Site Search

756 results for form to restart a pac on insurance

-

Advisor Code of Conduct - Updated!

Our Advisor Code of Conduct sets out Equitable Life's expectations of advisors in dealing with clients and other stakeholders. The Code of Conduct forms part of your contractual relationship with us.

We have updated our Code to clarify specific expectations to help you meet regulatory compliance requirements, support your needs-based sales, and treat customers fairly.

Please review our updated Advisor Code of Conduct. -

Update: Employment Insurance (EI) Sickness Benefit Extension

As it proposed in its 2022 Budget, the federal government has confirmed it is extending the Employment Insurance (EI) Sickness Benefits period from 15 weeks to 26 weeks later this year. The official implementation date and details have not yet been confirmed by the government and we will share further details once they are available. In the meantime, here’s what you need to know.

We will not require or implement any changes to our disability plan designs based on this extension. However, plan sponsors may wish to amend their short-term disability (STD) and long-term disability (LTD) plans and policies to align with the new 26-week EI period.Impact to short-term disability (STD) benefits integrated with EI

Plan sponsors with EI-integrated STD may wish to adjust their benefits to line up with the new 26-week extension.

Impact to plans with no STD benefits

For plan sponsors who do not offer STD, they have the option of adjusting their LTD plans to the new 26-week elimination period if members claim EI prior to LTD. This adjustment would help to avoid the plan member receiving disability and EI payments at the same time and potentially being required to return funds due to overpayment.Considerations for plan sponsors

Plan sponsors who amend their STD or LTD policies to align with the new 26-week EI period should note that there may be inadvertent delays to their employees’ return to work. While collecting EI, injured or ill employees do not benefit from our early intervention services or rigorous claims management practices that could help them get back to work sooner. So, by delaying the availability of STD or LTD coverage, the advantages that these programs are intended to provide could also be delayed.Impact to Premium Reduction Program (PRP)

The Premium Reduction Program (PRP) allows employers with eligible short-term disability plans to pay lower EI premiums. The eligibility criteria have not changed at this time. The government plans to review the PRP in 2024.Questions

If you have questions about these changes or what they mean for your clients’ disability plans, please contact your Group Account Executive or myFlex Sales Manager.

-

Delegation Requests Now Available on EquiNet

We are excited to announce a new feature that will help make it easier for you to do business with Equitable Life.

This new feature allows you, to submit a delegation request through the “Access” tab under your EquiNet profile.

Once the delegation request has been completed, the specified people will be able to view and manage the policies of the Advisor who submitted the request, as long as they have codes of their own within the system.

Please contact the customer service team at customerservice@equitable.ca for more information. -

NEW MARKETING MATERIAL! Equimax Participating Whole Life, Strong and Stable Dividends

Participating whole life policyholders can get some of the participating account earnings back as dividends.1

Dividend scales change over time. This new marketing piece shows how the actual values of policies look like against those that were estimated. It looks at two sample policies and compares them to the original sales illustrations. One example shows an Equimax Estate Builder® policy. The other example shows an Equimax® Wealth Accumulator® policy.

We are proud of our strong and stable dividend results. We have paid dividends to our participating policyholders every year since 1936. And we’re still going strong!

We want to make sure that we can continue to provide long-term income and growth to support the dividend scale and meet the product guarantees. We do this with constant focus on how we invest and manage risk to support the participating account.

As a mutual life insurance company, we are owned by our policyholders who count on us and our services. Their trust in our knowledge, experience, and financial strength helps us keep our commitments to them—now and in the future.

Dividend scales may change.2 But with a balanced approach, Equitable Life’s Equimax® Participating Whole Life continues to deliver excellent value. It gives guaranteed life insurance protection with the potential for earnings.

Want to learn more? Check out our new marketing piece: Equimax Participating Whole Life, Strong and Stable Dividends (2075).

For more information, reach out to your local wholesaler.

® and TM denote trademarks of The Equitable Life Insurance Company of Canada.

1 Dividends are not guaranteed and are paid at the sole discretion of the Board of Directors. Dividends may be subject to taxation. Dividends will vary based on the actual investment returns in the participating account as well as mortality, expenses, lapse, claims experience, taxes, and other experience of the participating block of policies.

2 If low interest rates continue, investment returns will be lower, and this may mean decreases in the dividend scale in the future. Dividend payments are not guaranteed, but they will never be negative. -

Celebrating our most popular Pivotal Select funds

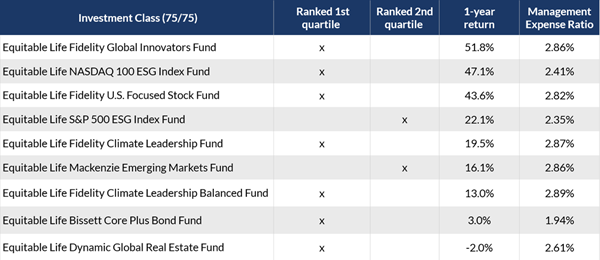

In August 2022, Equitable® launched 12 new segregated funds in Pivotal Select’s Investment Class (75/75). We wanted to bring some new innovative solutions to the product, including six sustainable investment funds. To say the launch of these funds was successful would be an understatement.

