Site Search

422 results for beneficiary change form

-

Important update regarding all paramedical appointments

Update regarding parameds for NEW and EXISTING cases:

- In the absence of Parameds, the preferred method is to complete the medical questions in EZComplete

- If you didn’t complete the new medical information, then complete the Health Information Form #1878

- If you are unable to complete the 1878 Health Information Form, then you can order a Video EPara through Dynacare or through Equitable

-----------------------------------------------------------

Equitable Life has made the decision to temporarily stop all face-to-face field service appointments effective immediately to ensure the protection of both our Clients and Examiners. All appointments will be cancelled by ExamOne. Dynacare has already cancelled their appointments.

We are doing this to support social distancing as requested by the Federal and Provincial governments. We are actively working on a plan to provide viable options in the absence of face-to-face paramedical service appointments. This will be communicated shortly.

-

Revised Witness Signature Process during COVID-19 for Individual Life and Critical Illness Insurance

Revised Witness Signature Process during COVID-19 for Individual Life and Critical Insurance Business

We are temporarily revising our policy around witness signatures during COVID-19. While the preference is to have a witness when one is available, we understand that may be difficult given our current environment.

Please follow the options below for witness signature with the first option being most preferable, and the last option being the least preferable:

1. Signature from a witness who is a disinterested party

2. Signature from a witness who is a party with an interest

3. No witness

If we receive a form that doesn’t have a witness signature, we will still process the form. Just a reminder this is only temporary during COVID-19.

-

Going digital with Pivotal Select Fund Facts

Did you know, with every new policy, your client should receive a copy of Equitable Life’s Pivotal Select™ Fund Facts (Form #1366)? Did you know you can send it electronically?

Over the last year, more and more advisors are opting out of traditional paper. Instead, advisors are going digital. Here are the top three reasons why.

- Clients receive the information quickly and conveniently.

- Advisors are confident clients are receiving the most current version available.

- Advisors can easily adhere to regulations. When providing the client with a link to the electronic Contract and Information Folder (Form #1403), it is easy to also provide a link to the Pivotal Select Fund Facts.

Make it easy and convenient by getting in the habit of going digital.

- Pivotal Select Fund Facts

- Pivotal Select Contract and Information Folder

- Pivotal Solutions Fund Facts

Does your client prefer a PDF brochure with Fund Facts for all the available funds? Download your copy by logging on to EquiNet®. For more information contact your Regional Investment Sales Manager.

® and TM denote trademarks of The Equitable Life Insurance Company of Canada. -

THREE new ways to help make your Savings & Retirement business run smoother

As of August 20, 2022, EZcomplete® will include several new features that allow applications to be completed faster and easier:

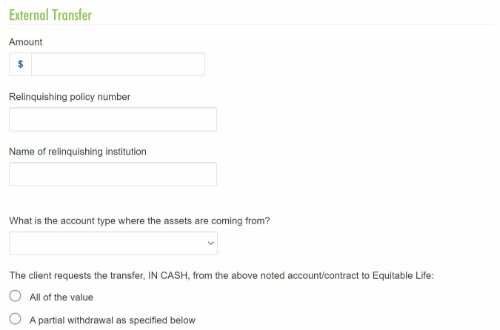

1. Prefilled Fund Transfer Form

The transfer form will be generated with the information from EZcomplete and included in the EZcomplete signing package, saving you time.

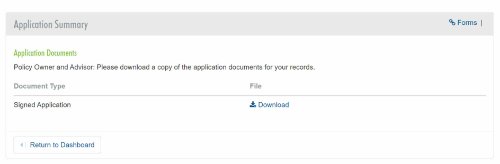

2. Client eSignature Audit History and Document Download

If you choose the e-signature option for the client, you’ll be able to download a copy of the e-signed transfer forms and the signature audit history.

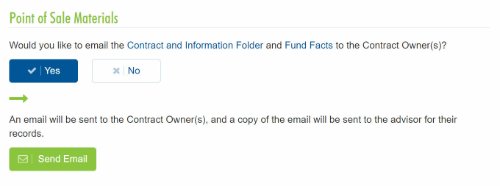

3. Email the Client Contract Info and Fund Facts Before Signing

You'll now be able to email Point of Sale materials (Contract & Info Folder and Fund Facts) to clients before they provide their e-signature.

Log in to EZcomplete today!

Speak to your Regional Investment Sales Manager to learn more!

-

Policy endorsement: Contracts and group benefits plan booklet updates related to BC PharmaCare Biosi

As we announced in the June 2019 issue of eNews, BC PharmaCare recently introduced a new Biosimilars Initiative that ends coverage of three biologic drugs, including Remicade, Enbrel, and Lantus. These drugs will no longer be eligible in British Columbia for most conditions for which lower-cost biosimilar versions are available. Patients in the province with these conditions will be required to switch to biosimilar versions of these drugs by Nov. 25, 2019 in order to maintain their coverage under BC PharmaCare.

The following table outlines the affected originator drugs and their biosimilars.

Drug Originator Biosimilar etanercept Enbrel® Brenzys®

Erelzi™infliximab Remicade® Inflectra®

Renflexis®insulin glargine Lantus® Basaglar™

Biologics are drugs that are engineered using living organisms, such as yeast and bacteria. Biosimilars are highly similar to the originator drugs they are based on and most have been shown to have no clinically meaningful differences in safety or efficacy.

