Site Search

422 results for beneficiary change form

-

Mental health support for all plan members

As the COVID-19 pandemic continues, many Canadians are dealing with increased stress and anxiety. Now, more than ever, plan members need easy to access resources to help them cope with these uncertain times.

Through our partnership with Homewood Health®, the Canadian leader in mental health and addiction services, all of our clients and their plan members have access to tools designed to provide guidance and support, including i-Volve, Homewood’s Online Cognitive Behavioural Therapy tool.

Proven therapy, at your own pace

Included with Homewood Online resources in every Equitable Life® plan, i-Volve can help plan members identify, challenge and overcome anxious thoughts, behaviours and emotions. It encourages incremental changes in behaviour and is proven to be an effective therapeutic approach for dealing with mild to moderate anxiety or depression. Plan members work at their own pace through a series of web-based exercises, ultimately helping to change the ways in which they think, feel and react in various situations.

Free for all Equitable Life plan members

All Equitable Life clients and their plan members have access to i-Volve. It’s available 24 hours a day, seven days a week, wherever you choose to access it.

Contact your Group Account Executive or myFlex Sales Manager to learn more about Homewood Health and i-Volve Online CBT. -

Deposits to the Fidelity Special Situations mutual fund are being limited but the segregated fund is

Fidelity Investments® recently said they would no longer accept deposits from new investors into the Fidelity® Special Situations Fund. This notice however does not affect Equitable Life® clients.

The Special Situations Fund will continue to be open to new and existing Equitable Life clients. This includes clients with Pivotal Select™, Pivotal Solutions* or Personal Investment Portfolio segregated funds contracts.

Why is Fidelity limiting access to the mutual fund?

This award-winning mutual fund has grown significantly and now has $3.6 billion of managed assets. To preserve the integrity of the fund’s investment strategy, Fidelity® decided to limit inflows to the fund. Limiting the amount of managed assets held within the fund allows the fund’s portfolio manager to focus on what he does best - finding special situation investment opportunities and capitalizing on positive change within companies and industries across Canada and around the world.

If you like the Special Situations mutual fund, you will value the Equitable Life Fidelity® Special Situations segregated fund. Segregated funds are similar to mutual funds but offer different features and guarantees. To learn about these features, check out the Investment Advantage. To learn more about the Special Situations segregated fund, click here.

For more information about Equitable Life’s segregated funds, speak to your Regional Investment Sales Manager or visit our segregated funds page on EquiNet®.

References:

Fidelity’s press release announcing the limited fund closure

Fidelity® Special Situations portfolio management strategy, webinar featuring Mark Schmehl, Portfolio Manager.

*No Load, Deferred Sales Charge, Pivotal Solutions II

® or ™ denotes a trademark of The Equitable Life Insurance Company of Canada, except as noted below.

Fidelity and Fidelity Investments are registered trademarks of 483A Bay Street Holdings LP. Used with permission. -

Excelerator Deposit Option – maximum payment limit changes

The Excelerator Deposit Option (EDO) gives your client the option to make additional payments, subject to specified limits and our current administrative rules and guidelines, above the required guaranteed policy premium. EDO payments can help grow the long-term values in your client’s policy. This change is regarding the maximum EDO payment limit that applies to the policy.

● NEW! If a request is received to terminate, convert, or reduce the term rider and the term rider has been in effect for 10 years or longer, the EDO maximum for the policy will not be reduced.

For Equimax policies with an Owner Signature Date of June 26, 2021 or after where a term rider has increased the maximum EDO payment limit on the policy

● If a request is received to terminate, convert, or reduce the term rider and the term rider has been in effect for less than 10 years (it has not reached the 10th policy anniversary), the EDO maximum for the policy will be reduced accordingly.

Current rules as to when underwriting is required for EDO payments continue to apply, as do current rules surrounding acceptance of EDO payments and maintaining the tax-exempt status of the policy and can be found in the Equimax Product Admin Guide.

Want more information? Contact your Regional Sales Manager for more information on these changes

-

Changes to Short Term Disability Benefit Calculations

The Canada Employment Insurance Commission and Canada Revenue Agency have announced the 2022 changes to Maximum Insurable Earnings, and premiums for employment insurance. These changes take effect January 1, 2022.

2021 Amount As of Jan. 1, 2022 Maximum Insurable Earnings (MIE)

$56,300 $60,300 Maximum Weekly Insurable Earnings (MWIE)

$1,083 $1,160 EI Benefit

(55% of the MWIE, rounded to the nearest dollar)$595 $638

How does this affect your clients?

