Site Search

1362 results for if

-

EAMG Market Commentary August 2022

August 2022

The S&P 500 fell into bear market territory over the first half of 2022 with the index down -20.6%. This represented a top 10 ranking amongst the most dismal back-to-back quarterly performances going back to 1928. While comparisons have been made to the inflation driven bear market of 1973-74, the economic backdrop today has some significant differences including greater production capacity (factory utilization rates are running about 20% lower vs the 70’s) and a meaningful decline in raw industrial prices which have fallen -11% over the quarter. While these economic anecdotes are potential positives for the future, it’s important to remain cognizant that prices remain elevated.

As such, the US Federal Reserve seems to be taking every opportunity to telegraph their intentions of raising interest rates at the expense of both market and economic performance, so long as inflation remains a threat. Given this hawkish tone, the market narrative has morphed from fears of inflation to a fed driven recession. As a result, the move in the bond market has been swift with the 10-year treasury yield peaking at approximately 3.5% in June to today’s level of 2.7% (lower rates = higher bond prices). This positive bond performance reflects the consensus view that inflation is temporary (2023 CPI forecasts are approximately 3.6% vs the second quarter’s 8.7% CPI reading) and could allow the Fed to adjust their higher interest rate trajectory downward. The Fed also remains confident that a soft landing is achievable, and a recession avoidable.

Investors seem less convinced however, given the Fed has never been able to engineer a soft landing before, and so it’s no surprise equity markets entered a bear market over the quarter, and currently remain in a technical correction (defined as losses greater than -10%). To better assess future performance, we closely monitor earnings results to understand how companies are navigating these economic trends. With nearly 80% of the S&P 500 reported, the results have been better than expected, but still the EPS beat rate and magnitude of beats (actual vs expectation) remain below 5-year averages. This tells us companies are finding today’s economic conditions more challenging than the recent past. Consumer sectors including marketing, retail, autos and textiles posted the 2nd worst performance vs other sectors while the Financials sector saw the greatest challenges with aggregate EPS falling by -15% year-over-year. Wall Street analysts have started to revise S&P 500 forward growth estimates lower, a trend which we expect will continue for several quarters ahead. The forward (12-month blended) P/E ratio of 17.5 times remains 1.5 multiple points above the long-term average which potentially suggests risks may not be fully priced in.

In terms of the S&P/TSX Composite, after declining nearly -14% in Q2 as recession fears around the world jeopardized the global demand outlook, its’ since rebounded over 4.0%. Still, valuation remains below longer-term averages at 11.8x forward earnings with the heavier weighted Financials and Energy sectors trading at 9.5x and 7.9x, respectively. TSX earnings expectations have stalled as of late but downward revisions are lagging US and European counterparts. Additionally, the domestic labour market remains tight which has allowed the Bank of Canada to continue its aggressive rate hike path to curb soaring inflation. For most of 2022 the TSX has benefitted from surging commodity prices but an economic slowdown in China resulting from its commitment to a zero-Covid policy and a potential global recession could prove to be a challenge for the Canadian market.

Equity markets on average lose 30% of their value in recession led bear markets. If we use this as a potential road map, it suggests the S&P 500 could have further to fall. Using past performance as a forward-looking tool however is an imperfect technique and used in isolation of what’s happening today can often mislead.

Accounting for today’s backdrop, we come up with three scenarios of varying probabilities. The first is the most optimistic and includes an engineered soft landing by the Fed, meaning no recession and inflation cools. A less optimistic view is the fed tames inflation with higher interest rates but tips the economy into a mild-to-moderate recession. The outcome would be consumer spending and corporate hiring slow as a result of tighter financial conditions, and therefore financial results are negatively impacted. The least optimistic scenario is one where stagflationary conditions emerge as inflation continues to accelerate at the expense of growth despite higher interest rates, in other words the Fed loses control. The net result would be similar to our second scenario but with much more dire results in terms of unemployment, household spending and impacts to corporate profitability. While we don’t rule out any of the above scenarios completely, we assign the highest probability to the second one where macro economic issues get resolved at some point in the future, but the full effects of inflation and a possible recession have yet to be priced into the market. Currently, this view translates into a slight underweight equity position versus our benchmark with a tilt towards low volatility and defensive strategies along with an overlay of value and dividend paying securities. In other words, we’ve de-risked the portfolios relative to our benchmark to manage potential downside risks but remain meaningfully invested an on absolute basis. As always, time in the market tends to overcome trying to time the market, and so employing a strategic and diversified strategy is often the most prudent approach.

Downloadable Copy

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable Life of Canada® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy. -

Crunch the numbers with Equitable Life of Canada

Whether helping your client determine net worth or reviewing to see if your client’s retirement plan is on track, Equitable Life® is here to help with our online calculators. These number crunching tools can help you answer some of those challenging questions you get asked by your clients. From an RSP loan calculator to home budgeting to even figuring out if your client will be a future millionaire, check out our latest tools.

