Site Search

1362 results for if

- New Investment Policy

- New Investment Contract

- Equitable Partner Site

- [pdf] Personalized Brochure - Benefits of segregated funds in a Tax-free Savings Account

-

Savings & Retirement Policy and Procedure updates regarding Electronic Signatures

We have updated our policies and procedures regarding electronic signatures in the Savings and Retirement department. We are now able to accept electronically signed documents, from all major third-party signing vendors.

Including esign@equitable.ca as a non-signing reviewer is the preferred method as it ensures the security embedded documents are accurately and immediately available for Equitable. We will be automatically notified when signing is complete and will download eSigned forms immediately for processing. Including esign@equitable.ca as a non-signing reviewer is secure, quick, and efficient. Documents no longer need to be emailed to us – eSigned documents are sent directly to us once all signatures are completed, therefore you do not need to notify us once the documents are signed.

When esign@equitable.ca is not used to submit electronically signed documents, the following criteria are required:- The original signed form and audit trail with all the security features intact

- The email address used to sign must match what is in our files (as provided on the application, for electronic policy delivery or through previous communication). If an email address has changed, or we don’t have an email contact for the signer, we will follow up for confirmation.

A guide on how to use esign@equitable.ca can be found here.

Please note that Equitable does not accept digital signatures (images or fonts of a signature which are not stamped).

Date posted: June 13, 2024 -

Now is a great time to look at bonds

Bonds have a place in every investment portfolio. They help preserve capital and they offer predictable income. They help diversify portfolios and offer protection from both inflation and a volatile stock market.

Over the past few years interest rates have been rising, which has created a great opportunity for bonds and bond funds. Rising interest rates have lowered the price of existing bonds and increased both the coupon rates for new bonds and yields on existing bonds. Plus, rising rates also create opportunities for capital gains if interest rates fall.

Pivotal Select™ offers four great bond funds to help you diversify client assets. Three of the funds cover North American bonds, and one has a global focus. Learn more about these funds by visiting Equitable’s Fund Overview and Performance website.

To learn why now might be the right time to revisit bonds for clients’ portfolios and more information about our funds, please contact your Director, Investment Sales.

Also, if you missed the Equitable webcast, “Is it time to revisit bonds?” catch up On-Demand.

Date posted: May 16, 2024 -

Celebrating our most popular Pivotal Select funds

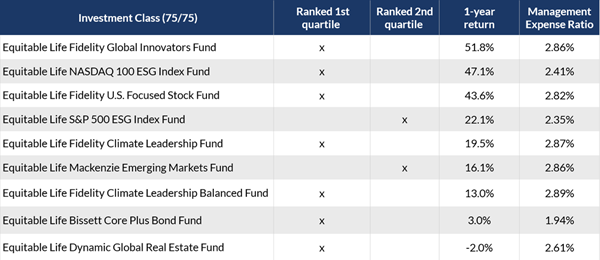

In August 2022, Equitable® launched 12 new segregated funds in Pivotal Select’s Investment Class (75/75). We wanted to bring some new innovative solutions to the product, including six sustainable investment funds. To say the launch of these funds was successful would be an understatement.

The funds are quickly becoming some of the most popular funds in Pivotal Select™, and their performance in 2023 was impressive. Equitable wants to celebrate these funds and encourage clients to consider them for their portfolios.

As of February 29, 2024, nine out of the 12 funds received a 1st quartile ranking for their 1-year return and two more were 2nd quartile. The table below shows the new funds that ranked in the top two quartiles for their 1-year returns.

Access additional fund performance information

If you haven’t looked at these funds yet, now is the time. Speak to clients about their investment options and see if these funds fit within their investment portfolio.

Talk to your Director, Investment Sales today for more information.Disclaimer

Any amount that is allocated to a segregated fund is invested at the risk of the contractholder and may increase or decrease in value. Segregated fund values change frequently, and past performance does not guarantee future results. Investors do not purchase an interest in underlying securities or funds, but rather, an individual variable insurance contract issued by The Equitable Life Insurance Company of Canada. There are risks involved with investing in segregated funds. Please read the Contract and Information Folder before investing for a description of risks relevant to each segregated fund and for a complete description of product features and guarantees. Copies of the Contract and Information Folder are available on equitable.ca.

