Site Search

961 results for life policy 300109556

- About

-

Step Up Your Wealth Sales with Equitable Life

Step up your wealth sales with Equitable Life® and you’ll be rewarded with a growth bonus for doing more business in 2022. Make this year your best year ever with Equitable Life!

The program rewards advisors who promote Equitable Life’s Savings & Retirement products to existing and new clients as part of an overall investment strategy based on client needs.

Commission Bonus Calculation:

Gross deposits into segregated funds

+ Gross deposits into Guaranteed Interest Account (GIA) contracts

+ 25% of payout annuity sales

― Segregated fund redemptions

― GIA redemptions

= 2022 Net Deposits

All eligible deposits, sales, and redemptions occurring between January 1 and December 31, 2022, will be used to calculate an advisor’s 2022 net deposits.

* The bonus amount will be calculated at the end of 2022 based on net deposits. The bonus will be paid within 90 days following December 31, 2022. Maximum bonus payable is $75,000.

For more information, download our flyer or contact your Equitable Life Regional Investment Sales Manager.

And as a reminder, we increased the CB5 sales option initial commission from 5.6% to 7.0% on Pivotal Select™ segregated funds. The 7% initial commission is effective from May 20 to August 31, 2022 only.** Learn more.

Equitable Life is committed to offering advisors and clients product, service, and feature choices that best suit their needs. We offer multiple sales charge options, three distinct guarantee classes, and a diverse selection of investment funds to align with advisors’ and clients’ unique needs.

** Equitable Life reserves the right to end the campaign, at any time and without notice.

™or ® denotes a registered trademark of The Equitable Life Insurance Company of Canada. -

