Site Search

1362 results for if

-

Referrals are important to your business...and they're important to ours too

MGA advisors ranked Equitable Life® #1 as the company they would be most likely to recommend to a friend.

Life Ops Consulting Group Distribution Service Satisfaction Survey 2021. (Independent advisors) -

Equitable Life Savings & Retirement Webinar Series featuring Franklin Bissett Investment Management

In 2022, Equitable Life’s S&R team will continue to spotlight various aspects of our competitive fund line up and product offerings. Each webinar in the series features a new topic. The series also gives advisors an opportunity to: learn more about various products and product features, hear from industry professionals, learn about investment strategies; and so much more.

This month, Equitable Life welcomes Les Stelmach, Senior Vice President, Portfolio Manager; Ryan Crowther, Vice President, Portfolio Manager; and Andrew Buntain, Vice President, Institutional Portfolio Manager, from the Franklin Bissett Investment Management team.

Learn More

Moderated by Andrew, Les and Ryan will discuss the Equitable Life Bissett Dividend Income Fund Select, and its goal of providing investors high current income by investing primarily in Canadian and American dividend paying preferred and common stocks.

-

EquiLiving offers more options to clients facing a covered Critical Illness condition

Consider these statistics…1 in 2 Canadians will develop cancer in their lifetimes1. They’re just numbers…until the day someone you know is diagnosed, someone who didn’t see it coming. Then it becomes very real - no longer incidence statistics, but costs. Today more people than ever are surviving and living with not only just the physical, but also the financial effects of their illness.

We’re there to help when illness strikes

NEW! EquiLiving® plans and riders have recently been enhanced including:

● 20 pay options with coverage to age 75 or coverage for life

● Support from Cloud DX to help monitor a client’s well-being from treatment to recovery.

● Added Acquired Brain Injury as a covered critical condition

● 30-day survival period removed for all non-cardiovascular covered conditions

● No age restriction to claim for Loss of Independent Existence (LOIE)

● EquiLiving Benefit now pays the higher of the EquiLiving Benefit or the Return of Premium Rider Benefit (not including Return of Premium on Death)

● And so much more …

Learn more

● CI product enhancement video

● Visit our launch event page with product change details and more

● Marketing Materials

Please contact your Regional Sales Manager for more information.

1 www.cancer.ca

-

Our Critical Illness Insurance Path to Success Program

Our Critical Illness Insurance Path to Success program was designed with you, the Advisor, in mind.

Path to Success: Expert Advice on navigating CI Sales provides you with actionable ideas and scripts that you can implement immediately into your critical illness insurance meetings. CE Credits are available if you review the program in its entirety and complete the quizzes at the end of each section.

Learn more about the CI Path to Success Program

Next steps:

If you have any questions or are interested in getting access to this program, please reach out to your Regional Sales Manager directly.

Enhancements to our Critical Illness Insurance product EquiLiving®

The timing couldn’t be better for connecting with your Regional Sales Manager to gain access to this program, as we have made recent enhancements to our Critical Illness product that will help you offer more options to clients. We’ve enhanced our EquiLiving plans and riders with:

• 20 pay options with coverage to age 75 or coverage for life

• Support from Cloud DX to help monitor a client’s well-being from treatment to recovery

• Added Acquired Brain Injury as a covered critical condition

• 30-day survival period removed for all non-cardiovascular covered conditions

• No age restriction to claim for Loss of Independent Existence (LOIE)

• Adult Covered Conditions definitions updated to 2018 CLHIA definitions

• Increased the number of Early Detection Benefit covered conditions from 4 to 8

• And so much more …

Contact your Regional Sales Manager to get set up in the program and learn about other CE accredited presentations happening each week. -

Advisor Code of Conduct - Updated!

Our Advisor Code of Conduct sets out Equitable Life's expectations of advisors in dealing with clients and other stakeholders. The Code of Conduct forms part of your contractual relationship with us.

We have updated our Code to clarify specific expectations to help you meet regulatory compliance requirements, support your needs-based sales, and treat customers fairly.

Please review our updated Advisor Code of Conduct. -

Equitable Life Savings & Retirement Webinar Series featuring Dynamic Funds

In 2022, Equitable Life’s® S&R team will continue to spotlight various aspects of our competitive fund lineup and product offerings. Each webinar in the series features a new topic. This series gives advisors an opportunity to:

-

learn more about products and product features,

-

hear from industry professionals,

-

learn about investment strategies; and so much more.

This month, Equitable Life welcomes David L. Fingold, Vice President and Portfolio Manager, 1832 Asset Management L.P.

Learn More!

-

-

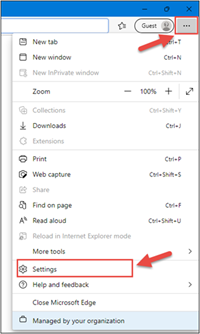

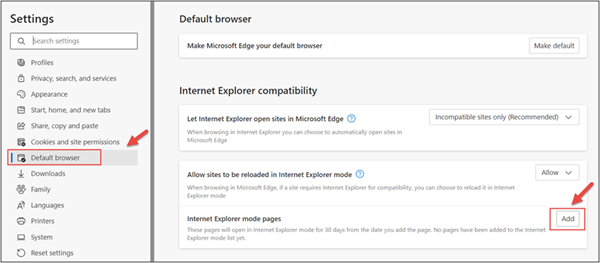

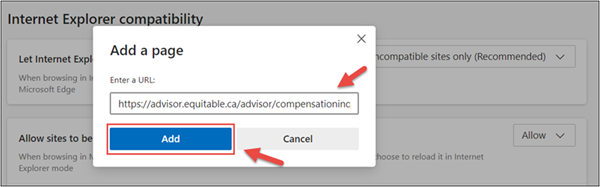

Changes to the Compensation Inquiry section on EquiNet

The Compensation Inquiry Section from EquiNet is only available on Microsoft Edge. Please follow the instructions below:

