Term Insurance

Term life insurance

Term 10 | Term 20 | Term 30/65

We are not a one-size-fits-all society. We like having things tailored specifically for us. With Equitable’s Term life insurance, clients can customize their coverage.

Help clients find the right Term life insurance that protects their needs and matches their budget.

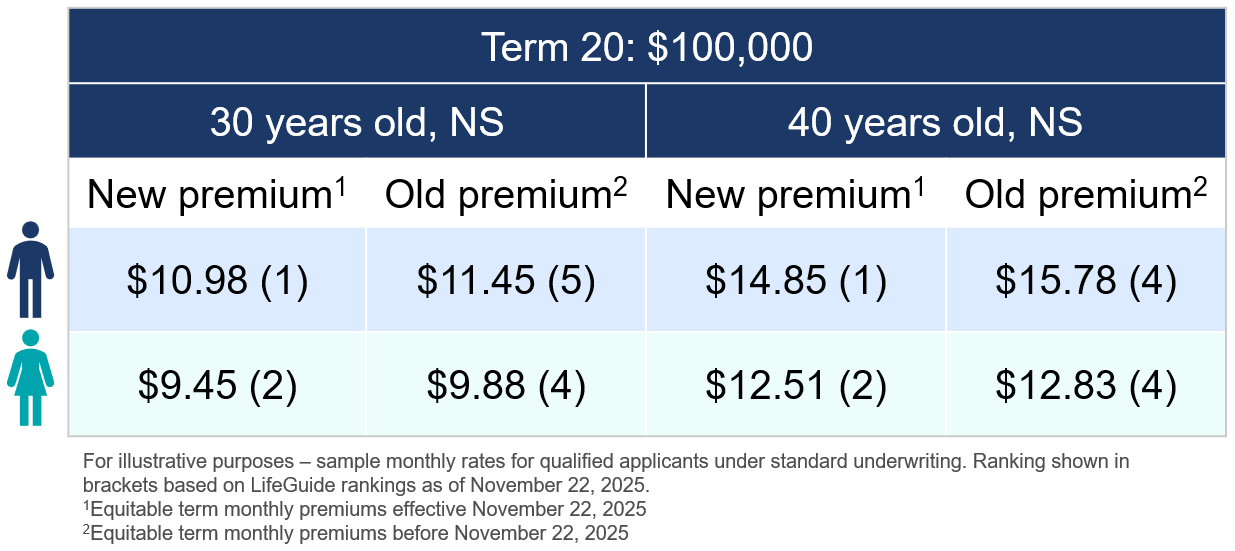

Check out our new term rates for yourself! For our best term rates, run quotes monthly (versus annually).

Features:

• More targeted, competitive pricing

• Yearly renewals after the initial term of level premiums

• Convertibility – convert part or all of the Term coverage to a permanent life policy. Choose from our industry-leading Equimax® Participating Whole Life or Equitable Generations® Universal Life insurance solutions. Age and amount limitations apply for conversion. See the policy for more details.

• Flexibility – Exchange options: Turn a T10 policy into a T20 or a T30/65, or a T20 policy into a T30/65. Exchanging means longer level premiums for your client. See the policy for more details.

• KIND™ benefits – Compassionate Advance* and Bereavement Counselling Benefit

Want to know more?

Visit www.equitable.ca/term

See our Term sample policy pages.

* The Compassionate Advance benefit is a non-contractual benefit that may be changed or withdrawn by Equitable at any time.

