Site Search

238 results for fund sheet

-

Access more fund performance information faster and easier

Welcome to a new and improved Fund Overview & Performance website for Equitable Life® segregated funds.

A central location for:-

fund performance and quartile rankings

-

daily and historical unit prices

-

fund information (available in web and PDF)

-

Fund Facts documents

-

MERs

Highlights:-

Save your favourite funds for easy access.

-

New fund search and filter tools by product, guarantee, asset class and sustainability.

-

Share features allow you to easily share fund information with clients.

-

Ability to compare fund performance of Equitable Life segregated funds.

-

Simulated backcasted returns for funds with less than five years of performance history.

Check out the new Fund Overview & Performance webpage today to see how Equitable Life is making fund information faster and easier to access. Speak to your Regional Investment Sales Manager to learn more!

® denote a trademark of The Equitable Life Insurance Company of Canada.

Posted February 27, 2023

-

- [pdf] Equitable Life Active Balanced Fund

-

Deposits to the Fidelity Special Situations mutual fund are being limited but the segregated fund is

Fidelity Investments® recently said they would no longer accept deposits from new investors into the Fidelity® Special Situations Fund. This notice however does not affect Equitable Life® clients.

The Special Situations Fund will continue to be open to new and existing Equitable Life clients. This includes clients with Pivotal Select™, Pivotal Solutions* or Personal Investment Portfolio segregated funds contracts.

Why is Fidelity limiting access to the mutual fund?

This award-winning mutual fund has grown significantly and now has $3.6 billion of managed assets. To preserve the integrity of the fund’s investment strategy, Fidelity® decided to limit inflows to the fund. Limiting the amount of managed assets held within the fund allows the fund’s portfolio manager to focus on what he does best - finding special situation investment opportunities and capitalizing on positive change within companies and industries across Canada and around the world.

If you like the Special Situations mutual fund, you will value the Equitable Life Fidelity® Special Situations segregated fund. Segregated funds are similar to mutual funds but offer different features and guarantees. To learn about these features, check out the Investment Advantage. To learn more about the Special Situations segregated fund, click here.

For more information about Equitable Life’s segregated funds, speak to your Regional Investment Sales Manager or visit our segregated funds page on EquiNet®.

References:

Fidelity’s press release announcing the limited fund closure

Fidelity® Special Situations portfolio management strategy, webinar featuring Mark Schmehl, Portfolio Manager.

*No Load, Deferred Sales Charge, Pivotal Solutions II

® or ™ denotes a trademark of The Equitable Life Insurance Company of Canada, except as noted below.

Fidelity and Fidelity Investments are registered trademarks of 483A Bay Street Holdings LP. Used with permission. -

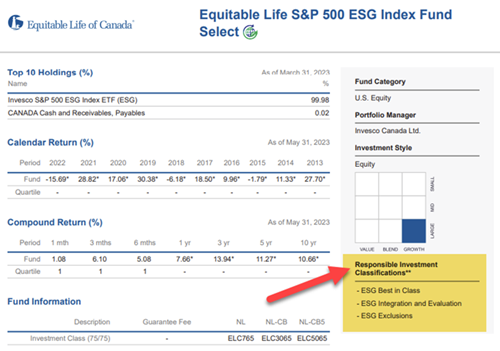

Responsible investing classification on Equitable Life Pivotal Select funds

Recently, the Canadian Investment Funds Standards Committee (CIFSC) classified responsible investing funds under its RI identification framework. The goal of the framework is to help investors and advisors identify and compare responsible investing funds.

We’re pleased to share that the following funds have been assigned multiple responsible investment classifications:• Equitable Life NASDAQ 100 ESG Index Fund Select

• Equitable Life S&P 500 ESG Index Fund Select

• Equitable Life S&P/TSX Composite ESG Index Fund Select

• Equitable Life ClearBridge Sustainable Global Infrastructure Income Fund Select

• Equitable Life Fidelity® Climate Leadership Balanced Fund Select

• Equitable Life Fidelity® Climate Leadership Fund Select

You can find the new responsible investment classifications for our funds by visiting our Fund Information webpage. After selecting a fund with the “Sustainable Investment” icon, the classifications can be found on the right side of the webpage or fund profile PDF:

™ or ® denote registered trademarks of The Equitable Life Insurance Company of Canada.

Posted: June 26, 2023

-

Equitable receives FundGrade A awards for outstanding performance

Equitable® is thrilled to announce that several of our funds have received Fundata FundGrade A awards for their exceptional performance in the first half of 2025.