EAMG - Macro Tear Sheet – Recent Market Volatility Summary

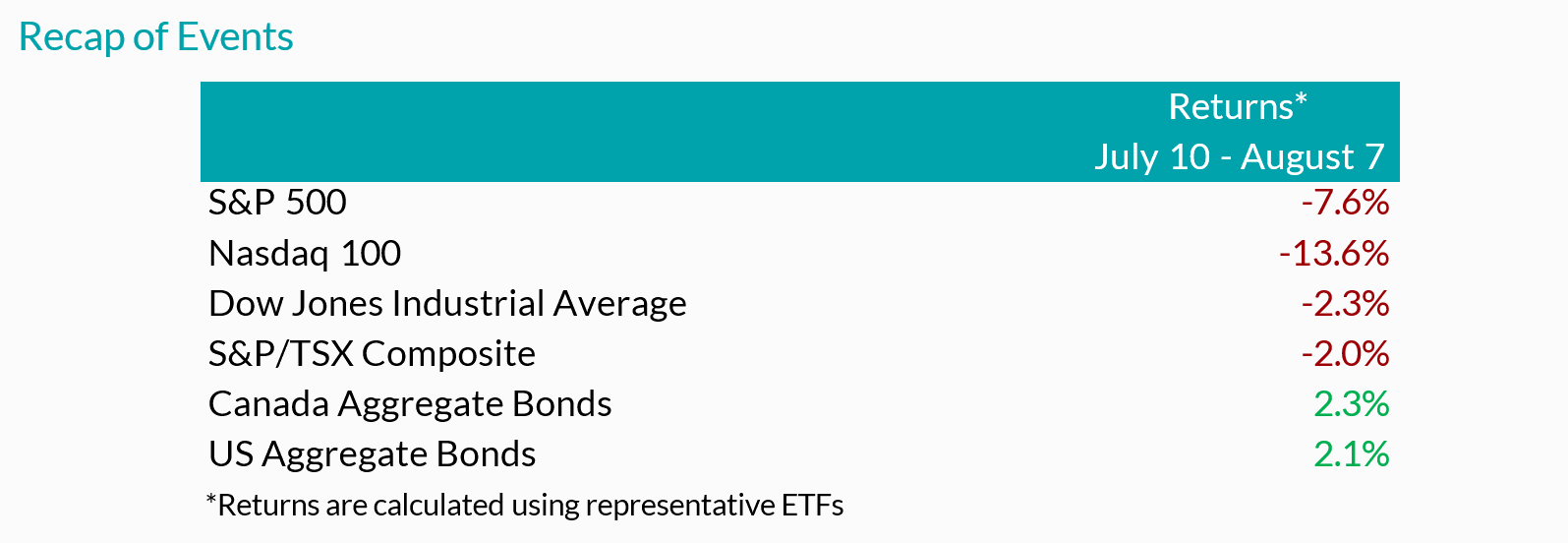

By separating the noise from the signals, we believe the rotation away from the mega-cap technology names is likely to continue. Recent market volatility, triggered by a multitude of factors that include the unwind of the carry trade, investor reactions to mixed mega-cap earnings, and U.S. economic data, may present more investment opportunities for long-term outperformance. Recall over the past year that the majority of U.S. stock market performance came from a limited number of mega-cap technology companies and, in our view, moving forward it will be prudent to analyze the source of returns as rapid market rotations may punish overly-concentrated portfolios.

Inflation Slows (July 11) – Headline U.S. inflation readings increased 3.0% year-over-year in June, decelerating from May (3.3%). With prices slowing ahead of forecasts but economic growth remaining strong, investors became more confident regarding the prospects of an economic soft landing.

Outcome: market strength broadened with traders rotating out of highly concentrated areas of the market (“Fabulous 5”) and into more economically sensitive stocks that had been left behind.

• Big Tech Earnings (July 23 – Aug 1) – High profile mega-cap technology companies – including many members of the Magnificent 7 – reported earnings growth that generally surpassed expectations as margins remained healthy. That said, investors were more focused on spending towards AI-initiatives, rewarding businesses with greater success translating their AI investments into higher sales.

Outcome: this trend is evident through the divergence of returns from IBM and Alphabet (Google’s parent company) after releasing their quarterly earnings. The limited number of companies that contributed to the returns of the S&P 500 failed to impress investors, extending the rotation into other areas of the market.

• Caution is Brewing – Following a strong rally of economically sensitive pockets of the market, notably a breakout of returns from U.S. small cap companies, the low volatility factor, which tends to outperform during times of stress, moved in sync with the small caps’ strength.

Outcome: with a lack of fundamental justification supporting small cap performance, markets showed signs of caution.

• Central Bank Decisions (July 31)– The Federal Reserve held interest rates unchanged during its July meeting, in line with market expectations, reiterating committee members’ need for greater confidence that inflation would continue to subside. That said, policymakers signaled a reduction in policy rates could be a possibility in the coming meetings. In contrast, the Bank of Japan (BoJ) increased its key interest rate while also announcing plans to scale back bond purchases – restrictive monetary policy maneuvers aimed at backstopping the depreciating Japanese currency.

Outcome: the bifurcation between the BoJ and most other major central banks sparked a sharp appreciation of the yen and a rapid unwind of the yen carry trade (see below for explanation).

• Growth Scare (August 2)– In early August, a downside surprise in U.S. nonfarm payrolls (114k actual versus 175k expected) and an increase in the unemployment rate to 4.3%, higher than the 4.1% that was expected and up from 3.5% a year ago triggered concerns of a cooling labor market.

Outcome: speculation swelled surrounding the pace of rate cuts with market participants expecting the Federal Reserve to cut rates as much as 125bps over the next 3 policy meetings, up from 50-75bps as of the end of July. Against this backdrop, the ongoing unwind of the yen carry trade accelerated.

Yen Carry Trade Explained

• Simply put, investors have been borrowing Japanese yen – a low yielding currency – to invest in higher-yielding foreign assets. The primary risks in a carry trade can include the uncertainty of foreign exchange rates (if unhedged), as well as changes to expectations of the underlying yields, among other risks. Over the last 2 decades, the BoJ has implemented an ultra-low interest rate monetary policy to combat deflation and stimulate growth. Furthermore, investors were emboldened by the Japanese yen’s ~53% depreciation versus the U.S. dollar over the last 10 years. With the BoJ hiking its key interest rate while also announcing plans to scale back bond purchases, the yen rallied abruptly. Consequently, highly leveraged investors have had to exit their long positions in riskier assets to repay their borrowed yen exposure.

Peak Carry Trade Unwind – Buying Opportunity

• Peak carry trade unwind, which implies heightened panic levels, has historically created an attractive buying environment. That said, we are focused on companies that have demonstrated robust earnings growth and healthy leverage. Given the unprecedented level of market concentration over the last year, we view the unwind of the carry trade as another catalyst for investors to rotate out of the “Fabulous 5”.