If your client’s Group Policy with Equitable Life includes a Short Term Disability (STD) benefit which is tied to the EI Maximum Weekly Insurable Earnings, and at least one classification of employees has less than a $638 maximum, then to comply with the provisions of their policy, their STD benefit will be revised with the maximums updated based on the percentage of EI Maximum Weekly Insurable Earnings shown in their policy.

The additional premium for any increase from their previous STD amounts and new STD amounts will be show on their January 2021 Group Insurance Billing (as applicable).

If their STD maximum is currently higher than $638 or based on a flat amount (not based on a percentage or regular earnings), no change will be made to their plan unless otherwise directed.

If your clients wish to provide direction regarding revising their STD maximum, or have questions about the process, they can email Kari Gough, Manager, Group Quotes and Issue. -

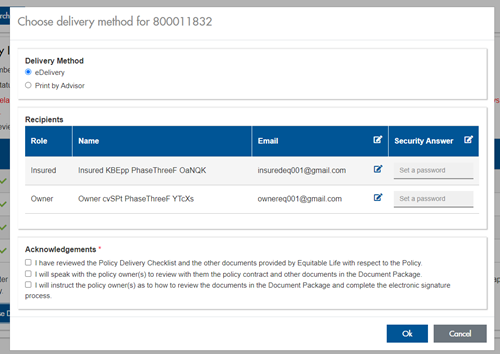

Manage more details within Contract Delivery for New Business applications

We are excited to announce further enhancements to our eDelivery process to empower you, the advisor, the ability to manage client details more easily within Contract Delivery.

Effective January 15, 2022, advisors will need to create a Password within Contract Delivery when choosing “eDelivery” as the contract delivery method and provide the password to the client to use as their password:

The Password must be between 4 and 100 alpha/numeric characters, and cannot be the Policy number. For multiple signers the password (and email address) must be unique per each signer.

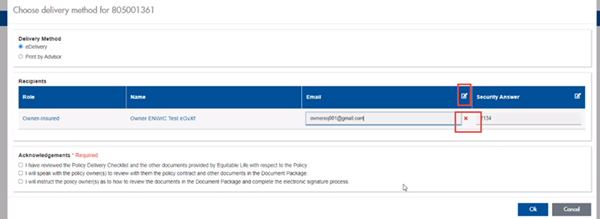

Advisors can now edit and/or update an email address within Contract Delivery, in the event of a bounce back or email change, to keep the eDelivery process moving and avoid delays in processing time. If a lock out occurs, advisors can trigger a resend of the signing email once they add a new valid email address in Contract Delivery. Simply click the pencil icon beside the Email field to enter the valid email address:

Another new feature- in the event a client has declined, the advisor will get an email from Equitable Life®. Click through to EquiNet® within the email to view the message within Contract Delivery that the client provided as the reason for decline under a new “Declined Details” section. This enables you to connect with the client to proceed with the sale by discussing the reasons for decline with them directly.

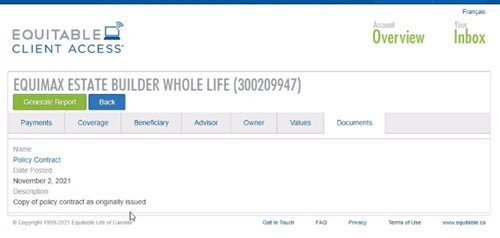

Also new for clients with this enhancement, policy owners of a policy created after January 15 will be able to see a PDF copy of their policy within client access. Note: this PDF copy is as the policy was originally issued.

Resources: -

Individual Insurance product enhancements

Equitable Life has exciting product enhancements that will help you offer more options to clients.

- Full Product Launch Video (approx. 20 minutes).

Watch our Virtual Product Launch NOW. Grab a coffee and get ready for this exciting news! Hear from our leaders and learn about our exciting product enhancements.

- Introduction video (View on Vimeo) / Product launch page

Highlights of the product changes effective February 12, 2022, include:NEW! 10 pay premium option with Equimax Estate Builder®

- The new EquiLiving® 20 pay rider options will be available on Equimax® plans

- 20 pay options with coverage to age 75 or coverage for life

NEW! EquiLiving plans and riders enhanced with:

- Support from Cloud DX to help monitor a client’s well-being from treatment to recovery.

- Added Acquired Brain Injury as a covered critical condition

- 30-day survival period removed for all non-cardiovascular covered conditions

- No age restriction to claim for Loss of Independent Existence (LOIE)

- EquiLiving Benefit now pays the higher of the EquiLiving Benefit or the Return of Premium Rider Benefit (not including Return of Premium on Death)

- And so much more …

New Illustration software available on February 11, 2022

The updated illustration software will be available for download after 9 a.m. ET on Friday, February 11, 2022, and will include all the Equimax and EquiLiving enhancements.