The FundGrade rating system is a great tool for identifying top-performing funds. This recognition highlights our commitment to providing high-quality investment options to clients.

And the winners are…

The following funds from Equitable's lineup have received a FundGrade A rating this year:

Pivotal Select:• Equitable Life NASDAQ 100 ESG Index Fund Select

• Equitable Life Fidelity® Climate Leadership Balanced Fund Select

• Equitable Life Fidelity® Global Innovators Fund Select

Personal Investment Portfolio/Pivotal Solutions:

• Equitable Life Invesco Global Bond Fund

An enhanced fund performance page

Equitable has also introduced several new features to our fund performance page to enhance user experience. These updates include:- Printable performance reports: Easily accessible and printable reports for detailed fund performance.

- Equity and Fixed Income breakdowns: Detailed breakdowns by fund displayed on the Fund Details tab.

- Fund Category display: Clear display of fund categories on the Fund Details tab.

- Filter enhancements:

- New “Risk Rating” filter.

- New “U.S. Equity” filter.

- Renamed “Domestic Equity” to “Canadian Equity”.

- Moved “Index Funds” and “Portfolio Solutions” out of asset class filters into “Additional filters”.

For more information on these funds and their performance, and to see the latest enhancements, visit our Fund Performance page.

Questions? Contact your Director, Investment Sales.

FundGrade A is used with permission from Fundata Canada Inc., all rights reserved.

Date posted: June 10, 2025 -

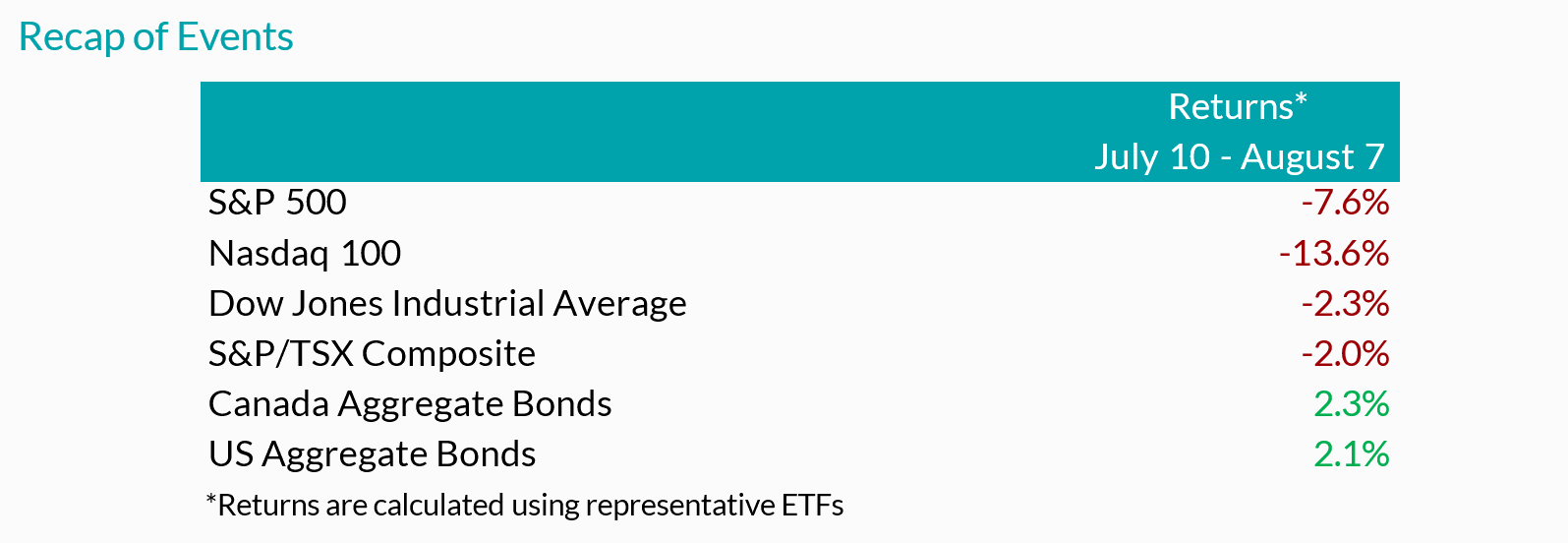

EAMG - Macro Tear Sheet – Recent Market Volatility Summary

By separating the noise from the signals, we believe the rotation away from the mega-cap technology names is likely to continue. Recent market volatility, triggered by a multitude of factors that include the unwind of the carry trade, investor reactions to mixed mega-cap earnings, and U.S. economic data, may present more investment opportunities for long-term outperformance. Recall over the past year that the majority of U.S. stock market performance came from a limited number of mega-cap technology companies and, in our view, moving forward it will be prudent to analyze the source of returns as rapid market rotations may punish overly-concentrated portfolios.

