Site Search

1362 results for if

-

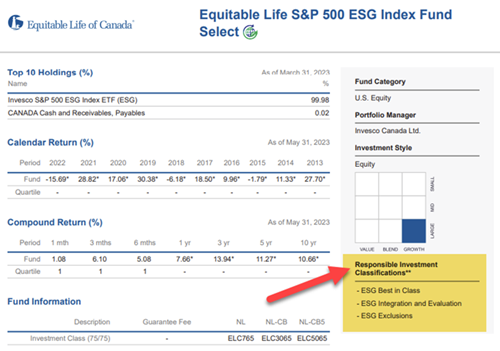

Responsible investing classification on Equitable Life Pivotal Select funds

Recently, the Canadian Investment Funds Standards Committee (CIFSC) classified responsible investing funds under its RI identification framework. The goal of the framework is to help investors and advisors identify and compare responsible investing funds.

We’re pleased to share that the following funds have been assigned multiple responsible investment classifications:• Equitable Life NASDAQ 100 ESG Index Fund Select

• Equitable Life S&P 500 ESG Index Fund Select

• Equitable Life S&P/TSX Composite ESG Index Fund Select

• Equitable Life ClearBridge Sustainable Global Infrastructure Income Fund Select

• Equitable Life Fidelity® Climate Leadership Balanced Fund Select

• Equitable Life Fidelity® Climate Leadership Fund Select

You can find the new responsible investment classifications for our funds by visiting our Fund Information webpage. After selecting a fund with the “Sustainable Investment” icon, the classifications can be found on the right side of the webpage or fund profile PDF:

™ or ® denote registered trademarks of The Equitable Life Insurance Company of Canada.

Posted: June 26, 2023

-

New Dividend Scale Effective July 1, 2023!

Equitable Life’s Board of Directors has approved a change to the dividend scale* for the period July 1, 2023, to June 30, 2024.

- The interest rate we use for the dividend scale will go from 6.05% to 6.25% on July 1, 2023.

- Other factors used to decide the dividend scale will stay the same.

- The interest rate for participating whole life policies with dividends on deposit will stay the same at 2.25%.

- The policy loan interest rate** will go from 6.20% to 6.50% on June 30, 2023

More good news!

Once the next dividend scale year starts, we expect policyholder dividends to be close to $105 million until the end of June 2024.

Learn more

- Advisor Dividend Scale Notice

- Client Dividend Scale Notice

- Dividend Information Page

Did you miss our virtual Spring Update & 2023 Dividend Scale Announcement? Watch it now:

(*The French and Chinese events will be partially in English, with sub-titles on screen).

TOGETHER – Protecting Today – Preparing Tomorrow™

As a MUTUAL we provide financial security DIFFERENTLY by focusing exclusively on our CLIENTS.

*Dividends are not guaranteed and are paid at the sole discretion of the Board of Directors. Dividends may be subject to taxation. Dividends will vary based on the actual investment returns in the Participating Account as well as mortality, expense, lapse, claims experience, taxes, and other experience of the participating block of policies. Changes in the dividend scale do not affect the guaranteed premium, guaranteed cash values, or guaranteed death benefit amount. A copy of Equitable Life’s Dividend Policy and Participating Account Management Policy can be found on our website at www.equitable.ca.

** This applies to all new and active policy loans, including automatic premium loans. This change is for Equimax® policies that have a 9-digit policy number beginning with a “3” or an “8”. Some older policies may have other loan rates as they are based on the prime interest rate. -

A message from Cam Crosbie, EVP, Savings and Retirement, Equitable Life

The first half of 2023 has been an exciting and busy year for us at Equitable Life®.

In this short video, I share with you some of the things we’ve done to show our commitment to you and some of the great things we’ve got planned for the remainder of the year.

I want to thank you again for your continued support and trust in us. We value our partnership and are always working hard to make things better.

Please take a few minutes to watch the video.

Thank you,

Cam Crosbie, Executive Vice-President, Savings and Retirement Division

Equitable Life of Canada

Posted: July 6, 2023

® denotes a trademark of The Equitable Life Insurance Company of Canada. -

Critical Illness Insurance Update

Path to Success CI program

This program was designed with you, the Advisor, in mind. It gives you ideas and scripts that you can use in your conversations with clients about Critical Illness. Catch a sneak preview below!

The three realities of health care are:

- Incidence of being diagnosed with a critical illness is exceptionally high

- No one is immune

- Survival with consequence; even if one survives a critical illness, the financial and emotional consequences are significant

Want to know more?

Visit the Critical Illness Path to Success page on EquiNet

Earn CE credits through the Path to Success program!

What’s new with CI?

