Site Search

1362 results for if

-

Claims payments and notifications will go fully digital on July 1, 2023

We are committed to providing a better benefits experience. We have secure and convenient digital options to make it easier for plan members to access and use their benefits plan, including EquitableHealth.ca and the EZClaim Mobile app.

Most plan members are already using these tools to set up email claim notifications and direct deposit. They get their claim updates faster and their claims paid more quickly, right into their bank account.

To help ensure that all plan members benefit from faster claim payments and notifications, we are making these services fully digital as of July 1, 2023. That means, in most cases, we will no longer mail paper claim cheques or explanation of benefits (EOB) notifications.**

Plan members who haven’t already activated direct deposit and email notifications will need to activate these services via their plan member account on EquitableHealth.ca.How we’ll help plan members get set up

Fortunately, it’s simple for plan members to set up these features. And it only takes a few minutes. To make it even easier, we’ve created a Plan Member Guide to Getting Started Online. It includes simple instructions to help plan members use our digital features and get the most from their benefits plan.

We have also created a toolkit that plan administrators can email to their plan members to walk them through the simple steps. Access the toolkit here.

And we’re available to guide plan members who may need help. They can call us at 1.800.265.4556 and select “Plan Member Web Support”. Our Client Care Centre Team is happy to help them activate these services.How we’ll communicate with plan members

We will start communicating this change to plan members in April. For plan members who aren’t taking advantage of these convenient features, we will send them an email to let them know about the change, with instructions and support on getting set up.

We will also include an insert with all mailings of paper cheques and EOB notifications sent out. And we will post an announcement and banner on EquitableHealth.ca to let plan members know about the change.

How we’ll support plan members who need extra help or accommodations

After July 1, 2023, we will follow up with plan members who have not yet activated direct deposit or email notifications for their claims and provide any extra help and support they may need. And, of course, we’ll make exceptions for plan members who aren’t willing or reasonably able to use these features.Questions?

If you have any questions, please contact your Group Account Executive or myFlex Sales Manager.

** Disability claimants will continue to receive paper Explanation of Benefits notifications in the mail. Some pay-direct drug claims will also continue to be paid by cheque. -

Supporting clients at claim time with KIND

Did you know that our KIND™ program is available for new sales of Equitable Generations™ universal life and Equimax® participating whole life?

In September 2022, we introduced our KIND program with our Equitable Generations launch and in February 2023 we announced the addition of KIND to new sales of Equimax.

Our KIND program includes:

● Compassionate Advance* - access up to 50% of your coverage to a maximum amount of $100,000 if the insured becomes terminally ill1

● Bereavement Counselling - benefit for beneficiaries up to $1,000 total1

● Snap Advance*- providing immediate access (if needed) of a portion of the death benefit up to $25,000 or the cash value of the policy, whichever is less when a death claim is submitted1

● Living Benefit - tax-free access to the policy cash value in the event of severe disability1 We offer benefits to clients and their heirs with our KIND program. This is an example of our commitment to our clients.

We offer benefits to clients and their heirs with our KIND program. This is an example of our commitment to our clients.

To learn more about KIND with Equitable Generation or Equimax, read our our KIND Caring Claim Support Package or contact your local wholesaler.

View our KIND video on YouTube or Vimeo!

® and TM denote trademarks of The Equitable Life Insurance Company of Canada.

* Snap Advance and Compassionate Advance are non-contractual and may be altered or terminated by Equitable Life at any time without notice

1 Subject to meeting the eligibility requirements.

-

Colaiacovo to lead Equitable’s Eastern Group Sales Team

We are pleased to announce that Sofia Colaiacovo has been appointed our new Group Sales Vice President, Eastern Canada.

In her role, Colaiacovo will lead the Eastern sales team. She will focus on working with distribution partners to grow our business together while continuing to provide clients and their plan members with a better benefits experience.

Colaiacovo brings to her role 18 years of experience with Equitable Life, building strong distribution partnerships and delivering exceptional client service.

She joined Equitable Life in 2005 and has held roles of increasing responsibility in our Group distribution organization.

Since 2011, she has served as our Group Account Executive for the Ottawa territory. In that role, she quadrupled the size of our client base in the region and established strong and lasting relationships with key distribution partners. She was recognized as Equitable Life’s Group Account Executive of the Year three consecutive times – in 2019, 2020 and 2021.

