Site Search

422 results for beneficiary change form

-

Easy and convenient digital options for your clients and their members

During this time of physical distancing, people are looking for ways to interact with their providers virtually. We have several convenient digital options available to make it easier for Plan Members and for Plan Administrators. Below is an overview to refer to when you're meeting with your clients. Or you can download this PDF version

For Plan Administrators:

Plan Administrator Portal (EquitableHealth.ca)

Our secure portal allows Plan Administrators to easily manage their plan anytime and anywhere. Instead of printing and mailing forms, Plan Administrators can make real-time updates at their convenience. The site also makes it easy to view or upload forms and other important documents, retrieve billing information, estimate monthly premium costs, and view announcements, tips and reminders. Plan Administrators can visit www.equitablehealth.ca to activate their account.

Online Plan Member Enrolment

Our Online Plan Member Enrolment tool simplifies the onboarding process for both Plan Administrators and Plan Members and offers a more secure and efficient alternative to traditional paper enrolment. The user-friendly interface allows Plan Members to easily enrol in their benefits plan in just minutes from their computer or mobile device. That saves work for Plan Administrators by eliminating the need to manage paper forms. And since Plan Members receive automatic reminders, it reduces late applicants and eliminates the need to chase down Plan Members for their paperwork. (This option is currently only available for new clients. It will soon be available for existing clients to add new hires.)

Digital Welcome Kits

Instead of paper kits that can easily get lost or quickly become outdated, Plan Members receive personalized welcome kits via an interactive email, including instructions on how to activate their online group benefits account, download their digital benefits card, submit claims from their computer or mobile device, review their coverage details, and explore their health and wellness resources.

Easy automated payments

Automated payments are a convenient way to avoid missed payments, suspended claims and disruption. Plan Administrators simply need to complete thepre-authorized debit formand send to GroupCollection@equitable.ca. Or contact Group Collections about online banking and electronic funds transfer (EFT).

We can help

For assistance, Plan Administrators can contact their Client Relationship Specialist or our Web Services team at 1.800.265.4556 ext. 283 or groupbenefitsadmin@equitable.ca.

For Plan Members:

Plan Member Portal (EquitableHealth.ca)

By logging into EquitableHealth.ca, Plan Members have secure 24/7 access to their personalized Group Benefits account where they can submit claims, view their claims status and history, and review their coverage details from their computer or mobile device. They can also visit Equitable HealthConnector®, our suite of services to help employees stay healthy and productive. They can simply visit www.equitablehealth.ca to activate their Group Benefits account.

Electronic Claim Payments and Notifications

Once Plan Members have activated their Group Benefits account on EquitableHealth.ca, they can easily get set up to receive their claim payments via direct deposit, and their claim notifications via email. Once logged in they simply click “My Information” and enter the required information.

EZClaim Mobile App

Submitting claims is fast, easy and secure with the Equitable EZClaim® mobile app. Plan Members can submit health and dental claims and receive payments directly to their bank account via direct deposit. Most claims are processed within three business days; some are processed in as little as 24 hours. They simply download the EZClaim app for their iPhone®, or Android™ device, fill out the interactive health or dental claim form, attach their receipt and submit.

Digital Benefits Cards

Instead of digging through their wallets, Plan Members can download a digital version of their benefits card on their mobile device via the Equitable EZClaim® Mobile app to easily provide coverage details to health providers.

We can help

We’ve created a video guide to help Plan Members access and use their digital resources. For further assistance, Plan Members can contact our Web Services team at 1.800.265.4556 ext. 283 or groupbenefitsadmin@equitable.ca.

-

There is still time for your clients to contribute to their Tax-Free Savings Account

If you have clients that have not contributed to their Tax-Free Savings Account (TFSA) this year, great news… there is still time!

You know that an Equitable Life® TFSA is a great way to save. Each year residents of Canada who are at least 18 years of age are eligible to invest up to $6,000* into their TFSA, in addition to any previously unused contribution room. Deposits made into a TFSA are made with after-tax dollars. This means that withdrawals can be made at any time on a tax-free basis.

Interested in increasing an existing Pre-Authorized Debit (PAD) TFSA deposit?

Clients with an existing PAD (or who had one in the previous six months), can go online to make any adjustments to a scheduled deposit to their TFSA. Clients can simply login to Equitable Life’s Client Access®. Client Access is Equitable’s secure online client site that connects clients to tools and policy information.

Consider a one-time deposit or set up a PAD?

