Site Search

78 results for beneficiary

- Policy Loan

- Understanding segregated funds

- Miscellaneous

- Anti-money Laundering Legislation Requirements Summary

-

Have you heard about Equitable Client Access?

Equitable Client Access® allows clients to self-serve on some of the more popular requests. Thousands of clients have already signed up for Equitable Client Access and are enjoying the benefits of accessing their secure information 24/7.

• Does your client need to change or stop existing Pre-Authorized payment (PAD)? Equitable Client Access can do that.

• Does your client need to change a withdrawal date for a PAD? Equitable Client Access can do that too.

• Address or banking information changes? Equitable Client Access has your clients covered.

• Does your client need to change her beneficiary from Aunt Flora to Uncle Ned? Equitable Client Access can even do that.

Equitable Client Access is a secure online client site that connects clients with policy information, right at their fingertips. In addition to the self-serve features, Equitable Client Access can also provide:

• Insurance coverage and guarantees

• Investment allocation, performance and market values

• Transaction history

• Statements and letters

• Advisor contact information, along with so much more.

If your clients have not signed up for Equitable Client Access, direct them to client.equitable.ca - it only takes a few minutes to set up an account, and connects your clients with their policy information online – anytime!

Have a question about Equitable Client Access? Want to tell your client how to go paperless? Check out our updated FAQ or contact your Regional Investment Sales Manager today.

-

Equitable Life Group Benefits Bulletin - September 2022

Homewood Health launches Sentio, an upgraded iCBT platform

Equitable Life’s mental health partner, Homewood Health, has launched Sentio, an upgraded platform for Internet-based cognitive behavioural therapy (iCBT). This self-directed platform is now available to all Equitable Life clients, and it replaces Homewood’s previous iCBT platform, i-Volve.

Sentio Self-Directed iCBT is a comprehensive digital cognitive behavioural therapy platform. Developed by Homewood’s mental health experts, it is an action-oriented solution for plan members, giving them practical resources and activities to help with their depression, anxiety and overall mental health challenges.

Available as a standalone app, on mobile, tablet and desktop, Sentio contains over 20 unique treatment goals for issues like stress management, improving sleep, managing depressive thoughts, and coping with panic. Users can work through treatment goals in any order, at their own pace. It also includes tools and resources to help plan members build skills and change their thought patterns.Sentio iCBT benefits

Sentio integrates seamlessly with Homewood Pathfinder so that users can easily locate and take advantage of the iCBT activities available. Sentio also includes a number of unique features:- More interactive features and activities to help plan members build valuable mental health skills

- Integrated symptom measurement and progress tracking

- Interactive multimedia learning and cognitive exercises to enhance learning

- Progress, learnings, and exercises that have been accessed are available to be re-accessed for 12 months

Please contact your Group Account Executive or myFlex Sales Manager if you have any questions.

Streamlining disability claims with Opifiny

Equitable Life is partnering with Opifiny to provide a quicker and more seamless disability claims experience.

Opifiny is an online platform that streamlines the disability claims process for consulting physicians, benefits plan sponsors, and disability plan members. Equitable Life will be using Opifiny for ongoing disability claims management, modernizing the process of gathering medical assessments and information.

Disability claims frequently involve several instances of correspondence between Equitable Life and the plan member’s medical team. By using the secure platform, health care professionals can access, respond to and process medical insurance requests easily from any device. They can typically complete administrative tasks associated with disability claims in a quarter of the time. The platform is secure and protects the privacy of their patients’ confidential information.

By digitizing and modernizing the claims management process for doctors, Equitable Life will have faster access to higher quality claims information. For some claims, using Opifiny may enable Equitable Life to help plan members safely return to work sooner.

Reminder: Obtaining plan member signatures on all administration forms

Please remind your clients that plan members must sign all administration forms, including enrolment forms, benefits change forms, and beneficiary designation forms. Once completed, a plan administrator can keep the form or send it to us. We are not able to accept a beneficiary designation that has not been signed by the plan member. Having appropriately signed forms helps to ensure that any life insurance claims are paid to the intended recipients.

For your clients’ convenience, forms can be signed electronically using one of our approved vendors, which include DocuSign, BambooHR, Adobe Sign, and many more.

If you have questions about providing signed forms, please contact your Group Account Executive or myFlex Sales Manager.

Correction: Coverage for full-time students and dependents with disabilities

In our August edition of eNews, we provided incorrect information about benefits coverage options for over-age dependents. We indicated that over-age dependents who are full-time students may continue to be eligible under the plan member’s benefits plan if they are studying in their home province. However, attending a post-secondary institution in their home province is not a requirement for continued eligibility. Dependents who are full-time students may continue to be eligible for coverage regardless of where in Canada they are attending post-secondary education.

