Site Search

103 results for 31

-

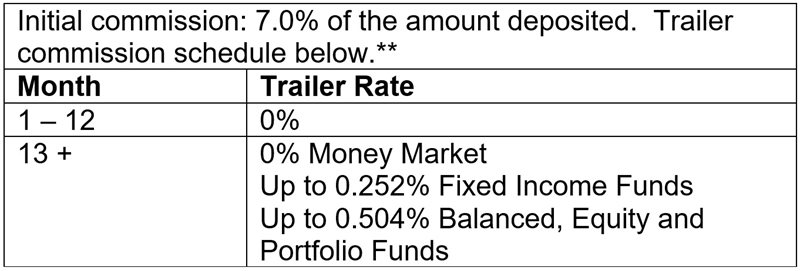

7% No Load CB5 Initial Commission – Limited time offer extended to December 31, 2022 for Investment

We are pleased to announce the temporary increase to the CB5 sales option initial commission from 5.6% to 7.0% has been extended to December 31, 2022 on Pivotal Select™ Investment Class (75/75) only.*

Equitable Life is committed to offering advisors and clients product, service, and feature choices that best suit their needs. We are pleased to offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds to align with advisors’ and clients’ unique needs.

For more information, please contact your Equitable Life Regional Investment Sales Manager.

* Equitable Life reserves the right to end the campaign, at any time and without notice. Prior temporary increase to CB5 sales option initial commission for Pivotal Select Protection Class 100/100 and Pivotal Select Estate Class 75/100 ends August 31, 2022.

** Applies to FundSERV trades occurring between September 1 and December 31, 2022. Initial commission on non-FundSERV trades occurring between September 1 to December 31, 2022 increases from 4% to 5%. Initial commission is subject to a chargeback.

™ or ® denote trademarks of The Equitable Life Insurance Company of Canada. -

7% No Load CB5 Initial Commission - Limited Time Offer!

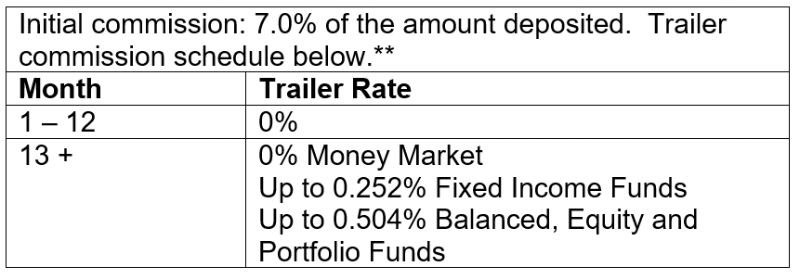

For a limited time only, Equitable Life® is pleased to announce an increase to the CB5 sales option initial commission from 5.6% to 7.0% on Pivotal Select™ segregated funds. The 7% initial commission is effective from May 20 to August 31, 2022 only.*

Equitable Life is committed to offering advisors and clients product, service, and feature choices that best suit their needs. We are pleased to offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds to align with advisors’ and clients’ unique needs.

For more information, please contact your Equitable Life Regional Investment Sales Manager.

* Increased initial commission does not apply to pre-existing PADs. Equitable Life reserves the right to end the campaign, at any time and without notice.

** Applies to FundSERV trades occurring between May 20 and August 31, 2022. Initial commission on non-FundSERV trades occurring between May 20 to August 31, 2022 increases from 4% to 5%. Initial commission is subject to a chargeback.

™or ® denotes a registered trademark of The Equitable Life Insurance Company of Canada.

- WFG Life Business Month End Cycle - Cut Off Schedule

-

An important announcement about our Travel Assist provider

Allianz Global Assistance, our Travel Assist emergency medical assistance provider, has informed us that it is exiting the Canadian group travel insurance market.

Allianz will continue to accept and support new claims up to June 30, 2023, and they will support ongoing claims until Dec. 31, 2023.

We are already meeting with potential new Travel Assist partners and plan to have a provider in place before June 30, 2023.

In the meantime, we are working closely with Allianz to help ensure a smooth and seamless transition for your clients and their plan members. Allianz is committed to maintaining its staff to meet and exceed service levels throughout the transition, as follows:

Before July 1, 2023:

Allianz will continue to accept calls and open new claims up to June 30, 2023. Any claims opened on or prior to June 30, 2023, will continue to be processed by Allianz until Dec. 31, 2023.

After July 1, 2023:

New cases will be directed to our new service provider. Allianz will work alongside us and our new provider to make this transition as simple as possible.

After Dec. 31, 2023:

For any cases still open as of Dec. 31, 2023, Allianz will work with our new service provider to responsibly transfer these cases while ensuring a seamless client experience.