To ensure this provincial change doesn’t result in your clients' plans paying additional drug costs, we are aligning our drug eligibility for these three biologic drugs with that of BC PharmaCare.

To facilitate this change, we are amending some of the wording in our contracts and booklets, effective Oct. 1, 2019. Below are links to the Endorsement to the Master Policy and the Summary of Master Booklet Wording Changes for those amendments. Please download and save these policy endorsement documents for your files.

In addition, please remind your clients to provide their plan members with a copy of the Summary of Master Booklet Wording Changes. The next time your clients amend their benefits plans, the updated wording will be included in their group benefits plan bookletsDOWNLOAD ENDORSEMENT TO THE MASTER POLICY

DOWNLOAD SUMMARY OF MASTER BOOKLET WORDING CHANGES

As of Nov. 25, 2019, Remicade and Enbrel will no longer be eligible for BC plan members with conditions for which lower-cost biosimilar versions of the drugs are available. These plan members will be required to switch to the biosimilar versions of these drugs in order to maintain eligibility on the Equitable Life drug plan.

We will be communicating with affected claimants in the coming weeks to allow them ample time to change their prescription and avoid any interruptions in their treatment or their coverage.

We intend to take a similar approach to Lantus. However, we are still investigating the options to implement this change. We will be communicating with you in the coming weeks to confirm our approach for this drug.

If you have any questions about this change, please contact your Group Marketing Manager or myFlex Sales Manager.

® and ™ denote trademarks of their respective owners -

Announcing Equitable Life's National Biosimilar Program

Beginning March 1, 2024, we are expanding our biosimilar switch program nationally** to protect all our clients and to make our coverage consistent across Canada.

Our national biosimilar initiative will simplify drug plan coverage, replacing our provincial programs with one program across the country.

Why now?

Over the past few years, most provinces have introduced policies to delist some originator biologic drugs. They require most patients to switch to biosimilar versions of those drugs to be eligible for coverage under their public drug plans. Soon, it is expected that all provincial drug plans will cover only biosimilars.

In response, we have implemented biosimilar switch initiatives in BC, Alberta, Saskatchewan, Ontario, Quebec, New Brunswick and Nova Scotia to align with these provincial changes. Our initiatives are designed to protect our clients from additional drug costs that may result from these government policies while providing access to equally safe and effective lower cost biosimilars.

How will this affect clients’ drug plans?

Because we have already introduced biosimilar switch initiatives in most provinces, the impact of this change will be minimal. It will primarily affect plan members in provinces or territories where we haven’t already required the switch to biosimilars, and plan members who are taking biosimilars that were not originally included in the switch initiative for their province.

Regardless of where they live, plan members across Canada will no longer be eligible for most originator biologic drugs if they have a condition for which Health Canada has approved a lower cost biosimilar version of the drug. Plan members already taking the originator biologic will be required to switch to a biosimilar version of the drug to maintain coverage under their Equitable plan. We will support their transition with education, personalized communication, and resources.

Will this change affect clients' rates?

Any cost savings associated with the change will be factored in at renewal.

Biologics are drugs that are engineered using living organisms like yeast and bacteria. The first version of a biologic developed is known as the “originator” biologic. Biosimilars are highly similar to the drugs they are based on, and Health Canada considers them to be equally safe and effective for approved conditions.

What is the difference between biologics and biosimilars?

Advance notice

We will be communicating with affected claimants in early December to allow them ample time to change their prescription and avoid any interruptions in their treatment or their coverage.

If you have any questions about this change, please contact your Group Account Executive or myFlex Account Executive.

**Excludes plan members in Quebec who participate in a separate provincial program. - Individual Insurance Marketing Materials

-

EquiNet Quick Tips

Need some help navigating your way around EquiNet? We’ve put together the top 5 Quick Tips on the following topics, based on the most frequently mentioned questions from advisors:

- Policy Inquiry/New Business Pending Inquiry

- Document Lookup

- Policy Statements & Correspondence

- Username & Email Address Support

- Need more help? Submit a request for support using the EquiNet Support Form.

See more details and information about other site tips in this FAQ created to help you find your way around.

- Practical approach to selling segregated funds in a TFSA

-

Grow your guarantee using resets from Equitable Life

Did you know that many of Equitable Life®’s segregated funds contracts, including Pivotal Select™ Estate Class and Protection Class, allow for an annual reset of the death benefit guarantee? Now could be a great time to remind clients to lock-in any gains with a death benefit reset; and increase their Death Benefit guarantee to 100% of the current market value. The ability to lock-in market growth using resets is one of the differences between segregated funds and mutual funds.

To complete a reset, submit the applicable investment direction form. If you have Limited Trading Authorization on file, you can sign the request on your client’s behalf*. The Investment Direction Forms are posted on EquiNet®, or can be found here (by product):

- Pivotal Select (form # 693SEL)

- Personal Investment Portfolio, Pivotal Solutions II or Pivotal Solutions DSC (form # 693ANN)

Be sure to check out the “Growing your Guarantee with Resets” marketing piece which can be shared with your clients. For questions about resets, contact your Regional Investment Sales Manager today.

*Advisors are required to keep notes of their conversation with their client for audit purposes when completing transactions using Limited Trading Authorization. World Financial Group (WFG) advisors are not permitted to use Limited Trading Authorization as per their agreement with WFG.

® and TM denote trademarks of The Equitable Life Insurance Company of Canada