If you missed some of our updates, check them out below!- June was Brain Injury awareness month… Check out some of our posts on our social media channels! LinkedIn | Facebook | Twitter | Instagram

- EZcomplete now automatically displays Critical Illness insurance premiums

- Cloud DX signs contract with Heart Centre

For more information, reach out to your local wholesaler. -

Introducing Path to Invest for learning and earning CE credits

Equitable Life is pleased to introduce Path to Invest, our self-serve Continuing Education accredited presentation platform for advisors.

Whether you want to learn more about the financial services industry or how responsible investment solutions can fit into a client’s overall financial well-being, Path to Invest has what you are looking for.

It’s a one stop shop with 15 accredited presentations on a variety of topics. All with a video tutorial, short quiz and resource links for more information.

A few important notes before you get started.

PLEASE USE CHROME to get the best online experience as elements of the platform may not display correctly in other browsers.

To get started on your Path to Invest:- • Click Equitable Life Education site

- • Use the email address that you received this email to login.

- • Your password is Equitable

- • This link is specifically for your use only. Please do not share this link.

- Select a module.

- Watch the entire video presentation.

- Complete the quiz and receive a passing grade.

Check out Path to Invest and start learning and earning CE credits today.

Questions? Contact your Regional Investment Sales Manager to get started on your Path to Invest today!

™ or ® denote registered trademarks of The Equitable Life Insurance Company of Canada.

Posted June 14, 2023 -

See how choosing Equimax Participating Whole Life can help Raj plan for his family’s future

Raj wants to buy life insurance. He has wealth he’s grown over the years. He wants it to go to his family. He likes what participating whole life has to offer.

By choosing an Equimax participating whole life insurance policy with Equitable Life, Raj gets permanent insurance coverage with tax-advantaged cash growth. His policy can also earn annual dividend payments.

He learns about how his premiums go into a participating account and are invested. Some of that investment can come back to him as dividends.

With Equitable Life, dividends are shared only with participating policyholders. This makes Equimax Participating Whole Life an easy choice for Raj.

Watch our new Dividends with Equitable Life of Canada video to learn more. View on Vimeo or YouTube.

You can use this video to send to clients before or after meetings to help them understand Dividends with Equitable Life.

Plus, visit our Equimax product page, then click on the Marketing Materials tab for the latest Dividend marketing materials.

Need more information? Please contact your local wholesaler.

® and ™ denotes trademarks of The Equitable Life Insurance Company of Canada.

To learn more about our dividend policy and participating account management policy, please visit www.equitable.ca/en/already-a-client/dividend-information/

Dividends are not guaranteed and are paid at the sole discretion of the Board of Directors. Dividends may be subject to taxation. Dividends will vary based on the actual investment returns in the participating account as well as mortality, expenses, lapse, claims experience, taxes and other experience of the participating block of policies. -

Equitable Life ClearBridge Sustainable Global Infrastructure Income Fund Select: Stability and diver

Although an often-overlooked asset class, infrastructure assets are physical assets that provide an essential service to society. Investing in infrastructure can offer stability and diversification in a well-balanced portfolio.

Check out Equitable Life® ClearBridge Sustainable Global Infrastructure Income Fund Select in this issue of Fund Focus. The fund aims to achieve long-term capital appreciation and income by investing in publicly listed real estate companies across a spectrum of property types and geographies.

Reasons to Invest:- ClearBridge has 50+ years as a leader in active management, with a focus on sustainable investing.

- An ESG (Environmental, Social and Governance) driven investment process: ESG factors are part of fundamental research and a bottom-up security selection process, and risks and opportunities are viewed through an ESG lens.

- Predictable income generation throughout the cycle: Invests in income-generating infrastructure assets, with cash flows underpinned by regulation or long-term contracts.

- Participation in global infrastructure renewal: Both developed and emerging economies are growing their infrastructure assets, producing new investment opportunities.

- Lots of flexibility - broad ranges for sector allocation and geographical allocation

For more information, check out the Equitable Life ClearBridge Sustainable Global Infrastructure Income Fund Select or contact your Regional Investment Sales Manager.

Date posted: July 20, 2023

™ or ® denote registered trademarks of The Equitable Life Insurance Company of Canada.

