Site Search

348 results for mode change request

-

Enhancements to ID Verification and Business Forms

We have made enhancements to some of our forms and created an additional form to help make it easier for you to do business with Equitable Life®.

The first enhancement is an update to the ID Verification section to allow for Third Party ID Verification when a client doesn’t want to provide ID documents to an Advisor. They are now given additional options to either use the Alternative Identification requirements, or consent to Equitable Life verifying their identity through a third party service provider. We’ve also clarified in the Advisor declaration that they can’t sign for their own policies as they aren’t able to validate their own ID.

The above changes have been made to the following forms:- 671OC – Ownership Change Form

- 1027 – Additional/Updated Customer Information

- 1616 – Application for Term Conversion

The second enhancement is an update to Business forms. We’ve created a new form, 2004 Signing Authorities Certificate, to help Businesses provide the Signing Authority information needed more easily! Forms 594 and 682ENT have been updated to point to the new Form 2004 and also have new “Ownership structure” requirements added in section 2.

View the below forms for details on these changes:- 2004 – Signing Authorities Certificate (NEW)

- 594 – Business Information Form

- 682ENT – Claimants’ Statement for Entities

® denotes a registered trademark of The Equitable Life Insurance Company of Canada.

-

Changes to Short Term Disability Benefit Calculations

The Canada Employment Insurance Commission and Canada Revenue Agency have announced the 2022 changes to Maximum Insurable Earnings, and premiums for employment insurance. These changes take effect January 1, 2022.

2021 Amount As of Jan. 1, 2022 Maximum Insurable Earnings (MIE)

$56,300 $60,300 Maximum Weekly Insurable Earnings (MWIE)

$1,083 $1,160 EI Benefit

(55% of the MWIE, rounded to the nearest dollar)$595 $638

How does this affect your clients?

If your client’s Group Policy with Equitable Life includes a Short Term Disability (STD) benefit which is tied to the EI Maximum Weekly Insurable Earnings, and at least one classification of employees has less than a $638 maximum, then to comply with the provisions of their policy, their STD benefit will be revised with the maximums updated based on the percentage of EI Maximum Weekly Insurable Earnings shown in their policy.

The additional premium for any increase from their previous STD amounts and new STD amounts will be show on their January 2021 Group Insurance Billing (as applicable).

If their STD maximum is currently higher than $638 or based on a flat amount (not based on a percentage or regular earnings), no change will be made to their plan unless otherwise directed.

If your clients wish to provide direction regarding revising their STD maximum, or have questions about the process, they can email Kari Gough, Manager, Group Quotes and Issue. -

Manage more details within Contract Delivery for New Business applications

We are excited to announce further enhancements to our eDelivery process to empower you, the advisor, the ability to manage client details more easily within Contract Delivery.

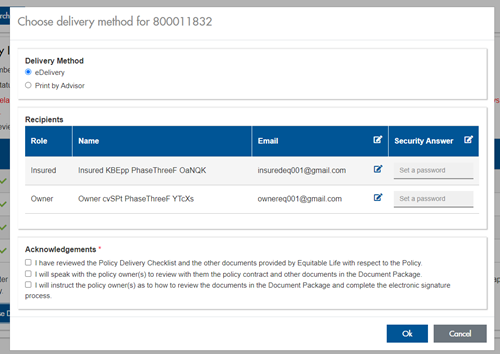

Effective January 15, 2022, advisors will need to create a Password within Contract Delivery when choosing “eDelivery” as the contract delivery method and provide the password to the client to use as their password:

The Password must be between 4 and 100 alpha/numeric characters, and cannot be the Policy number. For multiple signers the password (and email address) must be unique per each signer.

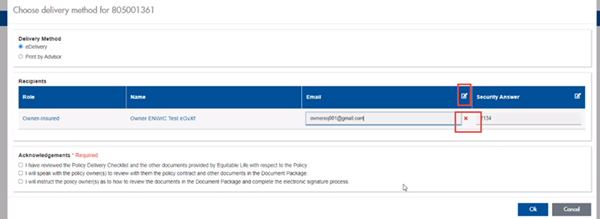

Advisors can now edit and/or update an email address within Contract Delivery, in the event of a bounce back or email change, to keep the eDelivery process moving and avoid delays in processing time. If a lock out occurs, advisors can trigger a resend of the signing email once they add a new valid email address in Contract Delivery. Simply click the pencil icon beside the Email field to enter the valid email address:

Another new feature- in the event a client has declined, the advisor will get an email from Equitable Life®. Click through to EquiNet® within the email to view the message within Contract Delivery that the client provided as the reason for decline under a new “Declined Details” section. This enables you to connect with the client to proceed with the sale by discussing the reasons for decline with them directly.