Inflation Slows (July 11) – Headline U.S. inflation readings increased 3.0% year-over-year in June, decelerating from May (3.3%). With prices slowing ahead of forecasts but economic growth remaining strong, investors became more confident regarding the prospects of an economic soft landing.

Outcome: market strength broadened with traders rotating out of highly concentrated areas of the market (“Fabulous 5”) and into more economically sensitive stocks that had been left behind.

• Big Tech Earnings (July 23 – Aug 1) – High profile mega-cap technology companies – including many members of the Magnificent 7 – reported earnings growth that generally surpassed expectations as margins remained healthy. That said, investors were more focused on spending towards AI-initiatives, rewarding businesses with greater success translating their AI investments into higher sales.

Outcome: this trend is evident through the divergence of returns from IBM and Alphabet (Google’s parent company) after releasing their quarterly earnings. The limited number of companies that contributed to the returns of the S&P 500 failed to impress investors, extending the rotation into other areas of the market.

• Caution is Brewing – Following a strong rally of economically sensitive pockets of the market, notably a breakout of returns from U.S. small cap companies, the low volatility factor, which tends to outperform during times of stress, moved in sync with the small caps’ strength.

Outcome: with a lack of fundamental justification supporting small cap performance, markets showed signs of caution.

• Central Bank Decisions (July 31)– The Federal Reserve held interest rates unchanged during its July meeting, in line with market expectations, reiterating committee members’ need for greater confidence that inflation would continue to subside. That said, policymakers signaled a reduction in policy rates could be a possibility in the coming meetings. In contrast, the Bank of Japan (BoJ) increased its key interest rate while also announcing plans to scale back bond purchases – restrictive monetary policy maneuvers aimed at backstopping the depreciating Japanese currency.

Outcome: the bifurcation between the BoJ and most other major central banks sparked a sharp appreciation of the yen and a rapid unwind of the yen carry trade (see below for explanation).

• Growth Scare (August 2)– In early August, a downside surprise in U.S. nonfarm payrolls (114k actual versus 175k expected) and an increase in the unemployment rate to 4.3%, higher than the 4.1% that was expected and up from 3.5% a year ago triggered concerns of a cooling labor market.

Outcome: speculation swelled surrounding the pace of rate cuts with market participants expecting the Federal Reserve to cut rates as much as 125bps over the next 3 policy meetings, up from 50-75bps as of the end of July. Against this backdrop, the ongoing unwind of the yen carry trade accelerated.

Yen Carry Trade Explained

• Simply put, investors have been borrowing Japanese yen – a low yielding currency – to invest in higher-yielding foreign assets. The primary risks in a carry trade can include the uncertainty of foreign exchange rates (if unhedged), as well as changes to expectations of the underlying yields, among other risks. Over the last 2 decades, the BoJ has implemented an ultra-low interest rate monetary policy to combat deflation and stimulate growth. Furthermore, investors were emboldened by the Japanese yen’s ~53% depreciation versus the U.S. dollar over the last 10 years. With the BoJ hiking its key interest rate while also announcing plans to scale back bond purchases, the yen rallied abruptly. Consequently, highly leveraged investors have had to exit their long positions in riskier assets to repay their borrowed yen exposure.

Peak Carry Trade Unwind – Buying Opportunity

• Peak carry trade unwind, which implies heightened panic levels, has historically created an attractive buying environment. That said, we are focused on companies that have demonstrated robust earnings growth and healthy leverage. Given the unprecedented level of market concentration over the last year, we view the unwind of the carry trade as another catalyst for investors to rotate out of the “Fabulous 5”.

Our Findings:

We found that the peak unwind of the carry trade may be a buying opportunity. At present, the current level of the unwind is similar to many notable market bottoms, including the Great Financial Crisis (2008), the European debt crisis (2010), the oil crash (2014), the subsequent emerging market crisis (2015), the Covid-19 crash (2020), and the collapse of Silicon Valley Bank (2023). We assessed the degree of the unwind by looking at the one-month implied volatility between three currency pairs, U.S. Dollar/Yen, Australian Dollar/Yen, and Euro/Yen. Implied volatility is a measure of the expected future volatility of the underlying assets over a given time period. Amid strong earnings growth and steady margins from quality businesses within the U.S. market, the fundamental backdrop suggests that businesses outside the concentrated AI-darlings may drive the next leg of market returns.