“Sofia will further strengthen our Group Leadership Team and reinforce our ongoing commitment to building enduring distribution partnerships and delivering great service,” says Marc Avaria, Equitable Life’s Senior Vice-President, Group.

“Sofia’s success has come from taking the time to understand the needs of her partner advisors and their clients,” he adds. “By asking the right questions and listening, she has been able to provide valuable and practical solutions to meet their needs.”

Colaiacovo graduated from Carleton University with a Degree in Psychology. She holds the Group Benefits Associate (GBA) designation through the International Foundation of Employee Benefits Plans. -

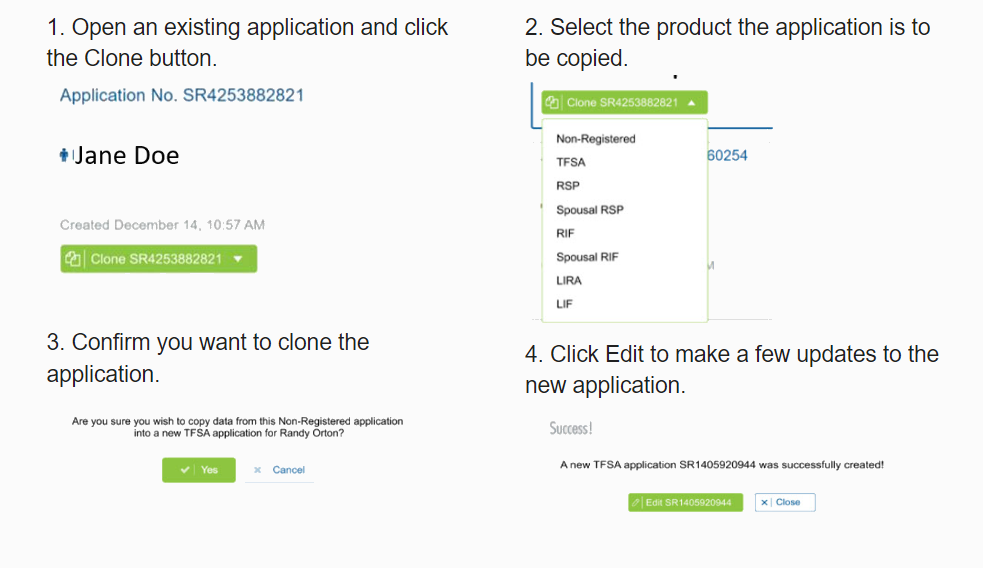

The new segregated fund EZcomplete cloning feature will save time and errors.

The new cloning feature for Savings & Retirement EZcomplete® applications means that advisors don’t need to enter the same client information when completing multiple applications for the same client.

Here's how easy it is to use.

.png)

Best of all, you can clone in progress and submitted applications.

This is just some of the information that will be automatically copied:-

Name

-

Date of birth

-

Gender

-

Occupation

-

Address

-

Phone numbers

-

Email address

-

Social Insurance Number

-

All beneficiary information

The new EZcomplete cloning feature will save advisors time and reduce errors.If you have any questions, contact your Regional Investment Sales Manager

® denotes a trademark of The Equitable Life Insurance Company of Canada.

Posted April 6, 2023 -

-

Universal Life Savings and Investment Options Updates

The fund pages for our Universal Life products have been updated.

Full details on the Equitable Generations™ funds available, visit Equitable Generations Savings and Investment Options (2055 pdf).

Full details on the Equation Generation® IV funds available, visit Universal Life Savings and Investment Options (1193 pdf).

We launched our Universal Life product update in September 2022, when an exciting new fund lineup became available.

Learn more about the funds:- Details on funds available

- American Equity Index (ESG)

- Canadian Equity Index (ESG)

- Special Situations fund (Fidelity)

- Sustainable Equity, Balanced, and Bond Funds (Fidelity)

- Target Date funds (Fidelity)

- Get all your ESG questions answered with Margaret Dorn, S&P

- Rates and Performance page

® and ™ denote trademarks of The Equitable Life Insurance Company of Canada. -

Cloud DX, Signs Contract with Heart Centre

Our partner, Cloud DX, has signed a 3-year contract with an Ontario hospital to help put patients with congestive heart failure at ease.

Cloud DX’s digital health platform works to improve healthcare delivery, provide better care outcomes, and lessen the burden on our national healthcare system. Now, an Ontario heart centre will use the Cloud DX platform to improve its patient monitoring services.

