they have made on our service standards.

Throughout 2021, we have invested significantly in our services and technology, including data & analytics to ensure that more of our new business applications are approved automatically without any intervention, leaving our teams available to engage in settling your complex cases. As a result of these enhancements, over the past 3 months we have improved from 8% of our new business flowing straight through to approval, to an impressive 25% of cases requiring no underwriting*.

There are a number of factors that contribute to this straight through approval success in processing applications, such as simpler cases, applicants with no medical history or medical issues, younger applicants and applications for lower face amounts. These factors, alongside our ongoing efforts to fortify our processes, has resulted in positive feedback from the field.

Advisors have mentioned you’ve felt the impact on our speed and service, and we will continue forward into 2022 with this positive momentum, with further enhancements to help make it easier for you to do business with Equitable Life.

*As of December 2021 -

Manage more details within Contract Delivery for New Business applications

We are excited to announce further enhancements to our eDelivery process to empower you, the advisor, the ability to manage client details more easily within Contract Delivery.

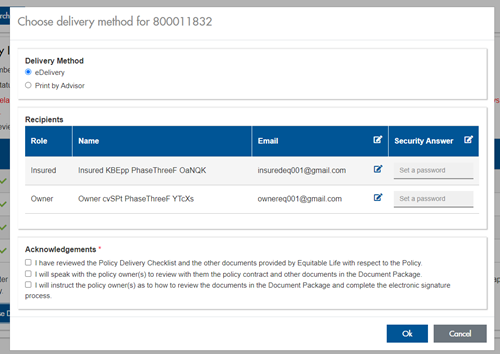

Effective January 15, 2022, advisors will need to create a Password within Contract Delivery when choosing “eDelivery” as the contract delivery method and provide the password to the client to use as their password:

The Password must be between 4 and 100 alpha/numeric characters, and cannot be the Policy number. For multiple signers the password (and email address) must be unique per each signer.

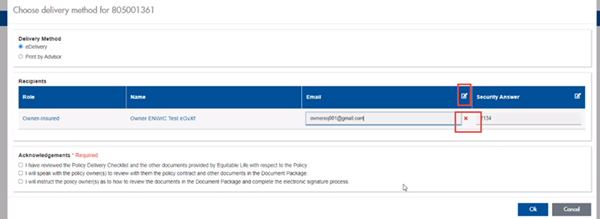

Advisors can now edit and/or update an email address within Contract Delivery, in the event of a bounce back or email change, to keep the eDelivery process moving and avoid delays in processing time. If a lock out occurs, advisors can trigger a resend of the signing email once they add a new valid email address in Contract Delivery. Simply click the pencil icon beside the Email field to enter the valid email address:

Another new feature- in the event a client has declined, the advisor will get an email from Equitable Life®. Click through to EquiNet® within the email to view the message within Contract Delivery that the client provided as the reason for decline under a new “Declined Details” section. This enables you to connect with the client to proceed with the sale by discussing the reasons for decline with them directly.

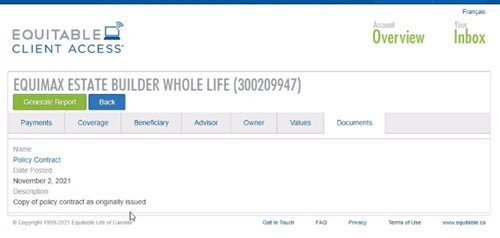

Also new for clients with this enhancement, policy owners of a policy created after January 15 will be able to see a PDF copy of their policy within client access. Note: this PDF copy is as the policy was originally issued.

Resources: -

Equitable Life Group Benefits Bulletin – January 2022

Short-term disability coverage for plan members with COVID-19*

Please note: This announcement applies only to groups with short-term disability coverage through Equitable Life

As the COVID-19 pandemic continues, and the situation evolves, we continue to adjust our practices to ensure ongoing support for our plan members.

