Site Search

1360 results for if

-

Take emotions out of investing

Taking the emotion out of investing can be easier said then done. Most of us at one time or another have decided upon something strictly because of how we felt at the time, not because it was logical or made good financial sense. I am sure most of us have a good story to tell.

When it comes to financial planning, you always want to encourage your clients to be a rational investor and accept that market fluctuation is part of the investment journey. Over the last few months, even the hardiest rational investor has been challenged to accept the market fluctuations. History shows us that this too, shall pass and markets will rise once more. The biggest question asked is always, when?

While no one has a crystal ball with that answer, the best we can do is help our clients understand that when building portfolios, risk is always at the forefront of any good investment strategy. The level of risk is just one of the building blocks to constructing a financial portfolio that will see the client through good times and bad.

Need more help? Equitable Life has created an emotional investing brochure to help your clients manage through these extraordinary times. To download a copy, click here. We have also included a template letter that you can personalize and use to reach out to your clients. To download an editable copy, click here.

-

Insights from a pandemic: Drug trends during COVID-19

We were expecting drug costs to rise this year due to the increase in “specialty” drugs, the shift to more expensive treatments for common conditions, and the introduction of new, costly medications. The COVID-19 pandemic has caused drug costs to rise even more than expected. While this was partly due to increased claims for certain drug categories, the most significant factor was the increase in dispensing fees as the provinces imposed 30-day refill limits.

Costs and claimants surge, drop, then climb again

Initially, as COVID-19 started to spread, we saw an overall spike in the volume and paid amounts for drug claims in March as plan members rushed to stock up on their medications. On our block, the average amount paid per certificate increased 16% in March, compared with the previous year.

This spike was followed by a drop in April after most provinces put 30-day refill limits in place. This led to a decrease in both average paid amounts and quantity per claim as people were limited to smaller refills. But the dispensing fee portion of drug cost tripled for many plan members who had to refill their prescriptions every month instead of every 90 days.

The April plunge was short-lived. Drug claims started to climb again in May as some provinces removed their 30-day refill limits. We’ve seen a continued increase so far in June as all remaining provinces have lifted their 30-day limits.

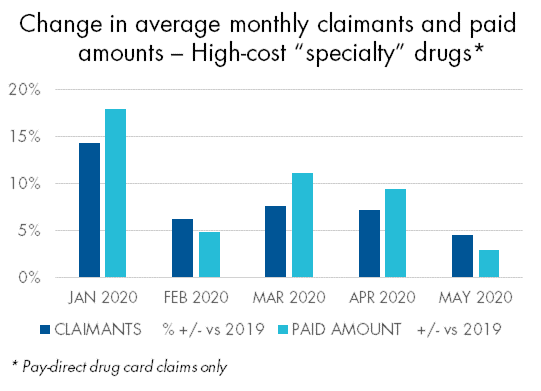

Claims for “specialty” drugs increase

There were some notable exceptions to this trend. For example, both claimants and paid amounts for high-cost “specialty” drugs increased in March, April and May. Thirty-day refills are the norm for these drugs, so they weren’t impacted by the re-fill limits.

There were some notable exceptions to this trend. For example, both claimants and paid amounts for high-cost “specialty” drugs increased in March, April and May. Thirty-day refills are the norm for these drugs, so they weren’t impacted by the re-fill limits.Claims for asthma drugs had the largest surge of any common disease category in March but had no subsequent drop in April. Not surprisingly, claims for mental health drugs increased throughout the pandemic, including a 33% increase in the number of claimants in May.

Going forward, we should see the average quantity per prescription stabilize in future months and return to normal, provided pharmacies return most patients to refills of more than 30 days.

The full impact of COVID-19 remains to be determined. We will continue to provide timely updates on any developments that impact our clients and their plan members or their benefits coverage. In the meantime, please contact your Group Account Executive or myFlex Sales Manager if you have questions.

-

Did you know that you can generate a report detailing all or some of your client’s investment policy

This can be a great tool when meeting to review your client’s account.

This easy to read PDF gives you and your client some, or all, of the pertinent policy information to discuss overall investment goals. The reporting tool also allows you to exclude any “Advisor only information” sections. With active links to fund pages, you can even review risk ratings, calendar and compound returns.

Generate the report just prior to your meeting to ensure the most up-to-date information is available to your client. Located in the top right corner of your client’s policy page on EquiNet®, it also makes a great takeaway or follow up for your client before or after your meeting. -

An update on Travel Assist coverage

The last several months have been very difficult for plan members. We recognize how important it is for them to get back to a sense of normalcy, including making summer travel plans.

As countries start to reopen their borders, plan members with Travel Assist emergency medical benefits may have questions about whether they will be covered while travelling.

For plan members who want to travel outside of Canada, here’s what they need to know.

Out-of-country travel

Plan members travelling to countries that are popular vacation destinations and have reopened their borders will be covered for eligible expenses, including those related to COVID-19.

Please note: While a country may be open for travel, plan members should contact Allianz before departing to confirm that they are covered for travel to their specific destination.

Plan members travelling to countries for which the Government of Canada has issued a Level 4 travel advisory (“Avoid all travel”) will not be covered.

Please note that every country has different travel restrictions. Travelers could be denied entry to another country, even though their travel may be considered essential. Or they may be forced to self-isolate when they arrive at their destination. Canadians travelling to another country should consult that country’s travel restrictions and guidelines before departure and re-entry into Canada.

Communicating with plan members

Below is a link to a plan member version of this communication. Please encourage your clients to share this with their plan members who have Travel Assist coverage on their benefits plan. It’s important for them to know their coverage details before they make their travel plans. We have also posted this update on the plan member website at EquitableHealth.ca.

An update on Travel Assist coverage PDF

If you have questions, please contact your Group Account Executive or myFlex Sales Manager.

-

Insights from a pandemic: Long-term COVID-19 drug risks

For the remainder of 2020 and beyond, COVID-19 will continue to add to the existing pressures driving up drug costs. Examples of contributing factors include:

- Claims for acute drugs will likely increase as elective surgeries resume and plan members address non-emergency health issues that were left unattended during COVID-19.

- Plan members whose employers are facing financial strain due to COVID-19 may stock up on their prescriptions in anticipation of losing their job and/or their benefits.

- An ongoing increase in the prevalence and severity of mental health issues and chronic conditions. In May and June, we saw a dramatic increase in the number of claimants for depression, ulcers, blood pressure and diabetes, and depression was associated with 1 in 5 claimants.

All trends thus far suggest we can expect about a 10% increase in average paid amounts per certificate in 2020 compared with 2019. But the impact won’t be the same for all groups. There will be significant variations, particularly for smaller groups, and some may see much larger cost increases.

Unknown COVID-19-related risks

Another risk exposure may come from the costs associated with drugs used to treat or prevent COVID-19. There are currently numerous vaccines in development, and more than 300 clinical trials are underway for both new and existing drugs to determine their effectiveness in treating the virus.

The cost of any vaccine or whether government or private plans will pay for it is unknown. Regardless, there will likely be other drugs indicated for the treatment or prevention of COVID-19 that private plans will be expected to cover. The cost of this impact for private payers is unknown, but potentially high.

Another unknown is what will happen with dispensing fees. While most provinces have lifted their 30-day prescription refill limits, it remains to be seen whether pharmacies will resume dispensing 60- and 90-day refills at pre-COVID levels for private plans. If not, this would mean the dispensing fees will continue to drive up drug costs.

Advisor opportunity

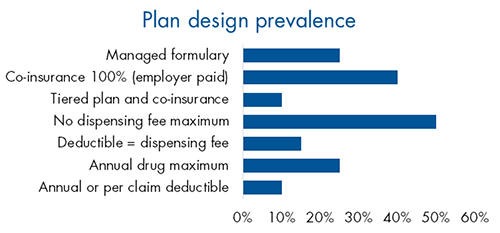

Despite the increase in drug plan risk in recent years, little has changed in plan design trends. Very few plan sponsors have adopted managed plans or other plan design options that could help manage risk.

This presents an opportunity for advisors to educate their clients about the risks their drug plan may be exposed to and the options available to manage that risk.

A practical starting point for those conversations is our Drug Plan Design Tool. With two simple questions, it can help confirm your client’s objectives and identify some best-fit solutions for their plan. Ask your Group Account Executive or myFlex Sales Manager for a copy of the tool.

-

Paper Pivotal Select applications (Form #1383 and #1384)

On April 27, 2020 Equitable Life® launched its NL-CB sales charge option to its Pivotal Select™ segregated fund lineup. The new option provides an additional choice to the existing Low Load (LL), No Load (NL) and Deferred Sales Charge (DSC) selections. To reflect the new sales charge option, Pivotal Select applications (Form #1383 and #1384) were updated.

The paper Pivotal Select applications (Form #1383 and #1384) with a version date prior to 2020/04/27 (located on the back page and in the bottom right-hand corner of the application) will no longer be accepted as of July 1, 2020. If you currently have applications with a date that is before 2020/04/27, please destroy them and order new applications from our Supply Team. To order new applications, click here.

Want to be sure you always have the most up-to-date application? Try our EZcomplete® online application platform. EZcomplete makes it easy to process your non-face-to-face applications and allows your clients to provide their signature remotely on their own device.

For more information about the NL-CB sales charge option, please click here. For more information about Equitable Life’s EZcomplete, click here. -

There is still time for your clients to contribute to their Tax-Free Savings Account

If you have clients that have not contributed to their Tax-Free Savings Account (TFSA) this year, great news… there is still time!

You know that an Equitable Life® TFSA is a great way to save. Each year residents of Canada who are at least 18 years of age are eligible to invest up to $6,000* into their TFSA, in addition to any previously unused contribution room. Deposits made into a TFSA are made with after-tax dollars. This means that withdrawals can be made at any time on a tax-free basis.

Interested in increasing an existing Pre-Authorized Debit (PAD) TFSA deposit?

Clients with an existing PAD (or who had one in the previous six months), can go online to make any adjustments to a scheduled deposit to their TFSA. Clients can simply login to Equitable Life’s Client Access®. Client Access is Equitable’s secure online client site that connects clients to tools and policy information.

Consider a one-time deposit or set up a PAD?

To get started with one-time deposit, clients simply log in to their online bank account and select the option to add a new bill/payee and search for Equitable Life Savings Plan. The Equitable Life savings plan policy number will serve as the account number.

Clients that complete their deposits using online banking do not have to worry about mailing a cheque or missing the deadline. Deposits are applied based on the investment direction on file.

If you have clients that would like to set up a PAD, simply complete Form #378. For details on how to submit forms during COVID-19, refer to the NEW APPLICATIONS & TRANSACTION AUTHORIZATION REQUIREMENTS webpage.

If you have any questions, please reach out to your local Regional Investment Sales Manager or Advisor Services at 1.866.884.7427 Monday to Friday, 8:30 a.m. to 7:30 p.m. ET or email savingsretirement@equitable.ca.

*The annual TFSA limit is set by Canada Revenue Agency (CRA) and is currently $6,000. Your notice of assessment will tell you if you have unused contribution room from previous years. Contributions over the maximum will be charged a monthly penalty of 1% by CRA.

® denotes a trademark of The Equitable Life Insurance Company of Canada -

Tools to manage mental health

As we all continue to manage the impacts of the COVID-19 pandemic, it’s important to remind your clients of the valuable supports available to help their plan members cope through this challenging time.

Free trusted information and COVID-19 resources

Our partner FeelingBetterNow® is responding to the pandemic by providing trusted public resources that offer mental health support. They are available to anyone 24 hours a day, seven days a week, and include:

- What to do if you’re anxious or worried about COVID-19;

- Resources for parents and caregivers; and

- National and Provincial Public Health resources.

Access COVID-19 resources from FeelingBetterNow.

FeelingBetterNow Mental Health Assessment

In addition to these public resources, Equitable Life clients with FeelingBetterNow as part of their group benefits plan have access to online mental health resources. FeelingBetterNow can help plan members identify their risk for mental health concerns and work with their doctor on diagnosis and treatment. It’s an anonymous tool developed by mental health experts which provides:

- Emotional and mental health assessments;

- Practical, evidence-based tools employees and their doctor can use to assess, treat, and follow-up on emotional and mental health concerns; and

- Convenient online access to information and effective resources.

FeelingBetterNow is easy to use and completely anonymous. It takes less than 20 minutes to complete the assessment and view your results.

Learn more about FeelingBetterNow, then contact your Group Account Executive or myFlex Sales Manager to discuss how your clients can add this service to their plan.