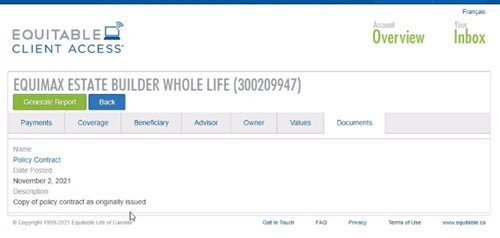

Also new for clients with this enhancement, policy owners of a policy created after January 15 will be able to see a PDF copy of their policy within client access. Note: this PDF copy is as the policy was originally issued.

Resources: -

Individual Insurance product enhancements

Equitable Life has exciting product enhancements that will help you offer more options to clients.

- Full Product Launch Video (approx. 20 minutes).

Watch our Virtual Product Launch NOW. Grab a coffee and get ready for this exciting news! Hear from our leaders and learn about our exciting product enhancements.

- Introduction video (View on Vimeo) / Product launch page

Highlights of the product changes effective February 12, 2022, include:NEW! 10 pay premium option with Equimax Estate Builder®

- The new EquiLiving® 20 pay rider options will be available on Equimax® plans

- 20 pay options with coverage to age 75 or coverage for life

NEW! EquiLiving plans and riders enhanced with:

- Support from Cloud DX to help monitor a client’s well-being from treatment to recovery.

- Added Acquired Brain Injury as a covered critical condition

- 30-day survival period removed for all non-cardiovascular covered conditions

- No age restriction to claim for Loss of Independent Existence (LOIE)

- EquiLiving Benefit now pays the higher of the EquiLiving Benefit or the Return of Premium Rider Benefit (not including Return of Premium on Death)

- And so much more …

New Illustration software available on February 11, 2022

The updated illustration software will be available for download after 9 a.m. ET on Friday, February 11, 2022, and will include all the Equimax and EquiLiving enhancements.

See the Equitable Sales Illustrations Update for information on how to download the software or check for updates.

Please review updates to the commission schedule A for these new enhancements.

Learn more- Transition rules are available

- Watch our virtual launch event video now! (Approx. 20 minutes),

- Watch our product launch intro video here. Watch on Vimeo

- Visit our launch event page with product change details and more

- Marketing Materials

Please contact your Regional Sales Manager for more information. -

Product Enhancements - Critical Illness

Equitable Life has exciting product enhancements that will help you offer more options to clients.

Access our Virtual Product Launch NOW. Grab a coffee and get ready for this exciting news! Hear from our leaders and learn about our exciting product enhancements.

NEW! EquiLiving plans and riders enhanced with:- 20 pay options with coverage to age 75 or coverage for life

- Support from Cloud DX to help monitor a client’s well-being from treatment to recovery.

- Added Acquired Brain Injury as a covered critical condition

- 30-day survival period removed for all non-cardiovascular covered conditions

- No age restriction to claim for Loss of Independent Existence (LOIE)

- EquiLiving Benefit now pays the higher of the EquiLiving Benefit or the Return of Premium Rider Benefit (not including Return of Premium on Death)

- And so much more …

The updated illustration software will be available for download after 9 a.m. ET on Friday, February 11, 2022, and will include all the Equimax and EquiLiving enhancements.

See the Equitable Sales Illustrations Update for information on how to download the software or check for updates.

Please review updates to the commission schedule A for these new enhancements.

Learn more- Transition rules are available

- Watch our virtual launch event video now! (Approx. 20 minutes)

- Watch our product launch intro video here

- Visit our launch event page with product change details and more here

- Marketing Materials

Please contact your Regional Sales Manager for more information. -

Product Enhancements - 10 Pay

Equitable Life has exciting product enhancements that will help you offer more options to clients.

Access our Virtual Product Launch NOW. Grab a coffee and get ready for this exciting news! Hear from our leaders and learn about our exciting product enhancements.

NEW! 10 pay premium option with Equimax Estate Builder®- The new EquiLiving® 20 pay rider options will be available on Equimax® plans

The updated illustration software will be available for download after 9 a.m. ET on Friday, February 11, 2022, and will include all the Equimax and EquiLiving enhancements.

See the Equitable Sales Illustrations Update for information on how to download the software or check for updates.

Please review updates to the commission schedule A for these new enhancements.