Cloud DX is a value-added service for Equitable Life’s Critical Illness claimants. Cloud DX delivers clinical grade hardware directly to the client so that they can remotely monitor the client’s vitals to help ensure they stay on the road to recovery*.

To learn more about our partnership with CloudDX, click here or contact your local wholesaler.

Watch our video on YouTube or Vimeo!

*Cloud DX is a non-contractual benefit and may be withdrawn or changed by Equitable Life® at any time. To be eligible for the Cloud DX offering, a claimant must be age 12 or older and have received payment on or after February 12, 2022 for a covered critical condition benefit under an individual critical illness insurance policy issued by Equitable Life. An early detection benefit payment does not qualify. Equitable Life pays for 6 months of Cloud DX subscription fees. If the claimant wishes to continue the Cloud DX service after 6 months, they will be responsible for the cost. The claimant must supply their own device to connect to Cloud DX app– a laptop, tablet or cellphone. As well, the claimant needs to supply their own data or internet service.

® and TM denote trademarks of The Equitable Life Insurance Company of Canada. -

Start a Conversation with EZstart – Now Available for Equimax Wealth Accumulator

Looking for an easy way to explain insurance? We have a digital tool to do just that!

Start a Conversation with EZstart™

EZstart helps to commence those initial client conversations. Think of it like a digital brochure: you start a conversation about life goals, enter a few details - and within a few clicks - get a quick quote on your phone or tablet instantly.

We have a NEW EZstart for Equimax Wealth Accumulator® available. Go to the EZstart for Equimax Wealth Accumulator now.

Don’t forget about our other EZstart tools that are available for you. Learn more.

® and TM denote trademarks of The Equitable Life Insurance Company of Canada. -

April 2023 eNews

Vision care discounts from Bailey Nelson for Equitable Life plan members*

We are pleased to announce we are partnering with Bailey Nelson to provide Equitable Life plan members with discounts on prescription and non-prescription eyewear. Bailey Nelson is a leading provider of prescription glasses, contact lenses and sunglasses with locations across Canada, as well as an online store.

All Equitable Life plan members will have access to the following discounts from Bailey Nelson:

*Includes anti-reflection and anti-scratch treatment. Glasses offers are based on 2 pairs of single vision or 1 pair of premium progressive lenses. Lens add-ons, such as high-index lenses and prescription tinted lens tints may involve additional costs.

**Non-prescription glasses only. Cannot be combined with 2 for $200 discount.

Plan members can provide their Equitable Life discount code in-store or at online checkout. Your clients may wish to distribute this convenient flyer with an overview of the available discounts to their plan members.

Plan members can bring their prescription to a Bailey Nelson location or provide it online to order glasses and contact lenses. Bailey Nelson also provides eye exams in-store for $99.

If you have any questions, please contact your Group Account Executive or myFlex Sales Manager.

Equitable Life helps tackle benefits fraud through Joint Provider Fraud Investigation (JPFI) initiative*

Protecting your clients’ plans is important to us. That’s why Equitable Life is working with other Canadian life and health insurers to conduct joint investigations into health service providers that are suspected of fraudulent activities through the Canadian Life and Health Insurance Association’s (CLHIA’s) Joint Provider Fraud Investigation (JPFI) initiative. This collaborative initiative between major Canadian life and health insurers through the CLHIA is a major step toward reducing benefits fraud in the life and health benefits insurance industry.How the JPFI works

The JPFI builds on the 2022 launch of a CLHIA-supported industry program. The program uses advanced artificial intelligence to help identify fraudulent activity across an industry pool of anonymized claims data. Joint investigations will examine suspicious patterns across this data.

Through this project, Equitable Life can initiate a request to begin a joint fraud investigation when we:- See suspected provider fraud in our own data or the pooled data, or

- Receive a substantiated tip about potential provider fraud

How Equitable Life protects your clients’ benefits plans from fraud

Benefits fraud is a crime that affects insurers, employers and employees and puts the sustainability of workplace benefits at risk. CLHIA estimates that employers and insurers lose millions each year to benefits fraud and abuse.

Our Investigative Claims Unit (ICU) consists of security and fraud experts who use data analytics and artificial intelligence to proactively identify and investigate suspicious billing patterns or claims activity to open investigations. We de-list healthcare providers who are engaged in questionable or fraudulent practices, pursue the recovery of improperly obtained funds, and report practitioners to regulatory bodies and law enforcement where appropriate.