To get started with one-time deposit, clients simply log in to their online bank account and select the option to add a new bill/payee and search for Equitable Life Savings Plan. The Equitable Life savings plan policy number will serve as the account number.

Clients that complete their deposits using online banking do not have to worry about mailing a cheque or missing the deadline. Deposits are applied based on the investment direction on file.

If you have clients that would like to set up a PAD, simply complete Form #378. For details on how to submit forms during COVID-19, refer to the NEW APPLICATIONS & TRANSACTION AUTHORIZATION REQUIREMENTS webpage.

If you have any questions, please reach out to your local Regional Investment Sales Manager or Advisor Services at 1.866.884.7427 Monday to Friday, 8:30 a.m. to 7:30 p.m. ET or email savingsretirement@equitable.ca.

*The annual TFSA limit is set by Canada Revenue Agency (CRA) and is currently $6,000. Your notice of assessment will tell you if you have unused contribution room from previous years. Contributions over the maximum will be charged a monthly penalty of 1% by CRA.

® denotes a trademark of The Equitable Life Insurance Company of Canada - [pdf] Verification of Identification (Remote Signer)

- [pdf] EZtransact FAQ

-

Paramedicals are Re-opening Shortly

We are pleased to announce that face-to-face insurance testing paramedical services, including the collection of vitals & fluids, are resuming shortly. Our service providers, Dynacare and ExamOne, have been monitoring the public health standards and have established standards they will operate under to protect the health of both the applicant and health professionals.

Our commitment to your client’s safety

It is Equitable Life's commitment that both clients and advisors will be provided clear and thoughtful communication before initiating any testing. Clients should fully understand the potential risks associated with having a paramedical test taken at this time and are always able to choose not to attend the appointment if they do not feel comfortable or safe.

How will paramedical services be conducted?

Dynacare is conducting appointments at fixed site facilities where clients will travel to the health professional for their appointment. The paramedical questions will be covered by video or telephone to minimize the time spent in the fixed site facility. For more information, see Dynacare’s COVID-19 client guide that will be provided to the client directly.

ExamOne examiners will travel to the client’s home for their appointment and the entire paramedical will be conducted at that time. Information about ExamOne’s COVID-19 processes and their Preparing for my exam client guide will also be provided to the client directy.

When are paramedical services re-opening?

In person paramedical services for Equitable Life cases will begin opening gradually. We have worked closely with our service providers, the CLHIA & provincial governments and believe it is prudent to begin re-opening services in the provinces that have a lower incidence of COVID-19. We will expand the schedule as the incidence of COVID-19 lowers or is expected to lower in specific regions.

Please note if you had an order in process prior to services shutting down, the provider will be looking to re-open and complete those orders. If requirements are no longer needed given the non-med limit changes, the order will remain closed.

Schedule for re-opening paramedical services:Province Start Date Saskatchewan June 1-Dynacare, June 11-ExamOne New Brunswick June 8-Dynacare, June 11-ExamOne PEI and Newfoundland June 15, Dynacare and ExamOne Manitoba June 15, Dynacare and ExamOne Alberta June 18, Dynacare and ExamOne British Columbia June 22, Dynacare and ExamOne Nova Scotia June 22, Dynacare and ExamOne Ontario* By June 30, Dynacare and ExamOne Quebec * By June 30, Dynacare and ExamOne

Note: Start dates are subject to change based on the progress of COVID-19.

*Ontario & Quebec to re-open regionally (starting with areas with lower incidence of COVID-19). Specifics for Ontario and Quebec will be communicated closer to the implementation dates for these provinces. Further details can be found in this communication. -

Extending premium relief for Dental and Extended Health Care benefits

We know this continues to be a challenging time for Canadian employers and we remain committed to looking for ways to help your clients manage while still supporting their employees.

Although many health practitioners have re-opened as pandemic restrictions are lifted, plan member use of dental benefits and some health benefits still remains lower than normal in June.

We are pleased to announce that we are extending premium relief for all Traditional and myFlex insured non-refund customers for Health and Dental benefits for the month of June, as follows:

- A 25% reduction on Dental premiums; and

- A 5% reduction on Extended Health Care premiums.

These reductions are effective for June 2020 and will appear as a credit on the July bill, or against the next available billing. We will assess the situation monthly and will continue with monthly refunds for as long as the current crisis period continues. The size of the credit may change over time as dentists and other health practitioners gradually reopen their offices. We will confirm premium credits for July (if any) at a later date. Credits for subsequent months will be communicated on a month-by-month basis.