See the Equitable Sales Illustrations Update for information on how to download the software or check for updates.

Please review updates to the commission schedule A for these new enhancements.

Learn more- Transition rules are available

- Watch our virtual launch event video now! (Approx. 20 minutes),

- Watch our product launch intro video here. Watch on Vimeo

- Visit our launch event page with product change details and more

- Marketing Materials

Please contact your Regional Sales Manager for more information. -

Product Enhancements - Critical Illness

Equitable Life has exciting product enhancements that will help you offer more options to clients.

Access our Virtual Product Launch NOW. Grab a coffee and get ready for this exciting news! Hear from our leaders and learn about our exciting product enhancements.

NEW! EquiLiving plans and riders enhanced with:- 20 pay options with coverage to age 75 or coverage for life

- Support from Cloud DX to help monitor a client’s well-being from treatment to recovery.

- Added Acquired Brain Injury as a covered critical condition

- 30-day survival period removed for all non-cardiovascular covered conditions

- No age restriction to claim for Loss of Independent Existence (LOIE)

- EquiLiving Benefit now pays the higher of the EquiLiving Benefit or the Return of Premium Rider Benefit (not including Return of Premium on Death)

- And so much more …

The updated illustration software will be available for download after 9 a.m. ET on Friday, February 11, 2022, and will include all the Equimax and EquiLiving enhancements.

See the Equitable Sales Illustrations Update for information on how to download the software or check for updates.

Please review updates to the commission schedule A for these new enhancements.

Learn more- Transition rules are available

- Watch our virtual launch event video now! (Approx. 20 minutes)

- Watch our product launch intro video here

- Visit our launch event page with product change details and more here

- Marketing Materials

Please contact your Regional Sales Manager for more information. -

Product Enhancements - 10 Pay

Equitable Life has exciting product enhancements that will help you offer more options to clients.

Access our Virtual Product Launch NOW. Grab a coffee and get ready for this exciting news! Hear from our leaders and learn about our exciting product enhancements.

NEW! 10 pay premium option with Equimax Estate Builder®- The new EquiLiving® 20 pay rider options will be available on Equimax® plans

The updated illustration software will be available for download after 9 a.m. ET on Friday, February 11, 2022, and will include all the Equimax and EquiLiving enhancements.

See the Equitable Sales Illustrations Update for information on how to download the software or check for updates.

Please review updates to the commission schedule A for these new enhancements.

Learn more- Transition rules are available

- Watch our virtual launch event video now! (Approx. 20 minutes)

- Watch our product launch intro video here

- Visit our launch event page with product change details and more here

- Marketing Materials

Please contact your Regional Sales Manager for more information. -

Equitable Life Group Benefits Bulletin – March 2022

In this issue:

- CLHIA launches industry anti-fraud initiative*

- Provincial biosimilar update*

- Quebec decreasing insurance premium tax*

- Coming soon: A survey to understand how we can better serve your clients’ needs*

- Remind your clients’ plan members in BC, Manitoba and Saskatchewan to register for Pharmacare *

CLHIA launches industry anti-fraud initiative*

In February, the Canadian Life and Health Insurance Association (CLHIA) announced a new anti-fraud initiative that is using advanced artificial intelligence (AI) to further identify and reduce benefits fraud.

Equitable Life is excited to be a part of this important initiative. It will enhance our own fraud detection analytics by using AI to connect the dots across a huge pool of anonymized claims data. This will lead to more investigations and actions to mitigate the impact of fraud on your clients’ plans.

The initiative is being led by the CLHIA and member insurers and is supported by technology provider Shift Technologies. It will be further rolled-out and expanded over the next three years.

Benefits fraud affects more than just insurers. The costs of fraud are felt by employers and their employees as well. We are looking forward to being able to better identify and reduce benefits fraud.

Provincial biosimilar update*

BC expands its biosimilar initiative

BC Pharmacare recently announced it is adding two rapid-acting insulins to the list of drugs included in its ongoing initiative to switch patients to biosimilar versions of high-cost biologics. Patients taking Humalog or NovoRapid for Type 1 or Type 2 diabetes will be required to switch to a biosimilar version of the drugs by May 29, 2022 to maintain coverage under the public plan.

Biologics are drugs that are engineered using living organisms like yeast and bacteria. The first version of a biologic developed is also known as the “originator” biologic. Biosimilars are also biologics. They are highly similar to the originator biologic drugs they are based on, and Health Canada considers them to be equally safe and effective for approved conditions.