-------------------------------------------------------------------------------------------------------Amesh just celebrated his 71st birthday. He is looking for a product that provides continued growth in a tax-sheltered environment. What should he do with his existing Registered Retirement Savings Plan?

Did you know?

It is mandatory that you convert your RRSP to a RRIF by December 31st in the year you turn 71. Check out Equitable Life’s RRIF Payment Calculator.Share calculators using your Facebook, Twitter or LinkedIn account.

-

THREE new ways to help make your Savings & Retirement business run smoother

As of August 20, 2022, EZcomplete® will include several new features that allow applications to be completed faster and easier:

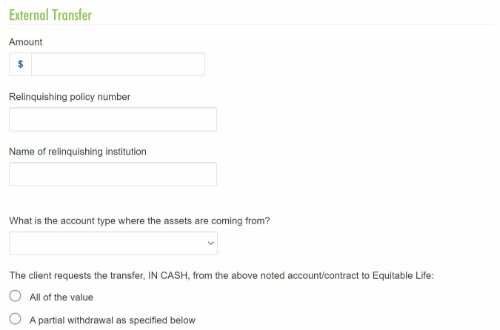

1. Prefilled Fund Transfer Form

The transfer form will be generated with the information from EZcomplete and included in the EZcomplete signing package, saving you time.

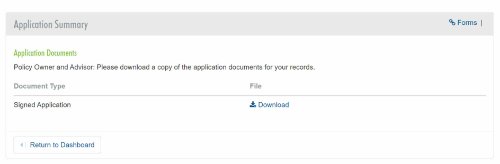

2. Client eSignature Audit History and Document Download

If you choose the e-signature option for the client, you’ll be able to download a copy of the e-signed transfer forms and the signature audit history.

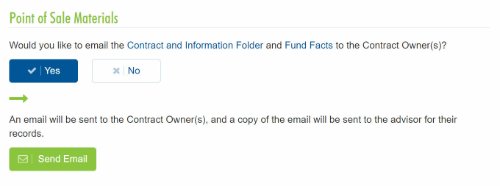

3. Email the Client Contract Info and Fund Facts Before Signing

You'll now be able to email Point of Sale materials (Contract & Info Folder and Fund Facts) to clients before they provide their e-signature.

Log in to EZcomplete today!

Speak to your Regional Investment Sales Manager to learn more!

-

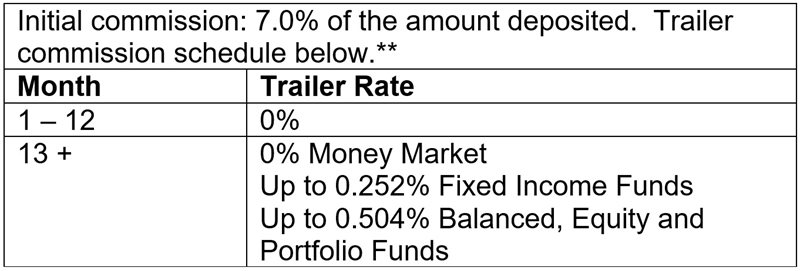

7% No Load CB5 Initial Commission – Limited time offer extended to December 31, 2022 for Investment

We are pleased to announce the temporary increase to the CB5 sales option initial commission from 5.6% to 7.0% has been extended to December 31, 2022 on Pivotal Select™ Investment Class (75/75) only.*

Equitable Life is committed to offering advisors and clients product, service, and feature choices that best suit their needs. We are pleased to offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds to align with advisors’ and clients’ unique needs.

For more information, please contact your Equitable Life Regional Investment Sales Manager.

* Equitable Life reserves the right to end the campaign, at any time and without notice. Prior temporary increase to CB5 sales option initial commission for Pivotal Select Protection Class 100/100 and Pivotal Select Estate Class 75/100 ends August 31, 2022.

** Applies to FundSERV trades occurring between September 1 and December 31, 2022. Initial commission on non-FundSERV trades occurring between September 1 to December 31, 2022 increases from 4% to 5%. Initial commission is subject to a chargeback.

™ or ® denote trademarks of The Equitable Life Insurance Company of Canada. -

Updates to Savings & Retirement forms and applications

To align with the launch of Pivotal Select’s 12 new segregated funds, Equitable Life has updated the following administrative documents for Savings & Retirement.

• Form #375SEL – Pivotal Select segregated fund codes

• Form #1383 – Pivotal Select TFSA Application

• Form #1384 –Pivotal Select Application Registered/Non-Registered

• Form #1403 – Pivotal Select Contract and Information Folder

New online documents and applications are available to download from EquiNet®. Paper applications are also available to order from Equitable’s Supply Team here.

Want to be sure you always have the most up-to-date application? Try our EZcomplete® online application platform. EZcomplete makes it easy to process your non face-to-face applications and allows clients to provide their signature remotely on their own device.

If you have any questions, contact your Regional Investment Sales Manager or Advisors Services Team Monday to Friday, 8:30 a.m. – 7:30 p.m. ET at 1.866.884.7427, or email savingsretirement@equitable.ca.

® and ™ denotes a registered trademark of The Equitable Life Insurance Company of Canada.