Product Summary

| Plan summary | Equitable’s Term life insurance plans provide low-cost life insurance protection. There are a variety of plan types available to meet your clients’ unique needs and financial obligations: • T10 and T20 Yearly Renewable and Convertible Term (YRCT) – guaranteed level premiums for the initial term and guaranteed annual renewable premiums to age 85. • Term 30/65 (convertible) – guaranteed level premiums payable to the later of 30 years or age 65. |

||

| Target market | • Individuals or families seeking mortgage/debt protection or income replacement. • Business owners seeking potential creditor protection, key-person protection or funding for a buy-sell agreement. • Individuals or families looking for an affordable alternative to more costly permanent coverage. |

||

| Exchange option | Option to exchange 10 YRCT or a 20 YRCT without evidence of insurability after the 1st anniversary, but before the earliest of the 5th anniversary and the: 1. anniversary nearest the insured’s 65th birthday if exchanging to T20 2. anniversary nearest the insured’s 55th birthday if exchanging to T30/65 |

||

| Convertibility | • 10 & 20 YRCT: convertible up to age 71 (oldest life for joint plans) • Term 30/65: convertible up to age 60 • 2 single life Term policies to 1 joint permanent life policy |

||

| Availability |

|

||

| Issue ages and expiry | • 10 YRCT: 18 - 75 (expires at age 85) • 20 YRCT: 18 - 65 (expires at age 85) • Term 30/65: 18 - 55 (expires at the later of 30 years or age 65) |

||

| Rate bands | Minimum death benefit: $50,000 • Band 1: $50,000 - $99,999 • Band 2: $100,000 - $249,999 • Band 3: $250,000 - $499,999 • Band 4: $500,000 - $999,999 • Band 5: $1,000,000 - $2,499,999 • Band 6: $2,500,000 + |

||

| Admin/policy fees | $50 per year / $4.34 per month | ||

| Underwriting classes | Preferred underwriting is available for face amounts starting at $2,000,000 for ages 18-50, and starting at $500,000 for ages 51-60. Preferred underwriting is not available for ages 61 and above. • Class 1 – Preferred plus non-smoker • Class 2 – Preferred non-smoker • Class 3 – Non-smoker (standard and ratable) • Class 4 – Preferred smoker • Class 5 – Smoker (standard and ratable) The health of the life insured as well as family medical history will factor into the ability to qualify for preferred rates. Please refer to the Preferred Underwriting Classifications guide (form 1345) for more information. While Equitable has made every effort to ensure the accuracy of the information presented here, the policy contract governs in all cases. |

||

| Optional riders |

|

||

| KIND™ | • Compassionate Advance* • Bereavement counselling benefit *The Compassionate Advance benefit is a non-contractual benefits and may be withdrawn or changed by Equitable at any time. |

||

| Built-in features | • Substitution of a life insured (multi-life policies only) • Special options provision (joint first-to-die) • Survivor benefits • Separate policy option |

||

| EZcomplete® online application | • Use it for in person or non face-to-face meetings. • EZcomplete easily guides you through only the required sections of the application. • It includes functionality that allows clients to sign the application using their own electronic devices. • Login to EquiNet® and click on the EZcomplete icon on the menu bar. |

Convertibility - The power of term life insurance

As clients’ needs change, their insurance should too. Equitable® Term life insurance can help cover a client’s temporary needs today and help protect a client’s permanent needs in the future.

All our term life insurance solutions give clients the option to convert to a permanent life insurance policy, regardless of their health at that time!

Let’s look at some of the flexibility Equitable Term life insurance gives clients.

What happens if a client’s temporary need for protection today extends beyond the initial term of the policy?

Term 10 and Term 20 coverages renew on an annual basis once the initial term is over, so clients can keep their coverage for longer than the initial term. At each renewal, premiums increase to an amount that is guaranteed in their contract.Our Term 10 and Term 20 plans have some extra flexibility with our exchange option. Clients can exchange their Term plan starting on the 1st policy anniversary up to the earlier of the 5th policy anniversary and

1. the insured’s age 65, if exchanging to T20, or

2. the insured’s age 55, if exchanging to T30/65.

The new Term plan will be issued at current age and rates. By exchanging their Term coverage, clients can be covered with premiums that stay level longer. They can also choose to convert their Term plan sometime in the future to a permanent plan. This is all without having to give us proof of continued good health (this means no underwriting!).

What if a client’s temporary need for protection today changes to both a temporary need and a lifetime need?

