Site Search

271 results for Buy fc 26 coins Buyfc26coins.com Their customer service is very responsive..6gfc

-

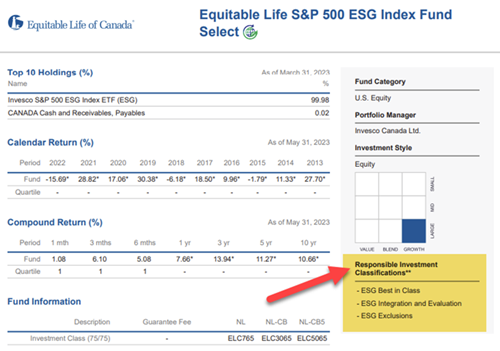

Responsible investing classification on Equitable Life Pivotal Select funds

Recently, the Canadian Investment Funds Standards Committee (CIFSC) classified responsible investing funds under its RI identification framework. The goal of the framework is to help investors and advisors identify and compare responsible investing funds.

We’re pleased to share that the following funds have been assigned multiple responsible investment classifications:• Equitable Life NASDAQ 100 ESG Index Fund Select

• Equitable Life S&P 500 ESG Index Fund Select

• Equitable Life S&P/TSX Composite ESG Index Fund Select

• Equitable Life ClearBridge Sustainable Global Infrastructure Income Fund Select

• Equitable Life Fidelity® Climate Leadership Balanced Fund Select

• Equitable Life Fidelity® Climate Leadership Fund Select

You can find the new responsible investment classifications for our funds by visiting our Fund Information webpage. After selecting a fund with the “Sustainable Investment” icon, the classifications can be found on the right side of the webpage or fund profile PDF:

™ or ® denote registered trademarks of The Equitable Life Insurance Company of Canada.

Posted: June 26, 2023

-

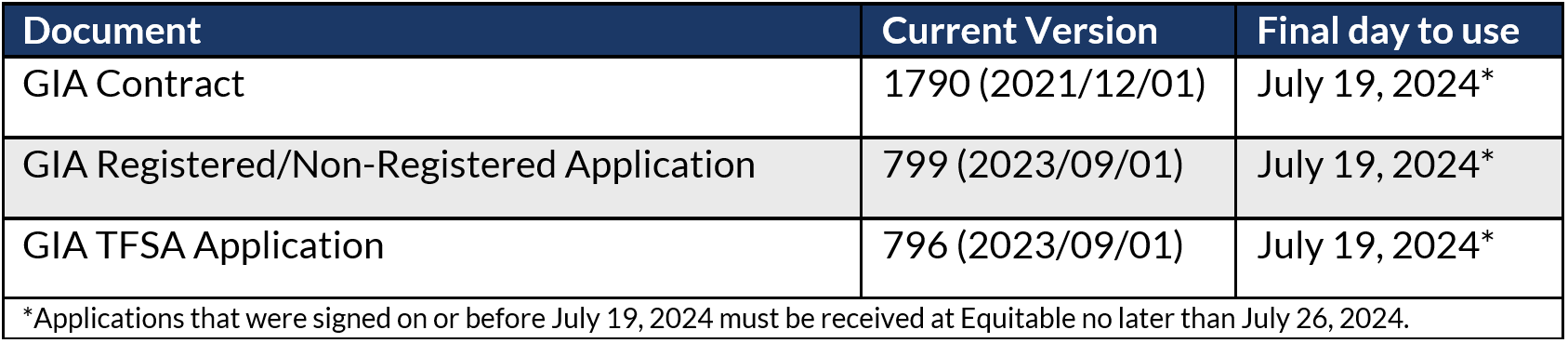

Updates to Guaranteed Interest Account Applications

New versions of the Guaranteed Interest Account (GIA) contract/applications will be available on July 20, 2024. The current versions can be used until July 19, 2024. GIA applications signed on or before July 19, 2024 must be received at Equitable® no later than July 26, 2024.

Changes will be made to the commission schedules (schedule A and B) on or around July 20, 2024. These changes include:

-

an improved layout and formatting to improve readability, and

-

decreases to the Daily Interest Account and Guaranteed Interest Account commissions.

To review the commission schedules, please login to EquiNet. Once you have logged in, you can access the commissions schedules by selecting “Contracting/Compensation” and selecting the “Compensation” option.

If you have any questions, please contact your Director, Investment Sales.