Learn more about benefits fraud, or contact your Group Account Executive or myFlex Sales Manager for more information.Second phase of TELUS eClaims transition*

In June 2022, we switched to TELUS Health eClaims as our digital billing provider to give our plan members a faster and more convenient option for submitting paramedical and vision claims. The switch has allowed our plan members to take advantage of TELUS’s extensive network of over 70,000 paramedical and vision providers.

We’ve now begun the second phase of our TELUS Health eClaims implementation. This phase will focus on improving the experience for paramedical and vision providers. We will begin issuing reconciliation statements for the claims they submit on behalf of their patients. These statements will make it easier for them to use the TELUS Health eClaims portal and provide incentive for even more providers to sign up.

Please encourage your clients to remind their plan members about this convenient option. We have created a helpful one-pager that plan members can bring with them next time they have an appointment with their healthcare provider.

If you have any questions about TELUS Health eClaims, please contact your Group Account Executive or myFlex Sales Manager.

Changes to STD application process for COVID-19 cases*

As the COVID-19 situation evolves, we continue to adjust our disability management practices to ensure ongoing support and a fair experience for all our plan members.

As of May 1, 2023, we will begin managing COVID-19-related short-term disability (STD) claims the same way that we manage disability claims for any other illness or condition. If a plan member is unable to work due to COVID-19 symptoms or a positive COVID-19 test, they must now use the standard STD application, including the Attending Physician Statement portion.

Once we receive the claim, we will adjudicate it according to our standard process.

If you have any questions, please contact your Group Account Executive or myFlex Sales Manager.

* Indicates content that will be shared with your clients.

-

The Equitable Life FHSA is coming!

We want to help clients save money for their first home. We’re working on offering the Equitable Life® First Home Savings Account!

A First Home Savings Account (FHSA) is a registered plan allowing prospective first-time home buyers to save for their first home tax-free (up to certain limits).

Highlights:- Must be a Canadian resident

- Minimum of 18 years of age

- Annual contribution limit of $8,000 with a lifetime limit of $40,000

- Contributions are tax deductible (like an RRSP)

- Qualifying withdrawals are tax-free (like a TFSA)

- Must be a first-time home buyer (has not owned a home in which they lived during the current or preceding four calendar years)

- Unused FHSA proceeds can be transferred on a tax-deferred basis to an RRSP or RRIF

For more information contact your Regional Investment Sales Representative.

Date posted: April 11, 2023

™ or ® denote registered trademarks of The Equitable Life Insurance Company of Canada. -

Giuliano Savini, Top 50 Best Wealth Management Wholesalers in Canada for 2023 award recipient

Meet Giuliano Savini, Regional Investment Sales Manager for the Greater Toronto Area, who was recently recognized as one of the Top 50 Best Wealth Management Wholesalers in Canada for 2023 by Wealth Professional Canada. We congratulate Giuliano on this prestigious industry award, which acknowledges his invaluable expertise and contribution to the field of wealth management wholesaling.

When asked what inspired him to pursue a career in this field, Giuliano credits a call from a trusted friend, Joseph Trozzo, who recommended Equitable as an excellent place to work. He joined the company four years ago and has not looked back. For Giuliano, the motivation lies in the meaningful work he does through his advisors and territory, finding the best solutions for their needs.

His greatest achievement at Equitable, according to Giuliano, is the recognition as one of the Top 50 Wealth Wholesalers in Canada. What makes this accomplishment even more special is that the award is advisor-nominated, which means his advisors recognized the impact of his work in helping them succeed.

Looking at his career overall, Giuliano takes pride in the relationships he has built with his advisors and territory over the years. He is proud to be recognized as a subject-matter expert and a business builder, always aiming to be a partner in his advisors' success.

When asked for advice for those starting out in the industry, Giuliano emphasizes the importance of focusing on the success of their advisors. He advises them to use their advisors' success to drive sales and always keep them at the forefront of their business.

Looking ahead, Giuliano sees the industry evolving into a more consultative and partnership-oriented approach. He believes that wholesalers will need to expand their knowledge base beyond competitive product information and into areas like marketing, investor psychology, and practice management to maintain a competitive edge in the industry.

To read more about Giuliano and the other Top 50 Wealth Management Wholesalers in Canada, visit Wealth Professional Canada's website.

Posted : April 12, 2023

.png?width=500&height=92)

.png?width=500&height=92)

.png?width=300&height=82)

.png?width=300&height=39)