If your clients have any questions about extending coverage for over-age dependents that are full-time students, please notify them of this error.

We apologize for any inconvenience or confusion this may have caused.

- Miscellaneous

-

EZcomplete enhancements for segregated fund applications

When we launched EZcomplete® for segregated funds back in January we heard a lot of positive comments from our advisors. We also heard that we could do better. So that's just what we did.

1. FUNDSERV CODE

Advisors with an active FundSERV code no longer need to remember to select the FundSERV code when starting a new segregated fund application. EZcomplete will now default to the FundSERV code.

2. LOAN DEPOSIT OPTION

Under the Contributions section of the segregated fund application for Non-registered, TFSA, RSP or Spousal RSP, Loan is now a deposit option under Deposit Types. If Loan is selected, EZcomplete will ask for amount and Lending Company name. Equitable Life® has partnered with B2B Bank to provide investment and RSP loans at competitive rates. Details can be found on EquiNet® under "Loans".

3. LIMITING SUCCESSOR ANNUITANT

Applicable to TFSA, RIF and Spousal RIF applications only, EZcomplete will now use validation to prevent advisors from accidentally naming the same person as both successor annuitant and beneficiary, reducing the instances of "not in good order" applications.

4. ONGOING PAD FUND SELECTION

If Ongoing PAD is selected as a Deposit Type, an advisor can allocate the Ongoing PAD to a fund allocation that is different than the rest of the deposit options.

5. TRANSFER FORM NOTIFICATION

The MGA and advisor confirmation emails now include text to confirm that a Transfer Form has been uploaded and submitted as part of the segregated fund application. This additional information will act as a reminder to the Advisor/MGA to send the Transfer Form to the relinquishing institution.6. POPULATING FIELDS

Advisors will no longer need to keep entering the same advisor and MGA information on new segregated fund applications. The first time an advisor code is used on an EZcomplete segregated fund application, the advisor will populate all the required fields. Each subsequent time a new segregated fund application is created with the same advisor code, the following fields will pre-populate with the values that were last entered.a) Advisor Email

b) Dealer/MGA Name

c) Branch Number

d) MGA Email -

Enhancing the Transfer Process: Equitable's New Signature Guarantee Service

Equitable® is making transfers even easier with EZcomplete®.

This enhancement will help advisors and clients by reducing the number of rejections from other institutions that need a signature guarantee. Reducing transfer rejections means less time and effort for advisors, and faster transfers from other institutions.

Signature Guarantees

Equitable will now offer signature guarantees on most transfers requested through EZcomplete.

When is a signature guarantee not available?

• For entity owned accounts

• If a Power of Attorney is signing on behalf of an owner

• If the transferring account has an irrevocable beneficiary

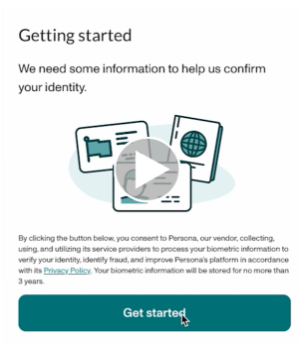

Watch the quick Identity Check with Persona video or read through instructions below.

To offer a signature guarantee, Equitable first needs to check the identity of all owners using Persona, a third-party service provider.

The advisor starts by selecting a signature guarantee in EZcomplete. An email link is sent to all proposed owners.

Clients can click the link within the email to Persona's verification process.

They will be prompted to take a picture of their photo ID and a selfie, turning their head slightly left and right by following the prompts.

Their identity can then be confirmed in seconds.

Sending Transfer Forms:

• If all owners' identities are verified, Equitable will send the transfer form with a signature guarantee stamp and the e-signature audit log to the transferring institution.

• If ID verification fails, clients will be prompted to try up to three times. If still unsuccessful, the transfer form and e-signature audit log is sent to the transferring institution without the signature guarantee stamp.

Handling Issues:

• Advisors’ obligations to verify ID is not affected by this process; ID verification is still required.

• If the client times out or loses the email to access Persona, the advisor can resend the link.

• If the client’s name or email changes after ID verification, the advisor will need to redo the ID verification with the updated information to get a signature guarantee.

This update strives to make processes smoother and more efficient for everyone. Just another reason to do business with Equitable. When we work together, success is mutual.

For more information or assistance, please contact your Director, Investment Sales.

Date published: May 7, 2025 - Additions and Increases