PCR tests no longer required for COVID-related STD claims

Some provinces have recently restricted access to COVID-19 PCR testing to only high-risk individuals. To ensure your clients' eligible plan members receive their short-term disability benefits in a timely manner, we no longer require a positive PCR test for plan members submitting COVID-19-related STD claims.

Plan members who are experiencing symptoms of COVID-19 or who have tested positive for the virus (either with a PCR test or with an at-home rapid test) and are unable to work from home should complete the Short Term Disability Plan Member COVID-19 Claim Form (#421A).

They should indicate the date of the onset of symptoms or date of their positive test result. Where applicable, they should also indicate the date they have been cleared by public health to end their self-isolation. The form includes an attestation that the information they have provided is accurate.

The employer needs to complete the Short Term Disability Employer COVID-19 Claim Form (#421B). They should indicate the expected return-to-work date according to their provincial health guidelines, or using the date provided by a public health official.

Waiting periods for COVID-related STD claims

To support your clients' plan members during the initial stages of the pandemic, we waived the STD waiting period if a plan member’s absence was due to symptoms or a diagnosis of COVID-19. Now that COVID-19 has become the “new normal,” we are returning to our standard practices and treating the virus as we would any other illness.

Effective Jan. 1, 2022, standard waiting periods will apply for COVID-related STD claims, according to the terms of the Group policy. This ensures that all plan members submitting a STD claim are treated fairly, no matter what the cause of the claim.

Eligible plan members will receive STD benefits up to a maximum of 10 days from the date of the onset of symptoms or a positive COVID-19 test result, minus the waiting period.

For example, if the plan has a five-day waiting period, and the plan member returns to work nine days after a positive test result, they would be eligible for four days of benefits payments.

If the claimant is still unwell after 10 days, then the standard Short Term Disability Claim Form (#421) needs to be completed.

If a plan member is admitted to hospital, benefits will be paid following the waiting period applicable to hospital claims. -

Equitable Life’s Participating Account reaches $1 billion in assets

We are thrilled to announce that we’ve recently reached a milestone!

Our PAR account has surpassed $1 billion in assets. This is something we’re very proud of and we ultimately view as a sign of confidence from you and our clients.

Thanks for your continued support.

-

Kickoff 2022 Webcast

Equitable Life's Savings & Retirement team is hosting a digital fireside chat with members from the leadership team. Join us to hear Fabien Jeudy, President and Chief Executive Officer and Cam Crosbie, Vice-President, Savings and Retirement share their perspectives of the industry, their future vision for Equitable Life, and the Savings & Retirement division.

We will also hear from Tawnya Duxbury, Director, Savings & Retirement Operations and Projects as she shares how her operations team has equipped themselves to provide industry leading service.

Last but not least, we have invited guest speaker Larry Distillio, Assistant Vice-President Practice Management, Mackenzie Investments to discuss "Mastering your Mind to Increase your Bottom Line”. * Larry helps advisors learn how to avoid self-sabotaging behaviours such as procrastination, worry and avoidance while minimizing emotional stress. This is a session not to be missed.

Learn More

*We will be seeking Continuing Education credits for Larry Distillio's portion of this webcast. -

Make It EZ2 EZtransact Contest – Twice As Nice!

The Make-It-EZ EZtransactTM contest is back by popular demand! This time we are making it twice as nice with one $200 winner each week, and a Grand Prize winner of $2000 at the end of the contest! Just in time for your busy RSP season, EZtransact, makes managing your client’s policies quick and convenient.

Every EZtransact online transaction submitted between January 24 and April 1, 2022 gives you the chance to WIN! Eligible non-winning Entries will be carried forward to subsequent Draw Dates. So the sooner you start using EZtransact, the more chances you have to win! First draw will be on January 31, 2022.

Click here for to start using EZtransact today.