-

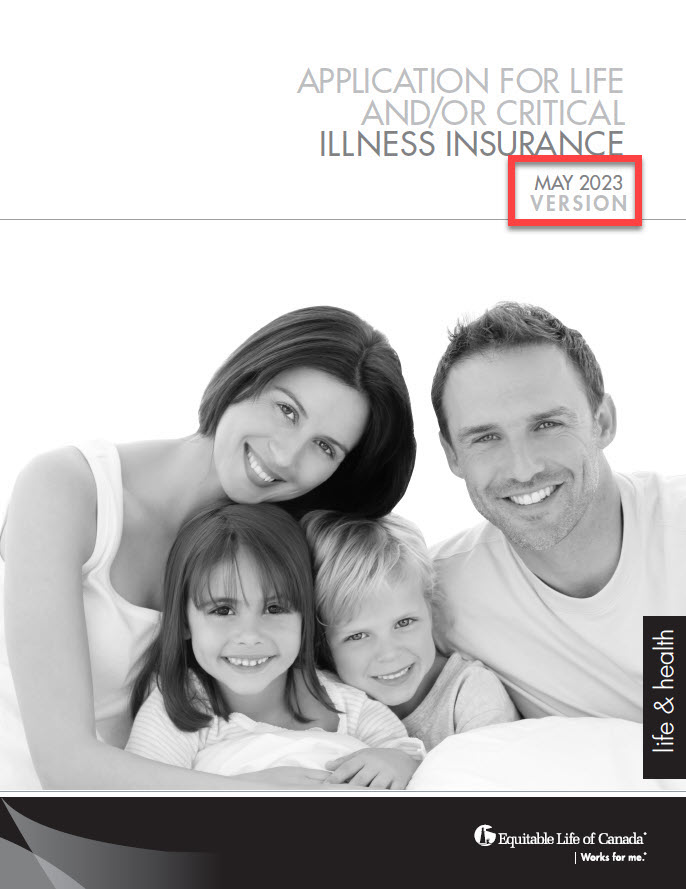

New 350 Life and CI Applications

On August 2nd, 2023, Equitable Life® will be updating the privacy and legal sections on some forms. This includes the form 350 Paper Application for Life and/or Critical Illness Insurance. This change will also be applied on our websites and our online application EZComplete®. These changes are part of Bill 64. The Bill is about the protection of personal and private information in Quebec. This will take effect on September 1st, 2023.

Due to this change, we ask all advisors to use the latest version dated May 2023 of the paper application after August 2nd. Applications in Quebec must use the lastest version from September 1, 2023 onwards.

For all regions outside Quebec, we will support a transition period from ‘old’ to ‘new’ applications until December 31st, 2023. After this date, we will no longer accept older versions of our Life and Critical Illness application.

To make sure you are using the latest version of the application, check the date on the title page. It should say May 2023. See the image below:

.jpg?width=200&height=259)

To order paper copies, click here.

Email completed applications to supply@equitable.ca.

To learn more about Bill 64, please visit Assemblee nationale du Quebec - Bill 64. You may also contact your wholesaler.

® denote a registered trademark of The Equitable Life Insurance Company of Canada. -

Predictive Analytics at Equitable Life

At Equitable Life®, we understand the importance of using technology and data in making informed business decisions. That's why we leverage predictive analytics to improve our Underwriting process.

LEARN MORE about Predictive Analytics at Equitable Life.

® denotes a trademark of The Equitable Life Insurance Company of canada -

EAMG Market Commentary July 2023

Posted July 27, 2023

July 17, 2023

Rates & Credit - The rates market was volatile in Q2 as investors focused on inflation, central bank interest rate decisions, and recession probabilities. Persistent strength in U.S. consumer spending and labour markets have surprised investors and prompted further interest rate tightening from central banks. In Canada, corporate bonds outperformed government bonds and the broader FTSE Canada Universe Index during the quarter, with a total return of 0.2%, versus a loss of 1.0% for government bonds and 0.7% for the overall Index. The corporate bond outperformance was driven by a broad risk-on tone to the market, most notably in April as the market recovered from the banking sector liquidity crisis that developed during March. That said, the market tone remained cautious, with the improved risk premium on corporate bonds tempered by lingering concerns around sticky inflation, high interest rates, and the potential for slower economic growth into the latter half of the year.

Dominance of U.S. Equities – U.S. equity markets posted another strong quarter with the S&P 500 returning 8.7%, outperforming Canada and other major international equity markets. The S&P/TSX Composite, returned 1.2% in CAD. Major developed economies from Europe, Australasia, and Far East (EAFE) returned 3.2% in local currency terms. The highly anticipated re-opening of the Chinese economy has failed to materialize with economic data indicating less strength than previously forecasted. Amid sluggish Chinese growth, closely interconnected economic partners such as the European Union, as well as commodity-driven markets like Canada, have all underperformed the U.S. on a relative basis.

U.S. Fundamentals – Earnings continued to contract versus prior year, albeit at a slower pace than forecasted. Forward earnings guidance improved quarter-over-quarter with corporate sentiment returning to neutral levels. Based on our analysis, we observed that 31% of major companies expect deteriorating financial performance, while 33% expect improved performance, with the remaining expecting no material change. Overall, major U.S. companies remain well capitalized with strong operating margins. However, company guidance indicates a prioritization of cost controls amid increased consumer indebtedness and concerns about the health of the consumer.