Downloadable Copy

Mark Warywoda, CFA

VP, Public Portfolio ManagementIan Whiteside, CFA, MBA

AVP, Public Portfolio ManagementJohanna Shaw, CFA

Director, Portfolio ManagementJin Li

Director, Equity Portfolio Management

Tyler Farrow, CFA

Senior Analyst, Equity

Andrew Vermeer

Senior Analyst, Credit

Elizabeth Ayodele

Analyst, Credit

Francie Chen

Analyst, Rates

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy. -

Going digital with Pivotal Select Fund Facts

Did you know, with every new policy, your client should receive a copy of Equitable Life’s Pivotal Select™ Fund Facts (Form #1366)? Did you know you can send it electronically?

Over the last year, more and more advisors are opting out of traditional paper. Instead, advisors are going digital. Here are the top three reasons why.

- Clients receive the information quickly and conveniently.

- Advisors are confident clients are receiving the most current version available.

- Advisors can easily adhere to regulations. When providing the client with a link to the electronic Contract and Information Folder (Form #1403), it is easy to also provide a link to the Pivotal Select Fund Facts.

Make it easy and convenient by getting in the habit of going digital.

- Pivotal Select Fund Facts

- Pivotal Select Contract and Information Folder

- Pivotal Solutions Fund Facts

Does your client prefer a PDF brochure with Fund Facts for all the available funds? Download your copy by logging on to EquiNet®. For more information contact your Regional Investment Sales Manager.

® and TM denote trademarks of The Equitable Life Insurance Company of Canada. -

Important changes are coming to the Equitable Life segregated funds contract.

Fund changes are coming on June 7, 2021 to Equitable Life’s® segregated fund lineup. These fund changes will appear on the June 2021 semi-annual client statement and will be reflected in the 2021 Pivotal Select™ and Pivotal Solutions Fund Facts.

Clients holding these funds received a letter in the mail. To view a copy of these letters, refer to the links below.

- Pivotal Select Special Note

- Pivotal Solutions II Special Note

- Personal Investment Portfolio and Pivotal Solutions Special Note

If you have any questions about these fund changes, please contact your Regional Investment Sales Manager or Advisor Services Team Monday to Friday from 8:30 a.m. to 7:30 p.m. ET at 1.866.884.7427 or email savingsretirement@equitable.ca -

Delivery Update of Pivotal Select segregated fund client statements

We understand the importance of timely delivery of our Pivotal Select™ segregated fund client statements. We have resolved the issue with delivery of these statements. I can confirm that our Pivotal Select segregated fund client statements will be delivered on February 17, 2025.

We regret the impact this delay may have had on you and clients. Rest assured, we are committed to delivering the highest standard of service and will continue to work hard to earn your business and that of clients. If you have questions or need further assistance, reach out to our Client Care Team at 1.866.884.7427.

Best Regards,

.png)

Cam Crosbie,Executive Vice-President, Savings and Retirement Division

Equitable

Posted: February 12 2025 -

Making it easier to do business with us

At Equitable® we are always looking for ways to improve your experience with us. We’ve made the following enhancements to make it easier for you to put your business with us.

New and Improved UL Fund Performance page

Access more fund performance information faster and easier on our new and improved Fund Overview & Performance website for funds held within Equitable universal life policies.

We partnered with Fundata to build a central location for fund performance, fund information (available in web and PDF) and Management Expense Ratios (MERs). This fund reporting will be available for all our universal life business (both legacy products and products currently being sold).

Highlights include:

● Save your favourite funds for easy access.

● Fund search and tools to filter by product, asset class and sustainability.

● Share feature allows you to easily share fund information with clients.

● Ability to compare fund performance.

Check out the new Fund Overview & Performance website today. See how Equitable is making fund information faster and easier to access.

New “Update Payment” feature for banking changes has launched!

Great news! We have launched a new self-serve "Update Payment" feature in Client Access and on EquiNet®. This new online capability enables clients and advisors to easily submit key banking change requests for eligible insurance policies*, with no need to complete a physical form.

*The Update Payment transactions are only available for eligible policies: those that have not lapsed, are not on Automatic Premium Loan, and are not owned by a corporation or other entity.

What’s new? Clients and advisors can now submit banking changes via EquiNet under Policy Inquiry. It allows them to easily submit requests for the following: stop and resume pre-authorized payments or change banks. Learn more.

Speak to your individual life wholesaler to learn more about these great enhancements!

® or TM denotes a trademark of The Equitable Life Insurance Company of Canada