Learn more- Transition rules are available

- Watch our virtual launch event video now! (Approx. 20 minutes)

- Watch our product launch intro video here

- Visit our launch event page with product change details and more here

- Marketing Materials

Please contact your Regional Sales Manager for more information. -

Equitable Life Group Benefits Bulletin – March 2022

In this issue:

- CLHIA launches industry anti-fraud initiative*

- Provincial biosimilar update*

- Quebec decreasing insurance premium tax*

- Coming soon: A survey to understand how we can better serve your clients’ needs*

- Remind your clients’ plan members in BC, Manitoba and Saskatchewan to register for Pharmacare *

CLHIA launches industry anti-fraud initiative*

In February, the Canadian Life and Health Insurance Association (CLHIA) announced a new anti-fraud initiative that is using advanced artificial intelligence (AI) to further identify and reduce benefits fraud.

Equitable Life is excited to be a part of this important initiative. It will enhance our own fraud detection analytics by using AI to connect the dots across a huge pool of anonymized claims data. This will lead to more investigations and actions to mitigate the impact of fraud on your clients’ plans.

The initiative is being led by the CLHIA and member insurers and is supported by technology provider Shift Technologies. It will be further rolled-out and expanded over the next three years.

Benefits fraud affects more than just insurers. The costs of fraud are felt by employers and their employees as well. We are looking forward to being able to better identify and reduce benefits fraud.

Provincial biosimilar update*

BC expands its biosimilar initiative

BC Pharmacare recently announced it is adding two rapid-acting insulins to the list of drugs included in its ongoing initiative to switch patients to biosimilar versions of high-cost biologics. Patients taking Humalog or NovoRapid for Type 1 or Type 2 diabetes will be required to switch to a biosimilar version of the drugs by May 29, 2022 to maintain coverage under the public plan.

Biologics are drugs that are engineered using living organisms like yeast and bacteria. The first version of a biologic developed is also known as the “originator” biologic. Biosimilars are also biologics. They are highly similar to the originator biologic drugs they are based on, and Health Canada considers them to be equally safe and effective for approved conditions.

How we are responding to protect our clients

To help prevent this change from resulting in additional costs for our clients’ drug plans while still providing plan members with access to safe and effective medications, we will no longer cover Humalog or NovoRapid for plan members in BC. Effective June 1, 2022, claimants currently taking Humalog or NovoRapid will be required to switch to a biosimilar version of the drugs to maintain coverage under their Equitable Life plan and their BC Pharmacare plan.

We will be communicating this change to plan administrators later this week. And we will be communicating with affected claimants in early April to allow ample time to change their prescription and avoid any interruptions in their treatment or their coverage.

If you have any questions about this change, please contact your Group Account Executive or myFlex Sales Manager.

Nova Scotia and Northwest Territories introduce biosimilar initiatives

The governments of Nova Scotia and the Northwest Territories each recently announced they are launching biosimilar initiatives to switch patients from certain originator biologic drugs to biosimilar versions of the drugs.

Patients in Nova Scotia using affected originator biologic drugs will have until February 2023 to switch to a biosimilar version of their medications in order to maintain coverage under the province’s public drug plans. Patients in the Northwest Territories will have until June 20, 2022, to switch.

Equitable Life® actively monitors and investigates all biosimilar policy changes and the ongoing evolution of biosimilar drugs entering Canada. We will keep you informed of any impact on private drug plans and how we are responding.

Quebec decreasing insurance premium tax*

The Quebec Government has announced that it plans to decrease its Insurance Premium Tax rates effective April 1, 2022. The premium tax rates for group life and accident and sickness insurance are expected to decrease from 3.48% to 3.3%. The new tax rates will be applied to premiums for the billing period beginning on or after April 1, 2022.

Coming soon: A survey to understand how we can better serve your clients’ needs*

We are committed to providing your clients and their plan members with industry-leading service. We’ve introduced several enhancements over the past year to make it easier to do business with us. And we’re continually looking for ways to improve.

In the coming weeks, we will conduct a survey of your clients to help us understand how we can better serve them. On March 28, we will send plan administrators an email with a link to the survey. The survey will remain open until the end of the day on April 11 and will take between five and 10 minutes to complete. Please encourage your clients to participate. Their feedback will be confidential, and their responses will help us improve our service and ensure we’re meeting their expectations. We may also follow up with plan administrators directly to address any concerns they’ve identified.

We know your clients’ time is valuable. So, each plan administrator who completes the survey will be entered into a random draw for a chance to win one of 25 prepaid gift cards for $25.

Remind your clients’ plan members in BC, Manitoba and Saskatchewan to register for Pharmacare*

If your clients have plan members in British Columbia, Manitoba or Saskatchewan, the provincial government offers a Pharmacare program to support prescription drug costs. Plan members in these provinces must register for their provincial Pharmacare program to maintain coverage under their Equitable Life drug plan.