Management Expense Ratios (MERs) are based on figures as of February 29, 2024, and are unaudited. MERs may vary at any time. The MER is the combination of the management fee, insurance fee, operating expenses, HST, and any other applicable non-income tax for the fund and for the underlying fund. For clients with larger contract values, a Management Fee Reduction may be available through the Preferred Pricing Program. For details, please see the Pivotal Select Contract and Information Folder.

® and TM denote trademarks of The Equitable Life Insurance Company of Canada.

Posted April 18, 2024

-

Equitable Life Active Balanced Portfolios – a unique investment opportunity

Find out how the Equitable Asset Management Group uses quantitative investing to uncover often overlooked investment opportunities to build the Equitable Life Active Balanced Portfolios. Clients benefit from asset allocation, style diversification, and cost-effective ETFs. The Portfolios are an ideal solution for a range of clients with diverse needs.

Join your host, Dave Irwin, AVP, External Fund Manager, and members of the Equitable Asset Management Group to learn how you can help clients achieve their financial goals with the Equitable Life Active Balanced Portfolios.

Learn more

Continuing Education Credits

This webcast has been submitted for continuing education (CE) approval with the Insurance Council of Manitoba and Alberta Insurance Council for all provinces excluding Quebec. Upon approval, you will be sent an email notification to come back to the webinar presentation console to download your personalized certificate from the tool bar. To be eligible for CE credits, you must register individually, watch the webcast in full and complete a short quiz. This webcast is available in English only.

™ and ® denote trademarks of The Equitable Life Insurance Company of Canada

Posted March 7, 2024

-

Step Up Your Wealth Sales with Equitable!

Welcome to the Step Up Your Wealth Sales program with Equitable®.

The program rewards advisors who promote Equitable’s Savings & Retirement products to existing and new clients as part of an overall investment strategy based on client needs.

Commission Bonus Calculation:

Gross deposits into segregated funds

+ Gross deposits into Guaranteed Interest Account contracts

+ 25% of payout annuity sales

- Segregated fund redemptions

- GIA redemptions

= 2024 Net Deposits

All deposits, sales, and redemptions occurring between January 1 and December 31, 2024, will be used to calculate an advisor’s 2024 net deposits.

Tier 2024 Net Deposits Bonus Rate* 1 Less than $250,000 $0 2 $250,000 - 499,999 .25% 3 $500,000 – 749,999 .50% 4 $750,000+ .75% 5 Elite Advisor re-qualifiers1 1.00% * The bonus amount will be calculated at the end of 2024 based on net deposits. The bonus will be paid within 90 days following December 31, 2024. Maximum bonus payable is $100,000 for Elite Advisor re-qualifiers; $75,000 otherwise.

For more information, download our flyer or contact your Regional Investment Sales Manager.

Equitable is committed to offering advisors and clients product, service, and feature choices that best suit their needs. We offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds to align with clients’ unique needs.

Posted: February 7, 2024

™or ® denotes a registered trademark of The Equitable Life Insurance Company of Canada.

1Elite Advisor re-qualifiers are advisors who attained Elite status as of end of 2023 and maintain Elite status at the end of 2024. To attain 2024 Elite Advisor status, an advisor must have $1,250,000 in gross deposits in at least 5 policies or $10,000,000 in assets. -

EquiNet email verification starting October 21

Starting October 21, 2023, advisors will be asked to verify or update the email we have on file when logging into EquiNet®. The purpose of verifying your email address is to enable multi-factor authentication in the future and enhance advisor communications based on accurate email addresses.

Instructions:-

Log into EquiNet with your username and password.

-

You will be redirected to the "Verify Email" page. Choose to verify or update your email address.

-

Check your email for the verification link.

-

In the email select "Verify Email" within 24 hours of receiving the email.

-

Once you have verified your email and are logged into EquiNet, you will return to the EquiNet home screen and a success message will display.

-

You will receive a confirmation email that you have verified your email address.

® denote trademarks of The Equitable Life Insurance Company of Canada.

Thank you for your cooperation.

Posted October 4, 2023 -