Our Findings:

We found that the peak unwind of the carry trade may be a buying opportunity. At present, the current level of the unwind is similar to many notable market bottoms, including the Great Financial Crisis (2008), the European debt crisis (2010), the oil crash (2014), the subsequent emerging market crisis (2015), the Covid-19 crash (2020), and the collapse of Silicon Valley Bank (2023). We assessed the degree of the unwind by looking at the one-month implied volatility between three currency pairs, U.S. Dollar/Yen, Australian Dollar/Yen, and Euro/Yen. Implied volatility is a measure of the expected future volatility of the underlying assets over a given time period. Amid strong earnings growth and steady margins from quality businesses within the U.S. market, the fundamental backdrop suggests that businesses outside the concentrated AI-darlings may drive the next leg of market returns.

Downloadable Copy

Mark Warywoda, CFA

VP, Public Portfolio ManagementIan Whiteside, CFA, MBA

AVP, Public Portfolio ManagementJohanna Shaw, CFA

Director, Portfolio ManagementJin Li

Director, Equity Portfolio Management

Tyler Farrow, CFA

Senior Analyst, Equity

Andrew Vermeer

Senior Analyst, Credit

Elizabeth Ayodele

Analyst, Credit

Francie Chen

Analyst, Rates

ADVISOR USE ONLY

Any statements contained herein that are not based on historical fact are forward-looking statements. Any forward-looking statements represent the portfolio manager’s best judgment as of the present date as to what may occur in the future. However, forward-looking statements are subject to many risks, uncertainties, and assumptions, and are based on the portfolio manager’s present opinions and views. For this reason, the actual outcome of the events or results predicted may differ materially from what is expressed. Furthermore, the portfolio manager’s views, opinions or assumptions may subsequently change based on previously unknown information, or for other reasons. Equitable® assumes no obligation to update any forward-looking information contained herein. The reader is cautioned to consider these and other factors carefully and not to place undue reliance on forward-looking statements. Investments may increase or decrease in value and are invested at the risk of the investor. Investment values change frequently, and past performance does not guarantee future results. Professional advice should be sought before an investor embarks on any investment strategy. -

Do clients imagine owning a dream home?

We’re here to help make that happen! Clients who contribute to a First Home Savings Account between May 1 and September 30, 2025, will be entered for a chance to win an incredible $8,000 in our Close to Home contest. Whether opening a new account or making an annual contribution, this is a golden opportunity to help them get one step closer to homeownership.Advisors, Your Efforts Matter Too! By guiding clients towards their homeownership dreams, you’ll be entered to win $1,000 as a special thank you for your dedication and support. At Equitable®, we believe that when we grow together, success is mutual.

Don’t Miss Out! Enter today using Equitable’s user-friendly online application platform, EZcomplete®, or process an online transaction with ease using Equitable’s EZtransact®. It’s fast, simple, and could bring clients closer to their dream home.Want to learn more? Speak to your Director, Investment Sales, and help clients take the first step towards making homeownership a reality.

Equitable’s Close to Home Contest: No purchase necessary. Contest period May 1, 2025, to September 30, 2025. Enter by making a deposit to an Equitable FHSA during the contest period or by submitting a no-purchase entry. Two prizes for a total value of $8,000 CAD to be drawn on October 15, 2025, will be awarded. The servicing advisor for the policy to which the selected entrant made the deposit is also an eligible winner and will receive a $1,000 CAD prize. For example, if an Equitable client is a winner of the $8,000 prize, the client’s servicing advisor wins a $1,000 prize. Open to legal residents of Canada of the age of majority. Odds of winning depend on number of eligible Entries received during the Contest Period. For full contest rules, including no-purchase method of entry, see the full contest rules.

-

Equitable Life presents Dynamic Funds featuring David L. Fingold

With the upcoming U.S. election, and the ongoing coronavirus pandemic, the challenges and uncertainty of today’s global market can create doubt for investors. Please join us to hear guest speaker David L. Fingold from Dynamic Funds discuss a look at global markets; insights on the current positioning of Dynamic American Fund and Dynamic Global Discovery Fund; and review of investment process

Do not miss the opportunity to hear about some of the key holdings of David’s portfolios!