In order to be eligible for the monthly credit calculation and payout, a policy must be in force on the first of the month and remain in force thereafter. The monthly credit calculation is based on employees in force on the June bill. If employees experienced layoffs during the month, that would not affect eligibility for a premium credit as long as the benefit itself is not terminated.

We expect that claims experience and premiums will return to normal once the current pandemic restrictions are lifted.

In the meantime, plan members will continue to have full access to their benefits coverage throughout the pandemic. In many cases, dental offices have remained open for emergency services, and a variety of healthcare providers are available virtually.

Commissions

We know the pandemic has put financial strain on your business as well, so we will continue to pay full compensation. Although your overall commission will be unaffected by these premium reduction adjustments, you may see a temporary reduction in your commission payments if you are on a pay-as-earned basis.

Communication

We will be communicating this premium relief program to your clients later this week.

Questions?

If you have any questions, please contact your Group Account Executive or myFlex Sales Manager. You can also refer to our online COVID-19 Group Benefits FAQ.

-

Celebrating our most popular Pivotal Select funds

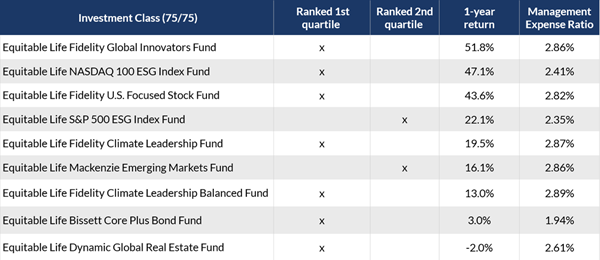

In August 2022, Equitable® launched 12 new segregated funds in Pivotal Select’s Investment Class (75/75). We wanted to bring some new innovative solutions to the product, including six sustainable investment funds. To say the launch of these funds was successful would be an understatement.

The funds are quickly becoming some of the most popular funds in Pivotal Select™, and their performance in 2023 was impressive. Equitable wants to celebrate these funds and encourage clients to consider them for their portfolios.

As of February 29, 2024, nine out of the 12 funds received a 1st quartile ranking for their 1-year return and two more were 2nd quartile. The table below shows the new funds that ranked in the top two quartiles for their 1-year returns.

Access additional fund performance information

If you haven’t looked at these funds yet, now is the time. Speak to clients about their investment options and see if these funds fit within their investment portfolio.

Talk to your Director, Investment Sales today for more information.Disclaimer

Any amount that is allocated to a segregated fund is invested at the risk of the contractholder and may increase or decrease in value. Segregated fund values change frequently, and past performance does not guarantee future results. Investors do not purchase an interest in underlying securities or funds, but rather, an individual variable insurance contract issued by The Equitable Life Insurance Company of Canada. There are risks involved with investing in segregated funds. Please read the Contract and Information Folder before investing for a description of risks relevant to each segregated fund and for a complete description of product features and guarantees. Copies of the Contract and Information Folder are available on equitable.ca.

Management Expense Ratios (MERs) are based on figures as of February 29, 2024, and are unaudited. MERs may vary at any time. The MER is the combination of the management fee, insurance fee, operating expenses, HST, and any other applicable non-income tax for the fund and for the underlying fund. For clients with larger contract values, a Management Fee Reduction may be available through the Preferred Pricing Program. For details, please see the Pivotal Select Contract and Information Folder.

® and TM denote trademarks of The Equitable Life Insurance Company of Canada.

Posted April 18, 2024

- RRSP Loan Calculator

-

January 2024 eNews

In this issue:

- Equitable scores high marks with group advisors*

- REMINDER: Equitable's National Biosimilar Program starts in March*

- 2024 dental fee guide updates*

- Homewood Health wins HR Reporter Reader's Choice award for EFAP excellence*

Equitable scores high marks with group advisors*

Equitable ranked first for operational service among major group insurers in a recent study of Canadian group benefits advisors.

NMG Consulting, a leading global consulting firm, conducted in-depth interviews with 146 Canadian group benefits brokers, consultants, MGAs and third-party administrators between May and August 2023 for its annual Canadian Group Benefits Study. Based on these interviews, NMG ranked group insurers in six categories, ranging from operational management to technology.