Artificial Intelligence (AI) Mania – Despite concerns that the U.S. economy is at a late stage in its economic cycle, that monetary tightening by central banks could go too far, and the fact that earnings contracted on a year-over-year basis, equity markets became more expensive during the quarter with price-to-earnings multiples expanding. This expansion was driven by investors crowding into AI focused technology companies, with the seven largest AI/technology themed companies averaging a 26% return while the other 493 members gained only 3%. Investors rewarded businesses with contributions to AI development (hardware and software components), as well as those with the ability to implement synergies from leveraging the technology. A crowded market surge is not uncommon at this point in the economic cycle, where positive economic surprises, in this instance, strong employment and consumer spending can lead to an upswelling in investor confidence.

U.S. Quant Factors – Using our investment framework, we currently favour exposures to large cash-rich companies with innovative product offerings, which we believe offer the strongest risk-adjusted returns in the current market environment. While the valuation of AI companies seems to defy traditional rationales, the momentum has continued to push the group higher. Consequently, the Quality factor (companies with higher return-on-equity, strong operating performance, and healthy leverage levels) participated in the AI trend and consistently outperformed throughout the quarter. The Low Volatility factor (stocks with lower sensitivity to broad market movement, and lower price volatility) underperformed through the quarter. While the Low Volatility factor typically performs well at this stage of the economic cycle, the fact that a small number of stocks were responsible for much of the market’s return hurt this factor. Lastly, the Momentum factor (stocks with a recent history of price appreciation) initially underperformed during the quarter before rebounding in June. This factor’s recent outperformance suggests that the market is becoming complacent and possibly signals that rotations within the market are slowing as current trends remain in favour.

Canadian Fundamentals – Top line revenue missed forecasts while bottom line earnings were consistent with expectations. Softer-than-expected results out of Canadian financials, as well as underwhelming results from the materials sector, dragged on the aggregate index performance. Earnings forecasts for the rest of the year have been revised downward with analyst expecting index aggregate earnings to detract 2% to 3%. Meanwhile, the Bank of Canada raised its overnight interest rate by 25 basis points, bringing it to 4.75% on the backdrop of robust economic data releases including Q1 GDP and April CPI.

Canadian Quant Factors – The most notable dislocation in Canada was the convergence of the dividend yield of High-Dividend ETFs and Equal-Weight Bank ETFs. We believe that the drag from Canadian banks following the U.S. regional banking concerns in March resulted in a discount of the Quality factor as the performance of the group is sensitive to the movements of banks. While banks did recover around 35% of their SVB-induced underperformance, the nature of banking has attracted investor scrutiny given the view that we are in the late-stage of the economic cycle. That said, this environment is an attractive environment to add variants of the Quality factor, which would gain exposure to a rebounding industry that offers a similar dividend yield to the high dividend stocks.

Views From the Frontline

Rates – On an outright basis, bond yields across the curve continue to look attractive. Economic data remains strong however we are beginning to see the first signs of weakness in spending, jobs and inflation. Slower growth, a more balanced labour market, declining inflation, and tighter credit conditions will likely drive interest rates lower throughout 2023. Market participants remain focused on the extent of interest rate hikes and the duration of a pause required to bring inflation back to the 2% target. With inflation remaining more persistent than previously expected forecasts around the timing, pace and extent of the removal of monetary policy have been pushed into 2024.

Credit – The uncertain economic outlook and risks around slower economic growth later this year merit caution about corporate bonds and a bias towards higher-quality, shorter-dated credit where we think the risk / reward dynamic are more favourable. That said, the “soft-landing” narrative, now more pervasive in the market, could continue to provide support to risk assets, which we view as an opportunity to further pare down higher beta exposure.

Equities – Given the direction of the current economic and company fundamental data, we continue to favour high quality growth segments of the market with strong operating margins. As such, the late cycle conditions in the market reinforce our preference for large cap stocks over smaller, more U.S. domestically focused businesses. The U.S. Low Volatility factor’s underperformance is unlikely to reverse in the short term given the resilience of the U.S. economy. Furthermore, after a steep decline last quarter, we expect that cyclical value will find support in the near term, echoing the increased chance of slowing inflation without stalling economic growth. In Canada, equities are typically more cyclical in nature, which coupled with the potential for an earnings contraction, makes us view the Low Volatility factor as more likely to outperform. Like the U.S., we prefer Canadian high-quality companies to navigate through the late cycle environment. On the heels of poor Chinese economic data and underwhelming stimulus, we are maintaining our overweight to the U.S. relative to Canada and EAFE.

Downloadable Copy

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable Life of Canada® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy.