Site Search

239 results for fund codes

-

Universal Life Product Fund Changes

In September 2022, we will be changing the underlying securities being tracked for several universal life funds, listed below.* These changes apply to our current Equation Generation IV universal life insurance product and to any legacy products that offer these same UL funds.

If your client would like to transfer money currently invested in any of the above UL funds to a different UL fund and/or change the investment option for their future deposits, please submit a request well in advance of September 2022 using form 693UL.

Please contact your Equitable Life® Regional Sales Manager for more information.

UL Fund Currently Tracked Upcoming Change* European DJ Euro STOXX 50 Total Return Index STOXX Europe 600 Paris-Aligned Index (ESG) Canadian Bond Sun Life MFS Canadian Bond Equitable Life Active Canadian Bond Fund Internal Linked Global Fixed Income Mackenzie Global Tactical Bond Invesco Global Bond Canadian Value Stock Mackenzie Cundill Canadian Security Franklin Bissett Canadian Equity Large Cap Canadian Equity Mackenzie Ivy Canadian Dynamic Equity Income Global Balanced Templeton Global Balanced Mackenzie Ivy Global Balanced

*Underlying security changes will occur in September 2022. Exact effective date has not yet been determined.

-

Equitable Life ClearBridge Sustainable Global Infrastructure Income Fund Select: Stability and diver

Although an often-overlooked asset class, infrastructure assets are physical assets that provide an essential service to society. Investing in infrastructure can offer stability and diversification in a well-balanced portfolio.

Check out Equitable Life® ClearBridge Sustainable Global Infrastructure Income Fund Select in this issue of Fund Focus. The fund aims to achieve long-term capital appreciation and income by investing in publicly listed real estate companies across a spectrum of property types and geographies.

Reasons to Invest:- ClearBridge has 50+ years as a leader in active management, with a focus on sustainable investing.

- An ESG (Environmental, Social and Governance) driven investment process: ESG factors are part of fundamental research and a bottom-up security selection process, and risks and opportunities are viewed through an ESG lens.

- Predictable income generation throughout the cycle: Invests in income-generating infrastructure assets, with cash flows underpinned by regulation or long-term contracts.

- Participation in global infrastructure renewal: Both developed and emerging economies are growing their infrastructure assets, producing new investment opportunities.

- Lots of flexibility - broad ranges for sector allocation and geographical allocation

For more information, check out the Equitable Life ClearBridge Sustainable Global Infrastructure Income Fund Select or contact your Regional Investment Sales Manager.

Date posted: July 20, 2023

™ or ® denote registered trademarks of The Equitable Life Insurance Company of Canada.

-

Important notice: Funds with Deferred Sales Charges

The Canadian Council of Insurance Regulators (CCIR) is requiring all insurance companies to discontinue the sale of segregated funds with deferred sales charges (DSC) effective June 1, 2023. This also impacts ongoing or new deposits to some existing segregated fund accounts. Please contact any Equitable Life clients who may be impacted.

How this impacts clients:

In response to the insurance regulator’s recommendation, Equitable Life® will be making changes to the administration of certain segregated fund products, which may impact clients. The details are outlined below:

Pivotal Select™ segregated fund product

On or about May 29, 2023:- Funds with DSC or Low Load (LL) sales charge options will be closed to additional deposits. Future deposits must be allocated to the No Load (NL) sales charge option of the funds available within the policy.

- Any existing amounts held in DSC or LL funds are not impacted and will retain the existing deferred sales charge schedule outlined in a client’s contract. The annual 10% available (20% for RIF policies) for withdrawal without fees continues to apply through to the expiry of the fee schedule.

- If the default deposit instructions that a client previously provided include funds with DSC or LL sales charge options, these instructions will be automatically updated to the NL sales charge option of the same fund for all future deposits.

- If a client has pre-authorized scheduled deposits into funds with the DSC or LL sales charge options, these instructions will be automatically updated to the NL sales charge option of the same funds for all future deposits.

- In alignment with our current administrative rules, if a client has DSC or LL funds, they will not be able to make deposits into No Load Chargeback funds (NLCB and NLCB5) within the same policy.

Legacy segregated fund products

Ongoing deposits to DSC funds are permitted when a segregated fund product does not have an alternative sales charge option available within the contract. This applies to the following products:- Personal Investment Portfolio

- Pivotal Solutions II

- Pivotal Solutions DSC

If a client plans on making additional deposits, they may be interested in alternative sales charge options that do not include DSC. For example, Equitable Life offers “No Load” (NL) and “No Load Chargeback” (NLCB and NLCB5) sales charge options within the Pivotal Select segregated fund contract. In these situations, a new application would need to be completed and submitted.

Please note that draft regulation in Quebec is currently under review which may impact Equitable Life’s approach for Quebec clients with legacy segregated fund products.

Equitable Life will continue to monitor provincial regulatory developments and adjust our approach as needed.

Client communication

We will be sending clients a letter within their December 31, 2022, statement describing their options, and the impacts to their policy (if applicable). We recommend that you contact clients to discuss the contents of Equitable Life’s letter and provide any advice that they may need regarding ongoing deposits to their segregated funds. You can access a copy of the client letter here:If you have any questions, please reach out to our Advisor Services Team at 1.866.884.7427.

December 23, 2022

™ or ® denote registered trademarks of The Equitable Life Insurance Company of Canada. -

IMPORTANT NOTICE: FUNDS WITH DEFERRED SALES CHARGE OPTIONS

The Canadian Council of Insurance Regulators require all insurance companies to discontinue the sale of segregated funds with Deferred Sales Charge (DSC) effective June 1, 2023*.

PIVOTAL SELECT™ SEGREGATED FUND PRODUCTS

On May 29, 2023, funds with a DSC or Low Load (LL) sales charge option will be allocated to the No Load (NL) sales charge option of the funds available within the policy.

- Any existing amounts held in DSC or LL funds will retain the existing DSC schedule, outlined in the client’s contract. The annual 10% available (20% for RIF policies) for withdrawal without fees continues to apply through to the expiry of the fee schedule.

- If the default deposit instructions and/or pre-authorized scheduled deposits the client previously provided include funds with DSC or LL, these instructions will automatically update to NL of the same fund for all future deposits.

In alignment with Equitable's current administrative rules, if the client has DSC or LL funds, the client will not be able to deposit No Load Chargeback funds (NL-CB and NL-CB5) within the same policy.

For more information, please click here.LEGACY SEGREGATED FUND PRODUCTS

Ongoing deposits to DSC funds continue when a segregated fund product does not have an alternative sales charge option available within the contract. This applies to the following products:

- Personal Investment Portfolio

- Pivotal Solutions II

- Pivotal Solutions DSC

Clients may continue to make new deposits to the DSC funds within the policy. Any new segregated fund deposits, as well as any existing segregated fund amounts within the policy, will retain the DSC schedule outlined in the contract.

For more information, please click here.

Equitable's Advisor Services Team is available Monday to Friday, 8:30 a.m. – 7:30 p.m. ET at 1.866.884.7427 or by email at savingsretirement@equitable.ca. You can also contact your Regional Investment Sales Manager.

*Draft regulation in Quebec is currently under review which may affect Equitable Life’s approach for clients in the Province of Quebec with legacy segregated fund products. We will continue to monitor provincial regulatory developments.

™ or ® denote registered trademarks of The Equitable Life Insurance Company of Canada.

Date posted: May 4, 2023

-

Equitable Life Savings & Retirement Webinar Series features Global Equity Investing Using a First Pr

In 2022, Equitable Life’s® S&R team will continue to spotlight various aspects of our competitive fund lineup and product offerings. Each webinar in the series features a new topic. This series gives advisors an opportunity to:

• learn more about various products and product features,

• hear from industry professionals,

• learn about investment strategies; and so much more.