New to EZtransact? Click here to try our new EZtransact Sandbox practice site.“Make It EZ2” EZtransactTM Contest: No purchase necessary. Contest period January 24, 2022 to April 1, 2022. Eleven prizes to be awarded, for a total value of $4,000 CAD. Ten weekly prize draws, each for one prize of $200 CAD, to be held every Monday from January 31, 2022 to April 4, 2022. One Grand Prize draw, for one prize of $2,000 CAD, to be held on April 4, 2022. Correct answer to mathematical skill testing question required to win. Open to legal residents of Canada of the age of majority. Eligible non-winning Entries will be carried forward to subsequent Entry Periods and will be eligible on subsequent Draw Dates. Maximum one weekly draw prize per person. Odds of winning depend on number of eligible Entries received during the Contest Period. Click here to see full contest rules, including no purchase method of entry.

-

Equitable Life Group Benefits Bulletin - Group Advisor Bonus Enhancement

Announcing our Enhanced Group Advisor Bonus Program

We have enhanced our Group Advisor Bonus program to make it more competitive and to help support you in building your business with Equitable Life in 2022. We have updated the structure of the bonus program to make it easier for you to qualify, as well as increased the amounts we pay.

Beginning for sales effective in 2022 we have:- Decreased the minimum premium required to qualify for the Sales Bonus to $35,000 from $150,000.

- Moved away from using Graded Annualized Premium for both the Sales and Persistency Bonus and are using actual Annualized Premium instead, up to a maximum of $500,000 per policy. This simplifies the program and aligns us with the rest of the industry.

- Increased the Sales Bonus payout to up to 5% of Annualized Premium for Traditional Sales and up to 3% of Annualized Premium for myFlex sales.

- Changed the minimum annual premium threshold for the Persistency bonus to $500,000 of capped Annualized Premium from $500,000 of Graded Annualized Premium to make it easier for you to qualify.

These enhancements do not apply to advisors who are not part of our standard Advisor Bonus program and who have special bonus arrangements in place. If you have a special bonus arrangement in place and would like to switch to the standard program, please contact your Group Account Executive or myFlex Sales Manager.

Below is a table comparing the current Sales Bonus structure and payout. For full details, please refer to the Group Advisor Compensation and Recognition brochure.

Enhanced Sales Bonus

For the new Sales Bonus, the Payout Band is based on total combined Traditional and myFlex Benefits new annualized premium (capped at $500,000 per policy). The Sales Bonus Rates for both Traditional sales and myFlex sales are shown in the table below:

New Sales Bonus Rates Payout Band Capped Annualized Premium* Sales Bonus Rate

(from first dollar)Traditional Sales myFlex Sales 1 $34,999 and under 0% 0% 2 $35,000 to $99,999 3.5% 1.5% 3 $100,000 and over 5% 3% *Total Traditional and myFlex new business sales combined, capped at $500,000 per policy.

If you have any questions about the Advisor Bonus enhancements, please contact your Group Account Executive or myFlex Sales Manager.

-

CapIntel Partners with Canadian Financial Services Leader Equitable Life to Enhance Experience for F

For more than 100 years Equitable Life has worked with advisors to support Canadians with their financial goals. As a mutual company, with no other competing interests, Equitable Life’s duty and priority rests only with clients.

CapIntel’s intuitive platform is helping Equitable Life meet this commitment by enabling wholesalers and financial advisors to build, analyze, and compare portfolios and deliver personalized recommendations.

Learn more. -

2022 brings a new year of retirement savings opportunities

As a new year begins, you will start to reach out to your clients about the upcoming Retirement Savings Plan deadline, March 1, 2022. This year, connect with your clients through social media, video chats, emails or even in-person. Try Equitable’s Case Studies, Prospecting Letters, Video and Equitable Blog on EquiNet® to make the most of your meetings. Designed for each specific target group, these sales strategies can help initiate a conversation about retirement savings goals.

To learn more about Retirement Savings Plans, click here.