How we are responding to protect our clients

To help prevent this change from resulting in additional costs for our clients’ drug plans while still providing plan members with access to safe and effective medications, we will no longer cover Humalog or NovoRapid for plan members in BC. Effective June 1, 2022, claimants currently taking Humalog or NovoRapid will be required to switch to a biosimilar version of the drugs to maintain coverage under their Equitable Life plan and their BC Pharmacare plan.

We will be communicating this change to plan administrators later this week. And we will be communicating with affected claimants in early April to allow ample time to change their prescription and avoid any interruptions in their treatment or their coverage.

If you have any questions about this change, please contact your Group Account Executive or myFlex Sales Manager.

Nova Scotia and Northwest Territories introduce biosimilar initiatives

The governments of Nova Scotia and the Northwest Territories each recently announced they are launching biosimilar initiatives to switch patients from certain originator biologic drugs to biosimilar versions of the drugs.

Patients in Nova Scotia using affected originator biologic drugs will have until February 2023 to switch to a biosimilar version of their medications in order to maintain coverage under the province’s public drug plans. Patients in the Northwest Territories will have until June 20, 2022, to switch.

Equitable Life® actively monitors and investigates all biosimilar policy changes and the ongoing evolution of biosimilar drugs entering Canada. We will keep you informed of any impact on private drug plans and how we are responding.

Quebec decreasing insurance premium tax*

The Quebec Government has announced that it plans to decrease its Insurance Premium Tax rates effective April 1, 2022. The premium tax rates for group life and accident and sickness insurance are expected to decrease from 3.48% to 3.3%. The new tax rates will be applied to premiums for the billing period beginning on or after April 1, 2022.

Coming soon: A survey to understand how we can better serve your clients’ needs*

We are committed to providing your clients and their plan members with industry-leading service. We’ve introduced several enhancements over the past year to make it easier to do business with us. And we’re continually looking for ways to improve.

In the coming weeks, we will conduct a survey of your clients to help us understand how we can better serve them. On March 28, we will send plan administrators an email with a link to the survey. The survey will remain open until the end of the day on April 11 and will take between five and 10 minutes to complete. Please encourage your clients to participate. Their feedback will be confidential, and their responses will help us improve our service and ensure we’re meeting their expectations. We may also follow up with plan administrators directly to address any concerns they’ve identified.

We know your clients’ time is valuable. So, each plan administrator who completes the survey will be entered into a random draw for a chance to win one of 25 prepaid gift cards for $25.

Remind your clients’ plan members in BC, Manitoba and Saskatchewan to register for Pharmacare*

If your clients have plan members in British Columbia, Manitoba or Saskatchewan, the provincial government offers a Pharmacare program to support prescription drug costs. Plan members in these provinces must register for their provincial Pharmacare program to maintain coverage under their Equitable Life drug plan.

Registration is easy! We will send two registration reminder messages directly to plan members’ pharmacists and post them on their Explanation of Benefits. We’ve also created a step-by-step guide that your clients can share with their plan members.

English version

French version

For more information about the provincial Pharmacare programs, including how plan members can register, please visit:

For British Columbia residents: https://www2.gov.bc.ca/gov/content/health/health-drug-coverage/pharmacare-for-bc-residents

For Manitoba residents: https://www.gov.mb.ca/health/pharmacare/apply.html

For Saskatchewan residents: https://www.saskatchewan.ca/residents/health/prescription-drug-plans-and-health-coverage/extended-benefits-and%20drug-plan/drug-cost-assistance#eligibility

-

EquiLiving offers more options to clients facing a covered Critical Illness condition

Consider these statistics…1 in 2 Canadians will develop cancer in their lifetimes1. They’re just numbers…until the day someone you know is diagnosed, someone who didn’t see it coming. Then it becomes very real - no longer incidence statistics, but costs. Today more people than ever are surviving and living with not only just the physical, but also the financial effects of their illness.

We’re there to help when illness strikes

NEW! EquiLiving® plans and riders have recently been enhanced including:

● 20 pay options with coverage to age 75 or coverage for life

● Support from Cloud DX to help monitor a client’s well-being from treatment to recovery.

● Added Acquired Brain Injury as a covered critical condition

● 30-day survival period removed for all non-cardiovascular covered conditions

● No age restriction to claim for Loss of Independent Existence (LOIE)

● EquiLiving Benefit now pays the higher of the EquiLiving Benefit or the Return of Premium Rider Benefit (not including Return of Premium on Death)

● And so much more …

Learn more

● CI product enhancement video

● Visit our launch event page with product change details and more

● Marketing Materials

Please contact your Regional Sales Manager for more information.

1 www.cancer.ca