Posted July 18, 2024 -

- Individual Insurance

- Anti-money Laundering Legislation Requirements Summary

-

Insights from a pandemic: Long-term COVID-19 drug risks

For the remainder of 2020 and beyond, COVID-19 will continue to add to the existing pressures driving up drug costs. Examples of contributing factors include:

- Claims for acute drugs will likely increase as elective surgeries resume and plan members address non-emergency health issues that were left unattended during COVID-19.

- Plan members whose employers are facing financial strain due to COVID-19 may stock up on their prescriptions in anticipation of losing their job and/or their benefits.

- An ongoing increase in the prevalence and severity of mental health issues and chronic conditions. In May and June, we saw a dramatic increase in the number of claimants for depression, ulcers, blood pressure and diabetes, and depression was associated with 1 in 5 claimants.

All trends thus far suggest we can expect about a 10% increase in average paid amounts per certificate in 2020 compared with 2019. But the impact won’t be the same for all groups. There will be significant variations, particularly for smaller groups, and some may see much larger cost increases.

Unknown COVID-19-related risks

Another risk exposure may come from the costs associated with drugs used to treat or prevent COVID-19. There are currently numerous vaccines in development, and more than 300 clinical trials are underway for both new and existing drugs to determine their effectiveness in treating the virus.

The cost of any vaccine or whether government or private plans will pay for it is unknown. Regardless, there will likely be other drugs indicated for the treatment or prevention of COVID-19 that private plans will be expected to cover. The cost of this impact for private payers is unknown, but potentially high.

Another unknown is what will happen with dispensing fees. While most provinces have lifted their 30-day prescription refill limits, it remains to be seen whether pharmacies will resume dispensing 60- and 90-day refills at pre-COVID levels for private plans. If not, this would mean the dispensing fees will continue to drive up drug costs.

Advisor opportunity

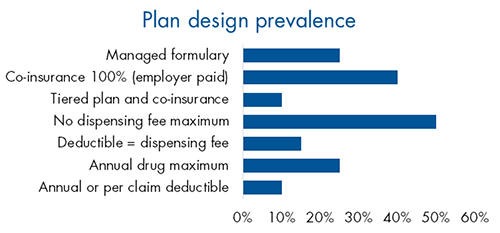

Despite the increase in drug plan risk in recent years, little has changed in plan design trends. Very few plan sponsors have adopted managed plans or other plan design options that could help manage risk.

This presents an opportunity for advisors to educate their clients about the risks their drug plan may be exposed to and the options available to manage that risk.

A practical starting point for those conversations is our Drug Plan Design Tool. With two simple questions, it can help confirm your client’s objectives and identify some best-fit solutions for their plan. Ask your Group Account Executive or myFlex Sales Manager for a copy of the tool.

-

Taking the guess work out of market volatility with Equitable Life

Investing during market highs and market lows can leave even the most seasoned investors scratching their heads. Knowing when to buy and when to sell is not easy, but disciplined investing can be.

Dollar cost averaging with Equitable Life® is designed to provide a long-term investment solution. This strategy helps take the guesswork out of knowing when to get into the market. It can also provide consistency for a long-term financial plan regardless of whether there is a lot or a little to invest.

And for a limited time only, we’ve increased the initial commission for the CB5 sales option from 5.6% to 7.0% on Pivotal Select™ segregated funds*, effective from May 20 to August 31, 2022.** During this time, advisors earn the increased full initial commission even if funds are placed into Equitable Life Money Market Fund to start the PAC.

For more information on dollar cost averaging, please contact your Equitable Life Regional Investment Sales Manager.

* Applies to FundSERV trades occurring between May 20 and August 31, 2022. Initial commission on non-FundSERV trades occurring between May 20 to August 31, 2022 increases from 4% to 5%. Initial commission is subject to a chargeback.

** Equitable Life reserves the right to end the campaign at any time and without notice.

™or ® denotes a registered trademark of The Equitable Life Insurance Company of Canada.

-

See how choosing Equimax Participating Whole Life can help Raj plan for his family’s future

Raj wants to buy life insurance. He has wealth he’s grown over the years. He wants it to go to his family. He likes what participating whole life has to offer.

By choosing an Equimax participating whole life insurance policy with Equitable Life, Raj gets permanent insurance coverage with tax-advantaged cash growth. His policy can also earn annual dividend payments.

He learns about how his premiums go into a participating account and are invested. Some of that investment can come back to him as dividends.

With Equitable Life, dividends are shared only with participating policyholders. This makes Equimax Participating Whole Life an easy choice for Raj.

Watch our new Dividends with Equitable Life of Canada video to learn more. View on Vimeo or YouTube.