This month, Equitable Life welcomes Michael Hatcher, CFA, Head of Global Equities and Director of Research for the Invesco Canada Equity team. Join your host Taylor Stavenjord, Regional Vice President and Invesco Canada.

Equitable Life is pleased to highlight access to Invesco Global Companies Fund, Invesco International Companies Fund, and Invesco Europlus Fund in the Pivotal Select™ segregated fund lineup.

Learn more

Continuing Education Credits

This webinar has been submitted for continuing education (CE) approval with the Insurance Council of Manitoba and Alberta Insurance Council for all provinces excluding Quebec. Upon approval, you will be sent an email notification to come back to the webinar presentation console to download your personalized certificate from the tool bar. To be eligible for CE credits, you must register individually, watch the webcast in full and complete a short quiz. This webcast is available in English only. -

Equitable Life Webcast Series featuring Equitable Life Dynamic Asia Pacific Equity Fund Select

Benjamin Zhan and Bruce Zhang will discuss the Equitable Life Dynamic Asia Pacific Equity Fund Select along with the fund's people, philosophy, process and performance.

Equitable Life® continues to spotlight various aspects of our competitive fund lineup and product offerings. This series gives advisors an opportunity to:

• learn more about products and product features,

• hear from industry professionals,

• learn about investment strategies; and so much more.

Join your host, Joseph Trozzo, Investment Sales Vice President, MGA, Equitable Life of Canada along with Dynamic Funds.Learn More

Continuing Education Credits

This webinar has been submitted for continuing education (CE) approval with the Insurance Council of Manitoba and Alberta Insurance Council for all provinces excluding Quebec. Upon approval, you will be sent an email notification to come back to the webinar presentation console to download your personalized certificate from the tool bar. To be eligible for CE credits, you must register individually, watch the webcast in full and complete a short quiz. This webcast is available in English only.

® denote a registered trademark of The Equitable Life Insurance Company of Canada

Posted May 31, 2023 -

Do you have clients looking for growth but are concerned about taking on too much risk?

Please join us to hear Dina DeGeer, Senior Vice President, Portfolio Manager, Head of the Mackenzie Bluewater Team and David Arpin, Senior Vice President and Portfolio Manager, Mackenzie Investments, discuss how the Mackenzie Bluewater Team is positioning the Mackenzie Canadian Growth Balanced Fund for future success

Learn about the value of investing in high-quality businesses and how taking a broader approach to fixed income investing can deliver the balanced solution your clients are looking for

Equitable Life is pleased to offer the Mackenzie Canadian Growth Balanced fund as one of six different Mackenzie funds in Pivotal Select™ segregated fund lineup.

Learn More

-

Equitable Life presents Dynamic Funds featuring David L. Fingold

With the upcoming U.S. election, and the ongoing coronavirus pandemic, the challenges and uncertainty of today’s global market can create doubt for investors. Please join us to hear guest speaker David L. Fingold from Dynamic Funds discuss a look at global markets; insights on the current positioning of Dynamic American Fund and Dynamic Global Discovery Fund; and review of investment process

Do not miss the opportunity to hear about some of the key holdings of David’s portfolios!

Equitable Life is pleased to offer access to five different Dynamic Funds in the Pivotal Select™ segregated fund line-up, including the Equitable Life Dynamic American Value Select and Equitable Life Dynamic Global Discovery (the underlying funds of which are managed by David).

Learn more

-

THREE new ways to help make your Savings & Retirement business run smoother

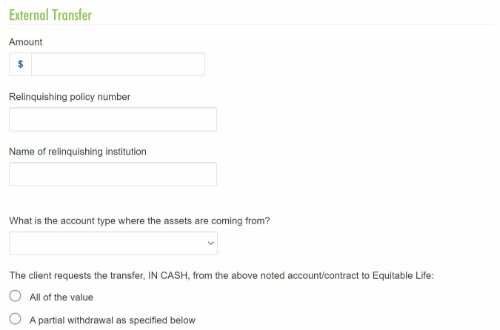

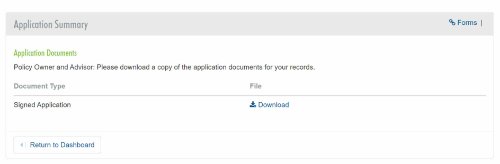

As of August 20, 2022, EZcomplete® will include several new features that allow applications to be completed faster and easier:

1. Prefilled Fund Transfer Form

The transfer form will be generated with the information from EZcomplete and included in the EZcomplete signing package, saving you time.