The funds are quickly becoming some of the most popular funds in Pivotal Select™, and their performance in 2023 was impressive. Equitable wants to celebrate these funds and encourage clients to consider them for their portfolios.

As of February 29, 2024, nine out of the 12 funds received a 1st quartile ranking for their 1-year return and two more were 2nd quartile. The table below shows the new funds that ranked in the top two quartiles for their 1-year returns.

Access additional fund performance information

If you haven’t looked at these funds yet, now is the time. Speak to clients about their investment options and see if these funds fit within their investment portfolio.

Talk to your Director, Investment Sales today for more information.Disclaimer

Any amount that is allocated to a segregated fund is invested at the risk of the contractholder and may increase or decrease in value. Segregated fund values change frequently, and past performance does not guarantee future results. Investors do not purchase an interest in underlying securities or funds, but rather, an individual variable insurance contract issued by The Equitable Life Insurance Company of Canada. There are risks involved with investing in segregated funds. Please read the Contract and Information Folder before investing for a description of risks relevant to each segregated fund and for a complete description of product features and guarantees. Copies of the Contract and Information Folder are available on equitable.ca.

Management Expense Ratios (MERs) are based on figures as of February 29, 2024, and are unaudited. MERs may vary at any time. The MER is the combination of the management fee, insurance fee, operating expenses, HST, and any other applicable non-income tax for the fund and for the underlying fund. For clients with larger contract values, a Management Fee Reduction may be available through the Preferred Pricing Program. For details, please see the Pivotal Select Contract and Information Folder.

® and TM denote trademarks of The Equitable Life Insurance Company of Canada.

Posted April 18, 2024

-

Equitable presents docuseries “Moments Matter”

We went behind the scenes at Equitable and spoke with 15 colleagues completely unscripted. Learn about what we uncovered in our docuseries, Moments Matter. Meet people like Aliya from Client and Advisor Care who creates meaningful interactions by starting with genuine care. Or Joe who is passionate about earning the trust of advisors.

Watch our stories: https://info.equitable.ca/moments -

We want to hear from you!

We’re building the Equitable ListensTM advisor community and invite you to join!

What’s in it for me?

.png)

How do I join?

It’s simple. Click on your invitation link below to get started, answer a few questions then confirm your email and you’re in!

Thank you,

The Equitable Listens Team

This advisory panel is for research purposes only. Your email address will only be used to invite you to participate in studies or to share study results with you. This community is currently in English only. - [pdf] Corporate Preferred Estate Transfer® using whole life

-

Equimax Enhancements – Coming Soon

More updates for a better and stronger solution!

We have exciting news! Further to our October 5th product updates, we will be rolling out more changes to Equitable’s flagship Equimax whole life solution.

Stay tuned for more details, coming on December 10, 2024.

Transition Rules

Check out our Transition Rules for new and in-progress life applications, which take effect on December 7, 2024.

Questions? Contact your Equitable wholesaler. -

From piggy banks to property, the journey of helping clients save for a first home

With the smell of spring in the air and for sale signs popping up on front lawns, no doubt clients are starting to ask, is it time to save for a house? Of course, a million other questions generally arise like, can I afford a house? How do I save? What do I do?

If you’ve got clients asking for direction, join your host Joseph Trozzo, Vice President, Investment Sales, at Equitable® along with Equitable’s own, Chris Petroff CPA CMA, Product Manager, Savings and Retirement to learn how Equitable can help you set clients up for success, when it comes to purchasing their first home.

Why Attend?

This informative session will cover all the ins and outs of first-time home ownership,

• from potential sources of funds to tax implications,

• withdrawal rules, and

• so much more.

You’ll get a deep dive into the various account types available through Equitable with segregated funds and DIA/GIA, and a comparison of each account type. We’ll also touch on mortgages, investment time horizon and other considerations, including specific case studies to help equip you with all the knowledge necessary to help clients purchase a first home.Learn more

Continuing Education Credits

This webcast has been accredited for 1.00 Life continuing education (CE) credit for all provinces excluding Quebec via the Insurance Council of Manitoba and Alberta Insurance Council. To be eligible for CE credits, you must register individually, watch the webcast in full and complete a short quiz. It is the advisor's responsibility to ensure Continuing Education credits being offered are accepted by their licensing body. Alberta Insurance Council (AIC) credits are valid in Yukon, British Columbia, Alberta, Saskatchewan, Ontario, New Brunswick, Prince Edward Island and Nova Scotia. Insurance Council of Manitoba (ICM) credits are valid in Manitoba only.

This webcast is available in English only.

Date posted: May 8, 2025