-

Grow your guarantee using resets from Equitable Life

Did you know that many of Equitable Life®’s segregated funds contracts, including Pivotal Select™ Estate Class and Protection Class, allow for an annual reset of the death benefit guarantee? Now could be a great time to remind clients to lock-in any gains with a death benefit reset; and increase their Death Benefit guarantee to 100% of the current market value. The ability to lock-in market growth using resets is one of the differences between segregated funds and mutual funds.

To complete a reset, submit the applicable investment direction form. If you have Limited Trading Authorization on file, you can sign the request on your client’s behalf*. The Investment Direction Forms are posted on EquiNet®, or can be found here (by product):

- Pivotal Select (form # 693SEL)

- Personal Investment Portfolio, Pivotal Solutions II or Pivotal Solutions DSC (form # 693ANN)

Be sure to check out the “Growing your Guarantee with Resets” marketing piece which can be shared with your clients. For questions about resets, contact your Regional Investment Sales Manager today.

*Advisors are required to keep notes of their conversation with their client for audit purposes when completing transactions using Limited Trading Authorization. World Financial Group (WFG) advisors are not permitted to use Limited Trading Authorization as per their agreement with WFG.

® and TM denote trademarks of The Equitable Life Insurance Company of Canada

-

Equitable Life Group Benefits Bulletin - September 2020

In this issue:

Enhancements to Equitable EZClaim Mobile

New reports available on EquitableHealth.ca* Indicates content that will be shared with your clients.

Enhancements to Equitable EZClaim® Mobile*

We’ve updated our Equitable EZClaim mobile app to process vision claims faster, to provide a new option for submitting documents and to increase password security.

Faster vision claims processing and payment

Equitable Life now provides faster processing of vision claims submitted via EZClaim Mobile.

This means plan members can find out the status of their vision claim almost instantaneously. And, for approved claims, they will receive payment even sooner – often in as little as 24 hours.

In order to allow for instant processing and faster payment, plan members will be prompted to enter some additional information, including their practitioner’s name, the date of the expense, the type of expense and amount of the expense when submitting their claims for these services.

Equitable Life plan members can submit all vision claims via Equitable EZClaim, including coordination of benefits and Health Care Spending Account claims.

Submit documents from a mobile device

We have added our Document Submission tool to EZClaim Mobile so plan members can conveniently submit documents directly from their mobile device. Applications, change forms, statement of health forms and more can all be easily uploaded whenever and wherever they are.

Improved security with stronger passwords

To help you, your clients and plan members better protect personal information, we have increased the maximum length of passwords for both EZClaim Online and EZClaim Mobile from 12 to 32 characters. This longer character limit makes it easier to create stronger and more secure passwords.

There is no change for plan members, plan administrators or advisors. All existing passwords will continue to function. However, if you choose to update your password you will now be able to choose longer passwords or passphrases.

Why should I change my password?

Changing your password frequently helps keep your information safe. The longer and more random the password, the more secure it is. To improve security even more, a passphrase is recommended.

A passphrase is a series of words or other text used like a password. Because it is much longer, a passphrase is more secure. Although the words in the phrase may be meaningful to you and easy to remember, they can be random enough that the full phrase is difficult for someone else to guess. It’s even better if you use numbers or other characters in your passphrase.

Your passphrase should be:

- Long enough to be hard to guess;

- Not a famous quotation;

- Easy to remember and type; and

- Not used in multiple places.

To change your password:

- Log in to EquitableHealth.ca

- Click on My Information > User Profile

- Click Edit

- Confirm your information and enter your new password

- Click Save

We will be announcing this enhancement to plan members on EquitableHealth.ca.

New reports available on EquitableHealth.ca*

Plan administrators and advisors with reporting access can now download three additional reports any time via the plan administrator and advisor websites on EquitableHealth.ca:

- Premium and Tax – This report provides a breakdown of premiums and taxes paid per plan member for any specific time period for all applicable benefits.

- Occupation and Earnings – This report provides current plan member earnings and occupation information and gives plan administrators an efficient way to report updates to us.

- Employee listing – This report lists all plan members’ information, including name, certificate number, date of birth, province, occupation and salary, as well as benefit coverage currently in place and HCSA allocations.

These reports can be downloaded in Excel format for easy updating, filtering or sorting.

For more information, please contact your Client Relationship Specialist.

*Indicates content that will be shared with your clients