1. Open Microsoft Edge, click on the three dots in the top right corner and select ‘Settings’.

2. In the Settings menu, locate ‘Default browser’ and click on ‘Add’ in Internet Explorer mode pages.

3. Enter the URL https://advisor.equitable.ca/advisor/compensationinquiry and click on ‘Add’.

4. Login into EquiNet using Microsoft Edge and you will be able to access ‘Compensation Inquiry’.

This configuration expires in 30 days, if you want to continue accessing ‘Compensation Inquiry’ after 30 days, you will need to redo the steps above.

If you encounter problems configuring, call our support line at 1.800.722.6615 ext. 8888 -

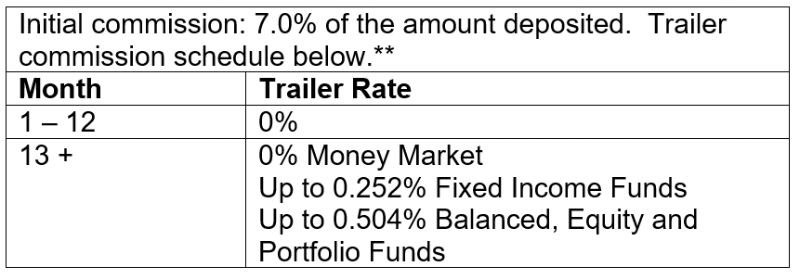

7% No Load CB5 Initial Commission - Limited Time Offer!

For a limited time only, Equitable Life® is pleased to announce an increase to the CB5 sales option initial commission from 5.6% to 7.0% on Pivotal Select™ segregated funds. The 7% initial commission is effective from May 20 to August 31, 2022 only.*

Equitable Life is committed to offering advisors and clients product, service, and feature choices that best suit their needs. We are pleased to offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds to align with advisors’ and clients’ unique needs.

For more information, please contact your Equitable Life Regional Investment Sales Manager.

* Increased initial commission does not apply to pre-existing PADs. Equitable Life reserves the right to end the campaign, at any time and without notice.

** Applies to FundSERV trades occurring between May 20 and August 31, 2022. Initial commission on non-FundSERV trades occurring between May 20 to August 31, 2022 increases from 4% to 5%. Initial commission is subject to a chargeback.

™or ® denotes a registered trademark of The Equitable Life Insurance Company of Canada.

-

The value of Equitable Life’s EZcomplete online application for Pivotal Select

Necessity is the mother of invention. And COVID-19 has taken Equitable Life’s® EZcomplete® online application to the next level. Prior to the pandemic, EZcomplete was touted as being convenient and easy to use. Well, it is. But now…it is so much more.

Whether secure in an office or safe at home, EZcomplete’s non face-to-face capabilities include an alternative to physical verification. EZcomplete simply requires verification of ID using a third-party service provider. The third-party service provider completes the verification behind the scenes using information that was already required to complete an application. By removing the physical ID requirements, the ID verification process has been automated and simplified.

EZcomplete’s electronic signature functionality is also easy and secure. To enable a remote signature, your client just provides an e-mail address. Your client will receive a link and security code that you provide. The client enters the code, reviews the application and e-signs the documents.

Step by step directions ensure you have the right details without any confusing or unnecessary questions. Highlighted fields alert you to any missing information, eliminating any extra work or effort. The immediate processing also helps make it an attractive resource.

Whether selling segregated funds face to face or from the comfort of home, Equitable Life’s EZcomplete online application and Pivotal Select™ segregated fund line up provide the solution for even the most rattled and weary investor. Learn more, visit EquiNet or contact your Regional Investment Sales Manager.

-

Step Up Your Wealth Sales with Equitable Life

Step up your wealth sales with Equitable Life® and you’ll be rewarded with a growth bonus for doing more business in 2022. Make this year your best year ever with Equitable Life!

The program rewards advisors who promote Equitable Life’s Savings & Retirement products to existing and new clients as part of an overall investment strategy based on client needs.

Commission Bonus Calculation:

Gross deposits into segregated funds

+ Gross deposits into Guaranteed Interest Account (GIA) contracts

+ 25% of payout annuity sales

― Segregated fund redemptions

― GIA redemptions

= 2022 Net Deposits

All eligible deposits, sales, and redemptions occurring between January 1 and December 31, 2022, will be used to calculate an advisor’s 2022 net deposits.

* The bonus amount will be calculated at the end of 2022 based on net deposits. The bonus will be paid within 90 days following December 31, 2022. Maximum bonus payable is $75,000.

For more information, download our flyer or contact your Equitable Life Regional Investment Sales Manager.

And as a reminder, we increased the CB5 sales option initial commission from 5.6% to 7.0% on Pivotal Select™ segregated funds. The 7% initial commission is effective from May 20 to August 31, 2022 only.** Learn more.

Equitable Life is committed to offering advisors and clients product, service, and feature choices that best suit their needs. We offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds to align with advisors’ and clients’ unique needs.

** Equitable Life reserves the right to end the campaign, at any time and without notice.

™or ® denotes a registered trademark of The Equitable Life Insurance Company of Canada.