We will communicate this news next week to your clients who have Travel Assist coverage on their plan. And we will continue to communicate more details to you about this transition in the coming weeks.

If you have any questions, please contact your Group Account Executive or myFlex Sales Manager. -

Equitable's Fresh Outlook DIA/GIA Contest

CONGRATULATIONS to Immaculata A., Manitoba. Winner of the PRIZE of $1000.

The contest is now over. Thank you to those who participated.

Win with Equitable’s Fresh Outlook DIA/GIA Contest

August 1 to October 31, 2024

® or TM denotes a registered trademark of The Equitable Life Insurance Company of Canada.

Fresh Outlook DIA/GIA Contest: No purchase necessary. Contest period is August 1, 2024 to October 31, 2024. One (1) prize to be awarded for a total value of $1,000 CAD. Correct answer to mathematical skill-testing question required to win. Open to legal residents of Canada of the age of majority. Odds of winning depend on number of eligible Entries received during the Contest Period. For full contest rules, including no-purchase method of entry, see full contest rules. -

Important Information Regarding FHSA Contributions

Many clients have already taken advantage of Equitable’s First Home Savings Account (FHSA), available on Pivotal Select™ Investment Class (75/75) and Pivotal Select Estate Class (75/100).

Below, we answer questions we have received regarding cut-off dates for 2023 FHSA contribution tax receipts.

1. The client submitted an application with a deposit before 11:59 p.m. ET on December 29, 2023. Will they get a 2023 FHSA contribution tax receipt?

Yes, the client will receive a 2023 FHSA contribution tax receipt.

2. The client submitted an application with a deposit on December 30 or 31, 2023. Will they get a 2023 FHSA contribution tax receipt?

No, the client will not receive a 2023 FHSA contribution receipt. The client’s deposit will be made effective the next business day, January 2, 2024. The client will receive a FHSA contribution tax receipt for the 2024 tax year.

However, since the client signed the application on or before December 31, 2023, they are eligible to take advantage of the 2023 contribution room in 2024 (up to $16,000 total*).

3. The client submitted an application with a deposit after January 1, 2024, but it was signed on or before December 31, 2023. Will they be eligible for the 2023 contribution room?

Yes. Any FHSA application received on or before 4:00 p.m. ET on January 12, 2024 that was signed on or before December 31, 2023 will be eligible to take advantage of the 2023 contribution room in 2024*.

4. The client received a confirmation letter stating their deposit was effective in January, but the application and contribution was submitted on or before December 29, 2023, will they receive a 2023 tax receipt for their contribution?

Yes, if the client received a confirmation letter stating their deposit was effective in January but the application and deposit was received at Equitable® on or before December 29, 2023, they will receive a 2023 tax receipt for their contribution. We are currently updating any impacted FHSA policies to reflect a December trade date. The client will receive a revised confirmation letter reflecting the December trade date.

5. When will 2023 FHSA contribution tax receipts be issued?

FHSA contribution receipts for the 2023 tax year will be mailed to clients by February 29, 2024.

If you have further questions, please contact your Regional Investment Sales Manager or one of our Client Services Representatives at 1.866.884.7427.

*Clients must consider all eligible FHSAs with any other institutions to determine their remaining contribution room.

® or ™ denotes a trademark of The Equitable Life Insurance Company of Canada.

Posted January 2, 2024 -

Step Up Your Wealth Sales with Equitable Life

Step up your wealth sales with Equitable Life® and you’ll be rewarded with a growth bonus for doing more business in 2022. Make this year your best year ever with Equitable Life!

The program rewards advisors who promote Equitable Life’s Savings & Retirement products to existing and new clients as part of an overall investment strategy based on client needs.

Commission Bonus Calculation:

Gross deposits into segregated funds

+ Gross deposits into Guaranteed Interest Account (GIA) contracts

+ 25% of payout annuity sales

― Segregated fund redemptions

― GIA redemptions

= 2022 Net Deposits

All eligible deposits, sales, and redemptions occurring between January 1 and December 31, 2022, will be used to calculate an advisor’s 2022 net deposits.

* The bonus amount will be calculated at the end of 2022 based on net deposits. The bonus will be paid within 90 days following December 31, 2022. Maximum bonus payable is $75,000.

For more information, download our flyer or contact your Equitable Life Regional Investment Sales Manager.

And as a reminder, we increased the CB5 sales option initial commission from 5.6% to 7.0% on Pivotal Select™ segregated funds. The 7% initial commission is effective from May 20 to August 31, 2022 only.** Learn more.

Equitable Life is committed to offering advisors and clients product, service, and feature choices that best suit their needs. We offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds to align with advisors’ and clients’ unique needs.