Nationally, Equitable ranked among the top three in five of the six main categories, including number one for Operational Management:Category Ranking Operational management 1st Initiatives (including seminars & training) 2nd Technology 3rd Underwriting & claims management 3rd Relationship management 3rd

“Advisors regard us highly in many categories. That’s a testament to our mutual status and ability to focus exclusively on our clients and advisor partnerships,” said Marc Avaria, Executive Vice President, Group Insurance Division. “We are truly working together to build strong, enduring and aligned partnerships with our clients and advisors.”

“We’re delighted with these results and are committed to continuously advancing our delivery of a better benefits experience for our clients and advisors,” added Avaria.More highlights from the latest NMG survey

Nationally, we ranked first in seven subcategories in Operational Management, including:- Overall service to intermediaries,

- Overall service to plan sponsors,

- New quote process,

- Plan implementation,

- Renewal process,

- Accuracy and timeliness of reporting and billing, and

- Administration quality and responsiveness

And we were rated strongly in Technology, finishing in the top three for:- Overall technology for Intermediary (2nd)

- Member experience (3rd)

- Quality of technology for the plan sponsor (2nd)

- Quality of mobile application (2nd)

REMINDER: Equitable's National Biosimilar Program starts in March*

In October 2023 we announced the upcoming launch of our national biosimilar program. Starting March 1, 2024, we are expanding our biosimilar switch initiatives to provide a single, nationwide** program.

Why we’re making the switch

Over the past few years, most provinces have introduced policies to delist some originator biologic drugs. They require most patients to switch to biosimilar versions of those drugs to be eligible for coverage under their public drug plans. Soon, it is expected that all provincial drug plans will cover only biosimilars.

Equitable’s National Biosimilar Program simplifies drug plan coverage by replacing our provincial programs. It also protects clients from additional drug costs while offering access to lower-cost biosimilars deemed equally safe and effective by Health Canada.

How will this affect clients' drug plans?

Because we have already introduced biosimilar switch initiatives in most provinces, the impact of this change will be minimal. It will primarily affect plan members in provinces or territories where we haven’t already required the switch to biosimilars. It will also affect plan members who are taking biosimilars that were not originally included in the switch initiative for their province.

Regardless of where they live, plan members across Canada will no longer be eligible for most originator biologic drugs if they have a condition for which Health Canada has approved a lower-cost biosimilar version of the drug. Plan members already taking the originator biologic will be required to switch to a biosimilar version of the drug to maintain coverage under their Equitable plan. We will support their transition with education, personalized communication, and resources.

Advance notice for plan members

We contacted affected claimants in early December to give them enough time to change their prescriptions and avoid any interruptions in their treatment or their coverage.

If you have any questions about this change, please contact your Group Account Executive or myFlex Account Executive.

** Excludes plan members in Quebec who participate in a separate provincial program.

2024 dental fee guide updates*

Each year, Provincial and Territorial Dental Associations publish fee guides. Equitable uses these guides to help determine the reimbursement limits for dental procedures.

For your reference, you may wish to refer to the 2024 list of the average dental fee increases for general practitioners.

Homewood Health wins HR Reporter Reader's Choice award for EFAP excellence*

Equitable is proud to congratulate our Employee and Family Assistance Plan (EFAP) partner, Homewood Health®, for winning the Canadian HR Reporter 2023 Reader’s Choice Award in Employee Assistance Plan services. Homewood’s EFAP provides confidential support for a range of health, family, money, and work issues through face-to-face, phone, email, chat, or video counselling. The award recognizes their high standards in counselling and mental health support services.

The annual Reader’s Choice Awards identify organizations that provide outstanding expertise and services for HR professionals and employers across Canada. Those organizations provide valuable information on useful, innovative HR and employee benefits products and programs, in categories such as recruitment, mental health services, employee engagement programs, and more.

Sharing Homewood Health with your clients

Since 2019, we have worked with Homewood to provide mental health services for Equitable benefits plan members.

Your clients can access Homewood Health’s award-winning EFAP for an additional fee by adding it to their benefits plan. Services are available 24/7, 365 days a year.

All Equitable clients also have free access to Homewood Health Online in their benefits plan. Homewood Online provides a variety of helpful wellness resources, including:

- Homeweb, an online and mobile health and wellness portal,

- Health Risk Assessment, a group of assessment tools to help plan members identify and overcome health and wellness barriers, and

- Online Internet-based cognitive behavioural therapy (iCBT) through Sentio to manage symptoms of anxiety and/or depression.

Questions

To learn more about Homewood Health’s services, contact your Group Account Executive or myFlex Account Executive.

- About