Equitable Life is pleased to offer access to five different Dynamic Funds in the Pivotal Select™ segregated fund line-up, including the Equitable Life Dynamic American Value Select and Equitable Life Dynamic Global Discovery (the underlying funds of which are managed by David).

Learn more

-

Launching Equitable Life Savings & Retirement Webinar Series

In 2021, Equitable Life’s® S&R team will spotlight various aspects of our competitive fund lineup and product offerings. Each webinar in the series will feature a new topic. This series will also give advisors an opportunity to learn more about various products and product features, hear from industry professionals, learn about investment strategies; and so much more.

This month, Equitable Life welcomes Kimberley West, Senior Client Portfolio Manager for Invesco Canada’s International Companies Fund. West will be joined by Ryan Diamant, Senior Product Manager, Invesco Canada.

Equitable Life is pleased to highlight access to Invesco Global Companies Fund, Invesco International Companies Fund, and Invesco Europlus Fund in the Pivotal Select™ segregated fund line-up.

Learn More

-

Equitable Life offers more than 60 years of RSP innovation

In 1957, Equitable Life® began offering a Retirement Savings Plan (RSP). That is more than 60 years of RSP innovation in the Canadian marketplace. Today, Equitable Life offers two great accumulating RSP products to meet your clients’ needs.These products provide both protection and flexibility for your clients. They also provide the tax savings and benefits of an RSP. Get your clients to start saving to their RSP now. Make RSP contributions a financial priority each year.

This year’s RSP deadline is March 1, 2022. This will be the last day that an RSP deposit can reduce your clients’ 2021 taxable income.

If your client is looking to convert registered savings to guaranteed income, click here to learn more about Equitable Life’s payout annuity options.

Need additional support? Contact your local Regional Investment Sales Manager today. -

Equitable Life Savings & Retirement Webinar Series welcomes Franklin Templeton

In 2021, Equitable Life’s® S&R team will spotlight various aspects of our competitive fund lineup and product offerings. Each webinar in the series will feature a new topic. This series will also give advisors an opportunity to:- learn more about various products and product features,

- hear from industry professionals,

- learn about investment strategies; and so much more.

Join your host Joseph Trozzo, Investment Sales Vice President and Franklin Templeton. Equitable Life is pleased to highlight access to the Bissett Monthly Income and Growth Fund Select, Bissett Canadian Equity Fund and Bissett Dividend Income Fund in the Pivotal Select™ segregated fund line-up.

Learn More

-

Short and long-term income solutions from Equitable Life

Do you have clients without a company pension plan, close to retiring and worried about outliving their savings? Have you talked to them about annuities? Maybe it’s time you did.

A payout annuity from Equitable Life® provides regular guaranteed income in retirement. Your clients can choose from

- Life Annuity – guaranteed income for life

- Joint Life Annuity – guaranteed income for two lives

- Term Certain – guaranteed income for a specific period of time (5 to 30 years)

- Term Certain to Age 90 – guaranteed income until age 90

There’s no need for your clients to worry about stock market fluctuations or changing interest rates, what better time to add an annuity to your client’s retirement savings strategy.

Payout annuities are an excellent solution for

- Converting your savings into retirement income

- Covering predictable fixed monthly expenses

- Providing lifetime income

For more information on payout annuities, please click here.

-

Equitable Life Savings & Retirement Webinar Series featuring Franklin Bissett Investment Management

In 2022, Equitable Life’s S&R team will continue to spotlight various aspects of our competitive fund line up and product offerings. Each webinar in the series features a new topic. The series also gives advisors an opportunity to: learn more about various products and product features, hear from industry professionals, learn about investment strategies; and so much more.

This month, Equitable Life welcomes Les Stelmach, Senior Vice President, Portfolio Manager; Ryan Crowther, Vice President, Portfolio Manager; and Andrew Buntain, Vice President, Institutional Portfolio Manager, from the Franklin Bissett Investment Management team.

Learn More

Moderated by Andrew, Les and Ryan will discuss the Equitable Life Bissett Dividend Income Fund Select, and its goal of providing investors high current income by investing primarily in Canadian and American dividend paying preferred and common stocks.