Site Search

961 results for life policy 300109556

-

Manage more details within Contract Delivery for New Business applications

We are excited to announce further enhancements to our eDelivery process to empower you, the advisor, the ability to manage client details more easily within Contract Delivery.

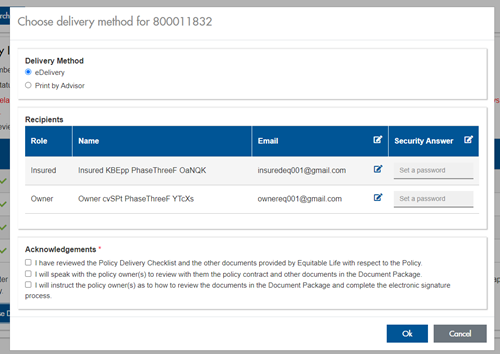

Effective January 15, 2022, advisors will need to create a Password within Contract Delivery when choosing “eDelivery” as the contract delivery method and provide the password to the client to use as their password:

The Password must be between 4 and 100 alpha/numeric characters, and cannot be the Policy number. For multiple signers the password (and email address) must be unique per each signer.

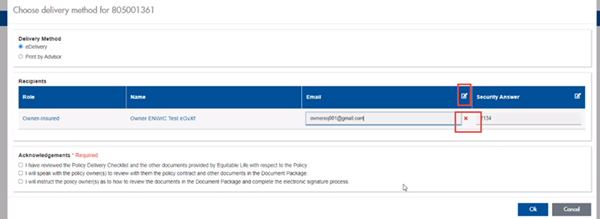

Advisors can now edit and/or update an email address within Contract Delivery, in the event of a bounce back or email change, to keep the eDelivery process moving and avoid delays in processing time. If a lock out occurs, advisors can trigger a resend of the signing email once they add a new valid email address in Contract Delivery. Simply click the pencil icon beside the Email field to enter the valid email address:

Another new feature- in the event a client has declined, the advisor will get an email from Equitable Life®. Click through to EquiNet® within the email to view the message within Contract Delivery that the client provided as the reason for decline under a new “Declined Details” section. This enables you to connect with the client to proceed with the sale by discussing the reasons for decline with them directly.

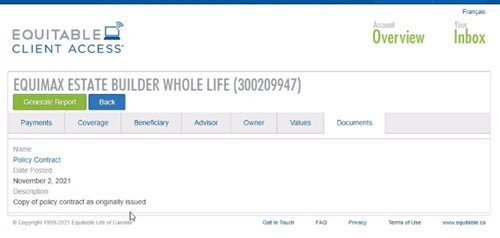

Also new for clients with this enhancement, policy owners of a policy created after January 15 will be able to see a PDF copy of their policy within client access. Note: this PDF copy is as the policy was originally issued.

Resources: - [pdf] Verification of identity for policy owner(s)

- [pdf] Policy Loan OR Premium History Request

-

COVID-19 Vaccinations and your Equitable Life of Canada Insurance Coverage

Equitable Life of Canada would like to reassure our policyholders that getting vaccinated for COVID-19 will not negatively impact your life or health insurance coverage.

Being vaccinated for COVID-19 would have no impact on any claim made under an insurance policy or group benefits plan with Equitable Life of Canada. Your Equitable Life policies provide life and health insurance based on the conditions outlined in your contract with us. Our contracts do not include limitations related to adverse reactions to vaccines.

Equitable Life will continue to follow the guidance and recommendations from the Canadian government to protect the health of Canadians, and we fully support government-approved vaccines as one of the most effective ways to protect yourself from serious illness or death from COVID-19. -

Policy endorsement: Contracts and group benefits plan booklet updates related to BC PharmaCare Biosi

As we announced in the June 2019 issue of eNews, BC PharmaCare recently introduced a new Biosimilars Initiative that ends coverage of three biologic drugs, including Remicade, Enbrel, and Lantus. These drugs will no longer be eligible in British Columbia for most conditions for which lower-cost biosimilar versions are available. Patients in the province with these conditions will be required to switch to biosimilar versions of these drugs by Nov. 25, 2019 in order to maintain their coverage under BC PharmaCare.

The following table outlines the affected originator drugs and their biosimilars.

Drug Originator Biosimilar etanercept Enbrel® Brenzys®

Erelzi™infliximab Remicade® Inflectra®

Renflexis®insulin glargine Lantus® Basaglar™

Biologics are drugs that are engineered using living organisms, such as yeast and bacteria. Biosimilars are highly similar to the originator drugs they are based on and most have been shown to have no clinically meaningful differences in safety or efficacy.

To ensure this provincial change doesn’t result in your clients' plans paying additional drug costs, we are aligning our drug eligibility for these three biologic drugs with that of BC PharmaCare.

To facilitate this change, we are amending some of the wording in our contracts and booklets, effective Oct. 1, 2019. Below are links to the Endorsement to the Master Policy and the Summary of Master Booklet Wording Changes for those amendments. Please download and save these policy endorsement documents for your files.

In addition, please remind your clients to provide their plan members with a copy of the Summary of Master Booklet Wording Changes. The next time your clients amend their benefits plans, the updated wording will be included in their group benefits plan bookletsDOWNLOAD ENDORSEMENT TO THE MASTER POLICY

DOWNLOAD SUMMARY OF MASTER BOOKLET WORDING CHANGES

As of Nov. 25, 2019, Remicade and Enbrel will no longer be eligible for BC plan members with conditions for which lower-cost biosimilar versions of the drugs are available. These plan members will be required to switch to the biosimilar versions of these drugs in order to maintain eligibility on the Equitable Life drug plan.

We will be communicating with affected claimants in the coming weeks to allow them ample time to change their prescription and avoid any interruptions in their treatment or their coverage.

We intend to take a similar approach to Lantus. However, we are still investigating the options to implement this change. We will be communicating with you in the coming weeks to confirm our approach for this drug.

If you have any questions about this change, please contact your Group Marketing Manager or myFlex Sales Manager.

® and ™ denote trademarks of their respective owners - Banking Changes

-

Flexibility for a client’s ever-changing life

Term life insurance offers full and partial conversion options to meet changing needs

Life is always changing—whether a client is buying their first home, welcoming a new baby, or sending the kids off to college. While most clients think of term life insurance as a solution to meet a temporary need, they don’t necessarily consider the power of term conversion options to meet their future needs.

Full and partial conversion options can help meet a client’s needs as their life journey and insurance needs change, without having to provide proof of continued good health.

Full conversion:

• With full conversion, clients can convert all of their term coverage from their policy or rider to permanent life insurance. This allows the client to lock in a level premium rate for life.

Partial conversion:

• With a partial conversion, clients can convert a portion of their term coverage from their policy or rider to a permanent plan. This allows them to help cover off both a short-term need and also provides lifetime protection.

Did you know?

Our partial conversion with a term rider carryover is now more flexible than ever. Read more about it here!

For more information, please consult the Equitable Term Life insurance admin guide. - [pdf] Equinet FAQ

- EquiNet-FAQ