A partial conversion might be the way to go!Clients can choose to convert part of their term coverage to a permanent plan and:

1. keep their remaining term coverage on the original term plan, or

2. cancel or reduce their remaining term coverage, or

3. carryover the remaining term coverage as a term life insurance rider on the new permanent plan at then-current age and rates.

How a partial term conversion with a term rider carryover works

If 50% or more of the original term coverage is being converted to permanent coverage, the remaining term coverage can be added as a term rider to the new permanent plan. That means, all their coverage on one policy with one policy fee.If less than 50% of the original term coverage is being converted to permanent coverage, the maximum amount that can be carried over as a term rider will be equal to the new permanent coverage amount. Any remaining term coverage will stay on the original term policy.

See the Term Admin Guide for more details.

What if a client’s temporary need for protection today changes to a lifetime need?

Explore a full conversion! Under a full conversion, clients can convert their entire term coverage to Equimax®, our industry-leading participating whole life plan, or an Equitable Generations™ universal life plan. By doing this, the client’s need for lifetime protection can be covered off with guaranteed level premiums!Any conversion must be done before the age specified in the term life insurance policy. See the Term Admin Guide and policy for more details.

Access the power of term

Encourage clients to explore the ways that our term life insurance solution can meet their needs today!

Want to learn more?

• 1801 – Term Life Insurance protection• 1004 – Case study – Balancing need and affordability

• Term Life Insurance Admin/Advisor Guide

Interested in ordering marketing materials? Complete our Life & Health supply order form

Canada's Anti-Spam Legislation - The digital printer friendly versions of these brochures are not to be altered. PLEASE NOTE that if you choose to distribute the brochure by electronic mail to your clients or prospects, you must comply with Canada's new anti-spam legislation. You could be subject to severe penalties should you not comply. Find out more at fightspam.gc.ca.

| Form Number | Cover | Marketing Material Name | Available Languages | Product |

|---|---|---|---|---|

| 1271 |

|

5 Reasons for doing business with Equitable

File

This advisor piece lists the top 5 reasons why Equitable Life should be your first choice. |

FR | General Content |

| 1346 |

|

A closer look at life insurance

File

For advisor use only. This chart takes a closer look at life insurance and highlights some of the key differences between Equitable's term, whole life and universal life products. (Available in PDF Format only.) |

FR |

Participating Whole Life Term Universal Life |

| 1004 |

|

Balancing need and affordability File | FR | Term |

| 1758 |

|

Take a Premium Holiday File | FR |

Critical illness Insurance Term Universal Life |

| N/A | Term Advisor/Admin Guide File | FR | ||

| 2061 |

|

The Ultimate Bundle for Young Professionals File | FR |

Critical illness Insurance Term Universal Life |

| SS2 |

Equimax & Term Certain Annuity Package

File

This sales track shows you how to use a Term Certain Annuity to prearrange funding for an Equimax policy. |

FR |

Participating Whole Life Term |

|

| 1025 |

|

Individual Life & Health Products At-a-glance

File

This guide can be used as an easy reference to all of Equitable's Life and Health products currently available for sale. |

FR |

General Content Critical illness Insurance Participating Whole Life Term Sales Strategies |

| 1345 |

|

Preferred Underwriting Classifications

File

This guide provides an overview of the Preferred Underwriting Classifications that determine the rates for Preferred Term insurance at Equitable. |

FR | Term |

| 2039 |

|

Term Insurance Product Summary

File

This one page document provides advisors with an overview of the target market, features and benefits specific to this product. |

FR | Term |

| 1801 |

|

Term Life Insurance - Flexible protection that can last a lifetime

File

Affordable protection. Rewards for your healthy lifestyle. Adjust your plan to meet your changing needs. |

FR | Term |

| 1255 |

|

Unique Mortgage Protection

File

This brochure compares some of the key features of mortgage protection and highlights the advantages of using Equitable Life’s Term insurance over typical mortgage insurance from a lending institution |

FR CH | Term |

| 2114 |

|

Your guide to Term life insurance File | FR | Term |