** Equitable Life reserves the right to end the campaign, at any time and without notice.

™or ® denotes a registered trademark of The Equitable Life Insurance Company of Canada. -

Taking the guess work out of market volatility with Equitable Life

Investing during market highs and market lows can leave even the most seasoned investors scratching their heads. Knowing when to buy and when to sell is not easy, but disciplined investing can be.

Dollar cost averaging with Equitable Life® is designed to provide a long-term investment solution. This strategy helps take the guesswork out of knowing when to get into the market. It can also provide consistency for a long-term financial plan regardless of whether there is a lot or a little to invest.

And for a limited time only, we’ve increased the initial commission for the CB5 sales option from 5.6% to 7.0% on Pivotal Select™ segregated funds*, effective from May 20 to August 31, 2022.** During this time, advisors earn the increased full initial commission even if funds are placed into Equitable Life Money Market Fund to start the PAC.

For more information on dollar cost averaging, please contact your Equitable Life Regional Investment Sales Manager.

* Applies to FundSERV trades occurring between May 20 and August 31, 2022. Initial commission on non-FundSERV trades occurring between May 20 to August 31, 2022 increases from 4% to 5%. Initial commission is subject to a chargeback.

** Equitable Life reserves the right to end the campaign at any time and without notice.

™or ® denotes a registered trademark of The Equitable Life Insurance Company of Canada.

-

Guaranteed Interest Account Application version update

Equitable® Guaranteed Interest Account applications with a version date prior to 2023/09/01 (located on the bottom right-hand corner of the application) will no longer be accepted after December 31, 2023. If you currently have applications with a date that is before 2023/09/01, please destroy them and download digital applications from EquiNet® or order paper applications from our Supply Team.

If you have any other questions, contact your Regional Investment Sales Manager or Equitable’s Advisor Services Team, Monday to Friday from 8:30 a.m. to 7:30 p.m. at 1.866.884.7427 or email savingsretirement@equitable.ca

Posted December 13, 2023® or ™ denotes a registered trademark of The Equitable Life Insurance Company of Canada.

-

2024 Holiday hours

The Holiday season brings thoughts of gratitude, and there is no better time to express our thanks and sincere appreciation for your dedication and commitment to Equitable.

Thank you for your support this past year and for trusting Equitable with your Individual Insurance and Savings & Retirement business. Happy Holidays!

Client Care Centre Holiday Hours

Friday December 6, 2024 - CLOSED

Tuesday December 24, 2024 - 8:30 a.m. – 11:00 a.m. ET

Wednesday December 25, 2024 – CLOSED

Thursday December 26, 2024 – CLOSED

December 27, 30 and 31, 2024 - 8:30 a.m. – 7:30 p.m. ET

Wednesday January 1, 2025 - CLOSED

Savings & Retirement

All transaction requests to be handled same business day must be submitted in good order by:

● December 24, 2024, 11:00 a.m. ET

● December 31, 2024, 11:00 a.m. ET

FHSA applications to be considered for 2024 contribution year must be submitted in good order by:

● December 31, 2024, 11:59 p.m. ET

FHSA online banking deposit deadline for 2024 contribution receipt:

● December 24, 2024, 4:00 p.m. ET Note: Transaction requests submitted after 11:00 a.m. ET will be processed effective next business day

RRSP deposits to be considered for the 2024 tax year must be:

● Dated March 3, 2025, or before

● Must be submitted to Head Office in good order by March 7, 2025, by 4:00 p.m. ET

RRSP applications to be considered for 2024 contribution year must be submitted in good order by:

● March 3, 2025, 11:59 p.m. ET

RRSP B2B Loans:

● RRSP loan deposits must be received by March 14, 2025, by 4:00 p.m. ET

Note: Transactions submitted after these dates will not receive a 2024 contribution receipt

Individual Insurance

Underwriting

● Underwriting must receive all evidence and outstanding Underwriting requirements by December 9th at the latest. Underwriting will then be able to decision these cases by December 16th. This will give the New Business team December 13th – December 31st to issue and settle policies.

New Business

● New Business will continue to process all issue and settle requirements every business day until the last working day of the year – December 31st. New Business needs to receive ALL final settle documents in Good Order within our posted service standards. We are currently operating at a 3 business day turn around time.

Field Payroll

● Second Last Pay Period for 2024 – December 11, 2024 to December 17, 2024 (Transmission/Statement date December 18, 2024)

● Last Pay Period of 2024 – December 18, 2024 to December 31, 2024 (Transmission/Statement date January 2, 2025)

● First Pay of 2025 – January 1, 2025 to January 7, 2025 (Transmission/Statement date on January 8, 2025)

Daily Pay will run on business days.

Please note that all requirements must be received in Head Office by the above dates to guarantee settlement for year end.