Site Search

362 results for where to check completed case

-

A good time to look at the Equitable Life Money Market Fund Select

Whether clients are looking for a short-term cash savings solution or are interested in funding a dollar cost averaging strategy, the Equitable Life Money Market Fund Select may be an ideal solution.

With a current yield to maturity of 1.93%*, the fund provides maximum income through short-term investments consistent with preservation of capital and liquidity.

And advisors earn the full commission upon deposit on funds used for a dollar cost averaging strategy.

For more information check out Equitable Life Money Market Fund Select or contact your Director, Investment Sales.

* As of July 14, 2025, net of fees. Yield to Maturity: The market value weighted average yield to maturity includes the coupon payments and any capital gain or loss that the investor will realize by holding the bonds to maturity.

™ or ® denote registered trademarks of The Equitable Life Insurance Company of Canada.

Date posted: July 15, 2025

-

A New Universal Life Insurance Solution for the 21st Century – Available NOW!

Introducing a new universal life solution built for the 21st century: Equitable Generations™ universal life insurance is available for sale NOW!

Check out our Equitable Generations universal life splash page: www.equitable.ca/ul

Our new Equitable Generations universal life insurance

Equitable Generations is a universal life product that offers investment options that resonate with today’s 21st century client while reducing every fee possible. It also reduces the cost of insurance to help clients maximize their opportunity to purchase coverage and build tax-advantaged wealth.

NEW: EZstartTM Generations

Today we are launching EZstart Generations which is:

- A mobile-optimized tool for advisors

- Designed to start a conversation and provide a possible universal life solution in under one minute

- Goals based - you can see how Equitable Generations™ universal life insurance can perform at different stages of a client’s life.

NEW: SMS

Effective today, September 26, 2022 when you submit an application, you can opt-in to receive text message updates for your new business applications.

That’s a text message when:- The application is received,

- A decision has been made by Equitable Life,

- The policy is ready for delivery, and

- The commissions have been triggered.

Learn more

Find all the exciting details on our virtual launch splash page (www.equitable.ca/ul) and watch our informative videos to get all the information you need to start selling Equitable Generations universal life.

Check out our Equitable Generations universal life splash page: www.equitable.ca/ul

Click on the Marketing Materials tab on EquiNet® for all of our new Equitable Generations marketing materials.Please contact your Regional Sales Manager for more information.

TM and ® denote trademarks of The Equitable Life Insurance Company of Canada.

-

Enhancing the Transfer Process: Equitable's New Signature Guarantee Service

Equitable® is making transfers even easier with EZcomplete®.

This enhancement will help advisors and clients by reducing the number of rejections from other institutions that need a signature guarantee. Reducing transfer rejections means less time and effort for advisors, and faster transfers from other institutions.

Signature Guarantees

Equitable will now offer signature guarantees on most transfers requested through EZcomplete.

When is a signature guarantee not available?

• For entity owned accounts

• If a Power of Attorney is signing on behalf of an owner

• If the transferring account has an irrevocable beneficiary

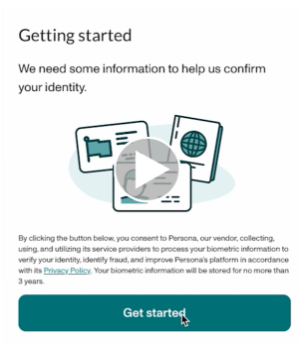

Watch the quick Identity Check with Persona video or read through instructions below.

To offer a signature guarantee, Equitable first needs to check the identity of all owners using Persona, a third-party service provider.

The advisor starts by selecting a signature guarantee in EZcomplete. An email link is sent to all proposed owners.

Clients can click the link within the email to Persona's verification process.

They will be prompted to take a picture of their photo ID and a selfie, turning their head slightly left and right by following the prompts.

Their identity can then be confirmed in seconds.

Sending Transfer Forms:

• If all owners' identities are verified, Equitable will send the transfer form with a signature guarantee stamp and the e-signature audit log to the transferring institution.

• If ID verification fails, clients will be prompted to try up to three times. If still unsuccessful, the transfer form and e-signature audit log is sent to the transferring institution without the signature guarantee stamp.

Handling Issues:

• Advisors’ obligations to verify ID is not affected by this process; ID verification is still required.

• If the client times out or loses the email to access Persona, the advisor can resend the link.

• If the client’s name or email changes after ID verification, the advisor will need to redo the ID verification with the updated information to get a signature guarantee.

This update strives to make processes smoother and more efficient for everyone. Just another reason to do business with Equitable. When we work together, success is mutual.

For more information or assistance, please contact your Director, Investment Sales.

Date published: May 7, 2025 - EZtransact Training and Resources

- [pdf] Equinet FAQ

- EquiNet-FAQ

- What is the process to change the agent on record for a policy?

-

November is Financial Literacy Month

During the month of November, financial services organizations throughout Canada will be participating in Financial Literacy month. Created by the Financial Consumer Agency of Canada (Agency), the goal of this initiative is to share information that will help Canadians achieve their financial goals. This can include managing debt, saving for the future, and understanding their rights and responsibilities.To support this initiative, Equitable Life® will be posting articles on Equitable’s® Blog and sharing relevant information on Facebook, Twitter and LinkedIn. Feel free to share our content with your followers.

If you’re interested in learning more about your own financial literacy, take this Self-Assessment Quiz. When you have completed the quiz, you will see a list of suggested topics that you might want to explore further.® and TM denote trademarks of The Equitable Life Insurance Company of Canada

Posted November 1, 2023 -

THREE new ways to help make your Savings & Retirement business run smoother

As of August 20, 2022, EZcomplete® will include several new features that allow applications to be completed faster and easier:

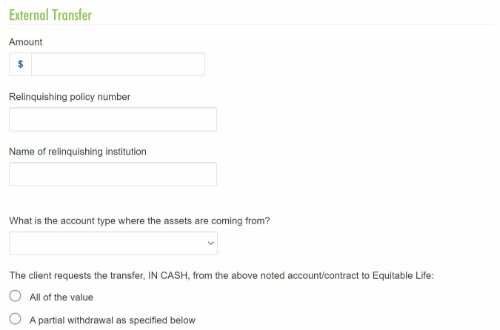

1. Prefilled Fund Transfer Form

The transfer form will be generated with the information from EZcomplete and included in the EZcomplete signing package, saving you time.

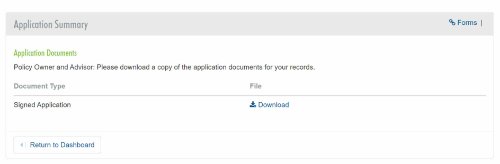

2. Client eSignature Audit History and Document Download

If you choose the e-signature option for the client, you’ll be able to download a copy of the e-signed transfer forms and the signature audit history.

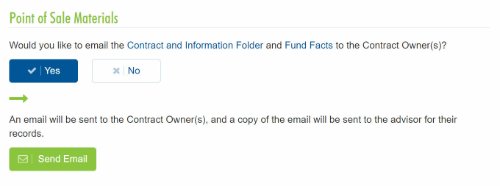

3. Email the Client Contract Info and Fund Facts Before Signing

You'll now be able to email Point of Sale materials (Contract & Info Folder and Fund Facts) to clients before they provide their e-signature.

Log in to EZcomplete today!

Speak to your Regional Investment Sales Manager to learn more!