-

Equitable Life of Canada Webcast Series Featuring Invesco Canada

Equitable Life® continues to spotlight various aspects of our competitive fund lineup and product offerings. This series gives advisors an opportunity to:

- learn more about products and product features,

- hear from industry professionals,

- learn about investment strategies; and so much more.

In this webcast, we welcome

Join us to learn the reasons for the growth in ESG, how the following funds are managed and how they can be positioned in a client’s portfolio.- Equitable Life S&P/TSX Composite ESG Index Fund Select

- Equitable Life S&P 500 ESG Index Fund Select

- Equitable Life NASDAQ 100 ESG Index Fund Select

Learn more

-

Application cloning option now available on EZcomplete

As of September 10th, you will now have the option to clone any Life Insurance and Critical Illness applications that is showing on the EZcomplete dashboard. “Cloning” means the information that has been completed in the existing application is duplicated in a new application.

This feature is meant for situations where multiple applications are being completed and at least one of the parties (the policy owner or insured person) is the same. For example, a single policy owner might own policies on the lives of each of their children. Cloning the application will save re-typing the information about the policy owner into each application.

Please note the following important details regarding cloning:

- Cloning the application will duplicate all information that has been completed in the existing application into the new application.

- In the family situation described above, the information about the policy owner should be completed in the original application. The application should then be cloned before entering any information about the insured person, as there will be a different insured person for the new application.

- Cloning applications can be convenient, but it carries risk. It is imperative that the advisor review every section of the new cloned application to ensure that the information is meant to apply to the new application. If an advisor incorrectly includes information about an individual in the new application, this could give risk to a privacy breach or to liability for the advisor if the questions are answered incorrectly for that individual.

- If the application was submitted and is no longer on the dashboard you will not have the option to clone it.

- You will not be able to change the product type on a cloned application so if you need to select a different product, you will need to start a new application.

- Any documents that were attached to the previous application will not be cloned. The documentation will need to be attached again if required.

- All information from an existing application will be duplicated to the cloned app up to the Signatures step (step 8). Signatures/advisor report will need to be obtained and completed again on the new cloned application.

Resources

Please contact your Regional Sales Manager for more information

-

SMS is Available for Individual Insurance Application Updates

If you haven’t opted in to receive your client's application status via text message, give it a try on your next application.

When you submit a client’s application, you can opt-in to receive text message updates for your new business applications. No need to log in to your advisor portal to know exactly what is going on with a case.

Once you opt-in to receive text messages, you will receive short text updates for your new business applications. That’s a text message when:- The application is received,

- Equitable Life has made a decision,

- The policy is ready for delivery, and

- The commissions have been triggered.

In addition to these messages, Equitable Life will continue to send proactive emails detailing outstanding requirements.

Be sure to opt-in to text messages when you complete your next application on EZComplete®.

We’ve recently made a number of changes to make doing business with us easy. Learn more about SMS and other ways we are making it easy to do business with us.

® denotes a registered trademark of The Equitable Life Insurance Company of Canada.

-

A New Universal Life Insurance Solution for the 21st Century – Available NOW!

Introducing a new universal life solution built for the 21st century: Equitable Generations™ universal life insurance is available for sale NOW!

Check out our Equitable Generations universal life splash page: www.equitable.ca/ul

Our new Equitable Generations universal life insurance

Equitable Generations is a universal life product that offers investment options that resonate with today’s 21st century client while reducing every fee possible. It also reduces the cost of insurance to help clients maximize their opportunity to purchase coverage and build tax-advantaged wealth.

NEW: EZstartTM Generations

Today we are launching EZstart Generations which is:

- A mobile-optimized tool for advisors

- Designed to start a conversation and provide a possible universal life solution in under one minute

- Goals based - you can see how Equitable Generations™ universal life insurance can perform at different stages of a client’s life.

NEW: SMS

Effective today, September 26, 2022 when you submit an application, you can opt-in to receive text message updates for your new business applications.

That’s a text message when:- The application is received,

- A decision has been made by Equitable Life,

- The policy is ready for delivery, and

- The commissions have been triggered.

Learn more

Find all the exciting details on our virtual launch splash page (www.equitable.ca/ul) and watch our informative videos to get all the information you need to start selling Equitable Generations universal life.

Check out our Equitable Generations universal life splash page: www.equitable.ca/ul

Click on the Marketing Materials tab on EquiNet® for all of our new Equitable Generations marketing materials.Please contact your Regional Sales Manager for more information.

TM and ® denote trademarks of The Equitable Life Insurance Company of Canada.

-

Equitable Life Webcast Series featuring Franklin Templeton

Equitable Life® continues to spotlight various aspects of our competitive fund lineup and product offerings. This series gives advisors an opportunity to:

• learn more about products and product features,

• hear from industry professionals,

• learn about investment strategies; and so much more.

In this webcast, we welcome

.jpg)

Join us to learn about Equitable Life ClearBridge Sustainable Global Infrastructure Income Fund Select along with the fund’s people, process, philosophy, and performance.Learn more