Registration is easy! We will send two registration reminder messages directly to plan members’ pharmacists and post them on their Explanation of Benefits. We’ve also created a step-by-step guide that your clients can share with their plan members.

English version

French version

For more information about the provincial Pharmacare programs, including how plan members can register, please visit:

For British Columbia residents: https://www2.gov.bc.ca/gov/content/health/health-drug-coverage/pharmacare-for-bc-residents

For Manitoba residents: https://www.gov.mb.ca/health/pharmacare/apply.html

For Saskatchewan residents: https://www.saskatchewan.ca/residents/health/prescription-drug-plans-and-health-coverage/extended-benefits-and%20drug-plan/drug-cost-assistance#eligibility

-

EquiLiving offers more options to clients facing a covered Critical Illness condition

Consider these statistics…1 in 2 Canadians will develop cancer in their lifetimes1. They’re just numbers…until the day someone you know is diagnosed, someone who didn’t see it coming. Then it becomes very real - no longer incidence statistics, but costs. Today more people than ever are surviving and living with not only just the physical, but also the financial effects of their illness.

We’re there to help when illness strikes

NEW! EquiLiving® plans and riders have recently been enhanced including:

● 20 pay options with coverage to age 75 or coverage for life

● Support from Cloud DX to help monitor a client’s well-being from treatment to recovery.

● Added Acquired Brain Injury as a covered critical condition

● 30-day survival period removed for all non-cardiovascular covered conditions

● No age restriction to claim for Loss of Independent Existence (LOIE)

● EquiLiving Benefit now pays the higher of the EquiLiving Benefit or the Return of Premium Rider Benefit (not including Return of Premium on Death)

● And so much more …

Learn more

● CI product enhancement video

● Visit our launch event page with product change details and more

● Marketing Materials

Please contact your Regional Sales Manager for more information.

1 www.cancer.ca

-

Application cloning option now available on EZcomplete

As of September 10th, you will now have the option to clone any Life Insurance and Critical Illness applications that is showing on the EZcomplete dashboard. “Cloning” means the information that has been completed in the existing application is duplicated in a new application.

This feature is meant for situations where multiple applications are being completed and at least one of the parties (the policy owner or insured person) is the same. For example, a single policy owner might own policies on the lives of each of their children. Cloning the application will save re-typing the information about the policy owner into each application.

Please note the following important details regarding cloning:

- Cloning the application will duplicate all information that has been completed in the existing application into the new application.

- In the family situation described above, the information about the policy owner should be completed in the original application. The application should then be cloned before entering any information about the insured person, as there will be a different insured person for the new application.

- Cloning applications can be convenient, but it carries risk. It is imperative that the advisor review every section of the new cloned application to ensure that the information is meant to apply to the new application. If an advisor incorrectly includes information about an individual in the new application, this could give risk to a privacy breach or to liability for the advisor if the questions are answered incorrectly for that individual.

- If the application was submitted and is no longer on the dashboard you will not have the option to clone it.

- You will not be able to change the product type on a cloned application so if you need to select a different product, you will need to start a new application.

- Any documents that were attached to the previous application will not be cloned. The documentation will need to be attached again if required.

- All information from an existing application will be duplicated to the cloned app up to the Signatures step (step 8). Signatures/advisor report will need to be obtained and completed again on the new cloned application.

Resources

Please contact your Regional Sales Manager for more information

-

NEW Jump Around feature available on EZcomplete

One of the most requested features is available on EZcomplete® effective November 19, 2022. We like to call it “jump around”. It’s the ability to jump from one part of the application to another and back again. You no longer have to complete the application one section after another in order. This will allow a lot more flexibility when submitting a policy application.

This functionality is helpful as you can input basic client information ahead of a meeting to review with the client later. After completing the Owner’s step (step 1), you could jump to step five (Subsequent Payment) or step six (Third Party). This allows you the opportunity to easily jump back and add a second owner once you have all their details from the client. You can also return to your dashboard, and when you go back into the application, you will be returned to the owner’s section.

Hitting the Save button will save the information you have inputted already, so after jumping ahead to a different section, you can return to complete those questions knowing your progress will be saved. When you have completed all the necessary fields, hitting the Done button will validate all the information and the step will be complete. A check mark will appear beside each completed and validated step.

Please note, if you go back to a previously validated step and change information you will have to go through all subsequent steps and complete and validate them again by clicking next if nothing has changed or making any necessary changes.

To Equitable Life®, the term EZ really means something! Learn more about how doing business with Equitable Life continues to be easy.

Questions: Please contact your Regional Sales Manager

® denotes a trademark of The Equitable Life Insurance Company of Canada.