2. Client eSignature Audit History and Document Download

If you choose the e-signature option for the client, you’ll be able to download a copy of the e-signed transfer forms and the signature audit history.

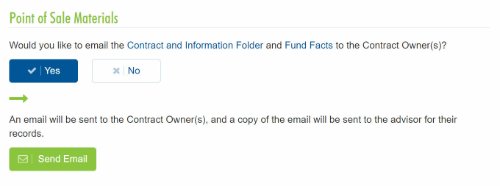

3. Email the Client Contract Info and Fund Facts Before Signing

You'll now be able to email Point of Sale materials (Contract & Info Folder and Fund Facts) to clients before they provide their e-signature.

Log in to EZcomplete today!

Speak to your Regional Investment Sales Manager to learn more!

-

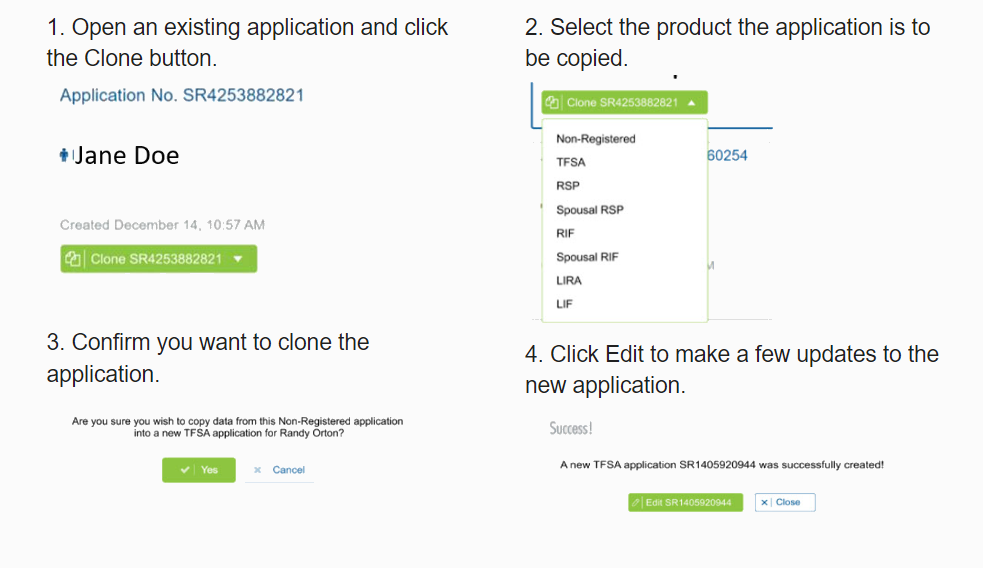

The new segregated fund EZcomplete cloning feature will save time and errors.

The new cloning feature for Savings & Retirement EZcomplete® applications means that advisors don’t need to enter the same client information when completing multiple applications for the same client.

Here's how easy it is to use.

.png)

Best of all, you can clone in progress and submitted applications.

This is just some of the information that will be automatically copied:-

Name

-

Date of birth

-

Gender

-

Occupation

-

Address

-

Phone numbers

-

Email address

-

Social Insurance Number

-

All beneficiary information

The new EZcomplete cloning feature will save advisors time and reduce errors.If you have any questions, contact your Regional Investment Sales Manager

® denotes a trademark of The Equitable Life Insurance Company of Canada.

Posted April 6, 2023 -

.png?width=500&height=92)

.png?width=500&height=92)

.png?width=300&height=82)

.png?width=300&height=39)