You can use this video to send to clients before or after meetings to help them understand Dividends with Equitable Life.

Plus, visit our Equimax product page, then click on the Marketing Materials tab for the latest Dividend marketing materials.

Need more information? Please contact your local wholesaler.

® and ™ denotes trademarks of The Equitable Life Insurance Company of Canada.

To learn more about our dividend policy and participating account management policy, please visit www.equitable.ca/en/already-a-client/dividend-information/

Dividends are not guaranteed and are paid at the sole discretion of the Board of Directors. Dividends may be subject to taxation. Dividends will vary based on the actual investment returns in the participating account as well as mortality, expenses, lapse, claims experience, taxes and other experience of the participating block of policies. -

Homewood Health COVID-19 Resources

As the COVID-19 situation continues to rapidly evolve, you may need information from a trusted source to support your clients, their organizations and their employees.

Through our partnership with Homewood Health, the Canadian leader in mental health and addiction services, all of our clients and their plan members have access to a number of tools and resources designed to provide guidance and support.

Online Cognitive Behavioural Therapy

For plan members dealing with increased anxiety during these uncertain times, Homewood’s Online Cognitive Behavioural Therapy tool, i-Volve, can help. Through self-paced, web-based therapy, i-Volve can help plan members identify, challenge and overcome anxious thoughts, behaviours and emotions.

All Equitable Life clients and their plan members have access to i-Volve. It’s available 24 hours a day, seven days a week, wherever you choose to access it.

Learn more about Online CBT or access i-Volve at Homeweb.ca/Equitable.

COVID-19 Support Resources

Drawing on their expertise in mental health, as well as guidance from trusted sources including Health Canada, the Public Health Agency of Canada and the World Health Organization, Homewood has created a number of resources to help support your clients and their plan members.

- Self-isolation and quarantine: What you need to know

- Quelling COVID-19 Anxiety

- Managing stress and anxiety

- How to speak to children

- How to stay productive and motivated when working from home

- The COVID-19 Pandemic: Managing the Impact

- Support for First Responders, Front Line Workers and Public Facing Employees

- Financial tips for your financial health

- Increases in Domestic Violence

- Those with family members in long-term care facilities

- Parenting during a pandemic

- COVID-19: Employee Fatigue, Isolation and Loneliness

- COVID-19 Back to School - Considerations and tips for parents and caregivers

- COVID-19: Back to School Support for Kids

-

Supporting plan members affected by the British Columbia and Northwest Territories wildfires

Wildfires across Canada are disrupting the lives of many Canadians. During this difficult time, Equitable Life is providing additional support to help affected clients and plan members.

Prescription refills

Plan members who have been evacuated and/or lost their medication due to the wildfires will be able to make early refills until September 17, 2023, through TELUS Health, our pharmacy benefit manager.

Replacement of medical or dental equipment and appliances

Plan members who need to replace eligible medical or dental equipment or appliances due to the wildfires should first call 1.800.265.4556 to confirm coverage.

Disability or other benefit cheques

Plan members receiving disability benefits or other benefit reimbursements via cheques can visit www.equitable.ca/go/digital for instructions on how to sign up for direct deposit. It just takes a few minutes. Plan members can also call us at 1.800.265.4556 if they need help, a replacement cheque or assistance arranging a different mailing address.

Mental health support

Unpredictable, large-scale natural disasters can cause people to experience intense reactions, putting a lot of pressure on their mental health. Having coping mechanisms to deal with the current crisis can be a huge help. Any Equitable Life plan member who needs mental health support can visit Homeweb.ca/equitable to access online resources or contact Homewood at 1.888.707.2115.

For plan sponsors who have purchased Homewood Health’s Employee and Family Assistance Program (EFAP), their plan members also have access to confidential counselling services. The EFAP provides plan members with 24/7 access to confidential counselling through a national network of mental health professionals. Whether it’s face-to-face, by phone, email, chat or video, plan members will receive the most appropriate, most timely support for the issue they’re dealing with.

Plan Administrator support

We realize that the fires are having a profound impact on regular business operations in B.C. and N.W.T. If you have clients that are unable to carry out day-to-day plan administration, they can call us at 1.800.265.4556. They can also contact their Customer Relationship Specialist for support.

This is a challenging time for advisors, plan sponsors and plan members. We will continue to monitor the situation and provide additional updates as appropriate.Questions?

If you need more information, contact your Group Account Executive or myFlex Sales Manager.

- Accepted Payment Methods